United States Material Testing Market Size, Share, Trends and Forecast by Type, Material, End Use Industry, and Region, 2026-2034

United States Material Testing Market Summary:

The United States material testing market size was valued at USD 1,657.72 Million in 2025 and is projected to reach USD 2,048.69 Million by 2034, growing at a compound annual growth rate of 2.38% from 2026-2034.

The market is driven by stringent quality standards across manufacturing sectors, rising demand for advanced testing equipment in automotive and aerospace industries, and increasing focus on infrastructure development requiring material quality assurance. Growing emphasis on research and development activities, along with automated testing solutions adoption, further propels market expansion. Regulatory compliance requirements and enhanced safety protocols are stimulating demand for sophisticated testing machinery, contributing to the expanding United States material testing market share.

Key Takeaways and Insights:

- By Type: Universal testing machines leads the market with a share of 28% in 2025, owing to their versatility in performing tensile, compression, and flexural tests across multiple industries with high accuracy.

- By Material: Metals and alloys represent the largest segment with a market share of 40% in 2025, driven by extensive usage in automotive, aerospace, and construction sectors requiring stringent quality verification.

- By End Use Industry: Automotive dominates the market with a share of 25% in 2025, owing to rigorous safety standards, vehicle lightweighting initiatives, and comprehensive testing requirements throughout production cycles.

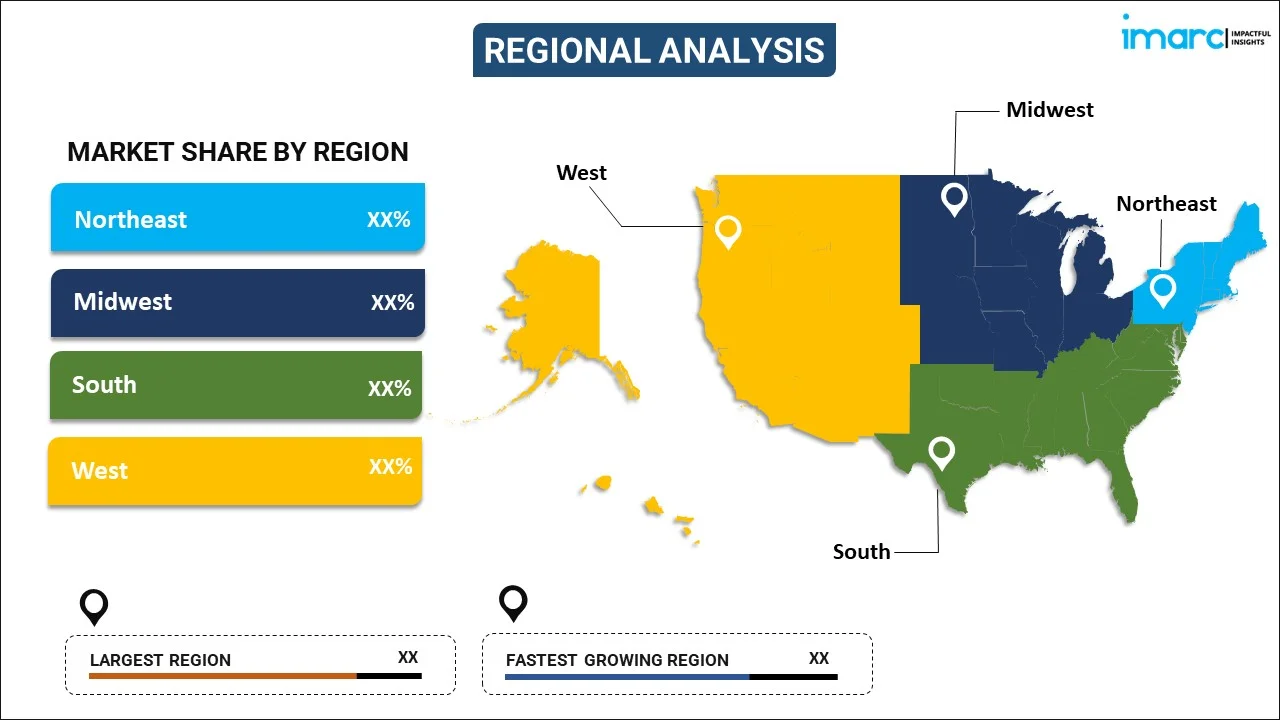

- By Region: South leads the market with a share of 30% in 2025, driven by significant industrial growth across Texas, Georgia, and North Carolina, along with expanding manufacturing facilities.

- Key Players: The United States material testing market exhibits a moderately consolidated competitive landscape, with established equipment manufacturers competing alongside specialized testing solution providers across diverse application segments and price tiers.

The United States material testing market continues to experience sustained growth driven by the expanding manufacturing sector and heightened emphasis on product quality and safety assurance. Industries across the country increasingly recognize the importance of comprehensive material characterization for maintaining competitive advantages and meeting regulatory requirements. According to reports, in September 2024, the U.S. Department of Transportation awarded a $5 Million research initiative to Rutgers University’s Center for Advanced Infrastructure and Transportation to develop innovative construction materials and testing methodologies that improve infrastructure resilience and sustainability. Moreover, the automotive and aerospace sectors particularly drive demand for advanced testing equipment capable of evaluating new material compositions and ensuring structural integrity. Infrastructure development initiatives and construction activities further contribute to market expansion as builders and contractors require reliable testing solutions for construction materials. Research institutions and academic laboratories also significantly influence market dynamics through their continuous pursuit of innovative testing methodologies and equipment upgrades to support cutting-edge scientific investigations. Additionally, growing adoption of automation and digitalization in testing processes enhances operational efficiency and measurement accuracy across applications.

United States Material Testing Market Trends:

Integration of Artificial Intelligence and Machine Learning in Testing Systems

The material testing industry is witnessing substantial adoption of artificial intelligence (AI) and machine learning (ML) technologies to enhance testing accuracy and operational efficiency. In October 2025, researchers at MIT unveiled “SpectroGen,” achieved 99 percent accuracy, generating cross-modality spectroscopic data in under one minute, dramatically reducing material quality verification time and equipment requirements for manufacturers. Furthermore, testing equipment manufacturers are integrating smart algorithms that enable predictive analytics, automated defect detection, and real-time data interpretation capabilities. These intelligent systems analyze complex patterns in test results, identify anomalies, and provide actionable insights that streamline quality control processes. ML models trained on extensive datasets improve testing precision and reduce human error in result interpretation.

Growing Demand for Non-Destructive Testing Solutions

Non-destructive testing methods are gaining significant traction across industries seeking to evaluate material properties without compromising component integrity. Advanced ultrasonic, radiographic, and electromagnetic testing techniques enable comprehensive material assessment while preserving specimens for actual application. In June 2025, Eddyfi Technologies launched Cypher, a portable ultrasonic inspection platform delivering the fastest TFM inspection speeds, automated probe detection, and rugged field-ready design for advanced non-destructive testing applications. Furthermore, this trend is particularly prominent in aerospace, energy, and critical infrastructure sectors where component replacement costs are substantial and structural integrity is paramount.

Expansion of Testing Capabilities for Advanced Materials

The emergence of innovative materials including carbon fiber composites, advanced polymers, and metal matrix composites necessitates development of specialized testing equipment and methodologies. Testing machine manufacturers are designing systems capable of evaluating complex material behaviors under diverse loading conditions and environmental factors. As per sources, SGS announced the acquisition of Applied Technical Services (ATS), strengthening its U.S. testing capabilities with 85 facilities and 2,100 skilled professionals to support aerospace, manufacturing, and power generation material testing requirements. Moreover, this trend responds to increasing utilization of lightweight, high-strength materials in automotive, aerospace, and renewable energy applications. Testing protocols are evolving to address unique characteristics of nanomaterials and additive manufacturing outputs.

Market Outlook 2026-2034:

The United States material testing market is positioned for sustained revenue growth throughout the forecast period, supported by expanding industrial manufacturing activities and increasing quality assurance investments. The automotive sector's transition toward electric vehicles (EVs) and lightweight materials will drive substantial demand for advanced testing equipment. Aerospace and defense industries will continue investing in sophisticated testing solutions to meet stringent safety and performance requirements. Infrastructure modernization initiatives will further contribute to market revenue expansion as construction projects require comprehensive testing services. The market generated a revenue of USD 1,657.72 Million in 2025 and is projected to reach a revenue of USD 2,048.69 Million by 2034, growing at a compound annual growth rate of 2.38% from 2026-2034.

United States Material Testing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Universal Testing Machines | 28% |

| Material | Metals and Alloys | 40% |

| End Use Industry | Automotive | 25% |

| Region | South | 30% |

Type Insights:

To get detailed segment analysis of this market Request Sample

- Universal Testing Machines

- Servohydraulic Testing Machines

- Hardness Testing Machines

- Impact Testing Machines

- Non-Destructive Testing Machines

Universal testing machines leads with a share of 28% of the total United States material testing market in 2025.

Universal testing machines represent the leading segment in the market, commanding the largest revenue share among testing equipment categories. These versatile systems accommodate multiple testing modes including tensile, compression, bend, and shear testing within a single platform, making them indispensable for quality control laboratories and research facilities. According to reports, Instron introduced a new 100 kN table model universal testing system, offering high‑force testing capabilities in a compact design that enables more flexible materials evaluation in space‑constrained labs. Moreover, the widespread adoption stems from their flexibility in testing diverse materials ranging from metals and plastics to textiles and composites using interchangeable fixtures and grips.

The dominance of universal testing machines is reinforced by continuous technological advancements that enhance their measurement accuracy, data acquisition capabilities, and user interface functionality. Modern systems incorporate sophisticated software platforms enabling complex test programming, real-time graphical analysis, and comprehensive reporting features. Manufacturers across automotive, aerospace, construction, and consumer products sectors rely on universal testing machines to validate the material specifications, develop new products, and ensure regulatory compliance throughout production processes.

Material Insights:

- Metals and Alloys

- Plastics

- Rubber and Elastomers

- Ceramics and Composites

- Others

Metals and alloys exhibit a clear dominance with a 40% share of the total United States material testing market in 2025.

Metals and alloys lead the market, reflecting the foundational importance of metallic materials across virtually all industrial sectors. The extensive testing requirements for steel, aluminum, titanium, and specialized alloys used in automotive, aerospace, construction, and manufacturing applications drive substantial demand for testing equipment and services. As per sources, Element Materials Technology expanded its Cincinnati facility, enhancing its 60,000-square-foot material testing lab with over 250 test machines, strengthening metal and ceramic testing for aerospace, transportation, and medical industries. Moreover, regulatory standards mandate comprehensive mechanical property verification for metallic components used in safety-critical applications, further reinforcing the segment's leading market position.

The prominence of metals and alloys testing is sustained by ongoing material development efforts seeking enhanced performance characteristics through alloying and processing innovations. Automotive lightweighting initiatives increase demand for testing advanced high-strength steels and aluminum alloys, while aerospace applications require rigorous evaluation of titanium and nickel-based superalloys. The construction industry's substantial consumption of structural steel and reinforcement materials generates continuous testing requirements for quality assurance and regulatory compliance throughout infrastructure development projects.

End Use Industry Insights:

- Automotive

- Construction

- Education

- Aerospace and Defense

- Oil and Gas

- Energy and Power

- Others

Automotive leads with a market share of 25% of the total United States material testing market in 2025.

The automotive emerges as the leading in the market, driven by comprehensive quality assurance requirements throughout vehicle development and manufacturing processes. Automotive manufacturers and their supply chain partners conduct extensive material testing to validate component performance, ensure safety compliance, and support continuous improvement initiatives. In April 2025, Boyd opened a state‑of‑the‑art battery material test lab in San Jose, California, dedicated to EV battery safety and material performance under rigorous conditions. The industry's transition toward EVs introduces new testing requirements for battery materials, lightweight composites, and novel joining technologies that demand sophisticated evaluation capabilities.

The automotive’s dominance reflects its substantial scale and rigorous quality standards that necessitate comprehensive testing programs across material categories. Vehicle safety regulations mandate extensive verification of structural materials, crash-resistant components, and fatigue-critical parts through standardized testing protocols. Additionally, the competitive nature of the automotive industry drives continuous investment in testing capabilities that support accelerated product development cycles, manufacturing efficiency improvements, and enhanced performance validation across diverse operating conditions.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northeast

- Midwest

- South

- West

South dominates with a market share of 30% of the total United States material testing market in 2025.

The South commands the largest share of the market, benefiting from significant industrial growth and manufacturing expansion across multiple states. Texas, Georgia, North Carolina, Tennessee, and Alabama host major automotive manufacturing facilities, aerospace production sites, and petrochemical complexes that generate substantial demand for material testing equipment and services. The region's favorable business environment and infrastructure investments attract continued industrial development, further strengthening its dominant position in the national market landscape.

The regions market leadership reflects diversified industrial activities spanning automotive assembly plants, aerospace component manufacturing, energy sector operations, and construction activities related to population growth and economic development. Major automotive manufacturers have established production facilities throughout the region, creating demand for comprehensive testing capabilities among original equipment manufacturers and suppliers. Additionally, the energy sector's concentration in Texas and the Gulf Coast region generates testing requirements for materials used in oil, gas, and renewable energy applications.

Market Dynamics:

Growth Drivers:

Why is the United States Material Testing Market Growing?

Stringent Quality Standards and Regulatory Compliance Requirements

The United States material testing market benefits significantly from increasingly rigorous quality standards and regulatory frameworks governing manufactured products across industries. Federal agencies and industry organizations continue expanding requirements for material verification and documentation to ensure public safety and product reliability. As per sources, OSHA expanded UL LLC’s recognition under the Nationally Recognized Testing Laboratory (NRTL) program, adding one test site and two test standards, reinforcing compliance requirements for industrial and safety-critical products. Furthermore, manufacturing sectors including automotive, aerospace, medical devices, and construction materials face comprehensive testing mandates that drive investment in advanced testing equipment. These regulatory pressures compel manufacturers throughout supply chains to maintain robust quality assurance programs supported by sophisticated testing capabilities.

Rapid Expansion of Advanced Manufacturing Technologies

The proliferation of advanced manufacturing technologies including additive manufacturing, automated production systems, and smart factory implementations creates expanded requirements for material testing across the industrial landscape. New manufacturing processes introduce unique material behaviors and quality considerations that necessitate specialized testing approaches and equipment capabilities. Additive manufacturing applications require comprehensive evaluation of powder materials, build parameters, and finished component properties to ensure reliable production outcomes. According to reports, in June 2025, Constellium partnered with Nikon AM and America Makes in a $2.1 Million project to test Aheadd® CP1 aluminum alloy for additive manufacturing in U.S. defense and aerospace applications, generating critical material property data

Growing Infrastructure Investment and Construction Activities

Substantial infrastructure investment programs and expanding construction activities throughout the United States generate significant demand for material testing services and equipment. Federal infrastructure legislation allocates substantial funding for transportation systems, bridges, utilities, and public facilities requiring comprehensive material quality verification throughout project execution. In December 2025, SOCOTEC USA expanded its construction materials testing capabilities by acquiring multiple regional firms, strengthening accredited testing services for concrete, asphalt, soils, steel, and masonry across the country. Moreover, construction industry growth in residential, commercial, and industrial sectors creates continuous testing requirements for concrete, steel, aggregates, and structural components ensuring structural integrity, durability, and regulatory compliance for projects.

Market Restraints:

What Challenges the United States Material Testing Market is Facing?

High Capital Investment Requirements for Advanced Equipment

Material testing equipment, particularly sophisticated systems incorporating advanced sensors, automation features, and comprehensive software platforms, requires substantial capital investment that presents barriers for smaller laboratories and manufacturers. The acquisition costs for modern universal testing machines, servohydraulic systems, and non-destructive testing equipment can challenge budget constraints for organizations seeking comprehensive testing capabilities.

Technical Complexity and Specialized Expertise Requirements

Advanced material testing equipment demands specialized technical expertise for proper operation, calibration, and result interpretation that presents workforce challenges for many organizations. The shortage of qualified testing professionals and engineers capable of operating sophisticated equipment and implementing complex testing protocols limits broader market adoption. Training requirements add operational costs and complexity.

Maintenance and Calibration Cost Considerations

Material testing equipment requires a regular calibration and maintenance to ensure measurement accuracy and regulatory compliance, creating ongoing operational expenses that impact total cost of ownership. Calibration services, replacement components, and technical support requirements add to lifecycle costs beyond initial equipment acquisition. Equipment downtime during maintenance can disrupt production schedules.

Competitive Landscape:

The United States material testing market features a competitive landscape characterized by the presence of established global equipment manufacturers alongside specialized regional providers offering diverse testing solutions. Market participants differentiate through technological innovation, product portfolio breadth, service capabilities, and industry-specific expertise. Leading companies invest substantially in research and development to introduce advanced features including automation, digitalization, and enhanced measurement technologies that address evolving customer requirements. The competitive environment drives continuous product enhancement and service quality improvements as manufacturers seek to strengthen market positions across target industries. Strategic partnerships between equipment manufacturers and software developers enable integrated solutions combining testing hardware with sophisticated data management and analysis capabilities.

Recent Developments:

- In November 2025, Intertek Group acquired Professional Testing Laboratory (PTL), a leading U.S. flooring products testing company, to expand its Total Quality Assurance services. The acquisition strengthens Intertek’s North American footprint, unlocking synergies across testing, inspection, and certification solutions while supporting rigorous quality, safety, and sustainability standards in the flooring industry.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Universal Testing Machines, Servohydraulic Testing Machines, Hardness Testing Machines, Impact Testing Machines, Non-Destructive Testing Machines |

| Materials Covered | Metals and Alloys, Plastics, Rubber and Elastomers,Ceramics and Composites, Others |

| End Use Industries Covered | Automotive, Construction, Education, Aerospace and Defense, Oil and Gas, Energy and Power, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States material testing market size was valued at USD 1,657.72 Million in 2025.

The United States material testing market is expected to grow at a compound annual growth rate of 2.38% from 2026-2034 to reach USD 2,048.69 Million by 2034.

Universal testing machines held the largest market share, driven by their exceptional versatility in performing multiple test types including tensile, compression, and flexural testing across diverse materials and various industries, along with widespread adoption in quality control and research laboratories.

Key factors driving the United States material testing market include stringent quality standards and regulatory compliance requirements, expansion of advanced manufacturing technologies, growing infrastructure investments, and increasing adoption of innovative materials requiring specialized testing capabilities.

Major challenges include high capital investment requirements for advanced testing equipment, technical complexity demanding specialized expertise, ongoing maintenance and calibration costs, shortage of qualified testing professionals, and integration complexities with existing laboratory information management systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)