U.S. Healthcare IT Market Size, Share, Trends and Forecast by Product and Services, Component, Delivery Mode, End User, and Region, 2025-2033

U.S. Healthcare IT Market Size and Share:

The U.S. healthcare IT market size was valued at USD 104 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 325.2 Billion by 2033, exhibiting a CAGR of 13.1% from 2025-2033. The widespread adoption of electronic health records (EHR), growth of telemedicine, the rising need for efficient healthcare management systems, significant advancements in AI, data analytics, and cloud computing, favorable government regulations, and the increasing push for better healthcare interoperability are some of the major factors driving the growth of the market across the United States.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 104 Billion |

|

Market Forecast in 2033

|

USD 325.2 Billion |

| Market Growth Rate 2025-2033 | 13.1% |

One of the primary market drivers is the aging population in the United States, which, coupled with an increase in chronic diseases, is pushing the healthcare sector to adopt IT solutions that improve care delivery and patient management. The growing consumer demand for personalized healthcare experiences is further encouraging the adoption of patient-centered technologies, such as mobile health apps and wearable devices. Additionally, the integration of value-based care models in the United States healthcare system is driving the need for robust IT infrastructures that support efficient data management, interoperability, and outcome tracking.

The market is being influenced by the growing emphasis on interoperability and health information exchange (HIE). The ability to seamlessly share patient data across healthcare providers and systems is critical to delivering integrated and efficient care. Innovations like Fast Healthcare Interoperability Resources (FHIR) standards and blockchain-based data sharing are gaining traction to address these challenges. Another key trend is the rise of consumer-focused healthcare IT solutions, including mobile apps and patient portals, which empower patients to take a more active role in managing their health. Furthermore, the growing adoption of cloud computing in healthcare IT is enabling scalability, cost savings, and secure storage of massive health datasets, supporting the sector's digital transformation.

U.S. Healthcare IT Market Trends:

Government Initiatives and Regulations

The U.S. government's emphasis on healthcare reforms and initiatives like the Affordable Care Act and the HITECH Act serve as a significant driver of the healthcare IT market. For instance, in September 2024, The U.S. Department of Health and Human Services (HHS), through the Assistant Secretary for Technology Policy/Office of the National Coordinator for Health Information Technology (hereafter ASTP), published the final 2024-2030 Federal Health IT Strategic Plan, by the Health Information Technology for Economic and Clinical Health (HITECH Act.) The Strategic Plan presents federal health information technology (health IT) goals and objectives to achieve a future state where health IT and electronic health information are used to promote health and wellness, enhance the delivery and experience of care, accelerate research and innovation, and connect the health system with health data. These regulations push healthcare providers to adopt electronic health records (EHR), improve data sharing, and enhance overall healthcare efficiency.

Rising Demand for Telemedicine and Remote Healthcare

The growing demand for telemedicine, especially accelerated by the COVID-19 pandemic, is a key factor driving the healthcare IT market across the United States. Telemedicine requires advanced IT solutions for virtual consultations, patient monitoring, and remote diagnostics. As patients increasingly seek convenient, at-home care options, healthcare providers are investing in digital tools and platforms to offer telehealth services, ensuring continuity of care while reducing costs and enhancing accessibility. For instance, in May 2024, LG Electronics announced the launch of a new venture, Primefocus Health, which will develop a provider-facing healthcare-delivery platform that leverages technologies and therapies to aid in remote patient monitoring and give patients access to new therapies through technology applications. It will also allow providers to collect patient data, communicate with patients, track progress, and intervene when needed.

Advancements in Data Analytics and AI

Healthcare organizations are increasingly leveraging advanced data analytics and artificial intelligence (AI) to enhance decision-making and patient outcomes. These technologies help in predictive analytics, diagnosing diseases, and personalizing treatment plans. As AI tools and big data applications evolve, healthcare IT systems can provide more efficient, precise, and cost-effective services. This transformation is helping providers manage vast amounts of health data while improving overall care delivery. For instance, in November 2024, GE HealthCare announced the launch of a new AI Innovation Lab to accelerate early-concept artificial intelligence (AI) solutions. The projects are part of GE HealthCare’s broader AI and digital strategy, which is focused on integrating AI into medical devices, building AI applications that enhance decision-making across the care journey and disease states, and using AI to support better outcomes and operational efficiencies system-wide.

U.S. Healthcare IT Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. healthcare IT market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product and services, component, delivery mode, end user, and region.

Analysis by Product and Services:

- Healthcare Provider Solutions

- Clinical Solutions

- Nonclinical Healthcare IT Solutions

- Healthcare Payer Solutions

- Pharmacy Audit and Analysis Systems

- Claims Management Solutions

- Analytics and Fraud Management Solutions

- Member Eligibility Management Solutions

- Provider Network Management Solutions

- Billing and Accounts (Payment) Management Solutions

- Customer Relationship Management Solutions

- Population Health Management Solutions

- Others

- Healthcare IT Outsourcing Services

- Provider HCIT Outsourcing Services Market

- Payer IT Outsourcing Services

- Operational IT Outsourcing Services

Healthcare provider solutions are expected to capture the largest share due to increasing demand for electronic health records (EHR), patient management systems, and telemedicine. Healthcare providers are adopting these solutions to improve operational efficiency, patient care, and regulatory compliance, spurred by government incentives and the growing need for digital transformation in healthcare.

Healthcare payer solutions are expected to witness significant growth in the market due to the rising demand for advanced analytics, claims management, and fraud prevention systems. Healthcare payers are investing in IT solutions to streamline operations, reduce costs, and improve customer service, driven by the need for better data management and adherence to evolving regulations.

The growth in outsourcing services is driven by healthcare organizations seeking cost-effective solutions for managing IT infrastructure, data storage, and software development. Outsourcing enables healthcare providers and payers to focus on core competencies while leveraging specialized expertise, reducing operational costs, and ensuring compliance with complex healthcare regulations.

Analysis by Component:

- Software

- Hardware

- Services

Software is expected to dominate due to the increasing need for integrated healthcare systems such as electronic health records (EHR), telemedicine platforms, and health information exchanges. These solutions improve patient care, streamline workflows, and ensure compliance with regulations, driving demand for advanced, customizable software solutions across healthcare providers and payers.

Hardware plays a critical role as healthcare institutions invest in servers, storage, and medical devices to support growing data volumes and ensure seamless patient care. The adoption of connected medical devices, wearable technologies, and infrastructure upgrades to support electronic health systems fuels demand for healthcare-related hardware, driving its market share.

Healthcare IT services, including consulting, maintenance, and system integration, are vital for organizations implementing or upgrading digital health solutions. These services help streamline processes, ensure proper integration with existing systems, and maintain regulatory compliance, contributing to their growing share in the healthcare IT market as providers and payers prioritize efficient, compliant healthcare IT operations.

Analysis by Delivery Mode:

- On-premises

- Cloud-based

On-premises solutions remain a dominant choice for healthcare organizations due to data security concerns, control over sensitive patient information, and compliance with regulations. These systems offer customized and robust infrastructure tailored to the specific needs of healthcare providers, driving their continued preference for secure, in-house IT solutions.

Cloud-based solutions are gaining significant traction due to their scalability, cost-effectiveness, and flexibility. With healthcare organizations embracing digital transformation, cloud computing offers seamless data storage, access, and integration, along with the ability to easily adapt to growing data volumes and evolving patient care needs, making it a major player in the healthcare IT market.

Analysis by End User:

- Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Home Healthcare Agencies, Nursing Homes, and Assisted Living Facilities

- Diagnostic and Imaging Centers

- Pharmacies

- Healthcare Payers

- Private Payers

- Public Payers

- Others

Healthcare providers are expected to hold the largest share of the market due to the growing need for electronic health records (EHR), telemedicine, and other IT solutions to improve patient care, enhance operational efficiency, and meet regulatory standards. The shift toward digital healthcare solutions is driving investments in advanced IT systems for providers.

Healthcare payers, including insurance companies, are key drivers of the market due to their need for robust data analytics, claims processing, and fraud detection systems. As the industry transitions toward value-based care, payers rely on healthcare IT solutions to streamline operations, reduce costs, and improve patient outcomes through efficient data management and decision-making.

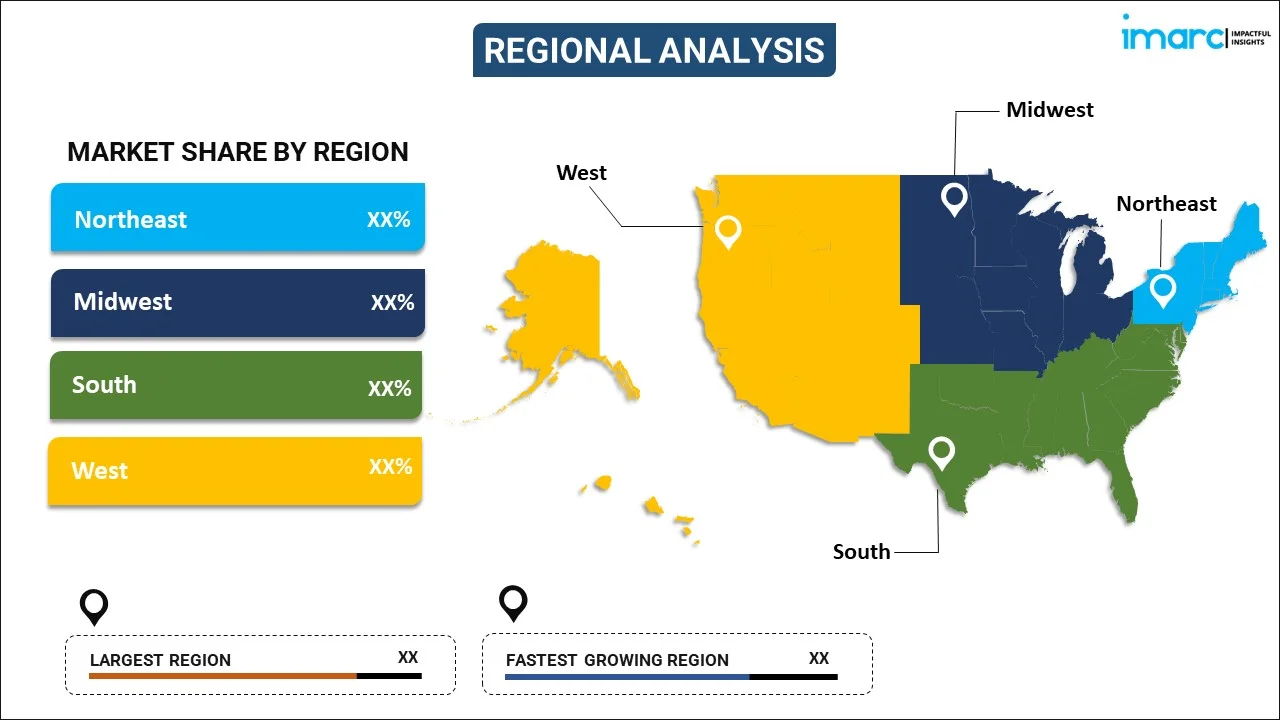

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northeast United States, the market is driven by the high concentration of healthcare providers, research institutions, and technological innovation hubs. These regions prioritize advanced healthcare IT solutions, including electronic health records and telemedicine, to improve patient outcomes, efficiency, and regulatory compliance. The focus on digital health transformation further fuels market growth in this region.

In the Midwest United States, the market is influenced by the increasing adoption of digital health solutions by both rural and urban healthcare facilities. Affordable care initiatives, along with government incentives, drive the need for healthcare IT solutions to improve patient care, streamline administrative tasks, and ensure interoperability across various healthcare systems in the region.

In the Southern United States, the market is propelled by the growing demand for telemedicine, patient engagement tools, and cost-effective IT solutions. Expanding healthcare networks, particularly in underserved areas, drive healthcare providers to invest in digital technologies. Additionally, the region’s efforts to improve healthcare access through digital means further promote healthcare IT adoption.

The West is a hub for technological innovation, with a focus on health tech startups and large healthcare organizations investing in advanced IT solutions. The region’s emphasis on telehealth, personalized medicine, and data analytics accelerates market growth. Additionally, government initiatives and healthcare policy changes supporting digital healthcare transformations further drive IT investments in this region.

Competitive Landscape:

The market in the United States is highly competitive, with key players offering a wide range of solutions such as EHRs, telemedicine platforms, and AI-driven data analytics. The competition is driven by technological innovation, regulatory compliance, and customer service. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their market presence, improve product offerings, and enhance integration capabilities within healthcare ecosystems. For instance, in October 2024, Microsoft announced the launch of several artificial intelligence enhancements in Microsoft Cloud for Healthcare innovations, including new healthcare AI models in Azure AI Studio, new healthcare data capabilities in Microsoft Fabric, and developer tools in Copilot Studio.

The report provides a comprehensive analysis of the competitive landscape in the U.S. healthcare IT market with detailed profiles of all major companies.

Latest News and Developments:

- In October 2024, Amazon One Medical launched AI tools to help doctors get back to focusing on patient care. Amazon’s technology teams work hand in hand with Amazon One Medical providers to develop effective, real-world AI solutions that simplify provider workflows while enhancing patient experiences. Amazon One Medical’s proprietary electronic health record system, 1Life, enables Amazon’s technology teams to continuously iterate, test, and refine the tools available to Amazon One Medical providers.

- In September 2024, Palantir Technologies Inc., and Nebraska Medicine, a $2.5B academic health system based in Omaha, and a national leader in healthcare innovation, announced a new multi-year, multi-million-dollar contract for Palantir’s Artificial Intelligence Platform (AIP) to help improve healthcare through transformational technologies.

- In July 2024, Maverick Medical AI announced a significant expansion of its presence in the United States through a new partnership with a leading national medical provider specializing in the growing outpatient radiology sector. In under three months, Maverick successfully transitioned the provider from contract signing to full implementation, achieving an impressive 85% direct-to-bill rate and over 93% accuracy with its groundbreaking real-time AI autonomous medical coding platform.

U.S. Healthcare IT Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product and Services Covered |

|

| Components Covered | Software, Hardware, Services |

| Delivery Modes Covered | On-premises, Cloud-based |

| End Users Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. healthcare IT market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. healthcare IT market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. healthcare IT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Healthcare IT refers to the application of information technology solutions like electronic health records (EHR), telemedicine platforms, AI, and data analytics in healthcare to enhance care delivery, improve patient outcomes, streamline operations, and ensure regulatory compliance. It promotes interoperability, personalized medicine, and value-based care.

The U.S. healthcare IT market was valued at USD 104 Billion in 2024.

IMARC estimates the U.S. healthcare IT market to exhibit a CAGR of 13.1% during 2025-2033.

The market is driven by the growing adoption of EHRs, telemedicine, AI, and data analytics, the need for efficient healthcare management, an aging population, value-based care models, government initiatives, and the push for interoperability and secure health data exchange.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)