United States Green Hydrogen Market Size, Share, Trends and Forecast by Technology, Application, Distribution Channel, and Region, 2025-2033

United States Green Hydrogen Market Size and Share:

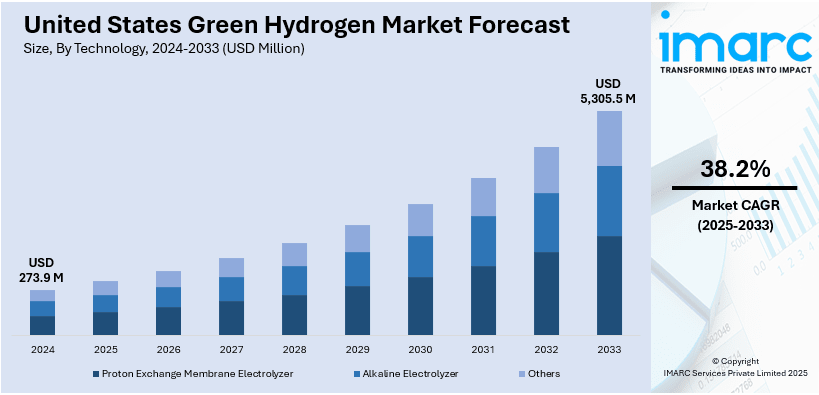

The United States green hydrogen market size was valued at USD 273.9 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 5,305.5 Million by 2033, exhibiting a CAGR of 38.2% from 2025-2033. The market is thriving, driven by the imposition of supportive government policies, expanding transportation sector, rapid technological advancements, growing private-sector investments, and the development of robust hydrogen infrastructure.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 273.9 Million |

| Market Forecast in 2033 | USD 5,305.5 Million |

| Market Growth Rate (2025-2033) | 38.2% |

The market for green hydrogen in the United States is growing substantially as a result of rising government assistance, technological developments, and increased public awareness of climate change. Furthermore, the market is expanding as an outcome of the implementation of federal programs like the Bipartisan Infrastructure Law and the Inflation Reduction Act (IRA), which offer significant financial support and tax breaks to support the production, delivery, and storage of green hydrogen. For example, in December 2023, the U.S. government released draft regulations on clean hydrogen production, establishing the requirements that companies must fulfill to be eligible for the $3 per kilogram hydrogen tax credit. Decarbonizing hard-to-abate areas like heavy industry and transportation, where conventional renewable energy sources are less successful, is the goal of these initiatives.

Another major factor of the United States green hydrogen industry growth is the increasing demand for green hydrogen in the transportation sector because of the rising interest in fuel cell vehicles (FCVs). According to an industry report, the transportation sector is said to account for around 37% of US carbon dioxide (CO2) emissions from fossil fuel combustion. This hiked emission rate has increased the adoption of hydrogen-powered trucks, buses, and trains, which are also long-range and quick refueling vehicles. Moreover, the major investment from car and logistics companies in the development of hydrogen infrastructure for this transition is further propelling the growth of the industry. Additional exploration of hydrogen-based fuels in the aviation and maritime industries for fulfilling severe carbon emission targets is driving the market expansion in the country.

United States Green Hydrogen Market Trends:

Expansion of Hydrogen Infrastructure

Among the major factors driving market growth are setting a hydrogen infrastructure in the US at a robust level. Additional substantial investments have been channeled in the country to establish hydrogen hubs that include pipelines, storage options, and production facilities. For instance, $7 billion is available in Regional Clean Hydrogen Hubs Program (H2Hubs) funding in developing regional clean hydrogen hubs across the US. It is part of the Bipartisan Infrastructure Law's broader $8 billion hydrogen hub program. The H2Hubs will form the foundation of a national clean hydrogen network that will greatly help to decarbonize several sectors of the economy, including heavy industry and heavy-duty transportation.

Growing Corporate and Industrial Investments

The growing involvement of the private sector is also promoting the market expansion for green hydrogen. The market is rising straight because businesses operating within different sectors are investing heavily in green hydrogen projects so as to meet their environmental, social, and governance responsibilities. Moreover, the market is increasing due to the growing partnerships of leading companies, like energy majors, automobile manufacturers, and industrial producers, in designing end-to-end hydrogen solutions. For example, 3M announced in July 2024 that it had completed a strategic investment in Ohmium International, an electrolyzer system manufacturer for green hydrogen production. This investment might further decarbonize 3M's operations in the pursuit of its aim to develop solutions that promote the transition to a low-carbon economy.

Rapid Technological Advancements

Growing technological developments that increase the efficiency and affordability of green hydrogen generation and use are broadening the scope of the market. Accordingly, a major advancement has been made in the creation of high-efficiency electrolyzers that split water into hydrogen and oxygen using renewable power. In addition, the market is experiencing growth because to American firms' increased emphasis on increasing output and investigating novel designs, such solid oxide and anion exchange membrane electrolyzers, to increase efficiency and reduce prices. For instance, Bloom Energy Inc. and Shell Plc. (Shell) are collaborating to investigate decarbonization options using Bloom's in-house hydrogen electrolyzer technology. The two businesses are working together to create large-scale, repeatable solid oxide electrolyzer (SOEC) devices that would create hydrogen for potential use at Shell assets.

United States Green Hydrogen Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States green hydrogen market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on technology, application, and distribution channel.

Analysis by Technology:

- Proton Exchange Membrane Electrolyzer

- Alkaline Electrolyzer

- Others

Proton exchange membrane (PEM) electrolyzers are effective, small, and can work with a range of loads. Its solid polymer membrane electrolyte permits high-purity hydrogen generation and rapid startup times. They are a popular option for applications where dependability and compatibility with renewable energy are crucial, such energy storage, industrial processes, and transportation, because to their flexibility and scalability.

Large-scale industrial applications employ alkaline electrolyzers because of their affordability and longevity. They are appropriate for continuous operations and high hydrogen generation quantities, and they use liquid electrolytes such potassium hydroxide. They are also attractive to businesses like steelmaking, chemical manufacturing, and ammonia production given their comparatively low capital expenditures.

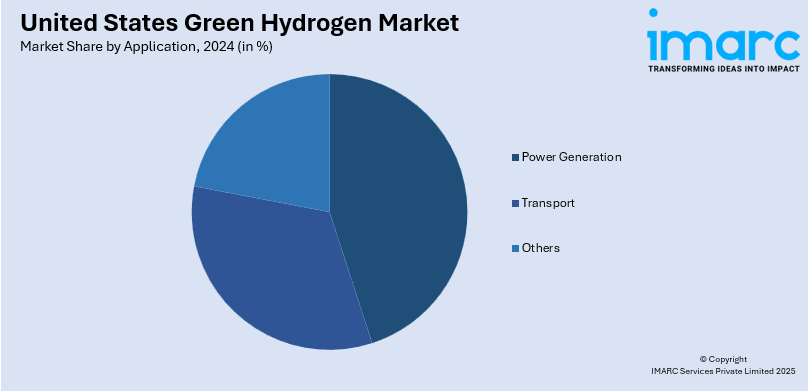

Analysis by Application:

- Power Generation

- Transport

- Others

In power generation, green hydrogen is essential, particularly for grid stabilization and the utilization of renewable energy sources. It provides an environmentally friendly replacement for fossil fuels in the creation of power through the use of hydrogen turbines and fuel cells. Furthermore, the market is expanding partly because of its capacity to store extra renewable energy for later use, guaranteeing energy supply during periods of low wind or sunshine.

Green hydrogen's ability to reduce greenhouse gases in long-distance and heavy-duty transportation is making it a promising application in the transportation industry. Accordingly, hydrogen fuel cells are perfect for trucks, buses, trains, and ships as they provide quicker refilling times and a higher energy density than battery-electric options.

Analysis by Distribution Channel:

- Pipeline

- Cargo

Green hydrogen is regularly and extensively supplied via pipelines to industrial centers and hydrogen recharging stations. They deliver an economical and effective way to move hydrogen across large distances while reducing transit energy losses. Furthermore, this sector is expanding as a result of the growing emphasis on reusing or combining current natural gas pipeline networks with hydrogen to speed up its delivery.

Green hydrogen delivery to isolated areas and smaller-scale users requires cargo-based distribution, which includes shipping, rail, and road transportation. This approach is adaptable and appropriate for areas without pipeline infrastructure since hydrogen can either be transferred as compressed gas or liquefied in specialized tanks. In addition, cargo distribution plays an important role in the early phases of market growth as it lets hydrogen producers to reach a wide range of consumers.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region's green hydrogen adoption is growing due to its dense population, ambitious state-level climate policies, and focus on decarbonizing urban transportation. Moreover, the rising investment heavily in hydrogen infrastructure, including fueling stations and production facilities, is acting as a growth-inducing factor. Besides this, the region's strong renewable energy base, such as offshore wind, which provides a steady supply of clean electricity for hydrogen production, is fueling the market growth.

With an emphasis on decarbonizing enterprises like steel and fertilizer manufacturing, the Midwest is using its industrial and agricultural sectors to propel the adoption of green hydrogen. The industry is expanding as a result of rising investments in hydrogen hubs that take advantage of the region's abundant wind energy resources.

Because to its vast natural gas infrastructure, availability of renewable energy, and pro-green state legislation, the South is establishing itself as a green hydrogen powerhouse. Aside from this, the region's wealth of solar energy and knowledge of energy infrastructure are fostering a favorable market perspective.

The West region is at the forefront of the green hydrogen market, owing to its stringent emissions regulations and ambitious renewable energy targets. Moreover, the vast solar and wind resources that enable cost-effective hydrogen production are fostering the market growth. Besides this, the increasing focus on integrating hydrogen into public transit systems, trucking, and port operations is enhancing the market growth.

Competitive Landscape:

To propel the market's expansion, the leading companies are increasing production capacity, developing technology, and encouraging cross-sector partnerships. In an effort to reduce manufacturing costs, they are also investing in extensive electrolyzer projects and increasing efficiency. In addition, several businesses are attempting to incorporate green hydrogen into industrial processes including steel manufacture, chemical synthesis, and refining in order to reach decarbonization targets. Aside from this, they are working to increase the use of hydrogen-powered vehicles by developing fuel cell technology and building infrastructure for refilling. Likewise, to hasten the adoption of hydrogen solutions, top companies are establishing strategic alliances with energy producers, business leaders, and technology suppliers.

The report provides a comprehensive analysis of the competitive landscape in the United States green hydrogen market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, the hydrogen solutions company, Plug Power announced that it had obtained a conditional commitment of $1.66 billion loan guarantee from the Loan Programs Office (LPO) of the US Department of Energy (DOE) to fund the creation, building, and ownership of six green hydrogen production facilities in the US.

-

In March 2024, ABB stated that it is collaborating with Green Hydrogen International (GHI) to build a sizable green hydrogen factory in South Texas, USA. They agreed to a Memorandum of Understanding (MoU) that permits the use of ABB's digital technologies, automation, and electrification in the GHI Hydrogen City project. This Power-to-X project intends to run a 2.2GW electrolyser plant using solar and onshore wind energy to generate 280,000 tons of green hydrogen yearly, which will then be converted into one million tonnes of green ammonia every year.

United States Green Hydrogen Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Proton Exchange Membrane Electrolyzer, Alkaline Electrolyzer, Others |

| Applications Covered | Power Generation, Transport, Others |

| Distribution Channels Covered | Pipeline, Cargo |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States green hydrogen market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States green hydrogen market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States green hydrogen industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Green hydrogen refers to hydrogen produced using renewable energy sources such as wind and solar power through processes like electrolysis, ensuring minimal carbon emissions. It is a clean energy alternative aimed at decarbonizing industries, transportation, and power generation while supporting the nation’s transition to a sustainable energy future.

The United States green hydrogen market was valued at USD 273.9 Million in 2024.

IMARC estimates the United States green hydrogen market to exhibit a CAGR of 38.2% during 2025-2033.

The market is driven by the imposition of supportive government policies, rapid advancements in hydrogen technologies, expanding transportation applications, increased private-sector investments, and the development of robust hydrogen production, storage, and distribution infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)