United States I-joist Market Size, Share, Trends and Forecast by Sector, New Construction and Replacement, Application, and Region, 2026-2034

United States I-joist Market Summary:

The United States I-joist market size reached 3.22 Million Cubic Meters in 2025 and is projected to reach 4.04 Million Cubic Meters by 2034, growing at a compound annual growth rate of 2.53% from 2026-2034.

The United States I-joist market is witnessing steady expansion, driven by sustained residential construction activities and the inherent advantages of engineered wood products over traditional lumber. Builders increasingly prefer I-joists for their superior strength-to-weight ratio, dimensional stability, and design flexibility. The market benefits from growing sustainability awareness, as these products promote efficient wood utilization and support green building certifications across the country.

Key Takeaways and Insights:

- By Sector: Residential dominates the market with a share of 63% in 2025, owing to the strong demand for single-family housing and the preference for lightweight, high-performance structural components in home construction. Rising household formation rates and persistent housing shortages continue to fuel residential building activities across metropolitan and suburban regions nationwide.

- By New Construction and Replacement: New construction leads the market with a share of 70% in 2025, driven by builders seeking cost-effective and dimensionally stable framing materials for new residential developments. The consistent quality and longer spanning capabilities of I-joists make them particularly attractive for contemporary home designs requiring open floor plans.

- By Application: Floors represent the largest segment with a market share of 48% in 2025, reflecting the widespread adoption of I-joists in floor framing applications where their resistance to warping, shrinking, and twisting ensures level surfaces and eliminates squeaking issues that commonly affect traditional lumber construction.

- Key Players: Key players drive the United States I-joist market by investing in production capacity expansion, developing innovative engineered wood solutions, and strengthening distribution networks. Their focus on sustainable manufacturing practices and strategic partnerships with builders accelerates market penetration and product availability.

The United States I-joist market continues to benefit from the country's ongoing housing deficit and strong construction fundamentals. Engineered wood products like I-joists offer significant advantages, including superior strength, reduced weight, and consistent dimensions that eliminate common issues associated with traditional solid lumber such as warping and splitting. These products enable longer spans without intermediate support, allowing architects and builders to create open floor plans that appeal to modern homebuyers. The residential construction sector remains the primary consumer, as single-family housing starts demonstrate resilience despite elevated mortgage rates. According to the National Association of Home Builders, single-family home building surged by 6.5% for 2024, as builders added more supply to address the persistent housing affordability crisis. The market also benefits from increasing environmental consciousness as I-joists utilize wood resources more efficiently than conventional lumber, aligning with green building practices.

United States I-joist Market Trends:

Growing Adoption of Sustainable Construction Materials

The construction industry is increasingly embracing sustainable building materials, with engineered wood products gaining significant traction. I-joists manufactured from sustainably harvested timber offer environmental benefits, including carbon sequestration and reduced greenhouse gas emissions, compared to steel or concrete alternatives. Using a wood-based structural frame could potentially cut overall material consumption by a significant margin while reducing the structural frame's weight, making I-joists an attractive option for environmentally conscious builders and developers.

Expansion of Manufacturing Capacity

Major engineered wood products manufacturers are significantly expanding production capabilities across the United States, especially in the southeastern area, to meet growing regional demand. Companies are investing in new I-joist production lines, veneer processing equipment, and facility modernization projects. In January 2024, Boise Cascade announced plans to invest USD 140 Million in Alabama and Louisiana facilities, including adding I-joist production capabilities to its Thorsby engineered wood products mill, reflecting the strategic importance of regional manufacturing presence.

Integration of Advanced Manufacturing Technologies

The I-joist manufacturing sector is adopting advanced production technologies to enhance product quality and operational efficiency. Automated quality control systems ensure dimensional consistency and structural integrity across production batches. Manufacturers are implementing precision engineering techniques that improve load-bearing capacity and reduce material waste during the production process. These technological advancements enable the creation of customized I-joist solutions with pre-engineered utility openings that accommodate electrical wiring, ductwork, and plumbing installations.

Market Outlook 2026-2034:

The United States I-joist market is positioned for steady growth through the forecast period, supported by favorable long-term housing demand fundamentals and the structural advantages offered by engineered wood products. The persistent housing shortage continues to drive new construction activities, fueling the market expansion. The market size was estimated at 3.22 Million Cubic Meters in 2025 and is expected to reach 4.04 Million Cubic Meters by 2034, reflecting a compound annual growth rate of 2.53% over the forecast period 2026-2034. Major manufacturers are expanding production facilities and strengthening distribution networks to capture growing regional demand, particularly in high-growth markets across the South and West regions where population migration trends are driving substantial residential construction activities.

United States I-joist Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Sector |

Residential |

63% |

|

New Construction and Replacement |

New Construction |

70% |

|

Application |

Floors |

48% |

Sector Insights:

To get detailed segment analysis of this market, Request Sample

- Residential

- Commercial

Residential dominates with a market share of 63% of the total United States I-joist market in 2025.

Residential commands the largest share of the United States I-joist market, driven by the strong demand for single-family housing construction across the nation. Homebuilders increasingly prefer I-joists over traditional solid lumber due to their superior performance characteristics, including dimensional stability, longer spanning capabilities, and resistance to common defects. According to the Congressional Budget Office (CBO) projections, housing starts are expected to average 1.68 Million annually from 2025 to 2029, indicating sustained demand for residential construction materials.

The residential construction landscape in the United States continues to benefit from favorable demographic trends, including household formation and migration patterns toward sunbelt states. Single-family housing starts demonstrate resilience despite affordability challenges, with builders adapting designs to include open floor plans and larger living spaces that I-joists readily accommodate. South accounts for the vast majority of new housing construction permits, more than the Northeast, Midwest, and West combined, reflecting strong population growth and favorable year-round building conditions that support consistent I-joist demand.

New Construction and Replacement Insights:

- New Construction

- Replacement

New construction leads with a share of 70% of the total United States I-joist market in 2025.

New construction dominates I-joist consumption, as builders increasingly specify engineered wood products for new residential and commercial projects. As per data released by the US Census Bureau and the US Department of Housing and Urban Development, in October 2025, the seasonally adjusted annual rate for privately-owned new housing completions stood at 1,386,000. This was 1.1% (±15.4%) higher than the adjusted September estimate of 1,371,000. New construction applications benefit from the consistent quality, uniform dimensions, and predictable performance characteristics of I-joists that simplify framing installation and reduce callbacks.

New construction projects increasingly leverage the design flexibility offered by I-joists, which allow architects to create expansive open floor plans without intermediate support columns. The prefabricated nature of I-joists enables faster installation compared to traditional lumber, reducing construction timelines and labor costs for builders. Major production centers continue to expand capacity to serve growing new construction demand, with facilities in the South strategically positioned to supply high-growth markets, where population migration and economic development drive residential building activities.

Application Insights:

- Floors

- Roofs

- Others

Floors exhibit a clear dominance with a 48% share of the total United States I-joist market in 2025.

Floors represent the primary application for I-joists in the United States market, as builders value their superior performance in creating level, squeak-free floor systems. I-joists are engineered to be resistant to warping, shrinking, and twisting that commonly affect traditional lumber joists, ensuring long-term structural stability. Their consistent dimensions improve installation accuracy and reduce on-site adjustments, supporting faster construction timelines and lower labor costs. Additionally, improved load distribution enhances occupant comfort by minimizing floor vibration in residential and multi-family buildings.

The segment benefits from the built-in utility openings that I-joists accommodate, allowing seamless installation of electrical wiring, plumbing, and heating, ventilation, and air conditioning (HVAC) ductwork during the framing phase. This design feature streamlines construction sequencing and reduces the need for notching or drilling that can compromise structural integrity in solid lumber joists. Floor systems constructed with I-joists demonstrate excellent deflection characteristics and can span longer distances than conventional lumber, enabling designers to create larger rooms and more flexible interior layouts that appeal to contemporary homebuyers.

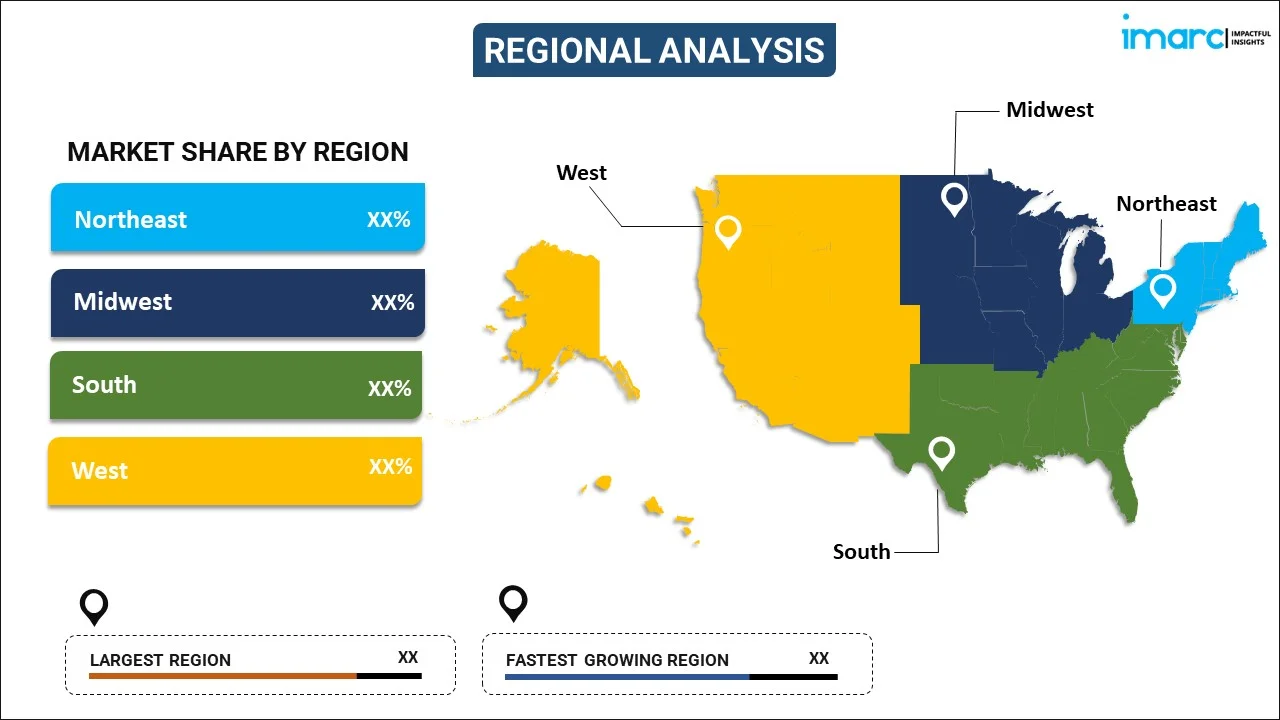

Regional Insights:

To get detailed segment analysis of this market, Request Sample

- Northeast

- Midwest

- South

- West

In Northeast, the market is driven by renovation and remodeling projects undertaken in old buildings for dwelling and commercial purposes. The dense population, scarcity of land space, and tougher construction regulations push the need to employ engineered wood products for their added strength and stability properties. The cold climate also aids the adoption of I-joists based on their stability and better load-carrying capacity features.

In Midwest, the market is aided by stable single-family home building activities, agriculture infrastructure development, and economical building methods. The builders in the region prefer I-joists due to their strength in long spans, material conservation, and simplicity of integral installation in large residential and mixed-use projects. The vast timber availability and established wood processing industries in the region boost usage of I-joists in construction projects.

South represents a major growth region for I-joists, due to rapid population growth, urban expansion, and strong residential construction activities. Warm climate conditions, large housing developments, and demand for affordable construction solutions drive usage. Builders increasingly adopt I-joists to reduce material waste, improve structural consistency, and meet modern building standards across residential and light commercial projects.

In West, the market is influenced by stringent seismic building codes, sustainability priorities, and high-value construction projects. Engineered wood products are widely used to meet structural performance requirements while reducing overall building weight. Growth is supported by multi-family housing, green building initiatives, and demand for precision-engineered materials in urban developments and high-cost real estate markets.

Market Dynamics:

Growth Drivers:

Why is the United States I-joist Market Growing?

Persistent Housing Shortage Driving Residential Construction Activities

The United States continues to face a significant housing deficit that drives sustained demand for residential construction materials, including I-joists. Years of underbuilding relative to population growth and household formation have created a structural shortage. This deficit compels builders to maintain active construction programs even during periods of elevated mortgage rates, as the fundamental need for housing persists across metropolitan and suburban markets. The shortage is particularly acute in high-growth regions where population migration and economic development create intense demand for new housing inventory. Single-family construction remains resilient, as builders respond to consumer preferences for detached homes with modern amenities and open floor plans that I-joists readily accommodate. In the United States, single-family housing starts rose 3.3% in December 2024, reaching a 10-month peak. The residential construction sector continues to absorb engineered wood products at steady rates, with builders appreciating the consistent quality, dimensional stability, and performance advantages that I-joists deliver compared to traditional solid lumber alternatives.

Superior Performance Characteristics of Engineered Wood Products

I-joists offer compelling technical advantages that drive their adoption across residential and commercial construction applications. The engineered design provides a superior strength-to-weight ratio compared to traditional lumber, enabling longer spans without intermediate support and reducing overall structural weight. Dimensional stability ensures consistent performance throughout the life of the structure, eliminating common issues like warping, shrinking, and twisting that affect solid wood joists. The consistent dimensions and quality of manufactured I-joists simplify installation and reduce framing labor costs for contractors. Pre-engineered utility openings accommodate electrical, plumbing, and HVAC systems without compromising structural integrity, streamlining the construction process and reducing potential conflicts between trades. These performance benefits translate into faster construction timelines, fewer callbacks, and improved customer satisfaction that motivate builders to specify I-joists over conventional framing materials.

Growing Environmental Consciousness and Sustainable Building Practices

Environmental sustainability considerations increasingly influence material selection in the construction industry, benefiting the market growth. Engineered wood products utilize wood fiber more efficiently than traditional lumber, maximizing resource utilization from sustainably managed forests. The manufacturing process generates minimal waste as byproducts are typically converted to biomass fuel or other useful applications. I-joists contribute to green building certifications by supporting sustainable construction practices and reducing the carbon footprint of residential and commercial structures. The construction sector accounts for a significant portion of global greenhouse gas emissions, making the adoption of sustainable materials like engineered wood increasingly important. Growing consumer awareness about environmental issues and corporate sustainability commitments drive demand for building products that demonstrate responsible resource management and lower environmental impact throughout their lifecycle.

Market Restraints:

What Challenges the United States I-joist Market is Facing?

Skilled Labor Shortages in the Construction Industry

The construction industry continues to face skilled labor shortages that limit overall building activity and influence demand for framing materials, including I-joists. Many contractors struggle to recruit qualified workers, leading to project delays and constrained construction volumes. An aging workforce is creating experience gaps as seasoned professionals retire, while fewer younger workers are entering construction trades. This imbalance reduces productivity and slows adoption of advanced framing solutions like I-joists, as limited labor availability forces firms to prioritize simpler or shorter projects over more complex builds.

Volatility in Raw Material Costs and Supply Chain Disruptions

The I-joist market experiences challenges from fluctuating raw material prices and periodic supply chain disruptions that affect production costs and product availability. Softwood lumber and oriented strand board prices have demonstrated significant volatility due to factors, including mill curtailments, tariff adjustments, and demand fluctuations. Canadian softwood lumber duties create additional cost pressures as manufacturers navigate changing trade policies that impact input costs and competitive positioning in regional markets.

Elevated Interest Rates Affecting Housing Market Activity

Elevated mortgage interest rates continue to dampen housing market activities and constrain demand growth for construction materials. Higher financing costs reduce housing affordability for potential homebuyers and increase carrying costs for builders maintaining inventory. Although underlying demand remains strong due to demographic factors and housing shortages, elevated rates suppress transaction volumes and moderate the pace of new construction starts compared to historical averages, creating headwinds for I-joist market expansion.

Competitive Landscape:

The United States I-joist market features a competitive landscape, characterized by established engineered wood product manufacturers with vertically integrated operations spanning timberlands, manufacturing facilities, and distribution networks. Key market participants compete through product innovations, production capacity expansion, and customer service excellence. Companies invest strategically in manufacturing modernization, geographic expansion, and sustainable forestry practices to strengthen competitive positioning. The market demonstrates consolidation trends as larger players acquire timberlands and production assets to enhance vertical integration and secure raw material supply. Strategic partnerships between manufacturers and distribution networks enable efficient product delivery across diverse regional markets.

United States I-joist Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Cubic Metres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sectors Covered | Residential, Commercial |

| New Construction and Replacements Covered | New Construction, Replacement |

| Applications Covered | Floors, Roofs, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States I-joist market reached a volume of 3.22 Milion Cubic Meters in 2025.

The United States I-joist market is expected to grow at a compound annual growth rate of 2.53% from 2026-2034 to reach 4.04 Million Cubic Meters by 2034.

Residential dominated the market with a share of 63%, driven by strong single-family housing construction activities and builder preference for lightweight, high-performance structural framing materials. This trend is further supported by ongoing suburban expansion and home renovation demand.

Key factors driving the United States I-joist market include persistent housing shortages fueling residential construction, superior performance characteristics over traditional lumber, and the growing adoption of sustainable building practices.

Major challenges include skilled labor shortages constraining construction activity, volatility in raw material costs and supply chain disruptions, elevated interest rates affecting housing market demand, and increasing competition from alternative building materials.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)