United States Interventional Cardiology Devices Market Size, Share, Trends and Forecast by Product, End User, and Region, 2026-2034

United States Interventional Cardiology Devices Market Size and Share:

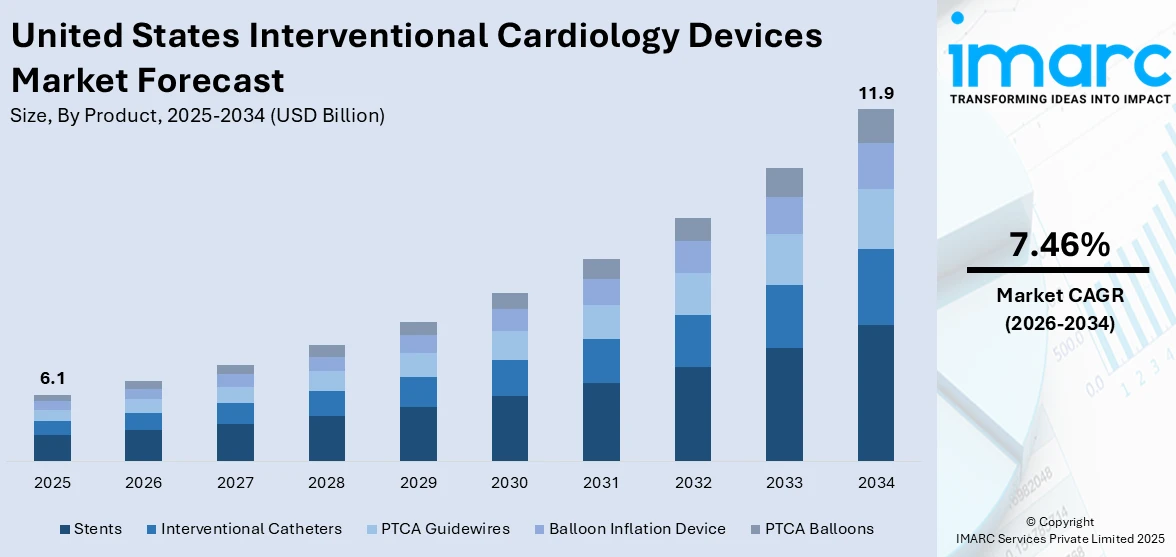

The United States interventional cardiology devices market size was valued at USD 6.1 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.9 Billion by 2034, exhibiting a CAGR of 7.46% during 2026-2034. South dominated the market, holding a significant market share of 35.3% in 2024. The increasing need for offering advanced solutions among physicians and improving patient outcomes in the realm of cardiac interventions is primarily contributing to the United States interventional cardiology devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 6.1 Billion |

|

Market Forecast in 2034

|

USD 11.9 Billion |

| Market Growth Rate 2026-2034 | 7.46% |

The interventional cardiology devices market in the US is growing due to a combination of clinical, demographic, and technological factors. The rising incidence of cardiovascular diseases, such as coronary artery disease and heart attacks, is significantly increasing the demand for diagnostic and treatment procedures. The aging population, which is more susceptible to heart conditions, further contributes to the growing patient base. Advancements in device technology, such as drug-eluting stents, bioresorbable scaffolds, and intravascular imaging tools, have improved the safety, accuracy, and outcomes of interventional procedures. Additionally, there is a strong preference for minimally invasive techniques among both patients and healthcare providers, supported by shorter hospital stays and faster recovery times. Favorable reimbursement policies and the expansion of specialized cardiac care centers are also further driving the United States interventional cardiology devices market growth.

To get more information on this market Request Sample

Regulatory approvals for advanced drug-coated balloon technologies are supporting growth in the interventional cardiology devices market. These innovations offer new treatment options for coronary in-stent restenosis, enhancing procedural effectiveness and broadening therapeutic choices for physicians managing complex coronary artery disease cases in the United States. For instance, in March 2024, the Boston Scientific Corporation secured US Food and Drug Administration (FDA) approval for the AGENT drug-coated balloon (DCB). The novel technology is a type of interventional cardiology device intended for the treatment of coronary in-stent restenosis (ISR) in individuals who suffer from coronary artery disease.

United States Interventional Cardiology Devices Market Trends:

Rising Cardiovascular Disease Burden Boosting Device Adoption

The growing burden of cardiovascular conditions in the United States is driving increased demand for interventional cardiology devices. Nearly half of the US population is affected by some form of cardiovascular disease, including stroke and coronary artery disease. This high disease prevalence has led to a steady rise in diagnostic and therapeutic procedures like angioplasty and stent placements. Healthcare providers are investing in advanced interventional tools to manage complex cardiac cases with improved safety and efficiency. The widespread availability of minimally invasive procedures and enhanced hospital infrastructure are further contributing to this shift. With cardiovascular conditions remaining a leading cause of hospitalization and mortality, the healthcare system is prioritizing early diagnosis and timely intervention. The result is growing procedural volume and accelerated adoption of next-generation devices designed to address diverse clinical needs, ultimately expanding the market for interventional cardiology solutions in the country. According to a 2024 report, approximately 48.6% of individuals in the United States suffer from some type of cardiovascular disease, such as stroke and coronary heart disease.

Growth in Minimally Invasive Procedures Supporting Market Expansion

The United States interventional cardiology devices market outlook illustrates a growing acceptance of minimally invasive procedures. These procedures are increasingly favored for their ability to reduce recovery times, minimize hospital stays, and lower the risk of complications. In cardiac care, minimally invasive techniques such as catheter-based interventions are becoming the standard approach for treating conditions like blocked arteries and structural heart defects. This shift is prompting greater demand for devices that support precision, flexibility, and real-time imaging. Healthcare facilities are expanding their capabilities in this area, investing in technology that enables quicker, safer procedures. As clinical practices evolve, the integration of minimally invasive solutions is reshaping how cardiovascular care is delivered, reinforcing the need for innovative interventional tools across hospitals and specialty centers. For example, the minimally invasive surgery market in the United States is growing at a CAGR of 3.73% during 2025-2033 and is expected to reach USD 36.3 Billion by 2033, as per a report published by the IMARC Group.

Innovation in Device Design Enhancing Procedural Precision

Based on the United States interventional cardiology devices market forecast, recent advancements in interventional cardiology are expected to improve procedural control and access in complex coronary cases. The development of next-generation microcatheters with enhanced guidewire support and low-profile designs is enabling physicians to navigate intricate lesions with greater accuracy. These innovations are particularly valuable during percutaneous coronary interventions, where precise tip control and flexibility are essential for successful outcomes. Devices designed to support better maneuverability and responsiveness are becoming increasingly important in treating patients with challenging vessel anatomies. The focus on user-friendly, performance-oriented tools is not only streamlining procedures but also expanding the scope of cases that can be effectively managed using minimally invasive cardiac interventions across US healthcare settings. For instance, in February 2024, BIOTRONIK launched the Micro Rx catheter, an innovative fast exchange microcatheter developed to easily improve guidewire support during percutaneous coronary interventions (PCI). The low profile and good support of this novel interventional cardiology device enable excellent tip control for coronary guidewires in intricate lesions.

United States Interventional Cardiology Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States interventional cardiology devices market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product and end user.

Analysis by Product:

- Stents

- Drug Eluting Stents

- Bare Metal Stents

- Bio-Absorbable Stents

- Interventional Catheters

- IVUS Catheters

- Guiding Catheters

- Angiography Catheters

- PTCA Guidewires

- Balloon Inflation Device

- PTCA Balloons

- Cutting Balloons

- Scoring Balloons

- Drug Eluting Balloons

- Normal Balloons

Stents stood as the largest product in 2024, holding around 65% of the market due to its widespread use in treating coronary artery disease. High prevalence of atherosclerosis and related conditions has led to an increased number of percutaneous coronary interventions (PCI), where stents are essential. Technological advancements, including drug-eluting and bioresorbable stents, have improved patient outcomes and reduced restenosis rates, fueling greater adoption. Growing preference for minimally invasive procedures has further boosted demand for stents, as they allow for quicker recovery and fewer complications. Moreover, favorable clinical guidelines recommending stent placement in specific cardiac cases continue to support procedural volume. These factors make the stents segment a key growth driver in the interventional cardiology devices market.

Analysis by End User:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Ambulatory Surgical Centers

- Others

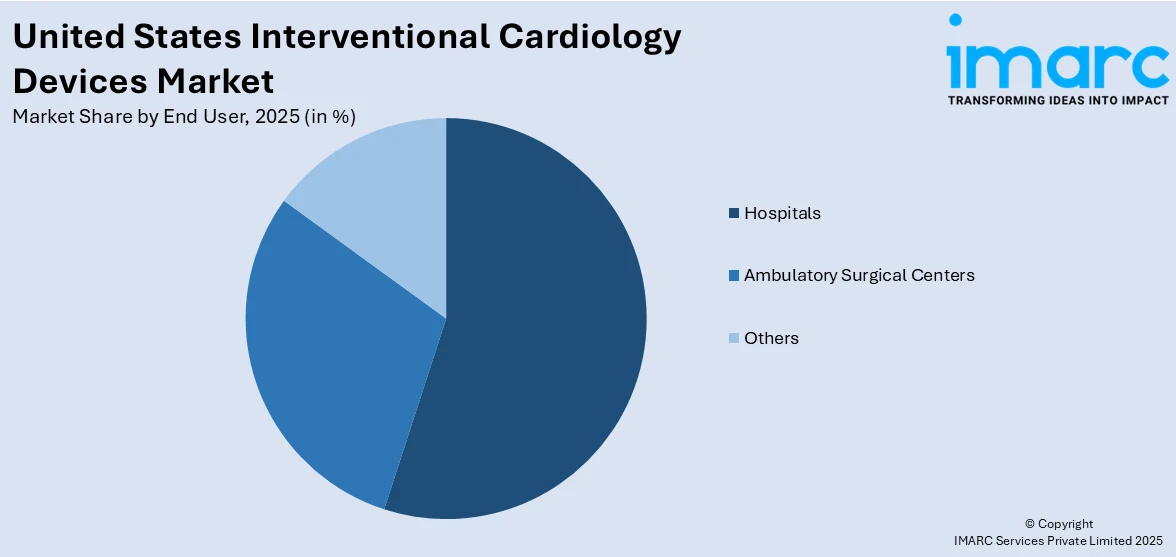

Hospitals led the market with around 43.2% of market share in 2024, owing to their role as the leading centers for advanced cardiac care. Hospitals are equipped with state-of-the-art catheterization labs and trained interventional cardiologists, making them the preferred choice for procedures such as angioplasty and stent implantation. The increasing number of cardiovascular cases being treated in hospital settings has led to higher utilization of interventional devices. Additionally, hospitals often have greater access to capital for adopting new technologies and maintaining large inventories of specialized devices. The growing trend of hospital-based integrated cardiac programs and 24/7 emergency care facilities further strengthens their position, making the segment a key contributor to market expansion across the United States.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2024, South accounted for the largest market share of 35.3% due to a combination of demographic and healthcare-related factors. This region has a higher prevalence of cardiovascular diseases, including hypertension, obesity, and diabetes, which significantly increases the demand for interventional procedures. The aging population in states like Florida and Texas further contributes to the need for advanced cardiac care. Additionally, the South has a relatively well-developed network of hospitals and specialized cardiac centers equipped to perform minimally invasive interventions such as angioplasty and stent placement. Government and private healthcare initiatives in these states also support early diagnosis and treatment, leading to greater utilization of interventional cardiology devices. Collectively, these factors position the Southern US as the dominant regional market for such medical technologies.

Competitive Landscape:

The US interventional cardiology devices market is witnessing active growth through product innovations, research advancements, and strategic industry moves. Recent developments include the launch of next-generation devices aimed at improving procedural precision and patient outcomes. Partnerships, agreements, and collaborations between firms are increasingly common, enabling technology integration and broader market access. Government support through research grants and healthcare initiatives is also encouraging innovation in minimally invasive cardiac procedures. Of all these activities, partnerships and collaborations are the most widespread practice at present, as they help firms combine expertise, accelerate development cycles, and meet the rising demand for advanced interventional solutions.

The report provides a comprehensive analysis of the competitive landscape in the United States interventional cardiology devices market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: GE HealthCare launched the AltiX AI.i editions of its Mac-Lab, CardioLab, and ComboLab systems, enhancing interventional cardiology devices for cardiac catheterization and electrophysiology procedures. These systems integrate advanced features like diastolic pressure ratio (dPR) measurements and AI-driven signal analysis, improving workflow efficiency and diagnostic precision in cath labs and electrophysiology labs.

- March 2025: The Boston Scientific Corporation revealed plans for the acquisition of SoniVie Ltd., the developer of the TIVUS Intravascular Ultrasound System. This acquisition will enable the Boston Scientific Corporation to include ultrasound-based renal denervation therapy to its list of interventional cardiology therapies available for the treatment of hypertension.

- February 2025: Teleflex announced its plan to acquire BIOTRONIK's Vascular Intervention business for approximately EUR 760 million, aiming to enhance its interventional cardiology device portfolio. This acquisition will expand Teleflex's offerings with advanced devices such as drug-coated balloons, drug-eluting stents, and the Freesolve resorbable metallic scaffold, thereby strengthening its position in both coronary and peripheral intervention markets.

United States Interventional Cardiology Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| End Users Covered | Hospitals, Ambulatory Surgical Centers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States interventional cardiology devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States interventional cardiology devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States interventional cardiology devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The interventional cardiology devices market in the United States was valued at USD 6.1 Billion in 2025.

The United States interventional cardiology devices market is projected to exhibit a CAGR of 7.46% during 2026-2034, reaching a value of USD 11.9 Billion by 2034.

The United States interventional cardiology devices market is driven by rising cardiovascular disease prevalence, increasing demand for minimally invasive procedures, technological advancements, a growing geriatric population, supportive reimbursement policies, and expanding healthcare infrastructure. Additionally, higher adoption of drug-eluting stents and imaging systems is supporting procedural efficiency and improved patient outcomes.

South accounted for the largest share, holding around 35.3% of the market in 2024 due to its high cardiovascular disease burden, larger aging population, and better access to advanced cardiac care facilities.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)