United States Landscaping Market Size, Share, Trends and Forecast by Service Type, Application, and Region, 2025-2033

United States Landscaping Market Size and Share:

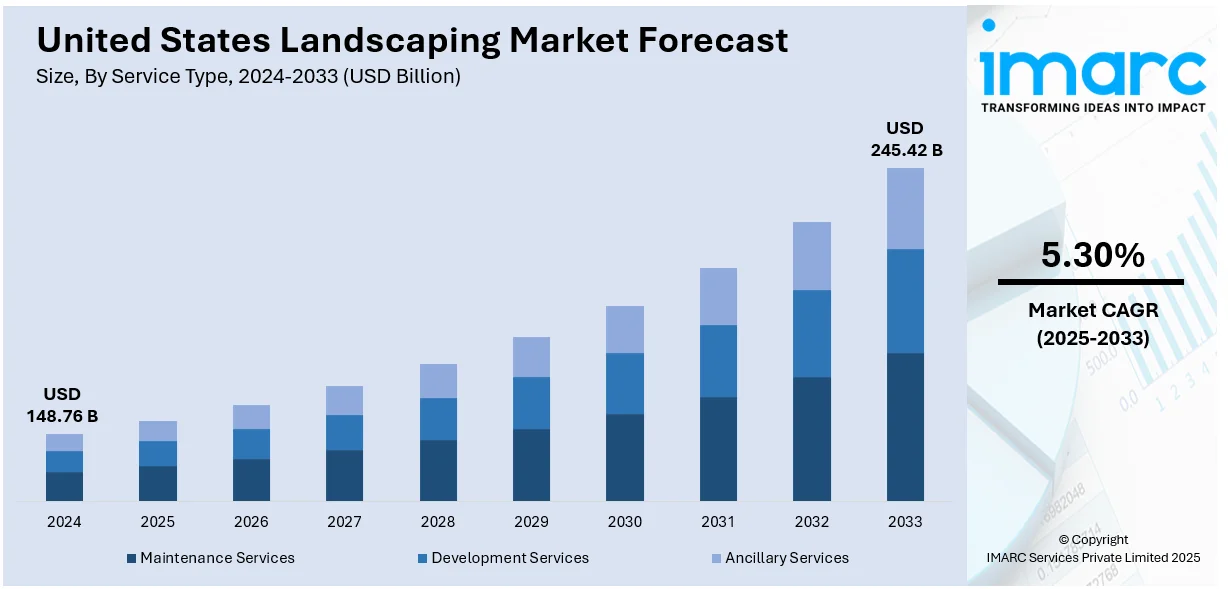

The United States landscaping market size was valued at USD 148.76 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 245.42 Billion by 2033, exhibiting a CAGR of 5.30% from 2025-2033. The growing awareness about water conservation, especially in areas that are experiencing water shortages and the need for well-maintained, well-designed landscaping that can enhance the value of real estate properties is providing a positive impact on the United States landscaping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 148.76 Billion |

| Market Forecast in 2033 | USD 245.42 Billion |

| Market Growth Rate (2025-2033) | 5.30% |

United States Landscaping Market Analysis:

- Major Drivers: Increased demand for outdoor living areas and work-from-home culture motivates homeowner investment in efficient outdoor spaces. Growing commercial property construction and real estate beautification programs boost demand for professional landscaping services in residential and commercial spaces.

- Key Market Trends: Awareness for water conservation drives the adoption of drought-resistant landscaping and xeriscaping. Integration of smart irrigation technology and automated maintenance systems with better service efficiency is supporting the United States landscaping market demand. Using sustainable native plants and environmentally friendly materials becomes the norm requirement.

- Market Challenges: Labor shortages pose service delivery and operational costs challenges in landscaping firms. Seasonal changes in weather patterns impact maintenance frequencies and project timelines for completion. Increased costs of materials for plants, equipment, and green landscaping materials put pressure on profit margins.

- Market Opportunities: Based on the United States landscaping market analysis, urban parkland development and city beautification schemes provide expansion opportunities. Integration of technology such as robotic mowers and smart systems provide competitive edges. Environmentally friendly consumer preferences generate demand for eco-friendly landscaping solutions.

The United States landscaping market growth is increasing due to a rising preference for residential and commercial outdoor beautification. Most homeowners aim to create an attractive, functional, and 'green' outdoor space, thus giving rise to the demand for services that include lawn care, hardscaping, and water-efficient systems installation, among others. There has been a high demand for low-maintenance, drought-tolerant landscaping due to the growing awareness about water conservation, especially in areas that are experiencing water shortages. Sustainable landscaping is also increasing demand, with consumers and businesses turning to native plants, xeriscaping, and other eco-friendly materials. As sustainability remains a top issue, many landscapers are employing smart technology, the use of highly efficient irrigation, and automated mowing systems, to develop efficient, sustainable solutions. In addition, local initiatives, such as the Business Beautification Grant by the Cortez Community & Economic Development, which matches 50% of project costs up to $3,000 for approved landscaping projects, are further fueling demand for landscaping services as businesses enhance their curb appeal and contribute to community beautification.

To get more information on this market, Request Sample

In addition, the trend of outdoor living spaces is also a key factor for propelling the United States landscaping demand. With more people spending time outdoors, there is an increased interest in creating customized environments that include features like outdoor kitchens, fire pits, and gardens. The rise of "staycations" and remote work has also driven the need for comfortable, aesthetically pleasing outdoor spaces that extend the home. Further, the growth being seen in new constructions and renovations being added by the real estate sector creates further demand for landscaping services. More people want to make their properties valuable, thereby putting commercial and residential landscaping projects on the rise. This is a perfect blend of aesthetics, practicality, and environmental reasons driving the growth in the U.S. landscaping market.

United States Landscaping Market Trends:

Rising urbanization

As urbanization continues its spread across the United States, there is need for the development of aesthetically pleasing and usable green spaces in cities. Reported by the Center for Sustainable Systems, it is estimated that 89% of the US population will reside in urbanized areas by 2050, bringing increased pressure for carefully designed cityscapes. Municipalities and private developers are now increasingly integrating landscaping into public spaces, residential complexes, and commercial premises to improve the quality of life in highly densely populated areas. From vertical gardens and rooftop greenery to pocket parks, new-age ideas are being employed to improve the space and reduce urban density. In addition, with the help of landscaping projects, pedestrian-friendly zones are achieved, air quality is improved, and heat island effects are combated in urban settings. Landscaping companies are countering with services that include designing and maintaining to fit urban needs, frequently emphasizing native plants and low-maintenance greenery suited to compact spaces and busy lifestyles.

Growing need for outdoor rooms

The demand for customized outdoor living spaces is shaping the United States landscaping market trends. As the number of "staycationers" rises and remote working becomes more ubiquitous, homeowners desire to make outdoor spaces as refreshing and functional additions to their living rooms. Such designs may include fire pits, outdoor kitchen spaces, patios, and water features alongside custom landscaping depending on personal wishes. This shift has increased the demand for landscaping services that go from simple lawn care to more complex hardscaping, lighting installation, and outdoor furniture setup. People want to invest in high-quality materials such as natural stone, wood, and sustainable products to create a personalized environment that complements their home's aesthetic. As a consequence, landscaping businesses are adding the services of consulting and installing exterior living spaces that have further amplified the growth rate in the market. Increased interest in well-being and outside activities is expected to increase this trend.

Technology and landscaping services

Technology is revolutionizing the U.S. landscaping market with a speed of change that increases the efficiency and precision of services. One of the main factors behind this trend is the implementation of smart irrigation systems, which can monitor weather patterns and soil moisture levels to adjust watering schedules automatically. As per Farmonaut, such intelligent systems save 50% water in comparison to conventional methods and therefore are one of the prime pieces of equipment for the development of sustainable landscaping practices. Additionally, robotic mowers, drones used for aerial surveying, and advanced software designs for landscaping operations are all becoming streamlined operations with reduced costs and better customer satisfaction. These technologies enable landscaping companies to provide highly detailed virtual representations of design layouts and enhance customer experiences with digital quotes, online consultations, and optimized maintenance schedules. With the increasing focus on eco-friendly solutions, these tech-driven advancements improve operational efficiency and help reduce the carbon footprint of landscaping services. The increasing demand for sustainable and customized landscaping makes the integration of technology a major driving force behind the industry's transformation.

United States Landscaping Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States landscaping market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on service type and application.

Analysis by Service Type:

- Maintenance Services

- Development Services

- Ancillary Services

Maintenance services lead the market with a share of 52.2%, as they involve regular care such as mowing, trimming, irrigation, and pest control to ensure that landscapes are maintained in a healthy and aesthetically pleasing manner over time. These services are significant due to the increasing demand for year-round maintenance in residential and commercial properties. This highlights the increasing demand for maintenance services that cater to modern outdoor aesthetics. Development services encompass designing and constructing new landscapes, including hardscaping, planting, and irrigation system installations. Custom outdoor spaces, like patios and gardens, are gaining more acceptance, and the demand for such services is pushing this segment. Ancillary services comprise snow removal, tree care, and other specialized seasonal work based on the weather conditions and regional demands.

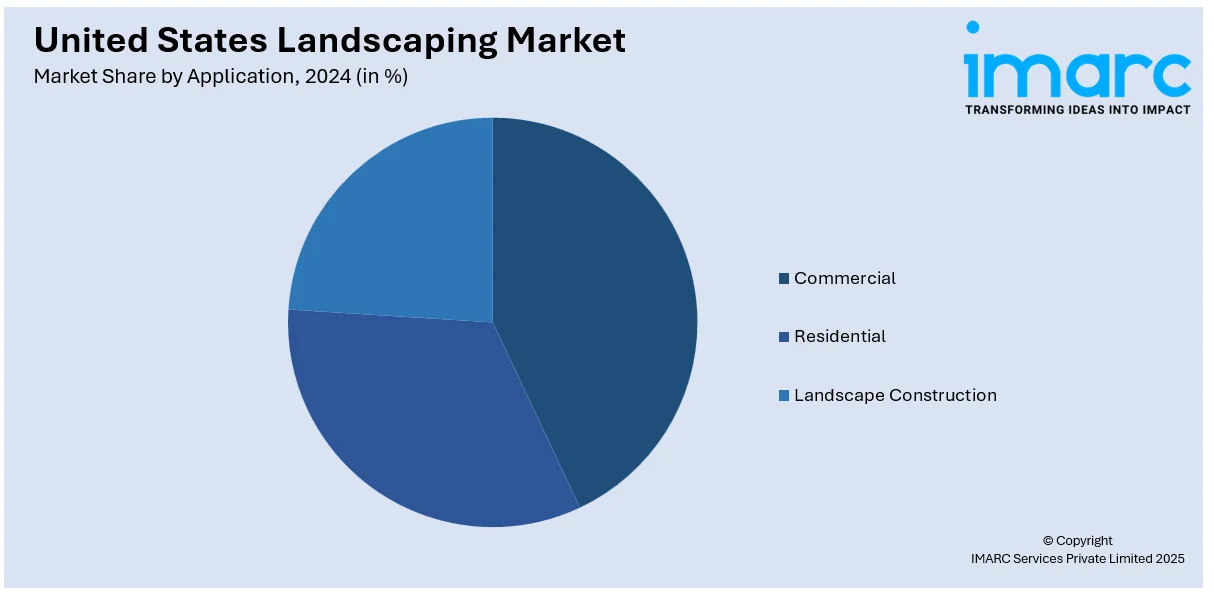

Analysis by Application:

- Commercial

- Residential

- Landscape Construction

Commercial represents the largest segment with a share of 58.7%. Their practices encompass malls, offices, retail stores, and public domain landscaping due to the enterprise-level initiatives toward curb appeal and sustainability. Residential is one of the significant segments influenced by the growing demand for outdoor home improvements and aesthetics. The trend here is for making functional outdoor spaces like patios, fire pits, and kitchen spaces for social get-togethers. Landscape construction that involves enormous things such as parks, golf courses, and urban green spaces is increasingly becoming popular due to the increasing urbanization and investments in public infrastructures.

Regional Analysis:

- Northeast

- Midwest

- South

- West

South regions dominate the market with a share of 37.8%, fueled by its warmer climate and growing residential and commercial sectors, including tourism and hospitality. The four-season climate of the U.S. Northeast has lent itself to a strong demand for seasonal services, including snow removal, garden preparation, and fall cleanup, hence creating a good chance for landscaping markets here. Urban areas are now shifting focus toward sustainable and community-driven landscaping initiatives, thereby well supported by programs like New York State's Urban Farms and Community Gardens Grant Program, which recently granted $1 Million to 22 organizations to foster urban farms and community gardens. High-end design and maintenance services are prevalent, driven by affluent urban and suburban populations seeking aesthetically pleasing outdoor spaces. The Midwest emphasizes lawn care and maintenance services, supported by its large residential base and extensive agricultural landscapes that often integrate functional and decorative landscaping. The West is leading the way in water-efficient landscaping, or xeriscaping, which is being implemented due to recurrent droughts and water scarcity. Urban and suburban areas across all regions are now embracing sustainable and community-based landscape designs that best fit changing demands for environmentally friendly, low-maintenance, and attractive solutions. Regional diversity shows how climatic, demographic, and cultural factors are affecting the U.S. landscaping market.

Competitive Landscape:

Market players in the U.S. landscaping industry are shifting focus to sustainability, innovation, and expanding service offerings to meet the changing needs of consumers. Companies are adopting eco-friendly practices such as water-efficient irrigation systems, xeriscaping, and native plants to meet growing environmental awareness. The integration of technology, including robotic mowers, smart irrigation systems, and landscape design software, is transforming service efficiency and customer engagement. Firms are investing in workforce development to address a key challenge to the industry, labor shortages. Public and private investments in projects for urban greening and community gardens offer growth opportunities, reflecting an increasing trend in sustainable and community-focused landscaping solutions across urban and suburban areas. For instance, GreenLatinos granted $2.65 Million in total, which is aimed at enhancing and revitalizing greenspace in urban Latino/a/e communities across the cities of Los Angeles, Albuquerque, and Chicago. This illustrates a further push for environmental equity through an increased revitalization of urban green spaces.

Recent News and Developments:

- In February 2025, Pro Landscaper launched its US edition, based in Los Angeles, following its success in the UK since 2011. The monthly magazine targets landscapers, garden designers, landscape architects, and installers on the west coast. The inaugural digital issue features an interview with Michael Bernier, portfolio showcases, and a pool special, with the next issue focusing on decking. Deputy editor Celia Cummiskey hopes the magazine will build community across the US landscaping industry.

- In February 2025, EarthaPro, a landscaping and lawn care software, launched in January targeting small businesses with fewer than 10 employees, starting at $60 per month. Founded by Courtney Krstich and Peter Quan, the platform offers easy-to-use tools for CRM, job costing, scheduling, invoicing, and proposal creation, with account manager support. The company, named after their cat Eartha, is expanding in the US and plans to release a free tier in late February.

United States Landscaping Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Maintenance Services, Development Services, Ancillary Services |

| Applications Covered | Commercial, Residential, Landscape Construction |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States landscaping market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States landscaping market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States landscaping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States landscaping market was valued at USD 148.76 Billion in 2024.

The United States landscaping market is projected to exhibit a CAGR of 5.30% during 2025-2033, reaching a value of USD 245.42 Billion by 2033.

The growing awareness about water conservation, especially in areas that are experiencing water shortages and the need for well-maintained, well-designed landscaping that can enhance the value of real estate properties is providing a positive impact on the United States landscaping market share.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)