United States Healthcare Discount Plan Market Size, Share, Trends and Forecast by Service, and Region, 2026-2034

United States Healthcare Discount Plan Market Summary:

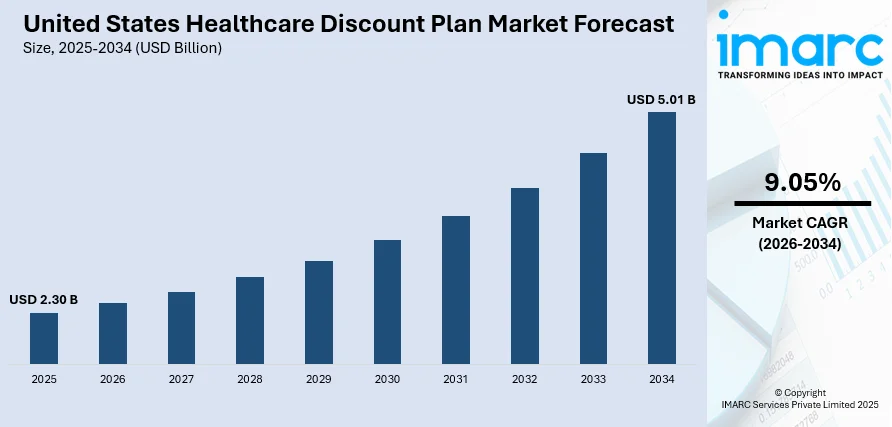

The United States healthcare discount plan market size was valued at USD 2.30 Billion in 2025 and is projected to reach USD 5.01 Billion by 2034, growing at a compound annual growth rate of 9.05% from 2026-2034.

The United States healthcare discount plan market is growing strongly, driven by rising medical costs and increasing demand for affordable care. These plans offer pre-negotiated discounts on dental, vision, prescription drugs, and telehealth services, making healthcare more accessible. Targeting uninsured and underinsured Americans, they provide cost-effective alternatives to traditional insurance, helping individuals manage expenses while ensuring access to essential medical services and promoting overall healthcare affordability.

Key Takeaways and Insights:

-

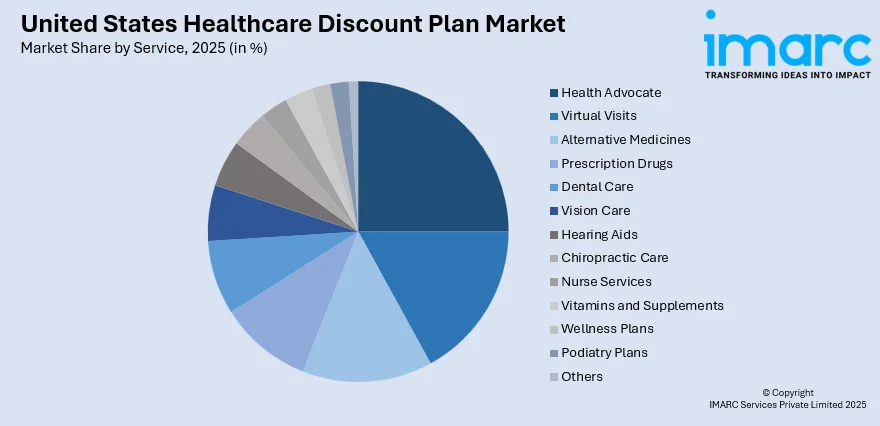

By Service: Prescription drugs leads the market with a share of 18% in 2025, driven by continuously rising medication costs and widespread consumer need for affordable access to essential pharmaceuticals across all demographic segments.

-

Key Players: The United States healthcare discount plan market exhibits a fragmented competitive landscape, with major discount medical plan organizations and established healthcare companies competing alongside regional providers to capture market share through innovative service offerings and expanded provider networks.

To get more information on this market Request Sample

The United States healthcare discount plan market continues to evolve as consumers increasingly prioritize affordability and accessibility in their healthcare decisions. The shift towards consumer-driven healthcare has accelerated adoption of discount plans, particularly among individuals seeking transparency in pricing and personalized healthcare experiences. For example, in September 2025, UnitedHealthcare recently launched a direct-to-consumer marketplace called the UHC Store, broadening access to discounted wellness programs and benefits for millions of members. These plans have become essential alternatives for populations facing high-deductible insurance coverage or substantial out-of-pocket expenses. The integration of telehealth services into discount plan offerings has further enhanced market appeal, enabling members to access virtual consultations at reduced costs. Provider network expansion remains a critical focus for market participants, with coverage now reaching a majority of healthcare facilities nationwide, strengthening the value proposition for prospective members.

United States Healthcare Discount Plan Market Trends:

Telehealth Integration Reshaping Service Delivery

Healthcare discount plans are increasingly integrating telehealth services to meet rising demand for convenience and accessibility. This approach allows members to consult healthcare professionals remotely, making non-emergency care more reachable while reducing overall costs. For example, in 2025, Health In Tech announced a strategic collaboration with telehealth provider DialCare to integrate virtual primary care, mental health, and behavioral health services into its self-funded health plan offerings, giving members streamlined access to licensed clinicians via phone or video consultations. By combining traditional in-person services with virtual consultations, discount plans enhance member experience, improve care efficiency, and position themselves as modern, flexible solutions in a rapidly evolving healthcare landscape.

Consumer-Driven Healthcare Accelerating Adoption

The shift toward consumer-driven healthcare is reshaping the market as individuals take greater control over their health decisions. Patients are seeking transparency in pricing, service options, and care quality, making discount plans more appealing. In August 2025, Blue Shield of California launched a first-in-the-nation digital experience that provides real-time prescription cost comparisons and alternative lower-cost options directly to members via mobile app notifications, enhancing decision-making and price transparency for consumers. These plans cater to informed consumers by offering predictable costs and clear benefits, enabling members to make value-based choices while maintaining access to essential healthcare services, ultimately fostering higher adoption rates across diverse demographic segments.

Network Expansion Strengthening Market Penetration

Discount plan providers are actively expanding provider networks to enhance member access and market presence. Broader networks allow enrollees to benefit from discounted services across multiple healthcare specialties, increasing plan attractiveness. In 2025, U.S. federal legislation extended key Medicare telehealth flexibilities, such as waiving geographic restrictions and expanding eligible provider types, through at least March 31, 2025, enabling more providers to deliver virtual care services that contribute to broader network accessibility for patients nationwide. Strategic expansion into new regions strengthens geographic coverage, improves member satisfaction, and drives enrolment growth. By offering comprehensive, accessible networks, providers position themselves as competitive options, catering to diverse consumer needs while maximizing market penetration and long-term sustainability.

Market Outlook 2026-2034:

The United States healthcare discount plan market outlook remains positive as rising healthcare expenditures continue pushing consumers toward affordable alternatives. The aging population requiring increased healthcare services combined with growing awareness of discount plan benefits is expected to sustain strong enrollment growth. Strategic partnerships between discount plan providers and healthcare facilities are anticipated to further expand service accessibility. The market generated a revenue of USD 2.30 Billion in 2025 and is projected to reach a revenue of USD 5.01 Billion by 2034, growing at a compound annual growth rate of 9.05% from 2026-2034.

United States Healthcare Discount Plan Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Service | Prescription Drugs | 18% |

Service Insights:

Access the comprehensive market breakdown Request Sample

- Health Advocate

- Virtual Visits

- Alternative Medicines

- Prescription Drugs

- Dental Care

- Vision Care

- Hearing Aids

- Chiropractic Care

- Nurse Services

- Vitamins and Supplements

- Wellness Plans

- Podiatry Plans

- Others

The prescription drugs dominates with a market share of 18% of the total United States healthcare discount plan market in 2025.

The prescription drugs segment maintains its leading position within the United States healthcare discount plan market due to persistently rising medication costs affecting consumers across all income levels. Discount plans offering substantial savings on pharmaceutical purchases have become increasingly attractive to individuals managing chronic conditions requiring ongoing medication regimens. In 2025 GoodRx expanded its partnership with Kroger’s healthcare division to include branded medications in its RxSmartSaver program, allowing customers to access discounted prescription pricing at Kroger pharmacies nationwide and strengthening its pharmaceutical network reach for discount plan members.

The segment benefits from widespread consumer awareness regarding prescription cost disparities and growing demand for affordable medication access solutions. Healthcare discount plan providers are actively expanding pharmaceutical network partnerships to improve member savings and enhance prescription accessibility. The inclusion of generic medication alternatives and mail-order pharmacy services further increases the attractiveness of discount plans for cost-conscious consumers. Additionally, rising specialty drug prices and the continuous expansion of pharmaceutical product portfolios are expected to sustain the prescription drugs segment’s dominant position throughout the forecast period.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast market grows strongly due to dense metropolitan populations and high healthcare costs from premium facilities. Middle-income urban consumers increasingly adopt discount plans to manage elevated medical expenses. The combination of cost-conscious behavior and demand for accessible healthcare drives steady uptake, making the region a key area for discount plan growth and adoption.

The Midwest shows consistent market growth supported by established employer-sponsored healthcare and rising demand from aging populations. Discount plans appeal to individuals seeking supplementary savings beyond traditional coverage, while collective-bargaining frameworks maintain comprehensive benefits. This balance of tradition and cost-conscious adoption positions the Midwest as a stable region for discount plan penetration and incremental market expansion.

The South plays an important role in the market due to high uninsured and underinsured populations seeking affordable healthcare alternatives. Economic disparities and prevalent chronic diseases drive strong demand for discount plans covering essential medical, dental, and prescription services. Cost-effective access solutions are central to consumer adoption, positioning the South as a dominant region in the healthcare discount market.

The West experiences the fastest growth, driven by diverse demographics and varied income levels across urban and rural areas. Rising health awareness and increasing telehealth integration enhance the appeal of discount plans. These plans address evolving consumer preferences for accessible, flexible healthcare services, making the West a dynamic region for rapid market expansion and innovation.

Market Dynamics:

Growth Drivers:

Why is the United States Healthcare Discount Plan Market Growing?

Escalating Healthcare Expenditures Driving Consumer Demand

The continuous increase in healthcare expenses across the United States is significantly propelling market growth as consumers actively seek affordable alternatives to traditional health insurance coverage. Rising costs of medical services, prescription medications, and administrative expenses combined with an aging population requiring enhanced healthcare services contribute to sustained demand for discount plan memberships. A recent Gallup poll found that nearly one-quarter of Americans now say the U.S. healthcare system is in crisis, with high costs cited as the most urgent issue, and many postponing care because of expense concern. Healthcare discount plans offer immediate savings on various medical services without deductibles or waiting periods, making them attractive options for individuals facing high out-of-pocket expenses.

Growing Uninsured and Underinsured Population Segments

The substantial population of uninsured and underinsured individuals across the United States creates significant market opportunities for healthcare discount plan providers. Many Americans remain ineligible for government subsidies or find traditional insurance premiums beyond their financial reach, making discount plans essential alternatives for healthcare access. According to the U.S. Census Bureau’s Small Area Health Insurance Estimates, the uninsured rate for people under age 65 in many counties remained above 9% in 2023, with notable variation across regions, highlighting persistent coverage gaps. Individuals with high-deductible health plans increasingly supplement their coverage with discount memberships to manage out-of-pocket expenses effectively. The flexibility of discount plans in covering services often excluded from traditional insurance, including dental, vision, and alternative medicine, further expands their appeal among underserved population segments seeking comprehensive healthcare solutions.

Consumer-Driven Healthcare Transformation

The fundamental shift toward consumer-driven healthcare significantly impacts market dynamics as individuals take increasingly active roles in their healthcare decisions. Modern consumers prioritize transparency, convenience, and personalized healthcare experiences, demanding clear communication regarding service costs and treatment options. Reinforcing this shift, the Centers for Medicare & Medicaid Services (CMS) strengthened enforcement of the Hospital Price Transparency Rule, requiring hospitals to provide clear, accessible pricing information for services, empowering consumers to compare costs before seeking care. Healthcare discount plans align perfectly with these evolving expectations by providing upfront pricing information and direct access to discounted services without complex claims processes. The emphasis on wellness and preventive care among health-conscious consumers further drives enrolment in discount programs offering comprehensive benefits spanning medical, dental, vision, and wellness services.

Market Restraints:

What Challenges the United States Healthcare Discount Plan Market is Facing?

Consumer Confusion Regarding Plan Limitations

Healthcare discount plans often face consumer confusion, as many mistakenly perceive them as traditional insurance. This misunderstanding can cause dissatisfaction when expected coverage for major medical events is not provided. Clear communication about plan scope, exclusions, and limitations is essential to set realistic expectations, improve member understanding, and enhance satisfaction with discount plan offerings.

Provider Network Inconsistencies

Variations in provider networks across regions pose challenges for discount plan members seeking consistent care. Limited participation in certain areas, particularly rural communities, reduces accessibility and diminishes plan appeal. Expanding and standardizing networks is crucial to ensure reliable service access, enhance member satisfaction, and strengthen the competitiveness of discount plans across diverse geographic markets.

Regulatory Compliance Requirements

Evolving state and federal regulations governing discount medical plans create operational and compliance complexities for providers. Differences in requirements across jurisdictions increase administrative costs and may limit market expansion. Staying updated with regulatory changes, implementing robust compliance processes, and ensuring adherence across all operations is critical for sustaining growth and maintaining legal and operational integrity.

Competitive Landscape:

The United States healthcare discount plan market exhibits a fragmented competitive structure with numerous discount medical plan organizations competing alongside established healthcare and insurance companies for market share. Large multinationals leverage extensive provider networks and brand recognition to attract members, while smaller regional providers differentiate through specialized service offerings and localized market expertise. Market participants focus on continuous innovation in plan design and benefit structures to address evolving consumer preferences for comprehensive and affordable healthcare solutions. Strategic partnerships with healthcare providers, pharmacies, and technology platforms remain critical competitive strategies enabling network expansion and service enhancement. The competitive intensity drives ongoing improvements in member value propositions, pricing transparency, and customer service capabilities across the market landscape.

Recent Developments:

-

In December 2025, Included Health has launched Dot, an AI-powered personal health assistant designed to help patients navigate benefits and care using claims and benefits data. The move marks a significant expansion of digital health tools in the U.S., aiming to simplify healthcare access and decision-making for consumers.

United States Healthcare Discount Plan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Health Advocate, Virtual Visits, Alternative Medicines, Prescription Drugs, Dental Care, Vision Care, Hearing Aids, Chiropractic Care, Nurse Services, Vitamins and Supplements, Wellness Plans, Podiatry Plans, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States healthcare discount plan market size was valued at USD 2.30 Billion in 2025.

The United States healthcare discount plan market is expected to grow at a compound annual growth rate of 9.05% from 2026-2034 to reach USD 5.01 Billion by 2034.

The prescription drugs segment dominates the market with an 18% share, driven by rising medication costs and consumer demand for affordable pharmaceutical access across all demographic segments nationwide.

Key factors driving the United States healthcare discount plan market include escalating healthcare expenditures, growing uninsured and underinsured population segments, and the shift toward consumer-driven healthcare emphasizing transparency and affordability.

Major challenges include consumer confusion regarding plan limitations versus traditional insurance, provider network inconsistencies across geographic regions, evolving regulatory compliance requirements, and competition from alternative healthcare financing solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)