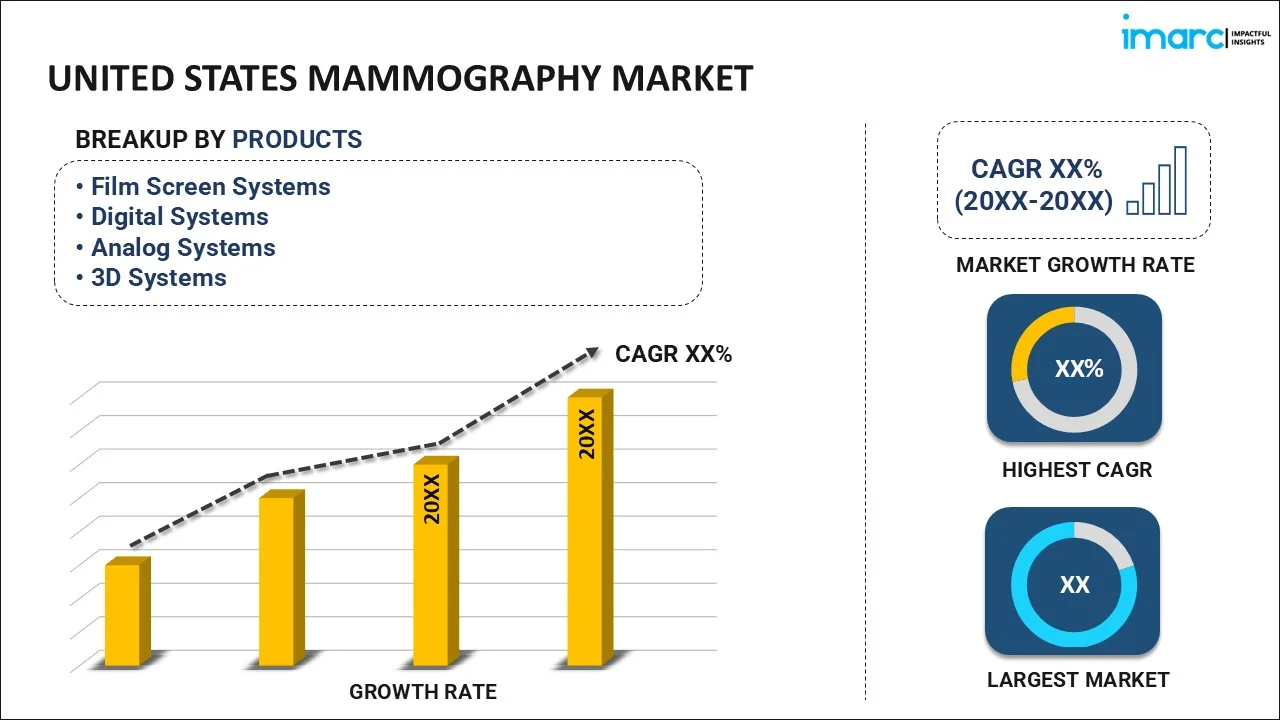

United States Mammography Market Report by Product (Film Screen Systems, Digital Systems, Analog Systems, 3D Systems), Technology (Breast Tomosynthesis, CAD Mammography, Digital Mammography), End-Use (Hospitals, Specialty Clinics, Diagnosis Centers, Others), and Region 2025-2033

United States Mammography Market Overview:

The United States mammography market size reached USD 788.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,413.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.4% during 2025-2033. Increasing breast cancer awareness, ongoing advancements in imaging technology, extensive government screening initiatives, rising healthcare expenditures, growing demand for early diagnosis, rising geriatric population, and improved reimbursement policies are some of the key factors contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 788.4 Million |

| Market Forecast in 2033 | USD 1,413.2 Million |

| Market Growth Rate (2025-2033) | 6.4% |

United States Mammography Market Trends:

Adoption of digital breast tomosynthesis (DBT):

The increasing use of digital breast tomosynthesis (DBT), commonly referred to as three-dimensional (3D) mammography is one of the key factors driving the U.S. mammography market. DBT offers significant improvements over traditional two-dimensional (2D) mammography by capturing multiple images of the breast from different angles, which are then reconstructed into a 3D image. This allows for better visualization of breast tissue, reducing the overlap of tissues that can sometimes hide cancers or create false positives in 2D images. The increased clarity and accuracy provided by DBT has led to higher detection rates of breast cancer, particularly in women with dense breast tissue, thereby strengthening the market growth.

Increased emphasis on early breast cancer detection:

There is a growing emphasis on early breast cancer detection as part of a broader public health strategy, which is driving the U.S. mammography market. Early detection of breast cancer is critical because it significantly improves the chances of successful treatment and survival. The emphasis on early detection has given rise to numerous government initiatives and public health campaigns that seek to raise awareness of breast cancer and the value of routine screening. Organizations such as the American Cancer Society and the U.S. Preventive Services Task Force have updated their guidelines to encourage more frequent mammography screening, particularly for women over the age of 40. Additionally, various state and federal programs are providing funding for mammography services, especially for underserved populations, which is contributing to the market growth.

Advancements in artificial intelligence (AI) for mammography:

The integration of AI into mammography is another significant trend aiding in market expansion. AI technologies are being developed to assist radiologists in interpreting mammograms more accurately and efficiently. These AI algorithms are trained on large datasets of mammographic images to identify patterns that may indicate the presence of breast cancer, sometimes even before it is detectable by the human eye. In addition to this, these AI tools are also useful in reducing the workload of radiologists by prioritizing cases that require urgent attention and decreasing the likelihood of false negatives and false positives. As AI technology continues to advance and become more widely adopted, it is expected to play an increasingly important role in improving the accuracy and efficiency of breast cancer screening, further bolstering market growth.

United States Mammography Market News:

- In December 2023, RadNet, Inc. launched MammogramNow, a groundbreaking mammography service at the Walmart Supercenter in Milford, Delaware, on December 8th. This initiative features advanced DeepHealth® AI technology to enhance breast cancer detection and streamline screening. The service aims to improve accessibility and early detection of breast cancer by integrating state-of-the-art technology into a convenient location, providing efficient, high-quality screening without extending appointment times.

United States Mammography Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product, technology, and end-use.

Product Insights:

- Film Screen Systems

- Digital Systems

- Analog Systems

- 3D Systems

The report has provided a detailed breakup and analysis of the market based on the product. This includes film screen systems, digital systems, analog systems, and 3D systems.

Technology Insights:

- Breast Tomosynthesis

- CAD Mammography

- Digital Mammography

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes breast tomosynthesis, CAD mammography, and digital mammography.

End-Use Insights:

- Hospitals

- Specialty Clinics

- Diagnosis Centers

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes hospitals, specialty clinics, diagnosis centers, and others.

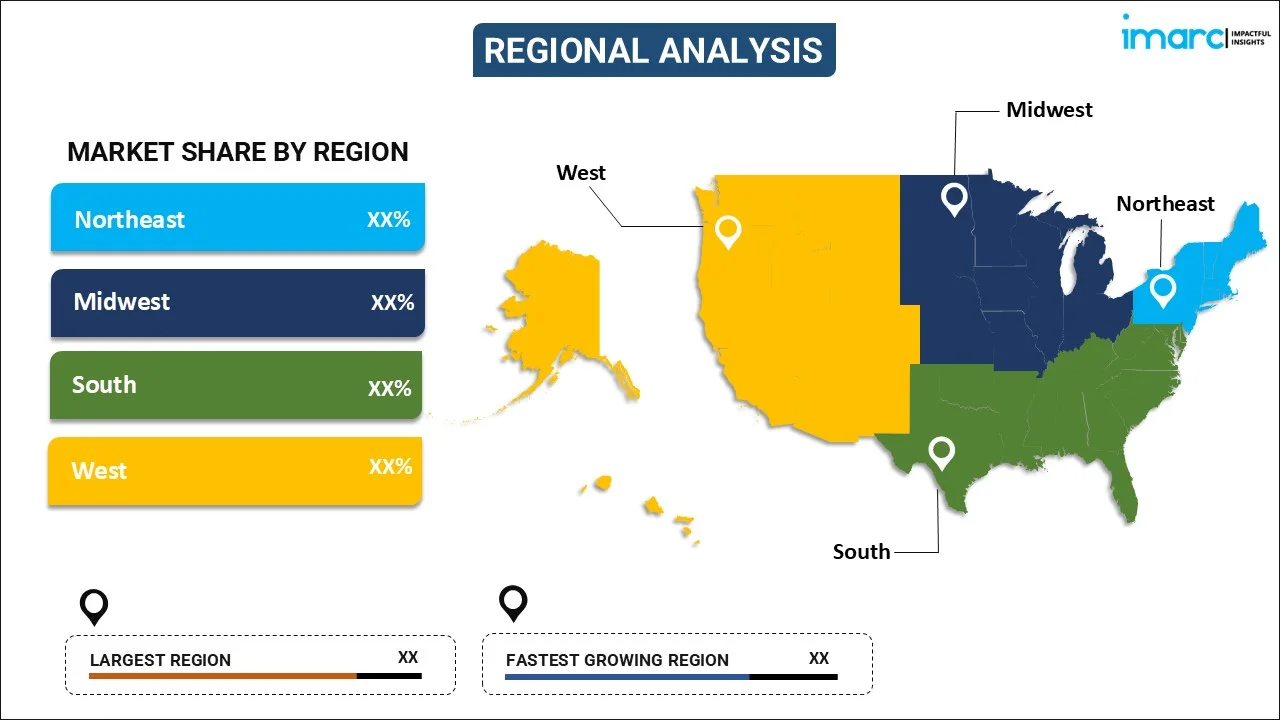

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States Mammography Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Film Screen Systems, Digital Systems, Analog Systems, 3D Systems |

| Technologies Covered | Breast Tomosynthesis, CAD Mammography, Digital Mammography |

| End-Uses Covered | Hospitals, Specialty Clinics, Diagnosis Centers, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States mammography market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States mammography market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States mammography industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mammography market in the United States was valued at USD 788.4 Million in 2024.

The United States mammography market is projected to exhibit a CAGR of 6.4% during 2025-2033, reaching a value of USD 1,413.2 Million by 2033.

The United States mammography market is driven by rising breast cancer prevalence, growing awareness about early detection, and government-led screening initiatives. Technological advancements such as 3D mammography and digital imaging enhance accuracy, while expanding healthcare access and preventive care programs further support widespread adoption of mammography services nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)