U.S. Lead Acid Battery Market Size, Share, Trends and Forecast by Product, Construction Method, Sales Channel, Application, and Region, 2025-2033

U.S. Lead Acid Battery Market Size and Share:

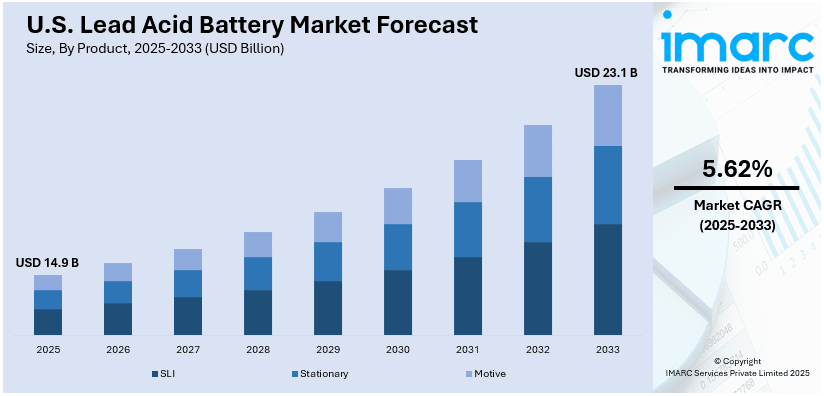

The U.S. lead acid battery market size is anticipated to reach USD 14.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 23.1 Billion by 2033, exhibiting a CAGR of 5.62% from 2025-2033. The market is primarily driven by the increased adoption of lead acid batteries in microgrids, grid-scale storage, and off-grid systems, the growing emphasis on sustainability and recycling, and rising investments in grid modernization and renewable energy integration for enhanced energy storage solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2025 | USD 14.9 Billion |

| Market Forecast in 2033 | USD 23.1 Billion |

| Market Growth Rate (2025-2033) | 5.62% |

The U.S. lead acid battery market is witnessing steady growth due to increasing demand for cost-effective energy storage in industrial, commercial, and residential sectors. These batteries are valued for their reliability and suitability for critical infrastructure, including hospitals and data centers. On November 18, 2024, EnerSys is expected to showcase NexSys TPPL batteries and iQ Mini monitoring devices at ISSA 2024, offering maintenance-free solutions that enhance efficiency and reduce costs. In addition, a higher focus on renewable energy fuels the demand for lead acid batteries, as these outperform in power storage and distribution, solidifying their place in the energy landscape.

Continuous developments in lead acid battery technologies, for example, improved charging efficiency and reduced environmental impacts, are driving their application across several industries. Increased uptake of electrified vehicles in commercial and agricultural industries is also providing a boost to the demand due to the exceptional load-handling capabilities. On September 20, 2024, the Biden-Harris Administration revealed funding of more than USD 3 billion for 25 projects aimed at increasing domestic battery production, which will result in the creation of 12,000+ jobs. Managed by the U.S. Department of Energy (DOE), these initiatives strive to improve critical mineral processing, battery manufacturing, and recycling. Paired with a USD 120 billion private sector investment in EVs, these efforts enhance energy security and competitiveness. The recyclability and domestic production of lead batteries support their importance in the U.S. energy sector.

U.S. Lead Acid Battery Market Trends:

Expansion of Grid-Scale Storage Solutions

The U.S. lead acid battery market is increasingly focused on grid-scale energy storage systems, primarily driven by the need to support renewable energy integration and enhance grid stability. In Q1 2024, the U.S. energy storage market set a record with 1,265 MW deployed, an 84% increase from Q1 2023. According to Wood Mackenzie and the American Clean Power Association’s 2024 US Energy Storage Monitor report, grid-scale installations accounted for 993 MW, the highest ever for a first quarter. Nevada, California, and Texas contributed 90% of this new capacity. Lead acid batteries are being adopted for peak shaving, load balancing, and backup power applications due to their cost-effectiveness and reliability. Increasing investments in grid modernization and distributed energy resources further accelerate this trend, solidifying their role in energy storage.

Increased Focus on Recycling and Sustainability

There is a rising emphasis on the recycling capabilities of lead acid batteries, with nearly 100% recyclability making them a cornerstone of circular economy practices. The 2024 Battery Council International report highlights the U.S. lead acid battery industry's 99% recycling rate, the highest among consumer products. This efficiency diverts millions of pounds of lead and plastic from landfills annually, with over 85% of recycled lead supporting domestic battery production. Valued at USD 33 Billion, the industry sustains 121,000 jobs. Government policies and industry-led advancements in recycling technologies further strengthen lead acid batteries' environmental benefits by reducing waste and ensuring a steady supply of secondary raw materials. These efforts minimize environmental impact and position lead acid batteries as a reliable and sustainable energy storage solution, reinforcing their importance across industrial, automotive, and energy applications in the shifting energy landscape.

Growing Demand for Energy Storage in Emerging Applications

The lead acid battery market in the United States is gaining traction in emerging applications such as microgrids and off-grid energy systems. On October 18, 2024, Ameresco, in collaboration with the U.S. Navy and Hawaiian Electric, announced the Pu`uloa Microgrid project as part of the DOE’s GRIP Program. This 99 MW hybrid microgrid at JBPHH will enhance Oahu’s energy resilience, deliver clean power, create 40 local jobs, and support community initiatives, emphasizing innovation and sustainability. Lead acid batteries are increasingly utilized for their affordability, reliability, and scalability, making them crucial for rural electrification, disaster recovery, and remote energy needs. This trend highlights the growing demand for resilient and accessible energy storage solutions to address diverse environmental challenges and shifting energy requirements across sectors.

U.S. Lead Acid Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. lead acid battery market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product, construction method, sales channel, and application.

Analysis by Product:

- SLI

- Stationary

- Motive

Starting, lighting, and ignition (SLI) batteries are the most popular type of lead acid battery in the United States market, largely due to their frequent usage in vehicles. These batteries are necessary for initiating engines, supplying power for lights, and assisting electrical parts in automobiles, trucks, and motorcycles. The consistent expansion of the automotive sector and need for new batteries maintain SLI as a crucial sector in the market.

Stationary lead acid batteries are commonly used for backup power and energy storage in essential infrastructure such as telecommunications, data centers, and power utilities. Their dependability and affordability render them the top choice for UPS and renewable energy systems. The growth of this segment is being driven by higher investments in grid infrastructure and the demand for strong power solutions.

The purpose of lead acid batteries is to meet the needs of industrial and commercial vehicles including forklifts, golf carts, and electric material-handling equipment. Their capacity for delivering reliable power and handling heavy loads makes them valuable in warehouse and manufacturing settings. The increase in online shopping and mechanization in the transportation industry is driving the need for motive batteries, strengthening their place in the market.

Analysis by Construction Method:

- Flooded

- Valve Regulated Sealed Lead-Acid Battery (VRLA)

Flooded lead acid batteries are an important player in the US lead acid battery market given their strength and affordability. These batteries are commonly used in automotive, industrial, and energy storage applications. Despite the need for frequent maintenance, their strong construction and ability to handle high discharge rates render them perfect for challenging conditions, attributed to their reliability and cost-effectiveness in extensive usage.

Valve regulated sealed lead–acid batteries (VRLA) are becoming increasingly popular in the United States market due to their minimal upkeep and sealed construction that prevents leakage of electrolyte. These batteries are favored for use in situations needing small, low-maintenance power sources, like telecom, UPS, and renewable energy systems. The increasing emphasis on renewable energy sources and effective power control augmented the need for VRLA batteries, showcasing their adaptable features.

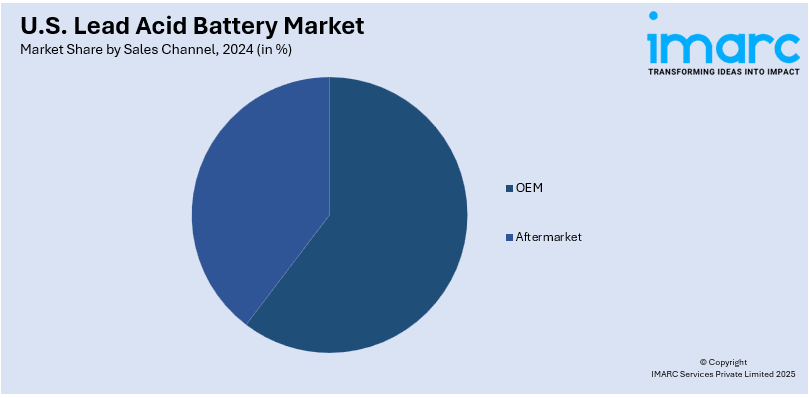

Analysis by Sales Channel:

- OEM

- Aftermarket

Original equipment manufacturer (OEM) lead acid batteries play a crucial role in the United States market by meeting the specific requirements of vehicle manufacturers and industrial equipment producers. These batteries are integrated during production to ensure optimal compatibility and performance. The steady expansion of the automotive and industrial sectors fuels the demand for OEM batteries, reflecting their importance in supporting new vehicle and equipment assembly.

The aftermarket segment in the U.S. lead acid battery market is flourishing due to the demand for replacement batteries across automotive, industrial, and consumer applications. Drivers frequently seek reliable replacements to maintain the efficiency of their vehicles and equipment, making the aftermarket a critical component of the market. Its growth is further bolstered by the increasing number of aging vehicles and the emphasis on battery recycling programs.

Analysis by Application:

- Automotive

- UPS

- Telecom

- Others

Automotive uses are the main focus in the market, as these batteries are widely used in vehicles such as cars, trucks, and motorcycles. Lead acid batteries play a crucial role in ensuring dependable vehicle performance by powering starting, lighting, and ignition systems. The rise in the electric vehicle market, along with the need for new batteries in older cars, is helping to maintain the importance of automotive applications in this industry.

The UPS sector plays a major role in the lead acid battery market in the United States given the crucial requirement for continuous power in data centers, hospitals, and industrial plants. Lead acid batteries are popular for their cost-effectiveness and reliability in supplying backup power during blackouts. The increasing focus on infrastructure resilience and the rise of cloud computing also strengthen the importance of UPS applications in the market.

Telecom applications represent a key segment in the U.S. lead acid battery market, driven by the constant need for reliable power in telecommunications networks. Lead acid batteries are used in base stations, switching centers, and emergency systems to ensure uninterrupted service. As the demand for better connectivity and 5G infrastructure grows, telecom applications continue to drive significant demand for lead acid batteries in this market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States showcases steady demand for lead acid batteries, driven by a high concentration of industrial and commercial facilities requiring reliable power solutions. Dense urban areas and aging infrastructure further contribute to the need for backup power systems, particularly in telecommunications and UPS applications, positioning the Northeast as a vital market for lead acid battery adoption.

In the Midwest, the demand for lead acid batteries is fueled by the region's robust manufacturing and agricultural sectors. These industries rely on industrial equipment and backup power systems that frequently use lead acid batteries. Additionally, the harsh weather conditions in the Midwest encourage the use of reliable automotive batteries, reinforcing the market's stability in this region.

The South represents a significant market for lead acid batteries due to its growing automotive and industrial base. The region's expanding logistics and warehousing operations create strong demand for motive power batteries, while the prevalence of hurricanes and power outages increases reliance on UPS systems, further driving the adoption of lead acid batteries in the area.

The West region of the United States sees substantial lead acid battery use in renewable energy systems and electric vehicles, reflecting the region's focus on sustainability. The demand for backup power in technology hubs and earthquake-prone areas also supports the use of lead acid batteries. With its diverse applications, the West remains an important contributor to the overall market.

Competitive Landscape:

The U.S. lead acid battery market is highly competitive, with key players focusing on technological advancements and strategic partnerships to maintain their market positions. Major manufacturers dominate through robust product portfolios and extensive distribution networks. The market also sees competition from smaller regional players offering cost-effective solutions. Companies are investing in innovations to improve battery efficiency, lifespan, and sustainability, addressing growing environmental concerns. Recycling initiatives and compliance with regulatory standards further shape competition. The increasing demand across automotive, industrial, and renewable energy sectors keeps the market dynamic and fosters continual innovation among competitors.

The report provides a comprehensive analysis of the competitive landscape in the U.S. lead acid battery market with detailed profiles of all major companies.

Latest News and Developments:

- September 26, 2024: American Resources Corporation, alongside ReElement Technologies and LOHUM Cleantech, has signed an MOU to establish the United States' first integrated battery recycling and critical material production facility in Indiana. With a 15.5 GWh capacity and a USD 30 Million investment, the project aims to recycle and refine high-purity battery materials, creating 250 green jobs. This initiative strengthens the domestic battery ecosystem and supports the U.S. critical mineral supply chain.

- April 9, 2024: The U.S. Department of Energy awarded USD 5 Million to Battery Council International (BCI) to establish the Consortium for Lead Battery Leadership in Long Duration Energy Storage (LDES). The program aims to enhance lead battery performance, targeting 10+ hours of storage and USD 0.05/kWh Levelized Cost of Storage by 2030. Collaboration with U.S. manufacturers, national labs, and researchers will drive innovation, leveraging lead batteries' domestic supply chain, recyclability, and efficiency for energy storage solutions.

U.S. Lead Acid Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | SLI, Stationary, Motive |

| Construction Methods Covered | Flooded, Valve Regulated Sealed Lead-Acid Battery (VRLA) |

| Sales Channels Covered | OEM, Aftermarket |

| Applications Covered | Automotive, UPS, Telecom, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. lead acid battery market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. lead acid battery market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. lead acid battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A lead acid battery is a type of rechargeable battery that uses lead dioxide (PbO2) as the positive electrode, sponge lead (Pb) as the negative electrode, and sulfuric acid (H2SO4) as the electrolyte. It operates through an electrochemical reaction that converts chemical energy into electrical energy. Known for its reliability, cost-effectiveness, and recyclability, it is widely used in automotive, industrial, and backup power applications.

The U.S. lead acid battery market size is anticipated to reach USD 14.9 Billion in 2025.

IMARC estimates the U.S. lead acid battery market to exhibit a CAGR of 5.62% during 2025-2033.

The key factors driving the market include the adoption of lead acid batteries in microgrids, grid-scale storage, and off-grid systems, increasing investments in grid modernization and renewable energy integration, ongoing advancements in battery technologies improving efficiency and sustainability, and strong government support promoting recycling and domestic battery production

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)