United States Microgrid Market Expected to Reach USD 24.4 Billion by 2033 - IMARC Group

United States Microgrid Market Statistics, Outlook and Regional Analysis 2025-2033

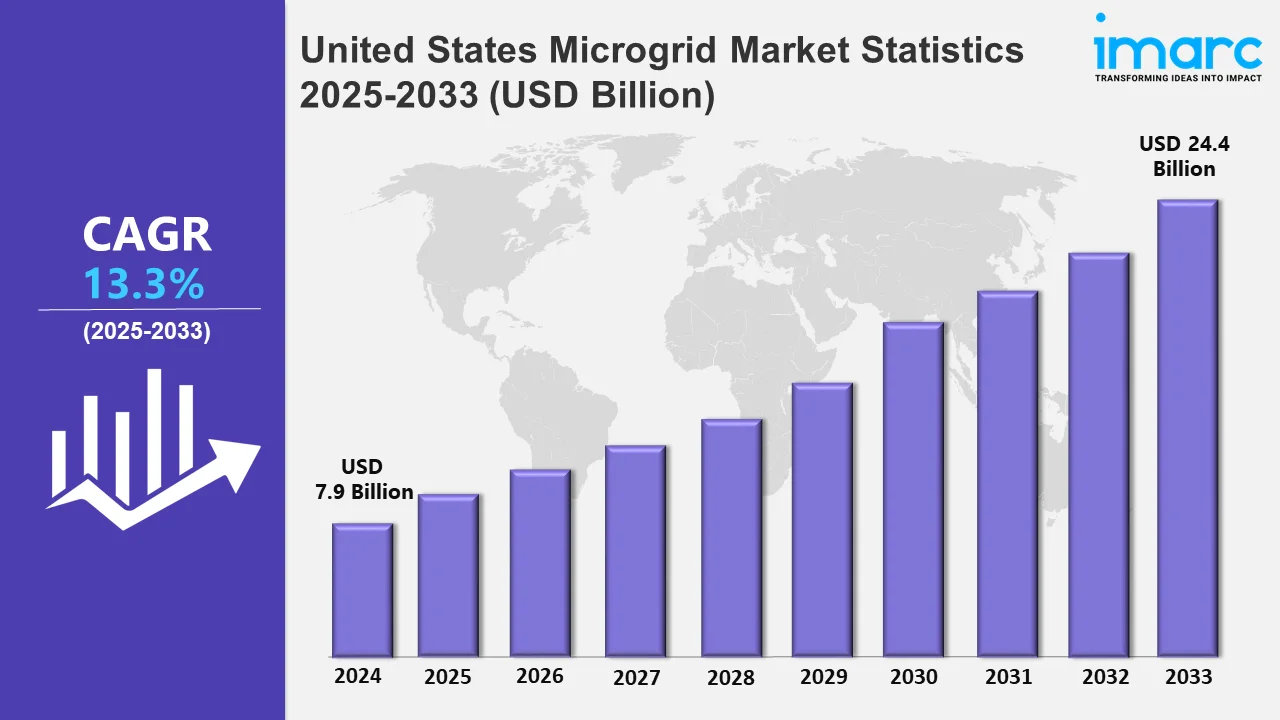

The United States microgrid market size was valued at USD 7.9 Billion in 2024, and it is expected to reach USD 24.4 Billion by 2033, exhibiting a growth rate (CAGR) of 13.3% from 2025 to 2033.

To get more information on this market, Request Sample

The increasing focus on grid resilience, energy decentralization, and integration of renewable energy sources is significantly favoring the growth of the microgrid market in the United States. As climate-related disruptions intensify, policymakers and utilities are prioritizing infrastructure improvements to enhance energy reliability. In addition, the push for decarbonization is leading to the widespread adoption of microgrids, which support the transition to clean energy by enabling localized energy generation and distribution. Market players are leveraging advancements in artificial intelligence, energy storage, and grid management to optimize microgrid operations and efficiency. These trends are strengthening decentralized energy frameworks, reducing dependency on centralized power systems, and fostering energy independence. For instance, in December 2024, the US Department of Energy’s Grid Deployment Office designated three National Interest Electric Transmission Corridors, prioritizing microgrid deployment. These projects aim to modernize the grid, facilitate renewable energy transmission, and bolster resilience against climate-related events, contributing to a stronger and more flexible energy infrastructure.

Concurrent with this, in November 2024, the Artificial Intelligence for Interconnection Program received USD 30 Million in federal funding to streamline microgrid approvals. This initiative addresses regulatory challenges, accelerates project timelines, and enhances the overall deployment of microgrids across the United States. Such government-backed efforts are reducing bureaucratic delays and fostering a favorable environment for microgrid expansion. Additionally, the growing emphasis on energy security in rural and underserved areas is driving investments in microgrid technology. Many remote and indigenous communities in the region face high energy costs and grid instability, making microgrids a viable solution for sustainable power generation. The rising adoption of distributed energy resources, coupled with advancements in battery storage and demand response technologies, is enabling more cost-effective and resilient energy solutions. In line with this, in October 2024, the US Department of Energy launched the Community Microgrid Assistance Partnership to support microgrid deployment in Alaska, Hawaii, and the Great Plains tribal regions. This initiative is enhancing grid resilience, reducing dependence on fossil fuels, and advancing microgrid development in rural and indigenous communities, reinforcing the broader trend of decentralized energy adoption in the United States.

United States Microgrid Market Statistics, By Region

The market research report has also provided a comprehensive analysis of all the major regional markets, which include the Northeast, Midwest, South, and West. The US microgrid industry is growing due to higher energy resilience demands, renewable energy integration, management tech advancements, rural electrification, and sustainable transportation and corporate goals.

Northeast Microgrid Market Trends:

The Northeast region is seeing significant growth in microgrids, with a focus on resilience and sustainability. For instance, Scale Microgrids expanded its portfolio by acquiring 500 megawatts of solar and storage projects across New York and nearby areas in January 2024. This acquisition enhances grid resilience and reduces CO₂ emissions by 800,000 tons. In urban cities like New York, where demand is heightened and power outages are common, microgrids are increasingly considered as a way to improve energy reliability. As a result, the area is providing decentralized energy solutions for home and commercial use top priority.

Midwest Microgrid Market Trends:

The Midwest, led by Illinois, is adopting microgrids to stabilize energy supply for industrial hubs and rural communities. As a region with significant wind energy potential, hybrid microgrids combining wind, solar, and storage are emerging. The Bronzeville Microgrid in Chicago, supported by ComEd, exemplifies utility-driven microgrids enhancing grid resilience and security. Furthermore, the state's Future Energy Jobs Act promotes distributed generation. Also, microgrids in agricultural zones ensure power reliability for grain processing and irrigation, reducing economic losses from grid disruptions during peak farming seasons.

South Microgrid Market Trends:

In the South, extreme weather events and the need for energy security are driving microgrid development. Aligned with this, in January 2025, the US Department of Energy allocated USD 28.7 Million to a utility-scale battery storage microgrid project in Tallahassee, Florida. This system ensures resilience for municipal utilities, reduces fuel costs by USD 160,000 annually, and enhances energy reliability for critical infrastructure. Concurrently, microgrids in the region are focusing on economic and operational benefits, particularly in areas prone to hurricanes and power disruptions, demonstrating how these systems mitigate risks in storm-prone zones.

West Microgrid Market Trends:

The West is embracing microgrids for community-driven solutions and energy sovereignty. Reflecting this trend, in August 2024, the Hoopa Valley, Yurok, and Karuk tribes in Humboldt County, California, launched a USD 177 Million microgrid initiative, with USD 88 Million funded by the DOE. These interconnected microgrids aim to reduce power outages and improve energy access for tribal communities. This project highlights the region’s commitment to using microgrids for local, sustainable energy, serving as a model for scalable systems in rural and indigenous areas. The initiative underscores the potential of microgrids to empower underserved populations.

Top Companies Leading in the United States Microgrid Industry

The United States microgrid market is highly competitive, driven by advancements in renewable energy technologies like solar and wind. Developments in smart grid integration and lithium-ion battery storage increase system dependability. For instance, in May 2024, a USD 10.5 Million DOE-funded project in Anchorage, Alaska, advanced AI-driven optimization for scalable microgrids, benefiting underserved communities and accelerating decentralized energy solutions. Besides this, in April 2024, SolMicroGrid deployed a solar-powered microgrid at Chick-fil-A in Santa Rosa, California, showcasing the commercial potential of microgrids for operational continuity and reducing grid dependency. These developments highlight the growing adoption and importance of microgrids across the country.

United States Microgrid Market Segmentation Coverage

- On the basis of the energy source, the market has been bifurcated into natural gas, combined heat and power, solar photovoltaic (PV), diesel, fuel cell, and others. These sources provide diverse, reliable energy for microgrids, supporting efficiency, sustainability, and resiliency. Also, ensures optimized energy production for varying load demands in decentralized systems.

- Based on the application, the market is categorized into remote systems, institution and campus, utility/community, defense, and others. Microgrids serve these systems by enhancing energy security, reliability, and autonomy. Furthermore, these applications enable localized, resilient power with tailored solutions addressing specific needs like off-grid operations, sustainability goals, and critical infrastructure support.

| Report Features | Details |

|---|---|

| Market Size in 2024 | USD 7.9 Billion |

| Market Forecast in 2033 | USD 24.4 Billion |

| Market Growth Rate 2025-2033 | 13.3% |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Energy Sources Covered | Natural Gas, Combined Heat and Power, Solar Photovoltaic (PV), Diesel, Fuel Cell, Others |

| Applications Covered | Remote Systems, Institution and Campus, Utility/Community, Defense, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Browse IMARC Related Reports on Microgrid Market:

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Inquire Before Buying

Inquire Before Buying

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

.webp)

.webp)