United States Green Data Center Market Size, Share, Trends and Forecast by Component, Data Center Type, Industry Vertical, and Region, 2025-2033

United States Green Data Center Market Size and Share:

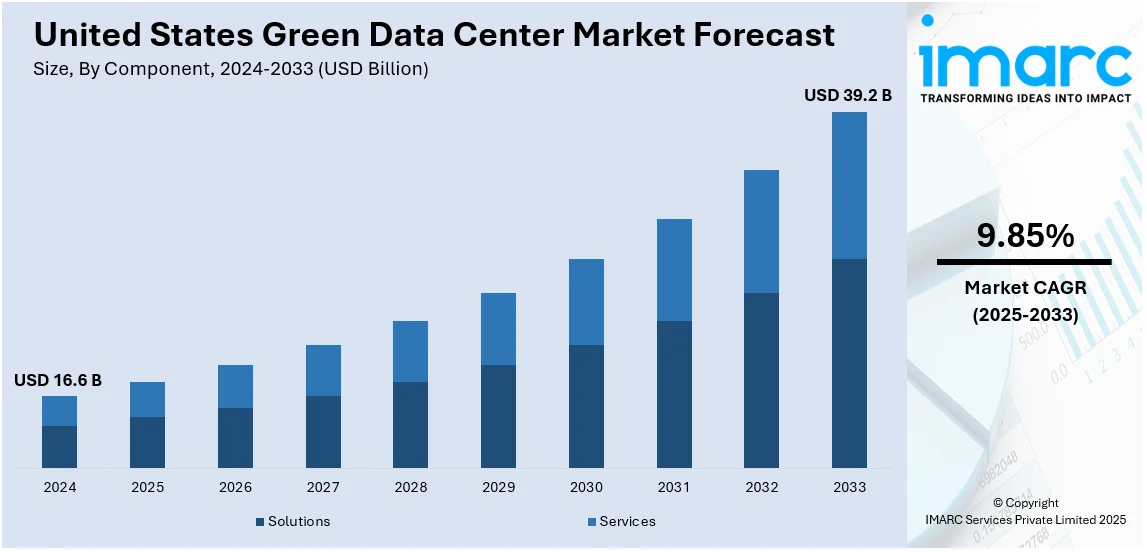

The United States green data center market size was valued at USD 16.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 39.2 Billion by 2033, exhibiting a CAGR of 9.85% from 2025-2033. The market is experiencing steady growth driven by rising energy costs, regulatory mandates on carbon emissions, and the increasing adoption of sustainable practices among enterprises. The rapid growth of cloud computing, IoT, and AI technologies, and advances in renewable energy integration and modular data center designs are further increasing demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 16.6 Billion |

|

Market Forecast in 2033

|

USD 39.2 Billion |

| Market Growth Rate 2025-2033 | 9.85% |

The United States green data center market is primarily driven by the growing emphasis on sustainability and environmental stewardship among enterprises. Regulatory mandates aimed at reducing carbon emissions, such as the U.S. Environmental Protection Agency’s (EPA) guidelines, compelling organizations to adopt energy-efficient practices are favoring the market. Moreover, the rising cost of electricity is incentivizing businesses to implement green technologies, including advanced cooling systems and energy-efficient servers, to minimize operational expenses. Increasing data consumption driven by cloud computing, AI, and IoT applications is also fueling demand for green data centers, as they offer a scalable solution while ensuring minimal environmental impact. Additionally, the financial benefits of tax credits and government incentives are further encouraging companies to transition to eco-friendly infrastructure, further favoring the market.

In addition, the rising demand for corporate social responsibility (CSR) and sustainability reporting are significantly supporting the market. Businesses are increasingly prioritizing green initiatives to align with stakeholder expectations and maintain a competitive edge in the market. Advances in technology, such as renewable energy integration, virtualization, and modular data centers, are accelerating the adoption of green data center solutions. According to the International Energy Agency, global annual renewable capacity additions increase from 666 GW in 2024 to nearly 935 GW in 2030 in the base case. Solar PV and wind are expected to comprise 95% of all renewable capacity additions through 2030, as their generation costs are cheaper than for both fossil and non-fossil alternatives in most countries, and policies continue to support them. Global renewable capacity is expected to grow over 5 520 GW in 2024-2030, 2.6 times more than the deployment of the last six years (2017-2023). Utility-scale and distributed solar PV growth more than triples, accounting for almost 80% of renewable electricity expansion worldwide. The rapid growth of hyperscale and edge computing, combined with a surge in data traffic, necessitates energy-efficient designs to meet expanding operational requirements sustainably. Additionally, growing awareness among consumers about environmental issues pushes enterprises to embrace green practices, reinforcing their market position and long-term profitability.

United States Green Data Center Market Trends:

Increasing Focus on Liquid Cooling Solutions

Liquid cooling technologies are among the emerging trends in the U.S. green data center market. In contrast to air-cooling systems, liquid cooling allows for improved energy efficiency as it transfers heat directly from hardware components, thereby reducing the total power consumption. This technology is highly applicable in high-performance computing environments where heat dissipation is critical. With data centers experiencing an increasing energy demand from AI, IoT, and cloud workloads, liquid cooling is emerging as the preferred choice to reduce operational costs and environmental impact. In addition, innovations in liquid immersion cooling and hybrid cooling systems are driving market adoption as they offer scalable solutions for sustainable operations. Moreover, industry leaders are investing in R&D to improve the efficiency and reliability of liquid cooling technologies which is creating a positive market outlook. On 14th October 2024, JetCool, the leading liquid cooling company for data centers in the US, and Flex announced a partnership to support the increasing demand for AI servers and high-density compute from hyperscalers and enterprise customers. The companies are designing rack-level solutions, which include a new line of co-designed liquid cooling-ready servers in accordance with the Open Compute Project (OCP) specification.

Adoption of Artificial Intelligence (AI) for Energy Optimization

A significant trend in the transformation of green data centers in the U.S. is the deployment of AI-powered energy management systems. AI facilitates real-time monitoring and predictive analytics that optimize energy usage, improve cooling efficiency, and help manage workload distribution effectively. Machine learning algorithms identify energy-saving opportunities, such as dynamically adjusting power consumption according to server activity or weather conditions. This capability reduces energy costs besides supporting sustainability goals by diminishing carbon footprints. Apart from this, AI incorporation also supports predictive maintenance, which helps reduce downtime and build reliability in data center operations. Major companies are using AI to attain the goal of operational excellence and keep their green data center ahead of the line as the power demand is increasing globally, along with environmental compliances. On 2nd May 2024, Meta Platforms, the American multinational technology conglomerate announced plans to open an USD 800 Million data center in Alabama's capital city, supporting 100 operational jobs and building on the company's previous investment in the state. Meta's new 715,000-square-foot, AI-optimized data center will be built off Interstate 65 in Montgomery, across from the Hyundai automotive assembly plant. It will be part of the company's other Alabama data center campus in Huntsville, representing an investment commitment of USD 1.5 Billion.

Growth of Modular and Prefabricated Data Centers

Modular and pre-fabricated data centers are an emerging trend in the U.S. green data center market. Such solutions present pre-engineered, energy-efficient designs which can be deployed and scaled up with ease and speed. They reduce waste and maximize efficiency during construction while keeping up with the goals of sustainability. These data centers also help integrate the most efficient cooling systems with renewable sources of energy that significantly lower power consumption. This trend is attractive to businesses that are seeking flexible and cost-effective ways to expand their data infrastructure while keeping a green footprint. On 11th September 2024, Vertiv, a US-based company providing critical infrastructure and services for data centers, launched the Vertiv MegaMod CoolChip – a liquid cooling-equipped prefabricated modular (PFM) data center solution. The solution can be configured to support the platforms of leading AI compute providers and scaled to customer requirements. MegaMod CoolChip offers quality and process efficiency facilitated by offsite fabrication together with best-in-class AI-ready technologies, delivering deployment time of AI-critical digital infrastructure reduced by up to 50%. In addition, modular designs also find further support from their compatibility with edge computing, where these compact units can be deployed closer to the end-users, reducing latency and energy consumption. This trend is presenting a sustainable and scalable solution for changing digital demands, and further driving the market.

United States Green Data Center Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States green data center market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, data center type, and industry vertical.

Analysis by Component:

- Solutions

- Power Systems

- Servers

- Monitoring and Management Systems

- Networking Systems

- Cooling Systems

- Others

- Services

- System Integration Services

- Maintenance and Support Services

- Training and Consulting Services

The solutions segment of the U.S. green data center market includes crucial parts such as power systems, servers, monitoring and management systems, networking systems, cooling systems, and others. These technologies are aimed at improving energy efficiency, lowering operational costs, and meeting sustainability goals with guaranteed smooth and reliable performance from the data center.

On the other hand, the services segment encompasses system integration, maintenance and support, and training and consulting services. These services ensure effective deployment, ongoing optimization, and compliance with green initiatives. It helps businesses integrate sustainable technologies, maintain operational efficiency, and comply with changing regulations, thus providing the long-term success of green data centers.

Analysis by Data Center Type:

- Colocation Data Centers

- Managed Service Data Centers

- Cloud Service Data Centers

- Enterprise Data Centers

Colocation data centers offer shared facility space to several businesses, reducing operations costs and energy consumption. They emphasize efficient resources that promote sustainability through pooled infrastructure and shared green technologies.

Managed service data centers are outsourced IT solution providers that are focused on operational efficiency and environmental stewardship. They include all energy-saving technologies to accommodate businesses that lack in-house data management capabilities.

Cloud service data centers cater to the demand for scalable and flexible computing. These facilities use advanced energy-efficient technologies to handle dynamic workloads while minimizing environmental impacts.

Enterprise data centers are in-house facilities designed according to specific organizational needs. They are adopting green technologies that help reduce operational costs, improve energy efficiency, and support corporate sustainability goals.

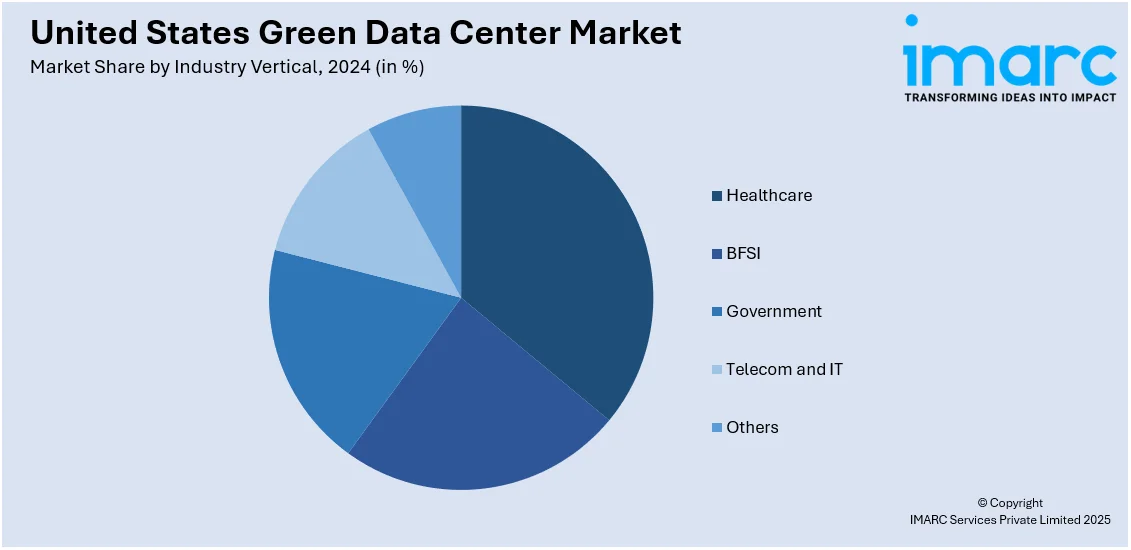

Analysis by Industry Vertical:

- Healthcare

- BFSI

- Government

- Telecom and IT

- Others

The healthcare sector uses green data centers to store and manage critical patient data safely. These centers are designed using energy-efficient solutions that ensure sustainability and reduce the costs of operation.

BFSI organizations consider green data centers for efficient and secure data management. The adoption of energy-saving technologies and regulatory compliance drives their focus on minimizing environmental impact while ensuring cost-effective operations.

Government agencies use green data centers to handle sensitive information with security. Sustainable practices and energy-efficient systems help support reduced carbon footprints, which are in compliance with environmental mandates.

Telecom and IT industries are embracing green data centers for high data traffic. They are increasing their focus on scalabilities, energy efficiency, and sustainability on the environmental front to cater to rising technological demands.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region drives green data center adoption due to stringent environmental regulations and high energy costs. Enterprises in this region prioritize sustainable practices to meet compliance and reduce expenses.

Green data centers are attracting popularity in the Midwest through abundant sources of renewable energies and ever-increasing industrial requirements. Eco-friendly infrastructure takes centre stage there in terms of efficiency and sustainability.

With increasing energy demand and reducing operational costs, the region is adopting green data centers. Sustainable infrastructure growth is bolstered by favorable government incentives and rising data center investments.

The West leads in green data center innovation, driven by tech-intensive industries and renewable energy initiatives. Advanced solutions and eco-friendly designs dominate, in line with the region's sustainability goals.

Competitive Landscape:

The market for green data centers in the United States is highly competitive, with key players emphasizing innovative solutions through which energy efficiency and sustainability can be improved. Strong investments in renewable energy, specifically solar and wind power, decrease carbon footprints. Research development on cooling technologies such as liquid cooling and free-air cooling is attaining increased energy efficiency. Companies are also embracing AI and automation to track energy consumption and enhance operational efficiency. Modular and prefabricated data center designs are also becoming popular as they provide scalable, eco-friendly solutions. Furthermore, companies are collaborating with the government and following environmental regulations to secure incentives and maintain compliance. Players are also expanding their service portfolios to include green consulting, integration, and maintenance solutions.

The report provides a comprehensive analysis of the competitive landscape in the United States green data center market with detailed profiles of all major companies.

Latest News and Developments:

- August 06, 2024: Stack Infrastructure secured USD 3 Billion in green financing to support data center developments in Virginia, Arizona, and Georgia with a total capacity of 900MW. It will utilize the cash to fund the construction of new and ongoing data centers in Prince William County, Virginia; Phoenix, Arizona; and Atlanta, Georgia.

- July 04, 2024: Converge ICT Solutions, one of the biggest broadband providers in the Philippines, announced that it has signed a Memorandum of Understanding (MOU) with US-based IT solutions provider Supermicro to aid it in the construction of three 'green' AI data centers in the Philippines. According to the terms of the MoU, Converge ICT will construct three data centers in Pampanga, Laguna, and Caloocan based on Supermicro's design and input. That involves the deployment of servers based on Nvidia GPUs supporting applications of generative AI such as a national LLM, smart manufacturing, and video generators.

-

January 07, 2024: Data center developer and operator DPO has entered into a new power purchase agreement with a multinational renewable energy producer. The agreement is expected to cover up to 100MW in total size from the seller's Texas wind assets, which comprise multiple 150MW+ wind farms in Texas, United States. DPO and the seller anticipate this will extend across as many as six sites.

United States Green Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Data Center Types Covered | Colocation Data Centers, Managed Service Data Centers, Cloud Service Data Centers, Enterprise Data Centers |

| Industry Verticals Covered | Healthcare, BFSI, Government, Telecom and IT, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States green data center market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States green data center market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States green data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A green data center is an environmentally sustainable facility designed for storing, managing, and processing data. It uses energy-efficient systems, renewable energy sources, and eco-friendly technologies to minimize environmental impact. Applications include cloud computing, IoT, AI, and other high-data traffic processes, ensuring operational efficiency while reducing carbon footprints.

The United States green data center market was valued at USD 16.6 Billion in 2024.

IMARC estimates the United States green data center market to exhibit a CAGR of 9.85% during 2025-2033.

The United States green data center market is driven by rising energy costs, regulatory mandates on carbon emissions, the adoption of sustainable practices by enterprises, advances in renewable energy technologies, and the increasing demand for scalable, energy-efficient infrastructure to support AI, IoT, and cloud computing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)