United States Luxury Travel Market Size, Share, Trends and Forecast by Type of Tour, Age Group, Type of Travellers, and Region, 2026-2034

United States Luxury Travel Market Summary:

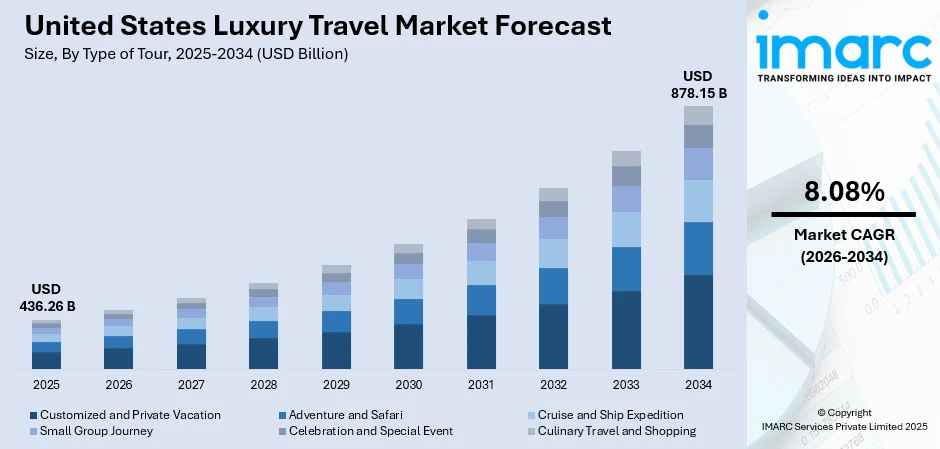

The United States luxury travel market size was valued at USD 436.26 Billion in 2025 and is projected to reach USD 878.15 Billion by 2034, growing at a compound annual growth rate of 8.08% from 2026-2034.

The luxury travel market in the United States is registering significant growth due to the rising disposable incomes of the HNWI population and an ever-increasing desire to have exclusive and customized travel experiences. The luxury travel market in the United States is also boosting due to the growing demands for customized travel experiences, luxurious stay options, and authentic cultural immersion experiences. Experiential travel, wellness travel, and sustainable luxury travel options are still major forces in shaping the preferences of the customers. Advancements in travel technologies and the growing options for customized travel experiences are enhancing the overall luxury travel market share in the United States.

Key Takeaways and Insights:

-

By Type of Tour: Customized and private vacation dominates the market with a share of 32% in 2025, driven by affluent travelers seeking highly personalized itineraries and exclusive experiences tailored to individual preferences.

-

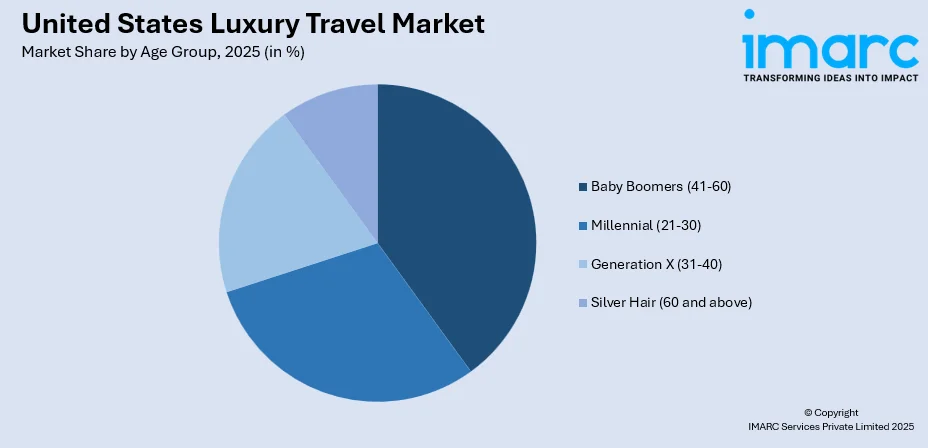

By Age Group: Baby boomers (41-60) lead the market with a share of 34% in 2025, owing to higher disposable incomes, greater leisure time, and a preference for premium travel experiences.

-

By Type of Traveller: Aspiring luxury dominates the market with a share of 39% in 2025, fueled by growing aspirational spending patterns among upper-middle-class consumers seeking premium travel options.

-

By Region: West leads the market with a share of 32% in 2025, supported by high concentrations of affluent populations in California and other coastal states.

-

Key Players: The United States luxury travel market exhibits a moderately fragmented competitive landscape, with established travel operators, luxury hotel chains, and boutique travel agencies competing across premium segments through differentiated services, exclusive partnerships, and personalized experiences. Some of key players include, Abercrombie & Kent USA, LLC, Lindblad Expeditions, Scott Dunn Ltd., Brownell Travel, All Roads North, Kensington Tours Ltd., Tully Luxury Travel, Black Tomato, Pique Travel Design, and The Luxury Travel Agency.

Access the comprehensive market breakdown Request Sample

The United States luxury travel market is transforming as affluent consumers increasingly value meaningful experiences over possessions. For example, Internova Travel Group in 2025 reported strong year‑to‑date U.S. luxury bookings, highlighting growth in group travel, luxury cruising, and privacy‑driven experiences that underscore rising demand for curated, high‑end journeys. Shifts in demographics and rising demand from both established and emerging high-net-worth individuals are driving this change. Supported by a strong tourism infrastructure, diverse destinations, and world-class hospitality, industry players are crafting curated experiences blending adventure, wellness, and cultural immersion. Emphasis on sustainability and authentic local engagement is reshaping offerings, while companies like Luxury Travel Marketing are connecting premium brands with travel advisors specializing in high-end and unique experiences.

United States Luxury Travel Market Trends:

Rise of Experiential and Immersive Travel

Affluent U.S. travelers are increasingly favoring authentic, culturally immersive experiences over conventional luxury amenities. According to reports, over 90% of high‑net‑worth travelers now prefer heritage‑rich, culturally rooted itineraries instead of standardized luxury stays. This reflects a broader desire for meaningful engagement with local communities, artisanal workshops, and unique destinations. Travel providers are responding with curated experiences encompassing adventure, culinary tourism, and exclusive cultural events that leave lasting impressions.

Growing Demand for Sustainable Luxury Options

Environmental consciousness is emerging as a key trend in U.S. luxury travel, with affluent consumers increasingly willing to pay more for sustainable options. In November 2025, Small Luxury Hotels of the World™ (SLH) released a sustainability Call-to-Action Report highlighting its commitment to positive environmental and social impact across over 650 boutique properties, encouraging wider industry adoption. Travelers are prioritizing eco-friendly accommodations, carbon-neutral transport, and community-positive experiences, while leading brands implement renewable energy, waste reduction, and sustainable sourcing practices, aligning luxury travel with environmental responsibility.

Integration of Advanced Technology in Travel Planning

Digital innovation is transforming U.S. luxury travel, with AI and personalization technologies enabling highly tailored experiences. In January 2025, The Luxurist, backed by HBX Group, launched an AI-powered platform connecting premium travel advisors to thousands of high-end global properties. The platform offers seamless itinerary planning, real-time inventory management, and enhanced concierge services. Travelers now enjoy AI-driven recommendations, virtual reality previews, and personalized booking experiences, while companies like The Luxurist elevate convenience, customization, and overall satisfaction in luxury travel.

Market Outlook 2026-2034:

The United States luxury travel market is positioned for sustained expansion throughout the forecast period, supported by favorable demographic trends and evolving consumer preferences toward premium experiences. The market is expected to benefit from increasing wealth concentration, expanding high-net-worth populations, and growing interest in exclusive travel offerings. Innovation in service delivery, personalization technologies, and sustainable luxury options will continue driving market development. The market generated a revenue of USD 436.26 Billion in 2025 and is projected to reach a revenue of USD 878.15 Billion by 2034, growing at a compound annual growth rate of 8.08% from 2026-2034.

United States Luxury Travel Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Tour | Customized and Private Vacation | 32% |

| Age Group | Baby Boomers (41-60) | 34% |

| Type of Traveller | Aspiring Luxury | 39% |

| Region | West | 32% |

Type of Tour Insights:

- Customized and Private Vacation

- Adventure and Safari

- Cruise and Ship Expedition

- Small Group Journey

- Celebration and Special Event

- Culinary Travel and Shopping

The customized and private vacation dominates with a market share of 32% of the total United States luxury travel market in 2025.

Customized and private vacation travel represents the leading tour type in the United States luxury travel market, driven by the growing preference among affluent consumers for highly personalized itineraries that cater to individual interests and preferences. This segment encompasses bespoke travel planning services, exclusive accommodations, and tailored experiences that provide privacy, flexibility, and distinctive opportunities unavailable through standard tourism offerings. High-net-worth individuals increasingly favor these services for their ability to curate every aspect of the journey, from transportation to dining experiences.

The segment's growth is further supported by the expanding network of luxury travel advisors and premium service providers who specialize in crafting unique travel experiences. Private vacation packages often include exclusive access to cultural landmarks, personalized wellness programs, and curated culinary experiences that align with individual traveler preferences. The demand for privacy and exclusivity, particularly among wealthy families and business executives, continues to reinforce this segment's market leadership position.

Age Group Insights:

Access the comprehensive market breakdown Request Sample

- Millennial (21-30)

- Generation X (31-40)

- Baby Boomers (41-60)

- Silver Hair (60 and above)

The baby boomers (41-60) lead with a share of 34% of the total United States luxury travel market in 2025.

Baby boomers represent the dominant demographic in the United States luxury travel market, leveraging their substantial accumulated wealth, greater leisure time, and established travel preferences. This generation demonstrates strong purchasing power for premium travel experiences, with many individuals prioritizing bucket-list destinations, extended luxury cruises, and comprehensive tour packages. Their financial stability and reduced family obligations enable significant investment in high-quality travel services, including first-class accommodations, private transportation, and exclusive guided tours.

The baby boomer demographic is characterized by a preference for comfort, convenience, and culturally enriching experiences that combine relaxation with educational value. This age group typically allocates larger budgets per trip compared to younger generations and demonstrates loyalty to trusted travel brands and service providers. Their interest in wellness tourism, heritage destinations, and premium cruise experiences continues to drive substantial revenue within the luxury travel sector.

Type of Travellers Insights:

- Absolute Luxury

- Aspiring Luxury

- Accessible Luxury

The aspiring luxury dominates with a market share of 39% of the total United States luxury travel market in 2025.

Aspiring luxury travelers form the largest segment in the U.S. luxury travel market, blending premium and budget choices for elevated experiences. In 2023, McKinsey reported that they accounted for about 35% of luxury travel spending, more than any other wealth group. This demographic, including upper-middle-class and emerging affluent consumers, selectively invests in high-end elements like business class flights or premium hotels while staying cost-conscious elsewhere, reflecting rising aspirational consumption trends.

The aspiring luxury segment demonstrates strong price sensitivity combined with appreciation for quality and exclusive experiences. These travelers often prioritize specific splurge-worthy elements, such as a signature dining experience or premium wellness treatment, while optimizing costs elsewhere. Social media influence and the desire for shareable travel experiences significantly impact this demographic's destination choices and service preferences, driving demand for Instagram-worthy locations and unique experiential offerings.

Regional Insights:

- Northeast

- Midwest

- South

- West

West exhibits a clear dominance with a 32% share of the total United States luxury travel market in 2025.

The western United States dominates the luxury travel market, supported by the concentration of high-net-worth populations in California, Washington, and other affluent coastal and metropolitan areas. The region benefits from diverse natural attractions, including premium beach destinations in Hawaii and California, mountain resorts in Colorado and Utah, and world-renowned urban experiences in Los Angeles and San Francisco. The technology sector's wealth creation has significantly expanded the affluent consumer base seeking premium travel experiences.

The west region's market leadership is reinforced by well-developed tourism infrastructure, international airport connectivity, and a strong presence of luxury hospitality brands. Beach destinations in the region have experienced substantial revenue growth, with Hawaii and California coastal areas seeing significant increases in premium bookings. The region's diverse offerings, from wine country experiences in Napa Valley to adventure tourism in national parks, attract both domestic and international luxury travelers.

Market Dynamics:

Growth Drivers:

Why is the United States Luxury Travel Market Growing?

Rising Disposable Income and Wealth Accumulation

Rising disposable income in American households is a key driver of luxury travel market growth. Wealth concentration among high-net-worth and emerging affluent consumers has expanded spending capacity for premium travel. According to reports, in 2024, the U.S. added over 379,000 new millionaires, more than thousand every day, bringing the total to 23.8 million, or about 40% of global millionaires. Growing prosperity enables investment in exclusive experiences, premium accommodations, and bespoke services, sustaining demand for luxury cruises, private tours, and tailored vacations.

Growing Preference for Experiential and Personalized Travel

Consumer preferences are shifting decisively toward experiential travel, where affluent individuals prioritize meaningful, immersive experiences over traditional luxury amenities. This transformation reflects broader cultural changes emphasizing personal growth, authentic cultural engagement, and unique memory-making opportunities. In fact, Marriott International’s 2025 The Intentional Traveler report found that an overwhelming majority of luxury travelers are now seeking deeper cultural engagement and personally meaningful journeys that align with their values, signaling a clear break from conventional tourism offerings. Luxury travelers increasingly seek customized itineraries that offer exclusive access to cultural landmarks, culinary experiences, and adventure activities unavailable through conventional tourism channels.

Technological Advancements Enhancing Travel Experiences

Digital innovation is transforming the luxury travel industry, resulting in levels of customization, simplicity, and services that were not possible before. Artificial intelligence, machine learning, and data analytics mean that travel companies can foretell customer preferences and simplify booking services. Virtual reality technology also means that customers can evaluate destinations and hotels prior to final decisions. Luxury travelers can communicate seamlessly via mobile technology. This technology is preferred by younger affluent segments who require digital sophistication, in addition to luxury services.

Market Restraints:

What Challenges the United States Luxury Travel Market is Facing?

Economic Volatility and Market Uncertainty

Economic instability and fluctuating market conditions pose significant challenges to luxury travel market growth. During economic downturns, discretionary spending on premium travel experiences typically contracts as consumers prioritize essential expenditures. Currency fluctuations, inflation pressures, and changing interest rate environments can impact travel budgets and consumer confidence in making substantial luxury purchases.

Intense Market Competition and Service Differentiation Challenges

The luxury travel market faces increasing competitive intensity as numerous providers seek to capture affluent consumer segments. The proliferation of premium offerings can dilute exclusivity perceptions and challenge established brands to maintain differentiation. Market saturation in certain destination categories requires continuous innovation and investment to sustain competitive positioning and customer loyalty.

Environmental and Sustainability Concerns

Growing environmental awareness among affluent travelers creates both opportunities and challenges for the luxury travel sector. Some consumers are reconsidering extensive travel due to carbon footprint concerns, while others demand sustainable options that may require significant operational investments. Balancing luxury service expectations with environmental responsibility presents ongoing challenges for industry participants.

Competitive Landscape:

The United States luxury travel market exhibits a moderately fragmented competitive landscape characterized by the presence of established global travel operators, premium hotel chains, boutique travel agencies, and specialized experience providers. Market participants compete through service differentiation, exclusive partnerships, technological innovation, and personalized offerings. Key competitive strategies include developing unique destination experiences, building strategic alliances with luxury hospitality brands, and investing in digital platforms that enhance customer engagement. The market demonstrates ongoing consolidation as larger players acquire specialized operators to expand service portfolios and geographic reach.

Some of the key players include:

- Abercrombie & Kent USA, LLC

- Lindblad Expeditions

- Scott Dunn Ltd.

- Brownell Travel

- All Roads North

- Kensington Tours Ltd.

- Tully Luxury Travel

- Black Tomato

- Pique Travel Design

- The Luxury Travel Agency

Recent Developments:

-

In October 2025, Brand USA launches “America the Beautiful” global tourism campaign in to promote U.S. destinations and attract international luxury travelers. The initiative aims to position the United States as a premium travel choice, boosting high-end tourism and enhancing the country’s appeal among affluent global travelers.

United States Luxury Travel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Tours Covered | Customized and Private Vacation, Adventure and Safari, Cruise and Ship Expedition, Small Group Journey, Celebration and Special Event, Culinary Travel and Shopping |

| Age Groups Covered | Millennial (21-30), Generation X (31-40), Baby Boomers (41-60), Silver Hair (60 and above) |

| Type of Travellers Covered | Absolute Luxury, Aspiring Luxury, Accessible Luxury |

| Regions Covered | Northeast, Midwest, South, West |

| Companies Covered | Abercrombie & Kent USA, LLC, Lindblad Expeditions, Scott Dunn Ltd., Brownell Travel, All Roads North, Kensington Tours Ltd., Tully Luxury Travel, Black Tomato, Pique Travel Design, The Luxury Travel Agency |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States luxury travel market size was valued at USD 436.26 Billion in 2025.

The United States luxury travel market is expected to grow at a compound annual growth rate of 8.08% from 2026-2034 to reach USD 878.15 Billion by 2034.

Customized and private vacation dominated the market with a 32% share, driven by growing demand for highly personalized travel itineraries and exclusive experiences among affluent consumers seeking privacy and flexibility in their travel arrangements.

Key factors driving the United States luxury travel market include rising disposable incomes among high-net-worth individuals, growing preference for experiential and personalized travel, technological innovations in travel platforms, and increasing demand for sustainable luxury options.

Major challenges include economic volatility affecting discretionary spending, intense market competition requiring continuous service differentiation, environmental sustainability concerns among eco-conscious travelers, and evolving consumer expectations demanding constant innovation in service delivery.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)