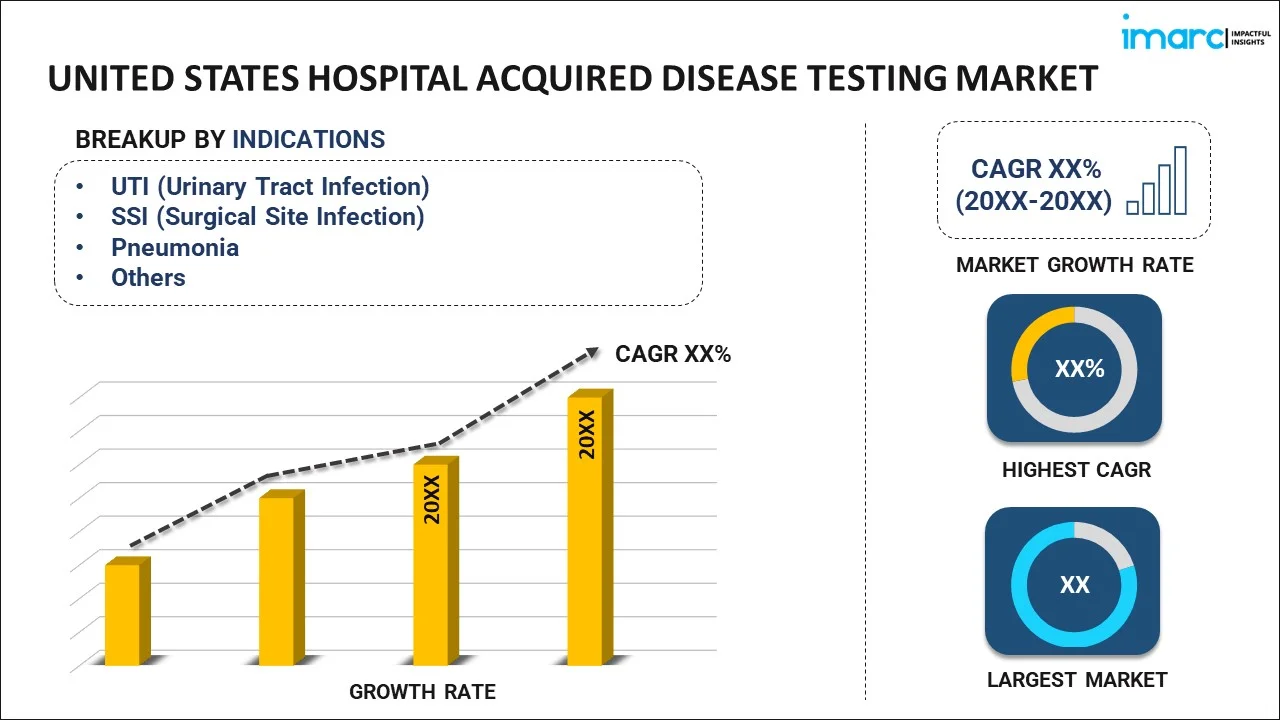

United States Hospital Acquired Disease Testing Market Size, Share, Trends and Forecast by Indication, and Region, 2026-2034

United States Hospital Acquired Disease Testing Market Summary:

The United States hospital acquired disease testing market size was valued at USD 5,720.58 Million in 2025 and is projected to reach USD 17,261.69 Million by 2034, growing at a compound annual growth rate of 13.06% from 2026-2034.

The United States hospital acquired disease testing market is experiencing robust expansion driven by the escalating prevalence of healthcare-associated infections, increasing antimicrobial resistance concerns, and the growing adoption of rapid molecular diagnostic technologies. Healthcare facilities across the nation are prioritizing infection prevention protocols and implementing advanced testing solutions to enhance patient safety outcomes. The market benefits from strong regulatory support, substantial healthcare infrastructure investments, and heightened awareness regarding early detection and management of nosocomial infections contributing to the United States hospital acquired disease testing market share.

Key Takeaways and Insights:

- By Indication: UTI (urinary tract infection) dominates the market with a share of 26% in 2025, due to the prevalent use of urinary catheters among hospitalized patients, especially those in intensive care settings. The high prevalence of catheter-associated urinary tract infections among vulnerable populations including elderly patients and those with compromised immune systems necessitates comprehensive diagnostic testing protocols.

- Key Players: The United States hospital acquired disease testing market exhibits a moderately consolidated competitive structure, characterized by the presence of established multinational diagnostic corporations alongside innovative molecular diagnostics specialists. Leading players leverage extensive distribution networks, proprietary testing platforms, and continuous product innovation to maintain competitive positioning.

The United States hospital acquired disease testing market demonstrates strong fundamentals supported by comprehensive federal initiatives and stringent infection control regulations. The Centers for Disease Control and Prevention reports that approximately one in thirty-one hospitalized patients experiences at least one healthcare-associated infection on any given day, underscoring the critical demand for effective diagnostic solutions. Healthcare facilities are increasingly investing in advanced molecular testing platforms that deliver rapid pathogen identification and antimicrobial resistance profiling. The market landscape reflects growing integration of artificial intelligence-driven analytics with conventional diagnostic methodologies, enabling more precise clinical decision-making. The U.S. Department of Health and Human Services released updated national targets in October 2024 for the period 2024-2028, reinforcing its commitment to HAI reduction through enhanced surveillance and prevention protocols. This regulatory emphasis, combined with technological innovation, positions the market for sustained growth throughout the forecast period.

United States Hospital Acquired Disease Testing Market Trends:

Accelerated Adoption of Rapid Molecular Diagnostic Platforms

Healthcare facilities are increasingly transitioning from traditional culture-based techniques to syndromic multiplex PCR testing that enables simultaneous detection of multiple pathogens and resistance markers. Modern platforms deliver actionable results within fifteen to sixty minutes compared to conventional methods requiring twenty-four to seventy-two hours. This technological shift supports timely therapeutic interventions and improves patient outcomes while reducing unnecessary empirical antibiotic prescribing.

Integration of Artificial Intelligence in Diagnostic Workflows

Advanced machine learning algorithms are being incorporated into hospital acquired disease testing systems to enhance pathogen identification accuracy and predict antimicrobial susceptibility patterns. Healthcare institutions are deploying AI-assisted diagnostic platforms that enable real-time infection tracking and outbreak surveillance capabilities. The FDA has authorized 1,250 AI-enabled diagnostic devices through its accelerated review pathway, signaling strong regulatory support for intelligent testing solutions.

Expansion of Point-of-Care Testing Capabilities

Decentralized testing is gaining significant traction as healthcare providers seek to reduce diagnostic turnaround times and improve bedside clinical decision-making. Point-of-care molecular systems now deliver laboratory-grade sensitivity and specificity in compact formats suitable for emergency departments, intensive care units, and ambulatory surgical centers. This trend enables earlier initiation of appropriate antimicrobial therapy and supports enhanced infection control measures across diverse clinical settings.

Market Outlook 2026-2034:

The United States hospital acquired disease testing market outlook remains favorable throughout the forecast period, supported by sustained investments in healthcare infrastructure modernization and advanced diagnostic technologies. Rising antimicrobial resistance continues to drive demand for comprehensive testing solutions that enable targeted therapeutic interventions. For instance, Thermo Fisher Scientific announced a four-year program investing over two billion dollars in US operations, with significant allocations toward diagnostics research and development focusing on AI-driven sequencing technologies. The market generated a revenue of USD 5,720.58 Million in 2025 and is projected to reach a revenue of USD 17,261.69 Million by 2034, growing at a compound annual growth rate of 13.06% from 2026-2034.

United States Hospital Acquired Disease Testing Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Indication |

UTI (Urinary Tract Infection) |

26% |

Indication Insights:

To get detailed segment analysis of this market, Request Sample

- UTI (Urinary Tract Infection)

- SSI (Surgical Site Infection)

- Pneumonia

- Bloodstream Infections

- MRSA (Methicillin-Resistant Staphylococcus Aureus)

- Others

UTI (urinary tract infection) leads the United States hospital acquired disease testing market with a 26% share in 2025.

Urinary tract infections represent the most prevalent category of hospital acquired infections, driven primarily by the extensive utilization of indwelling urinary catheters across healthcare settings. According to the Centers for Disease Control and Prevention, approximately 15-25% of hospitalized patients receive urinary catheters during their hospital stay, with seventy-five percent of hospital-acquired UTIs directly associated with catheter use. Elderly patients, immunocompromised individuals, and those with underlying conditions such as diabetes demonstrate heightened susceptibility to catheter-associated infections, driving sustained demand for diagnostic testing solutions.

The need for fast and precise diagnosis of urinary tract infections is driven by the risk of serious complications when treatment is delayed or inappropriate, including systemic infections and prolonged hospital stays. Timely identification of the responsible pathogens and their resistance characteristics is essential for effective therapy selection. Advances in molecular diagnostic technologies now allow clinicians to obtain actionable results much more quickly than conventional methods, supporting earlier intervention, improved patient outcomes, and more efficient infection management within clinical settings.

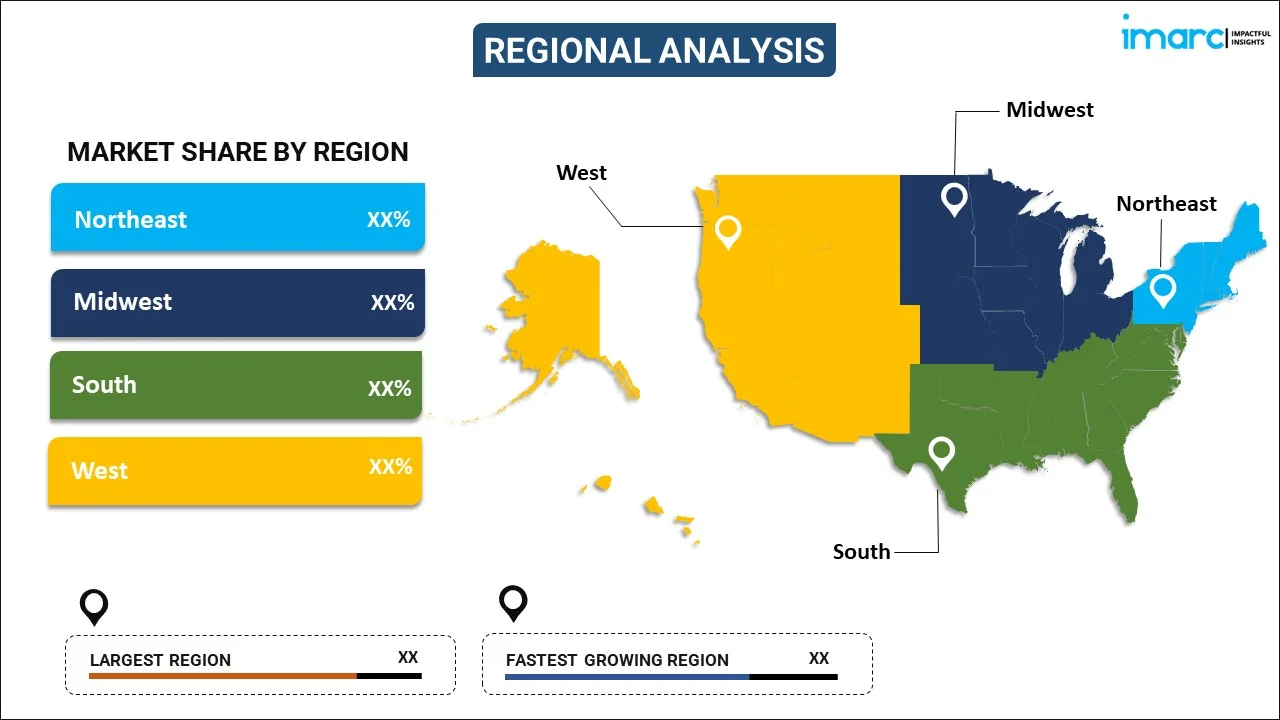

Regional Insights:

To get detailed regional analysis of this market, Request Sample

- Northeast

- Midwest

- South

- West

The Northeast market is driven by a dense concentration of large academic hospitals, high patient throughput, and strong adoption of advanced diagnostic technologies. Emphasis on infection surveillance, antimicrobial stewardship programs, and value-based care models supports demand for rapid and accurate hospital-acquired disease testing. Robust healthcare funding and research activity further encourage early adoption of innovative diagnostic solutions.

Growth in the Midwest is supported by extensive hospital networks serving both urban and rural populations, creating demand for scalable and cost-effective diagnostic testing. Increased focus on reducing hospital-acquired infections, improving patient safety metrics, and complying with quality reporting requirements drives adoption. Steady investment in laboratory modernization also supports expanded use of molecular diagnostic platforms.

The Southern region is driven by high hospitalization volumes, a growing elderly population, and rising prevalence of chronic conditions that increase infection risk. Expansion of healthcare infrastructure and greater emphasis on infection control initiatives are boosting demand for hospital-acquired disease testing. Cost containment pressures encourage the adoption of rapid diagnostics that support timely treatment decisions.

The Western United States benefits from strong technology integration within healthcare systems and early adoption of advanced diagnostic platforms. Emphasis on precision medicine, digital health, and data-driven infection management supports market growth. Large integrated delivery networks and progressive healthcare policies further drive demand for rapid, high-sensitivity testing for hospital-acquired infections.

Market Dynamics:

Growth Drivers:

Why is the United States Hospital Acquired Disease Testing Market Growing?

Rising Prevalence of Hospital Acquired Infections and Antimicrobial Resistance

The escalating burden of healthcare-associated infections across United States hospitals represents a primary catalyst for market expansion. According to the CDC, data indicate that approximately 687,000 HAIs occur annually in US acute care hospitals, with around 72,000 patients dying during hospitalizations complicated by these infections. The emergence and spread of antimicrobial-resistant pathogens including carbapenem-resistant Enterobacteriaceae, methicillin-resistant Staphylococcus aureus, and Clostridioides difficile, intensifies demand for comprehensive diagnostic testing solutions. The CDC published updated antimicrobial resistance threat data in July 2024, revealing that six bacterial antimicrobial-resistant hospital-onset infections increased by a combined twenty percent during the pandemic period compared to pre-pandemic levels, remaining elevated through 2022. This persistent infection burden drives healthcare facilities to invest in advanced diagnostic capabilities that enable rapid pathogen identification and targeted antimicrobial therapy.

Technological Advancements in Molecular Diagnostic Platforms

Ongoing advancements in molecular diagnostics are driving market expansion by enabling faster, more precise, and highly automated testing solutions. Modern syndromic panels allow the simultaneous identification of multiple pathogens and antimicrobial resistance markers within a single assay, significantly improving laboratory efficiency. These platforms shorten diagnostic turnaround times compared to conventional culture-based methods, supporting earlier clinical intervention. Additionally, the integration of artificial intelligence and machine learning enhances result interpretation, improves diagnostic accuracy, and aids clinicians with data-driven insights for optimized treatment decisions.

Stringent Regulatory Requirements and Quality Improvement Initiatives

Federal oversight and healthcare quality improvement initiatives continue to drive consistent demand for hospital-acquired disease testing solutions. Regulatory frameworks link reimbursement and performance evaluations to infection control outcomes, creating strong financial and operational incentives for healthcare facilities to invest in comprehensive diagnostic and surveillance capabilities. National agencies and accreditation bodies emphasize infection prevention, compliance, and continuous monitoring, reinforcing the importance of accurate and timely testing. In addition, mandatory reporting and benchmarking requirements compel hospitals to maintain reliable diagnostic systems to detect, track, and manage hospital-acquired infections, supporting sustained adoption of advanced testing technologies.

Market Restraints:

What Challenges the United States Hospital Acquired Disease Testing Market is Facing?

High Costs of Advanced Diagnostic Technologies

High capital investment in next-generation molecular diagnostic systems creates barriers to adoption by smaller healthcare institutions and resource-constrained institutions. The total costs of operation are often expensive because advanced analyzer systems often cost more than one million dollars to purchase the entire molecular testing package, and the recurring costs of consumables and maintenance. According to Medicare claims data, multiplex molecular UTI testing is more costly than the traditional urine cultures by a factor of more than seventy times, and has not been implemented widely in clinical practice despite perceivable clinical advantages.

Lack of Standardization in Diagnostic Testing Protocols

Inconsistency in interpreting the results and insufficient comparability across healthcare facilities are caused by the absence of standardized methods in the testing of hospital-acquired diseases. Variations in the performance of the tests, the markers of resistance tested, and the practice of reporting complicate the clinical decision and surveillance. The changing regulatory demands can create some extra operational burden on smaller labs that use specialized or proprietary testing protocols.

Complex Sample Collection and Handling Requirements

Ensuring the integrity of samples during the diagnostic process is a persistent problem in the performance of healthcare facilities. Inappropriate collection methods, delays in transportation and the variability in storage conditions may affect the accuracy and reliability of test results. Molecular testing platforms are complex to use and may need expert training and skills, which may restrict their use in a wide range of clinical environments and may also be a cause of workflow integration challenges.

Competitive Landscape:

The United States hospital-acquired disease testing market demonstrates a moderately consolidated competitive landscape, characterized by the presence of large, globally operating diagnostics companies with broad product offerings and well-established distribution networks. Competition is primarily driven by ongoing technological innovation, strategic mergers and acquisitions, and the expansion of clinical validation efforts to support wider adoption across healthcare settings. Market participants are increasingly prioritizing the development of integrated diagnostic platforms that combine rapid molecular testing with advanced data analytics, including artificial intelligence-enabled insights and antimicrobial stewardship support. Overall, the competitive environment reflects continued industry consolidation, as companies seek to enhance their technological capabilities and strengthen market positioning through the acquisition of specialized diagnostic solutions and complementary technologies.

United States Hospital Acquired Disease Testing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

|

Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Indications Covered | UTI (Urinary Tract Infection), SSI (Surgical Site Infection), Pneumonia, Bloodstream Infections, MRSA (Methicillin-Resistant Staphylococcus Aureus), Others |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States hospital acquired disease testing market size reached USD 5,720.6 Million in 2025.

The United States hospital acquired disease testing market is expected to grow at a compound annual growth rate of 13.06% from 2026-2034 to reach USD 17,261.7 Million by 2034.

The UTI (urinary tract infection) dominated the market with a 26% share in 2025, driven by the widespread use of urinary catheters in hospitalized patients and the high prevalence of catheter-associated infections among vulnerable populations.

Key factors driving the United States hospital acquired disease testing market include the rising prevalence of healthcare-associated infections, increasing antimicrobial resistance, technological advancements in molecular diagnostics, and stringent federal regulatory requirements for infection surveillance and prevention.

Major challenges include high costs of advanced diagnostic technologies limiting adoption by smaller facilities, lack of standardization in testing protocols across healthcare settings, complex sample collection and handling requirements, and evolving regulatory compliance burdens under new FDA laboratory-developed test rules.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)