United States Minimally Invasive Surgery Devices Market Size, Share, Trends, and Forecast by Products, Application, and Region, 2025-2033

United States Minimally Invasive Surgery Devices Market Size and Share:

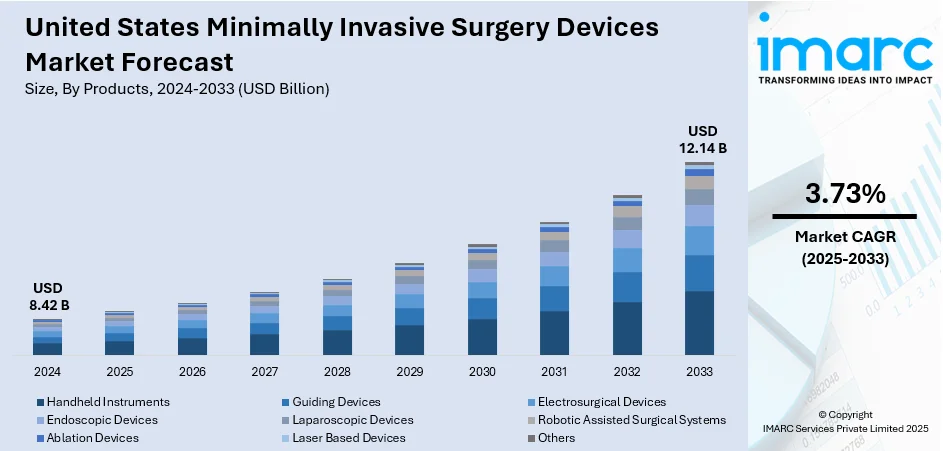

The United States minimally invasive surgery devices market size was valued at USD 8.42 Billion in 2024. Looking forward, the market is expected to reach USD 12.14 Billion by 2033, exhibiting a CAGR of 3.73% during 2025-2033. The market is experiencing steady growth, fueled by rising demand for advanced surgical procedures that reduce recovery time, hospital stays, and post-operative complications. Innovations in robotics, imaging, and laparoscopic tools are enhancing precision and outcomes. Increasing prevalence of chronic diseases, coupled with a strong preference for less invasive treatment options, is supporting expansion across hospitals and clinics, strengthening the United States minimally invasive surgery devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.42 Billion |

| Market Forecast in 2033 | USD 12.14 Billion |

| Market Growth Rate 2025-2033 | 3.73% |

The market is witnessing strong growth, majorly shaped by the increasing demand for advanced surgical solutions that improve patient outcomes and reduce recovery times. One of the key drivers is the rising prevalence of chronic diseases such as cardiovascular disorders, gastrointestinal conditions, and cancers, which necessitate procedures that are effective yet less invasive. MIS devices offer advantages such as reduced hospital stays, minimal scarring, fewer complications, and quicker rehabilitation, making them the preferred choice among both patients and healthcare providers. For instance, in January 2024, Arthrex, a renowned innovator in minimally invasive surgical technologies and medical training, introduced TheNanoExperience.com, a new platform dedicated to patients. The website showcases the science and advantages of Nano arthroscopy, an advanced, ultra-minimally invasive orthopedic technique designed to reduce pain and support faster recovery, enabling patients to return to activity sooner.

To get more information on this market, Request Sample

The United States minimally invasive surgery devices market growth is also driven by technological advancements. Innovations in robotic-assisted surgery, advanced imaging systems, and electrosurgical tools have enhanced the precision, safety, and efficiency of minimally invasive procedures. The integration of AI-driven platforms and real-time imaging is further revolutionizing surgical practices across leading hospitals and clinics in the country. For instance, in March 2025, Johnson & Johnson MedTech unveiled the DUALTO™ Energy System, a versatile platform that integrates multiple energy modalities for open and minimally invasive surgeries. Compatible with Service Solutions for uptime support and the Polyphonic Fleet software for device management, DUALTO is also designed for future integration with the OTTAVA Robotic Surgical System.

United States Minimally Invasive Surgery Devices Market Trends:

Growing Prevalence of Chronic Diseases

The rising prevalence of long-term illnesses such as high blood pressure, diabetes, and heart disease among the masses is bolstering the market growth in the United States. Hypertension, in particular, notably increases the risk of complications during and after surgery, making minimally invasive surgery (MIS) a preferred option. These methods are less invasive, reducing surgical impact and lowering the chance of complications, which is particularly vital for patients with chronic conditions. The growing prevalence of chronic illnesses among individuals is catalyzing the demand for sophisticated MIS devices to manage these conditions. A 2024 report from the U.S. Centers for Disease Control and Prevention (CDC) indicates that roughly 129 million Americans live with at least one major chronic condition. Additionally, 42% of the population has two or more chronic illnesses, and 12% experience as many as five. In 2023, the U.S. Food and Drug Administration (FDA) approved Medtronic’s Symplicity Spyral™ renal denervation system to treat hypertension. This minimally invasive device uses radiofrequency energy to target overactive renal nerves, aiming to reduce blood pressure in patients who do not respond sufficiently to conventional medications and lifestyle interventions. The approval marked a noteworthy advancement in the management of high blood pressure, providing a novel therapeutic choice for patients.

Advancements in Technology

Advancements, including robotics, artificial intelligence (AI), and improved imaging technology, are improving the accuracy and efficacy of these procedures, lowering the chance of complications. Surgeons can carry out intricate surgeries with more precision and flexibility using tools, such as robotic-assisted surgical systems and advanced endoscopic devices. According to the United States minimally invasive surgery devices market trends, this technological evolution is significantly improving surgical outcomes and also expanding the scope of procedures that can be performed less invasively. Moreover, the incorporation of AI and machine learning (ML) in MIS tools is improving real-time decision-making and surgical planning, increasing the utilization of these tools in different fields like orthopedic, gynecological, and cardiovascular surgeries. In 2023, US Medical Innovations and the Jerome Canady Research Institute launched the Canady Robotic AI Surgical System, the first AI-powered robotic system using cold atmospheric plasma (CAP) technology. This system aimed to precisely target and eliminate microscopic tumor cells while preserving healthy tissue. It also featured advanced AI software, 3D navigational-guided surgical planning, and speech-activated robotic controls for various minimally invasive procedures.

Increasing Patient Demand for Less Invasive Procedures

Patient preferences are shifting toward less invasive surgical options because of the numerous benefits they offer, such as reduced pain, shorter hospital stays, quicker recovery times, and minimal scarring. As a result, the minimally invasive surgery market in the United States reached USD 25.7 Billion in 2024 and is projected to reach USD 36.3 Billion by 2033, growing at a CAGR of 3.73% during 2025-2033, according to a report published by the IMARC Group. Patients are becoming more knowledgeable about the benefits of MIS and are actively looking for healthcare providers who offer these choices. Moreover, the growing focus on patient-centered care by healthcare providers is resulting in a higher rate of adoption of MIS devices. Hospitals and surgical centers are investing in novel minimally invasive technologies in response to changing individual demands, aiming to enhance patient outcomes. In 2024, Intuitive revealed that the FDA approved 510(k) clearance for da Vinci 5, the company's latest robotic system, aimed at improving MIS. The da Vinci 5 has been enhanced with over 150 features, including better precision, an advanced 3D screen, and updated force-sensing technology intended to minimize tissue damage and enhance surgical accuracy.

United States Minimally Invasive Surgery Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States minimally invasive surgery devices market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on products and application.

Analysis by Products:

- Handheld Instruments

- Guiding Devices

- Electrosurgical Devices

- Endoscopic Devices

- Laparoscopic Devices

- Robotic Assisted Surgical Systems

- Ablation Devices

- Laser Based Devices

- Others

Handheld instruments are expected to secure a significant share in the market due to their indispensable role in a wide range of procedures, including laparoscopy, arthroscopy, and endoscopy. Their precision, versatility, and ease of use make them critical for surgeons performing complex yet minimally invasive operations. Continuous advancements in ergonomics and material durability further enhance efficiency and reduce surgeon fatigue. The growing adoption of handheld instruments in both outpatient and inpatient surgical settings, alongside increasing demand for cost-effective and reusable solutions, supports their strong market presence and sustained growth trajectory.

Guiding devices hold a prominent position in the market because they provide surgeons with real-time visualization and navigation during procedures. Technologies such as imaging systems, catheters, and endoscopic cameras enhance accuracy, reduce risks, and minimize complications, ensuring better patient outcomes. With rising demand for image-guided and robotic-assisted surgeries, guiding devices are becoming indispensable tools across specialties such as cardiology, orthopedics, and neurology. Their ability to improve surgical precision, shorten recovery times, and align with value-based healthcare practices makes them a key growth driver, ensuring a major market share in the coming years.

Electrosurgical devices are projected to capture a significant share of the market due to their ability to cut, coagulate, and seal tissue with high precision. According to the United States minimally invasive surgery devices market forecast, these devices minimize blood loss, reduce operative times, and enhance patient recovery outcomes, making them vital in minimally invasive surgeries. Their widespread application across general surgery, gynecology, urology, and gastroenterology broadens their relevance. Additionally, ongoing innovations such as advanced energy-based technologies and integration with laparoscopic systems enhance performance and safety. The rising number of outpatient and ambulatory procedures further boosts adoption, solidifying their strong presence in the market.

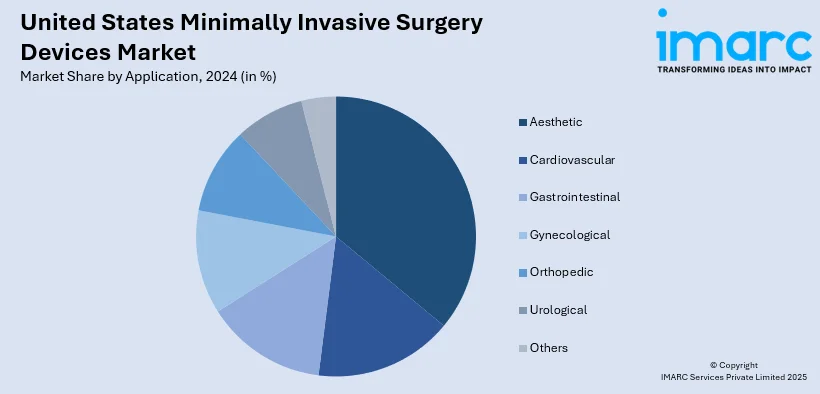

Analysis by Application:

- Aesthetic

- Cardiovascular

- Gastrointestinal

- Gynecological

- Orthopedic

- Urological

- Others

Aesthetic procedures are expected to hold a major share in the market due to rising demand for cosmetic enhancements with shorter recovery times. Treatments like liposuction, breast augmentation, and facial rejuvenation increasingly rely on minimally invasive techniques to reduce scarring and downtime. Advancements in laser-based, radiofrequency, and endoscopic technologies have broadened treatment options, attracting both younger and aging populations seeking effective results with minimal risks. The cultural shift toward personal wellness, combined with rising disposable incomes and growing acceptance of cosmetic procedures, continues to fuel the adoption of minimally invasive devices in aesthetic applications.

Cardiovascular applications account for a substantial share of the market, driven by the rising prevalence of heart disease and related conditions. Procedures such as angioplasty, stenting, and valve repair increasingly rely on minimally invasive devices to improve outcomes and reduce complications. These technologies allow surgeons to perform complex interventions with smaller incisions, leading to shorter hospital stays and faster recovery. Innovations in guiding devices, catheters, and electrosurgical systems further enhance precision and safety. With cardiovascular diseases remaining a leading health concern in the US, demand for minimally invasive solutions in this segment continues to expand.

Gastrointestinal applications are expected to maintain a strong presence in the market due to the rising incidence of digestive disorders such as colorectal cancer, gallstones, and gastroesophageal reflux disease (GERD). Minimally invasive techniques like laparoscopic colectomies, cholecystectomies, and endoscopic procedures are preferred for reducing surgical trauma and recovery times. The increasing use of advanced electrosurgical tools, handheld instruments, and guiding devices enhances procedural efficiency and patient safety, creating a positive impact on the United States minimally invasive surgery devices market outlook. Additionally, growing awareness of preventive care and early diagnosis drives demand for minimally invasive gastrointestinal procedures, solidifying this segment’s significant share in the overall market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast drives the market through its concentration of leading academic hospitals, research centers, and advanced healthcare facilities. Strong investments in surgical innovations, along with the presence of skilled medical professionals, accelerate the adoption of cutting-edge technologies. The region’s aging population contributes to rising demand for cardiovascular, orthopedic, and gastrointestinal minimally invasive procedures. Additionally, higher awareness of advanced treatment options, coupled with access to comprehensive insurance coverage, supports wider acceptance of these devices. Collaborations between medical schools and device manufacturers further enhance innovation, making the Northeast a key hub for minimally invasive surgical advancements in the US.

The Midwest market is fueled by a combination of growing healthcare infrastructure and increasing focus on cost-effective treatment options. With many rural and semi-urban populations, minimally invasive devices are gaining traction due to their ability to reduce hospital stays and recovery periods, lowering overall healthcare costs. Rising incidences of lifestyle-related conditions such as obesity and cardiovascular diseases also create a strong demand for minimally invasive solutions. The presence of several medical device manufacturing hubs and research facilities in the region strengthens accessibility to advanced products. Supportive state healthcare initiatives and growing awareness among patients further drive adoption across the Midwest.

The South plays a pivotal role in the United States minimally invasive surgery devices market demand due to its large and diverse population base. High prevalence of chronic conditions like diabetes, heart disease, and gastrointestinal disorders fuels the need for advanced surgical options. Healthcare providers in the region are increasingly adopting minimally invasive technologies to enhance patient outcomes while addressing the burden on healthcare systems. Rapid urbanization and investments in modern hospital infrastructure also support growth. Additionally, medical tourism, especially in states such as Florida and Texas, boosts demand for innovative surgical devices, further positioning the South as a key growth contributor.

The West region contributes significantly to the minimally invasive surgery devices market, driven by its strong healthcare innovation ecosystem and concentration of high-tech medical centers. States like California foster collaborations between healthcare institutions, technology firms, and device manufacturers, accelerating advancements in surgical tools. Rising demand for aesthetic procedures and lifestyle-related surgeries adds to market growth, particularly in urban centers. The region’s focus on preventive healthcare and early diagnosis drives adoption of minimally invasive options. Furthermore, growing venture capital investments and patient preference for advanced, less invasive treatments ensure that the West remains a vital growth driver in this market.

Competitive Landscape:

The United States minimally invasive surgery devices market is highly competitive, with global leaders and regional players striving to expand their presence through innovation, partnerships, and acquisitions. Companies like Medtronic, Johnson & Johnson (Ethicon), Stryker, Boston Scientific, and Abbott dominate with broad product portfolios spanning handheld instruments, guiding systems, and electrosurgical devices. Intense research and development (R&D) investment is focused on robotics, imaging integration, and AI-enabled surgical platforms to improve precision and patient outcomes. Smaller firms and startups are also entering niche segments, driving technological diversity. Competitive differentiation is largely achieved through advanced product performance, cost-effectiveness, and regulatory approvals. This dynamic landscape ensures continuous innovation and growing competition, shaping the market share.

The report provides a comprehensive analysis of the competitive landscape in the United States minimally invasive surgery devices market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Elucent Medical’s EnVisio X1 In-Body Spatial Intelligence System granted breakthrough device designation by the U.S. Food and Drug Administration (FDA), recognizing its potential to deliver innovative advancements in medical technology and improve patient outcomes. The novel device provides real-time localization and surgical supervision for the removal of soft tissue in cancer surgeries and other illnesses. With this device, the company aims to redefine minimally invasive surgical procedures, enabling more accurate, less invasive treatments that have the potential to genuinely transform lives.

- March 2025: Voom Medical Devices, Inc., a provider of minimally invasive orthopedic surgical solutions, announced the launch of its new single-use sterile Revcon Screw System. The device is expected to be commercially available starting May 2025.

- October 2024: Hologic, Inc., a provider of various minimally invasive surgical solutions, announced plans for the acquisition of Gynesonics, Inc., a manufacturer of minimally invasive gynecological surgical devices and other solutions. This acquisition enhances Hologic’s product line and will provide GYN physicians globally with greater possibilities for treating women with fibroids and heavy periods.

- September 2024: Stryker successfully acquired NICO Corporation, a manufacturer of minimally invasive neurosurgical devices for intracerebral hemorrhage (ICH) and tumor surgeries. This acquisition demonstrates Stryker's dedication to neurotechnology through the treatment of tumors and strokes.

- February 2024: Virtual Incision secured FDA approval for its MIRA Surgical System, the first miniaturized robotic-assisted surgical device developed for adult colectomy procedures. This authorization marks a significant milestone in advancing compact robotic technologies designed to enhance surgical precision and broaden minimally invasive treatment options. The authorization marked a significant milestone in advancing minimally invasive surgery.

United States Minimally Invasive Surgery Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Handheld Instruments, Guiding Devices, Electrosurgical Devices, Endoscopic Devices, Laparoscopic Devices, Robotic Assisted Surgical Systems, Ablation Devices, Laser Based Devices, Others |

| Applications Covered | Aesthetic, Cardiovascular, Gastrointestinal, Gynecological, Orthopedic, Urological, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States minimally invasive surgery devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States minimally invasive surgery devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States minimally invasive surgery devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The minimally invasive surgery devices market in the United States was valued at USD 8.42 Billion in 2024.

The United States minimally invasive surgery devices market is projected to exhibit a CAGR of 3.73% during 2025-2033, reaching a value of USD 12.14 Billion by 2033.

The United States minimally invasive surgery devices market is driven by rising demand for faster recovery procedures, advancements in surgical technologies, and increasing prevalence of chronic diseases. The growing adoption of robotics, imaging integration, and electrosurgical tools, coupled with patient preference for reduced hospital stays, further fuels the market’s strong growth trajectory.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)