U.S. Industrial IoT Market Size, Share, Trends and Forecast by Component, End User and Region, 2025-2033

U.S. Industrial IoT Market Size and Share:

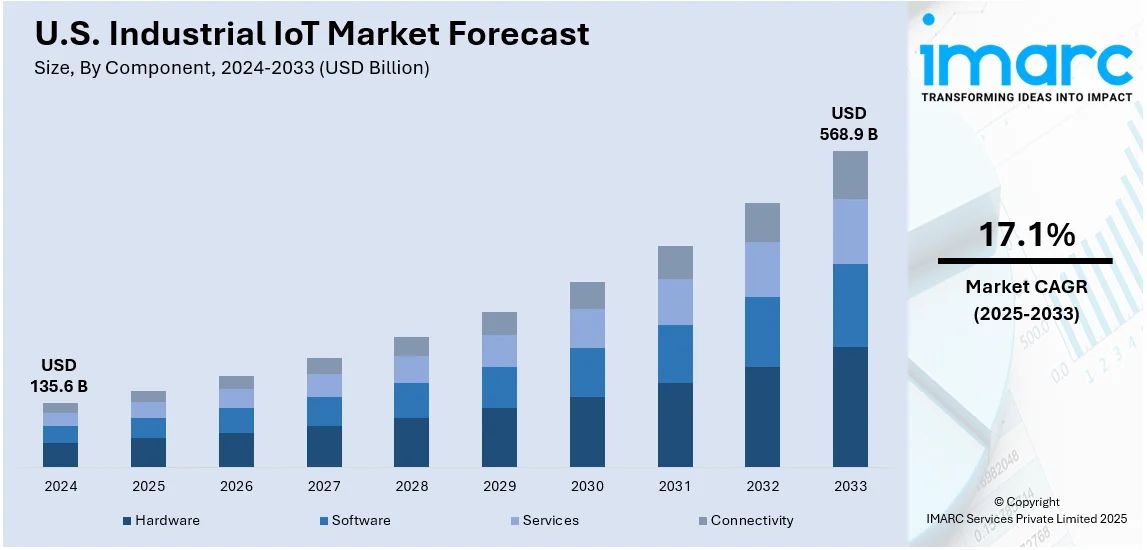

The U.S. industrial IoT market size was valued at USD 135.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 568.9 Billion by 2033, exhibiting a CAGR of 17.1% from 2025-2033. The market is majorly driven by increasing adoption of automation technologies, integration of advanced analytics and smart sensors, rising demand for predictive maintenance, advancements in 5G connectivity, growing focus on energy efficiency and sustainability, enhanced cybersecurity measures, and investments in digital transformation across key industrial sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 135.6 Billion |

| Market Forecast in 2033 | USD 568.9 Billion |

| Market Growth Rate (2025-2033) | 17.1% |

The market in the United States is majorly driven by the increasing adoption of automation technologies to improve operational efficiency for various industries. For instance, In the United States, there has been a significant rise in the adoption of automation technologies in recent times across various industries to improve operational efficiencies. In 2023, U.S. companies installed a record 44,303 industrial robots, up 12% from the year before, with the automotive sector being the largest contributor. In line with this, the rapidly growing integration of smart sensors and advanced analytics into the manufacturing processes enables real-time data collection and decision-making, further complementing the market growth. Also, increasing demand for predictive maintenance solutions that reduce equipment downtime and further optimally utilize resources is one of the major factors driving the market upwards. The growing need for the connection of supply chain systems for easy logistics and inventory management is also helping the market move forward.

Moreover, the increasing investments in digital transformation across the manufacturing and energy sectors. For instance, as per a recent report by Reuters, the strong demand from data centers with an AI focus and electric vehicles are resulting in U.S. utilities planning to increase their capital expenditures by an average of 22% over the next three years, starting in 2025. Besides this, the increasing deployment of IoT-enabled devices to monitor and manage industrial operations fuels the market growth. Additionally, the growing emphasis on sustainability and energy efficiency, coupled with government regulations, is encouraging the adoption of IIoT solutions. Growth in the rate of concern for worker safety and productivity also encourages wearable IoT devices and automation tools, adding to market growth.

U.S. Industrial IoT Market Trends:

Growing Integration of Artificial Intelligence in Industrial IoT

The adoption of Artificial intelligence (AI) in Industrial IoT systems is revolutionizing operational efficiency across the U.S. AI-powered tools enable predictive maintenance by analyzing equipment performance and predicting potential failures. Additionally, AI facilitates real-time monitoring and optimization of production processes, reducing waste and enhancing productivity. For instance, the integration of Artificial Intelligence (AI) into Industrial Internet of Things (IIoT) systems is significantly improving operational efficiency across the United States. AI-powered predictive maintenance is becoming increasingly prevalent, with 65% of organizations globally are regularly utilizing AI tools to analyze equipment performance and forecast potential failures, thereby minimizing downtime and maintenance costs. This integration allows businesses to make informed, data-driven decisions, ensuring continuous improvements in manufacturing and supply chain management. By embedding AI into IIoT, industries are automating complex tasks, improving resource allocation, and driving innovation in production technologies.

Expansion of 5G Networks Facilitating IIoT Deployment

The widespread of 5G technology is significantly improving the functionality of Industrial IoT systems across various sectors in the United States. With its ultra-low latency and faster data transfer speeds, 5G supports real-time communication among connected devices, which is critical for industrial automation. For instance, by the end of 2023, North America recorded 197 million 5G connections, representing 29% of all cellular connections in the region and marking a 64% year-over-year growth with 77 million new 5G connections added. The region is expected to have 700 million 5G connections by 2028, accounting for over 80% of all connections in North America. As of March 2024, North America has 17 commercial 5G networks. This growth reflects significant investments in infrastructure to meet increasing demand, positioning North America as a leader in 5G adoption. 5G is also advancing the efficiency of remote monitoring systems, autonomous equipment, and connected supply chains throughout the United States. As a result, industries are leveraging 5G to build robust IIoT infrastructures, enabling seamless operation of vital processes and ensuring reliability in high-stakes sectors such as manufacturing, logistics, and energy.

Emphasis on Cybersecurity in IIoT

The growing connectivity of industrial systems through IIoT underscores the importance of advanced cybersecurity measures. For instance, a recent industry report reveals a significant escalation in cyberattacks targeting U.S. utilities, with incidents increasing by nearly 70% in 2024 compared to the same period in 2023. The average number of attacks rose to 1,162 through August 2024, up from 689 during the same timeframe in 2023. This spike is attributed to the rapid expansion and digitalization of the power grid, which has heightened vulnerabilities, especially as many utilities operate with outdated software, showing significant risks persist for the nation's critical infrastructure. As a result, companies are prioritizing the creation and deployment of secure networks to safeguard sensitive data and protect critical operations from cyber threats. This involves the adoption of encrypted communication protocols, multi-factor authentication, and proactive threat detection systems. By emphasizing cybersecurity, industries aim to protect their IoT ecosystems, ensuring the uninterrupted operation of critical infrastructures and fostering trust in the adoption of interconnected technologies.

U.S. Industrial IoT Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. industrial IoT market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, and end user.

Analysis by Component:

- Hardware

- Software

- Services

- Connectivity

Hardware is one of the most essential components of connected systems, and therefore plays a fundamental role in the expansion of the US Industrial IoT market. Devices such as sensors, actuators, and edge devices enable real-time data collection and processing, hence driving hardware adoption to foster operational efficiency in industries for closely monitoring and controlling critical processes. Driving the deployment of more efficient and reliable IIoT hardware systems are also the advancements in 5G wireless communication technologies, among others.

Software is essential for transforming raw data generated by IIoT systems into actionable insights. The U.S. market exhibits significant demand for platforms focused on analytics, machine learning, and process optimization. Industrial IoT software helps in seamless integration, remote monitoring, and predictive maintenance, reducing downtime and increasing productivity. Besides, cloud-based solutions are gaining momentum to provide scalable and cost-effective tools for managing interconnected industrial environments.

Service implementation forms a critical foundation for the deployment and operation of IIoT systems in the U.S. market. Consulting, integration of systems, and various support services ensure a rather smooth deployment and operation/maintenance of IIoT solutions. As security considerations become increasingly prominent, industries are rapidly integrating cybersecurity measures into their routine operational processes. Managed services play a crucial role as strategic partners, ensuring robust network security and adherence to compliance requirements. With this, training and support will additionally help organizations adopt, scale the learning curve, and progress with IIoT for sustained market growth.

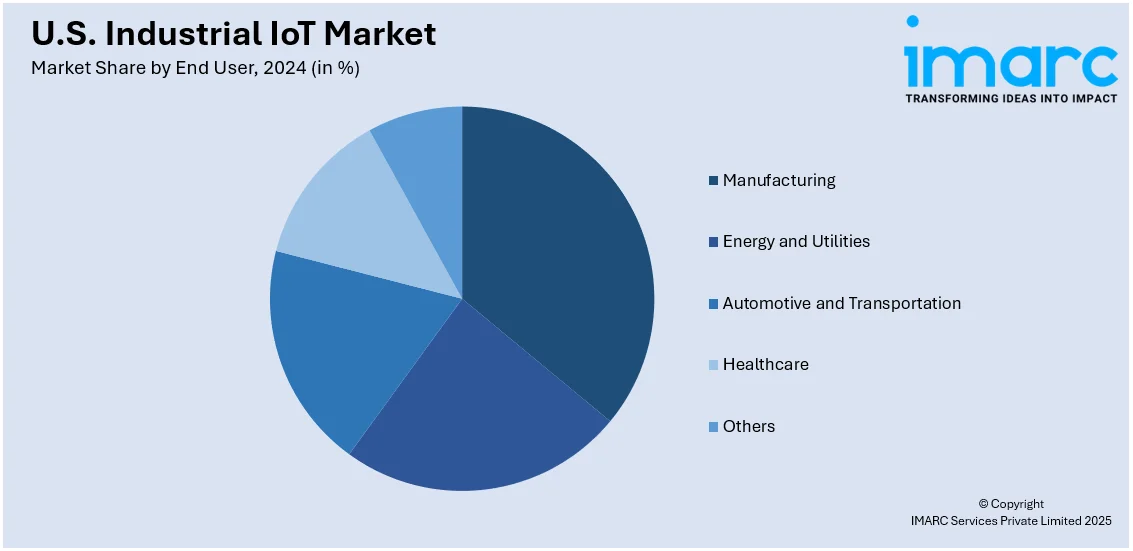

Analysis by End User:

- Manufacturing

- Energy and Utilities

- Automotive and Transportation

- Healthcare

- Others

The manufacturing sector, driven by the augmenting demand for automation and smart factory solutions, holds a strategic role in the U.S. industrial IoT market. IoT technologies enable real-time monitoring, predictive maintenance, and enhanced productivity in industrial operations. By utilizing connected devices and advanced analytics, manufacturers are reducing operational costs and improving supply chain efficiency, contributing significantly to overall market growth.

Energy and utilities are becoming key contributors to the U.S. industrial IoT market through the integration of IoT solutions in grid management and renewable energy systems. Smart grids and IoT-enabled energy meters optimize resource allocation and minimize energy waste. Additionally, real-time monitoring of critical infrastructure, such as pipelines and power plants, ensures operational reliability, highlighting IoT's transformative impact in this sector.

The automotive and transportation sector is a strong driver in the growth of the U.S. industrial IoT market, leveraging connected technologies for logistics, fleet management, and vehicle diagnostics. IoT solutions enhance supply chain visibility and ensure timely maintenance of transportation infrastructure. Furthermore, the emergence of autonomous vehicles and smart traffic management systems is creating new opportunities, solidifying the sector's importance within the IoT ecosystem.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is one of the largest contributors to the U.S. industrial IoT market, since most of the advanced manufacturing and technology hubs are concentrated in the region. The presence of research institutions and a skilled workforce enables the adoption of the latest IoT technologies. Furthermore, the region also lays much emphasis on the development of smart infrastructure and automation in industries like pharmaceuticals and logistics, adding more to the deployment of IIoT solutions.

The Midwest region is one of the critical regions in the U.S. industrial IoT market due to its firm industrial foundation, especially within automotive and agriculture. This region's emphasis on upgrading the manufacturing process with IoT-enabled machinery contributes toward enhanced operational efficiency. Furthermore, increasing investments in smart farming technologies through IIoT optimize agricultural productivity, thus making a strong case for resource management and strengthening the region's market position.

The South region is gaining more prominence in the industrial IoT market due to increasing adoption in energy and manufacturing industries. With a rich oil, gas, and renewable energy sector, the region is deploying IIoT for improved monitoring and reliability of operations. Also, the emergence of smart city initiatives in states such as Texas and Florida is driving the integration of IIoT in city infrastructure.

The West region currently is a key leader in the the U.S. industrial IoT market, driven by ongoing advancements and developments. Notably, states such as California, serve as hubs for a significant concentration of technology companies and groundbreaking innovations in the field. The pervasive trend observed for IIoT penetration across industries like the aerospace industry, semiconductor manufacturing sector, and renewable energy solutions markets contributes to market growth in the region. Coupled with this, increased priority on sustainability and energy efficiency products will drive the requirement toward IoT-enabled industrial appliances or products.

Competitive Landscape:

The competitive landscape of the US IIoT market is characterized by rapid innovations and high competition, with key players trying to capitalize on new technological developments. Companies are actively investing in research and development to enhance connectivity, automation, and data analytics capabilities. The number of partnerships and collaborations aimed at integrating the latest technologies such as 5G, edge computing, and AI into the industrial ecosystem has been increasing in the market. Furthermore, intense attention to cybersecurity solutions and industry-specific offerings for manufacturing, energy, and healthcare contributes to increasing competition. This dynamic environment continuously encourages improvements and the development of scalable and efficient IIoT solutions to meet the changing industrial needs.

Latest News and Developments:

- On November 27, 2024, Cloud Bees, a US-based enterprise software delivery company announced the availability of its AI-driven testing platform, Launchable, on AWS Marketplace. This integration enables developers to seamlessly incorporate Launchable's test intelligence and optimization capabilities into their workflows, enhancing software delivery efficiency. The platform offers features such as predictive test selection and intelligent test failure diagnostics, aiming to accelerate development cycles and improve software quality.

- On October 10, 2024, Qualcomm announced the launch of its industrial-grade IQ series processors and the Qualcomm IoT Solutions Framework, aiming to enhance AI integration in industrial applications. These processors, offering up to 100 TOPS of AI performance and built-in safety features, are designed to meet the rigorous demands of sectors such as manufacturing and energy within the United States. The IoT Solutions Framework provides comprehensive tools and reference designs to streamline the development and deployment of intelligent industrial IoT solutions.

U.S. Industrial IoT Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services, Connectivity |

| End Users Covered | Manufacturing, Energy and Utilities, Automotive and Transportation, Healthcare, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. industrial IoT market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. industrial IoT market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. industrial IoT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Industrial IoT (IIoT) refers to the integration of connected devices, advanced sensors, and analytics in industrial operations. Its applications include predictive maintenance, supply chain optimization, smart manufacturing, and energy management, enhancing efficiency, reducing downtime, and enabling real-time decision-making in industries like manufacturing, healthcare, and energy.

The U.S. Industrial IoT market was valued at USD 135.6 Billion in 2024.

IMARC estimates the U.S. Industrial IoT market to exhibit a CAGR of 17.1% during 2025-2033.

The market is witnessing rising adoption of automation technologies, increasing use of data analytics, and advancements in 5G connectivity. Additionally, growing demand for predictive maintenance, cybersecurity solutions, and energy-efficient systems are fuelling the expansion of IIoT in the United States.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)