U.S. Hemostats Market Size, Share, Trends and Forecast by Product, Application, Formulation, and Region, 2025-2033

U.S. Hemostats Market Size and Share:

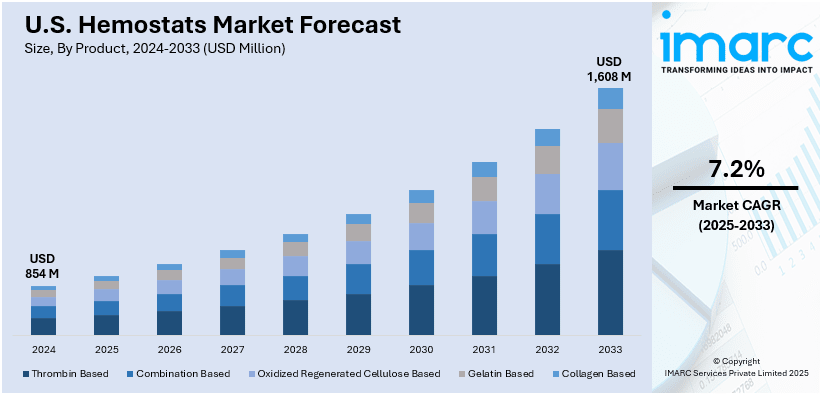

The U.S. hemostats market size was valued at USD 854 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,608 Million by 2033, exhibiting a CAGR of 7.2% from 2025-2033. The market is primarily driven by the considerable rise in personalized and precision solutions for specific surgical needs, widespread AI integration for improved decision-making and efficiency, and growing demand for portable, user-friendly products in ambulatory surgical centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 854 Million |

|

Market Forecast in 2033

|

USD 1,608 Million |

| Market Growth Rate 2025-2033 | 7.2% |

U.S. Hemostats Market Analysis:

- Major Market Drivers: Rising surgical procedures, aging demographics, and chronic disease prevalence drive U.S. hemostats market growth. Advanced minimally invasive techniques require precise bleeding control. FDA breakthrough device designations for innovative products like LifeGel and technological improvements in bioabsorbable materials accelerate market expansion through enhanced surgical outcomes and reduced operative complications.

- Key Market Trends: The market share benefits from AI-driven surgical solutions, personalized medicine approaches, and ambulatory surgical center expansion. Room-temperature storage products eliminate refrigeration needs. Synthetic polymer technologies and combination-based agents offer dual hemostatic-antimicrobial properties, addressing surgeon demands for versatile, easy-to-use solutions in complex procedures.

- Competitive Landscape: Market leaders including Baxter, Ethicon, and Pfizer dominate through continuous innovation and strategic partnerships. The market demand intensifies competition, driving research investments and product portfolio expansions. Emerging players contribute specialized solutions for specific applications, fostering dynamic competitive environment with focus on bioabsorbable and highly effective hemostatic technologies.

- Challenges and Opportunities: High costs of advanced hemostats create accessibility barriers while stringent regulatory requirements delay market entry. However, U.S. hemostats market analysis reveals opportunities in emerging applications, personalized surgical solutions, and expanding ambulatory settings. Growing trauma care needs and military applications present substantial growth potential for innovative hemostatic technologies.

The increasing number of surgeries in the United States greatly contributes to the growth of the hemostats market. Based on a 2024 NCBI study, 11% of Americans had a surgical procedure within the last year, with the highest rate among individuals 65 and older and those on Medicare, where 20% had undergone surgery. The rise in treatments for long-term illnesses such as heart problems, bone and joint conditions, and cancer is associated with a growing number of older people and better availability of healthcare services. Hemostats are crucial in reducing blood loss and improving accuracy in surgeries, especially those that are complex and minimally invasive. Increasingly, absorbable gels and patches are being utilized to enhance results, speed up recovery, and guarantee successful bleeding control.

To get more information on this market, Request Sample

In addition to this, continual technological advancements are driving the U.S. hemostats market demand with innovations such as bioabsorbable materials, synthetic polymers, and dual-action agents offering both hemostasis and antimicrobial properties. These developments have revolutionized surgical care, making hemostats more efficient, adaptable, and easier to use. For example, on October 01, 2024, Arch Therapeutics will showcase its FDA-cleared AC5® Advanced Wound System at the 2024 SAWC Fall Meeting, highlighting its self-assembling mechanism for bleeding control and wound healing in complex cases. Products such as combination-based hemostats and non-swelling gels are addressing challenges in confined surgical spaces including spinal and neurological procedures. These advancements improve outcomes, reduce operative time, and encourage adoption, with ongoing research ensuring continuous innovation.

U.S. Hemostats Market Trends:

Rapid Integration of Artificial Intelligence (AI)

Artificial Intelligence (AI) is increasingly transforming surgical practices, streamlining processes, and improving outcomes. On August 15, 2024, Caresyntax secured USD 180 Million in Series C funding, including an eight-figure investment from surgical.ai, to enhance its AI-enabled surgical software platform. Used by 30,000 professionals across 3,500 operating rooms, the platform integrates real-time data analysis to improve precision surgery, reduce costs, and optimize workflows. AI’s application extends to hemostatic products, assisting surgeons in selecting the most suitable agents by analyzing patient-specific data in real time. This approach minimizes procedural risks, enhances decision-making, and improves surgical efficiency. The adoption of intelligent hemostatic solutions, enabled by AI-driven tools, is reshaping surgical care, ensuring better patient outcomes while addressing challenges in complex procedures.

Increasing Demand in Ambulatory Surgical Centers

The growing number of procedures conducted in ambulatory surgical centers (ASCs) is significantly driving demand for portable and easy-to-use hemostatic products. According to Surgical Information Systems, there are over 6,300 Medicare-certified ASCs in the United States, with more than 18,000 operating rooms and an annual growth rate of 2.1%. ASCs prioritize efficiency and quick turnaround times, necessitating compact and user-friendly hemostatic solutions that support outpatient procedures. These products must ensure effective bleeding control while being adaptable to a variety of surgical scenarios. Manufacturers are focusing on developing advanced hemostats tailored for these settings, addressing the need for precision, speed, and ease of application. This trend highlights the pivotal role of hemostatic products in enhancing ASC operational efficiency and improving patient outcomes in outpatient surgical care.

Personalized and Precision Hemostats

The market is being increasingly influenced by the increasing emphasis on personalized medicine, where products are customized for specific surgical requirements and patient characteristics. Personalized medicines made up more than 33% of new FDA drug approvals for the fourth year in a row, as reported by the Personalized Medicine Coalition (PMC). In 2023, the FDA authorized 16 novel personalized therapies for rare illnesses, a significant increase from the six approved in 2022, with seven targeting cancer and three addressing other ailments. Precision hemostats are being used to tackle specific difficulties such as managing bleeding in intricate anatomical regions or individuals with coagulopathies, guaranteeing safer and more efficient results. This trend aligns with progress in minimally invasive surgeries, necessitating precise, adaptable hemostatic solutions that can perform optimally in complex surgical situations to improve patient care and surgical outcomes.

U.S. Hemostats Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. hemostats market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, application, and formulation.

Analysis by Product:

- Thrombin Based

- Combination Based

- Oxidized Regenerated Cellulose Based

- Gelatin Based

- Collagen Based

As they are effective at accelerating coagulation by directly converting fibrinogen into fibrin, thrombin-based hemostats are the most widely used in the US market. These hemostats are frequently used in surgeries that require rapid blood clotting and can be used in a variety of medical specialities, including orthopaedic and cardiovascular treatments. They are preferred by medical professionals because of their simplicity of use and compatibility with different surgical techniques.

Combination-based hemostats, which integrate thrombin with other active agents such as collagen or gelatin, are gaining traction in the market. These hemostats provide enhanced efficacy by addressing multiple aspects of hemostasis simultaneously. Ideal for surgeries involving complex bleeding scenarios, they offer superior adherence and rapid clotting, reducing operative time. Their versatility and ability to perform effectively in challenging conditions position them as essential tools in advanced surgical care.

Oxidized regenerated cellulose-based hemostats are commonly used due to their antimicrobial characteristics and compatibility with living organisms. These hemostats are very successful in managing mild to moderate bleeding, especially in vascular and general surgeries. Their popularity for different procedures results from their convenience, absorbency, and capability to form a protective barrier against bacterial infection. The increasing need for safer, bioabsorbable options continues to drive the expansion of ORC-based hemostats in the U.S. market.

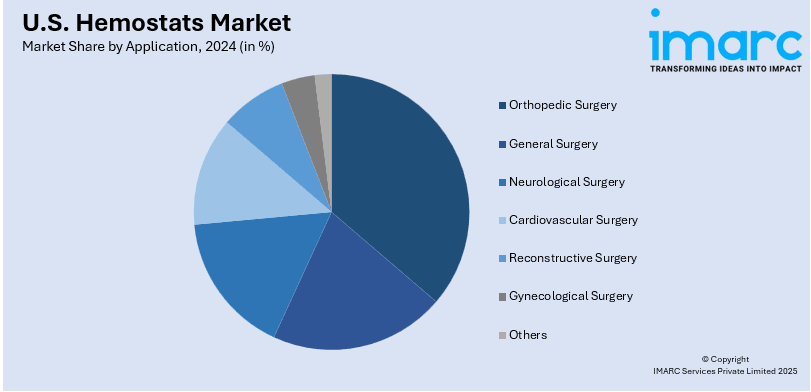

Analysis by Application:

- Orthopedic Surgery

- General Surgery

- Neurological Surgery

- Cardiovascular Surgery

- Reconstructive Surgery

- Gynecological Surgery

- Others

Orthopedic surgery holds a large portion of the hemostats market in the United States as many procedures necessitate efficient blood control. Sophisticated surgical procedures such as joint replacements and spinal fusions are improved by hemostats that encourage quick clotting and reduce blood loss, improving surgery accuracy and recovery results. The increasing number of musculoskeletal disorders is also increasing the need for hemostats designed for orthopedic uses.

In general surgery, hemostats play a crucial role in ensuring hemostasis across a variety of procedures, from abdominal to thoracic surgeries. Their versatility and efficacy in controlling both mild and severe bleeding render them indispensable in the operating room. Surgeons rely on advanced hemostatic agents to reduce complications and improve patient safety, fostering steady growth in this segment of the market.

Neurological surgery utilizes hemostats for intricate procedures involving the brain and spinal cord, where precision and minimal blood loss are paramount. These hemostatic solutions help control bleeding in delicate areas, ensuring a clear surgical field and reducing the risk of postoperative complications. As neurological conditions requiring surgical intervention rise, the adoption of hemostats in this field continues to expand, highlighting their critical role in advancing surgical outcomes.

Analysis by Formulation:

- Matrix and Gel Hemostats

- Sheet and Pad Hemostats

- Sponge Hemostats

- Powder Hemostats

Matrix and gel hemostats hold a significant position in the U.S. hemostats market due to their ability to conform to irregular surfaces and promote rapid clot formation. Commonly used in minimally invasive surgeries, these hemostats are favored for their ease of application and effectiveness in controlling bleeding in hard-to-reach areas. Their versatility across various surgical procedures drives their widespread adoption and steady market growth.

Sheet and pad hemostats are highly valued for their mechanical properties, providing a physical barrier to control bleeding in larger surgical areas. Their application is particularly prominent in cardiovascular and general surgeries where extensive bleeding occurs. These hemostats are easy to handle and can be customized to fit specific needs, enhancing their utility in diverse surgical environments, and contributing to their substantial market share.

Sponge hemostats are widely utilized in the U.S. market due to their absorbent properties and efficiency in promoting clot formation. Primarily used in orthopedic and trauma surgeries, sponge hemostats help control bleeding by providing a scaffold for clotting agents. Their ease of integration into surgical workflows and ability to be absorbed by the body over time render them a reliable choice for managing intraoperative blood loss.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region holds a significant share of the U.S. hemostats market, driven by its high concentration of advanced healthcare facilities and teaching hospitals. With a large number of complex surgeries performed annually, the demand for innovative hemostatic agents is substantial. The region’s strong focus on medical research and adoption of cutting-edge surgical technologies further fuels market growth.

The Midwest is a growing contributor to the U.S. hemostats market, supported by its extensive network of healthcare providers and specialized surgical centers. The region's focus on improving surgical outcomes and patient safety is leading to increased adoption of hemostatic solutions. Additionally, the prevalence of chronic conditions requiring surgical intervention contributes to steady market expansion in the region.

In the South, the market benefits from its large and diverse population, coupled with a rising number of surgical procedures. The presence of numerous healthcare institutions and ongoing investments in medical infrastructure drive the demand for hemostats. The region’s focus on expanding access to advanced surgical care supports the adoption of innovative hemostatic products, further strengthening its market representation.

The West region demonstrates robust growth in the hemostats Market due to its progressive healthcare system and high surgical volumes. Renowned for its innovation hubs and leading medical institutions, the West is at the forefront of adopting advanced hemostatic technologies. The region’s emphasis on minimally invasive procedures and patient-centric care drives the adoption of specialized hemostatic solutions, contributing to its significant market share.

Competitive Landscape:

The competitive landscape of the U.S. hemostats market is characterized by the presence of key global and regional players focused on innovation, strategic partnerships, and expanding their product portfolios. Companies dominate with advanced hemostatic products tailored for diverse surgical needs. These players emphasize the development of bioabsorbable and highly effective solutions to enhance surgical outcomes. Emerging competitors and niche manufacturers contribute by offering specialized products for specific applications, fostering competition. Additionally, collaborations with healthcare providers and continuous investment in research and development (R&D) drive advancements, ensuring a dynamic and competitive environment in the market.

The report provides a comprehensive analysis of the competitive landscape in the U.S. hemostats market with detailed profiles of all major companies.

- Baxter International Inc.

- Ethicon Inc. (Johnson & Johnson)

- Pfizer Inc.

- Teleflex Incorporated

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- April 3, 2024: Medcura, Inc. secured USD 22.4 Million in funding to advance its LifeGel Absorbable Hemostatic Gel, designed to stop bleeding in spinal surgeries without swelling, addressing neurological risks. With FDA Breakthrough Device Designation, Medcura aims to revolutionize the USD 2.8 Billion hemostatic biosurgery market. Strong investor interest highlights confidence in Medcura's innovative technology, demonstrated through successful live surgical trials and potential applications in neurosurgery and military trauma care.

- November 15, 2023: Ethicon, a Johnson & Johnson MedTech company, announced ETHIZIA, a hemostatic sealing patch using unique synthetic polymer technology for sustained hemostasis in challenging bleeding situations. Launching in 2024 after regulatory approvals, ETHIZIA offers adaptability, faster bleeding control, and is part of Ethicon's commitment to innovative surgical solutions following its 2022 acquisition of GATT Technologies.

U.S. Hemostats Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Thrombin Based, Combination Based, Oxidized Regenerated Cellulose Based, Gelatin Based, Collagen Based |

| Applications Covered | Orthopedic Surgery, General Surgery, Neurological Surgery, Cardiovascular Surgery, Reconstructive Surgery, Gynecological Surgery, Others |

| Formulations Covered | Matrix and Gel Hemostats, Sheet and Pad Hemostats, Sponge Hemostats, Powder Hemostats |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Baxter International Inc., Ethicon Inc. (Johnson & Johnson), Pfizer Inc., Teleflex Incorporated, etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. hemostats market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. hemostats market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. hemostats industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Hemostats are medical devices or agents used to control bleeding during surgical or traumatic procedures. They achieve hemostasis by facilitating blood clotting or acting as a physical barrier. Available in forms such as gels, powders, patches, and clamps, hemostats play a critical role in reducing blood loss and improving surgical outcomes.

The U.S. hemostats market was valued at USD 854 Million in 2024.

The U.S. hemostats market is projected to exhibit a CAGR of 7.2% during 2025-2033, reaching a value of USD 1,608 Million by 2033, driven by technological advancements and increasing surgical procedures.

The market is driven by rising surgical procedures, aging demographics, advanced minimally invasive techniques requiring precise bleeding control, AI integration in surgical solutions, personalized medicine approaches, ambulatory surgical center expansion, and FDA breakthrough device designations for innovative products enhancing surgical outcomes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)