United States Nematicides Market Size, Share, Trends and Forecast by Chemical Type, Formulation, Application Type, and Region, 2026-2034

United States Nematicides Market Summary:

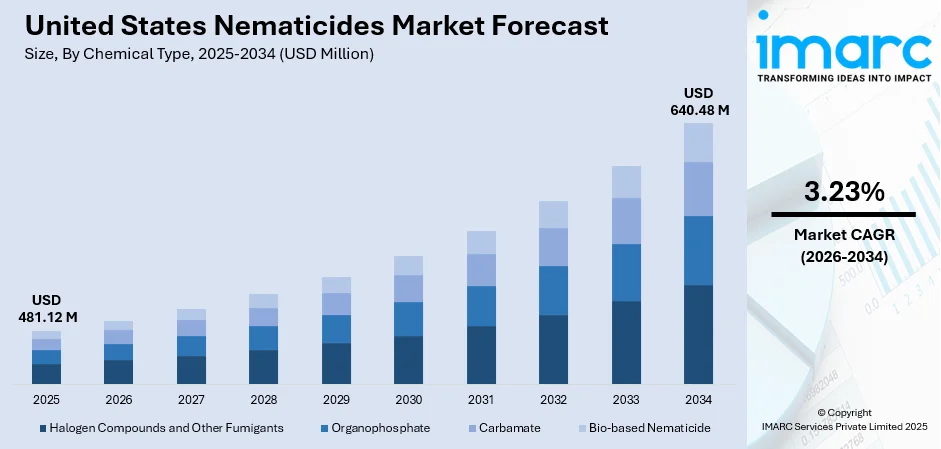

The United States nematicides market size was valued at USD 481.12 Million in 2025 and is projected to reach USD 640.48 Million by 2034, growing at a compound annual growth rate of 3.23% from 2026-2034.

The United States nematicides market is experiencing steady expansion driven by the growing recognition of nematode-related crop damage among agricultural producers. The increasing cultivation of high-value crops including fruits, vegetables, and commercial commodities has intensified demand for effective nematode management solutions. Farmers across the nation are adopting integrated pest management strategies that incorporate both chemical and biological nematicides to protect yields and maintain soil health. The rising awareness about sustainable agricultural practices is encouraging the development and adoption of eco-friendly nematicide formulations that align with environmental safety regulations, thereby strengthening the United States nematicides market share.

Key Takeaways and Insights:

- By Chemical Type: Halogen compounds and other fumigants dominate the market with a share of 31% in 2025, owing to their broad-spectrum efficacy against plant-parasitic nematodes and other soilborne pathogens. The high volatility and rapid diffusion of fumigants through soil pores enable comprehensive pest control in high-value crop production systems, particularly in vegetable and fruit cultivation across major agricultural states.

- By Formulation: Liquid leads the market with a share of 45% in 2025. This dominance is driven by ease of application through modern irrigation systems and precise dosage control capabilities. Liquid nematicides offer enhanced soil penetration and uniform distribution throughout the root zone, ensuring effective protection against nematode infestations in diverse soil types and farming conditions.

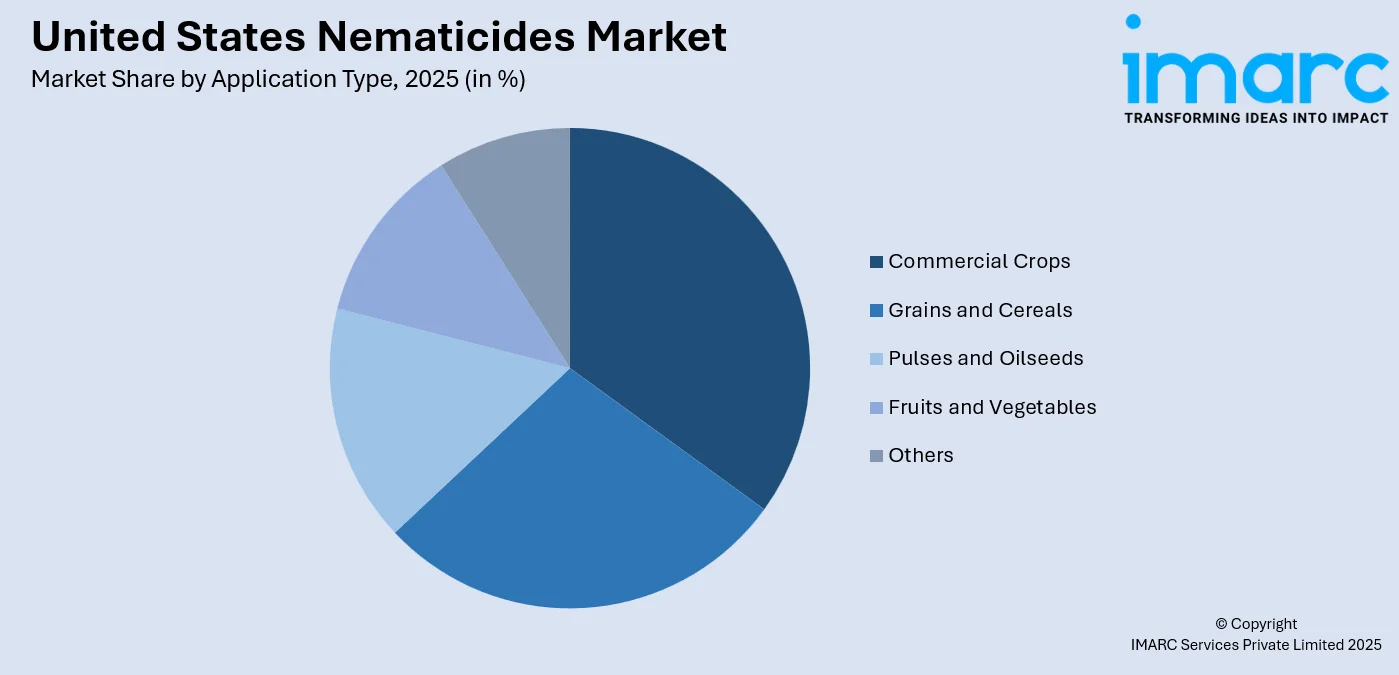

- By Application Type: Commercial crops hold the largest segment with a market share of 29% in 2025, reflecting the critical importance of nematode management in protecting economically significant commodities including cotton, tobacco, and sugarcane. The substantial yield losses caused by root-knot and reniform nematodes in these crops necessitate consistent nematicide applications throughout the growing season.

- By Region: Midwest represents the largest region with 30% share in 2025, driven by the extensive cultivation of soybeans and corn across states like Iowa, Illinois, and Indiana. The prevalence of soybean cyst nematode, the most economically damaging pathogen affecting American soybean production, has intensified demand for effective nematicide solutions in this agricultural heartland.

- Key Players: Key players drive the United States nematicides market by expanding product portfolios, advancing biological formulations, and strengthening distribution networks. Their investments in research and development, strategic partnerships with agricultural institutions, and introduction of innovative seed treatment technologies accelerate market penetration and enhance nematode management capabilities.

To get more information on this market Request Sample

The United States nematicides market continues to evolve as agricultural producers seek effective solutions to combat microscopic parasites that threaten crop productivity. Plant-parasitic nematodes cause substantial economic losses across American agriculture, with soybean cyst nematode representing the most damaging pathogen affecting soybean production nationwide. The market is characterized by increasing integration of precision agriculture technologies that enable targeted nematicide applications based on soil mapping and nematode population assessments. Farmers are increasingly adopting data-driven approaches to optimize nematicide deployment, concentrating treatments in areas with confirmed infestations while reducing unnecessary applications elsewhere. This technological advancement supports more efficient product utilization while minimizing environmental impact and operational costs for farming operations. The growing emphasis on sustainable pest management practices further encourages innovation in both chemical and biological nematicide formulations.

United States Nematicides Market Trends:

Rising Adoption of Biological Nematicides

The increasing consumer demand for organic produce and stringent regulations on chemical pesticide usage are driving significant interest in biological nematicides. Farmers are increasingly incorporating microbial-based solutions derived from beneficial bacteria and fungi into their pest management programs. These bio-based alternatives offer targeted nematode control while preserving beneficial soil organisms and supporting long-term soil health. The regulatory approval of new biological active ingredients containing beneficial microorganisms like Bacillus species is expanding the available toolkit for sustainable nematode management. In January 2025, Agrauxine by Lesaffre announced EPA registration and launch of Atroforce, a microbial bio-nematicide containing Trichoderma atroviride strain K5, labeled for use on soybeans, corn, cotton, and potatoes as both a seed treatment and in-furrow application.

Integration with Seed Treatment Technologies

The market is witnessing accelerated adoption of nematicide-treated seeds that provide early-season protection against nematode damage. Seed treatment applications offer targeted delivery directly to the developing root system, minimizing environmental exposure while maximizing crop protection efficacy. This technology enables convenient integration into existing planting operations without requiring additional application equipment or labor inputs. The development of multi-strain biological seed treatments combining nematicidal and biostimulant properties represents a significant advancement in crop protection technology. In December 2024, UPL Corp announced EPA registration of NIMAXXA bionematicide, the only triple-strain bionematicide seed treatment for season-long nematode protection in soybeans and corn, effective against soybean cyst nematode, root knot nematode, and reniform nematode.

Advancement of Precision Application Technologies

The emergence of precision agriculture tools is transforming nematicide application practices across American farms. Variable rate application technologies guided by soil sampling data and geographic information systems enable site-specific nematicide deployment based on actual nematode population densities. This approach optimizes product utilization by concentrating treatments in areas with confirmed infestations while reducing unnecessary applications in unaffected zones. The integration of digital monitoring platforms with nematicide management programs supports data-driven decision making for improved pest control outcomes. According to the US Government Accountability Office's January 2024 report, 27% of US farms or ranches used precision agriculture practices to manage crops or livestock based on 2023 USDA reporting, with federal agencies providing nearly USD 200 Million for precision agriculture research and development funding in fiscal years 2017-2021.

Market Outlook 2026-2034:

The United States nematicides market demonstrates favorable growth prospects supported by expanding agricultural production and rising awareness about nematode-related yield losses. The increasing adoption of integrated pest management strategies that combine chemical and biological solutions is creating opportunities for diverse nematicide formulations. Innovation in nematicide technologies, including novel biological formulations and enhanced delivery systems, continues to drive market expansion as producers seek effective tools to protect crop investments against persistent nematode threats. The market generated a revenue of USD 481.12 Million in 2025 and is projected to reach a revenue of USD 640.48 Million by 2034, growing at a compound annual growth rate of 3.23% from 2026-2034.

United States Nematicides Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Chemical Type |

Halogen Compounds and Other Fumigants |

31% |

|

Formulation |

Liquid |

45% |

|

Application Type |

Commercial Crops |

29% |

|

Region |

Midwest |

30% |

Chemical Type Insights:

- Halogen Compounds and Other Fumigants

- Organophosphate

- Carbamate

- Bio-based Nematicide

Halogen compounds and other fumigants dominate with a market share of 31% of the total United States nematicides market in 2025.

Halogen compounds and other fumigants maintain market leadership through their proven effectiveness in controlling diverse nematode species and other soilborne pests. These chemical formulations work by generating volatile gases that diffuse through soil pores to reach target organisms throughout the treated zone. Products containing active ingredients such as 1,3-dichloropropene and chloropicrin remain essential tools for pre-plant soil fumigation in high-value vegetable production systems. The broad-spectrum activity of fumigants against nematodes, fungi, and weed seeds makes them particularly valuable for intensive cropping operations.

The dominance of fumigant nematicides reflects their critical role in protecting vegetable crops grown under plasticulture systems in states like Florida and Georgia. According to the California Department of Pesticide Regulation Phase I report published in January 2025, pre-plant soil fumigants including 1,3-dichloropropene and chloropicrin remain fundamental components of nematode management programs for strawberries, tomatoes, and other high-value crops. The effectiveness of fumigation in sandy soils common to southeastern vegetable production regions continues driving demand for these established pest control solutions.

Formulation Insights:

- Gaseous Formulations

- Liquid

- Granules or Emulsifiable Liquid

- Others

Liquid leads with a share of 45% of the total United States nematicides market in 2025.

Liquid formulations command the largest market share due to their versatility in application methods and compatibility with modern farming equipment. These formulations can be delivered through drip irrigation systems, soil injection equipment, or foliar spray applications depending on crop requirements and nematode pressure levels. The uniform distribution characteristics of liquid nematicides ensure consistent coverage throughout the target soil volume, maximizing contact with nematode populations. Farmers appreciate the precise dosage control enabled by liquid formulations that supports efficient product utilization.

The preference for liquid nematicide formulations aligns with the expansion of chemigation practices that integrate pest control applications with irrigation management. According to University of Florida extension guidance published in February 2024, liquid nonfumigant nematicides may be applied through drip or overhead sprinkler irrigation systems, enabling efficient treatment of large acreage without specialized fumigation equipment. This application flexibility supports adoption across diverse cropping systems from row crops to perennial orchards where nematode management remains essential for sustained productivity.

Application Type Insights:

Access the comprehensive market breakdown Request Sample

- Grains and Cereals

- Pulses and Oilseeds

- Commercial Crops

- Fruits and Vegetables

- Others

Commercial crops exhibit a clear dominance with a 29% share of the total United States nematicides market in 2025.

Commercial crops including cotton, tobacco, and sugarcane represent major consumers of nematicide products due to the significant economic impact of nematode damage on these commodities. Root-knot and reniform nematodes cause substantial yield reductions in cotton production across the southeastern United States, necessitating consistent pest management investments. The perennial nature of sugarcane cultivation creates conditions favorable for nematode population buildup, requiring ongoing nematicide applications to protect multi-year crop stands from cumulative damage.

The economic importance of commercial crop protection drives substantial nematicide utilization across major production regions. According to the Crop Protection Network cotton disease loss estimates for 2024, root-knot nematode ranked as the greatest cause of yield reduction in American cotton production, followed by reniform nematode among the top five disease threats. The total disease-related yield reduction in 2024 was estimated at 5.4% across 17 cotton-producing states, emphasizing the ongoing need for effective nematode management solutions in commercial crop systems.

Regional Insights:

- Northeast

- Midwest

- South

- West

Midwest represents the leading region with a 30% share of the total United States nematicides market in 2025.

The Midwest region leads nematicide consumption driven by the extensive soybean and corn acreage spanning states including Iowa, Illinois, Indiana, and Ohio. Soybean cyst nematode remains the most economically damaging pathogen affecting American soybean production, creating persistent demand for effective management solutions. The intensive corn-soybean rotation systems prevalent throughout the region create conditions favorable for nematode population development, necessitating integrated approaches combining resistant varieties, crop rotation, and nematicide applications to minimize yield losses.

The regional dominance reflects the concentrated agricultural activity and nematode pressure characterizing Midwestern farming operations. According to Iowa State University surveys reported in January 2025, of Iowa soybean fields have been found infested with soybean cyst nematode over decades decades of monitoring. The SCN Coalition research indicates that soybean cyst nematode causes yield losses annually across North America, with the Midwest bearing the greatest economic burden from this persistent pest.

Market Dynamics:

Growth Drivers:

Why is the United States Nematicides Market Growing?

Increasing Awareness about Nematode-Related Yield Losses

The expanding recognition of plant-parasitic nematodes as significant contributors to crop yield losses is driving increased investment in nematicide solutions across American agriculture. Educational initiatives by extension services and industry organizations have elevated farmer awareness about the hidden damage caused by these microscopic pests that operate beneath the soil surface without visible aboveground symptoms. The development of diagnostic tools and soil testing services enables growers to quantify nematode populations and make informed treatment decisions based on actual infestation levels. This awareness is translating into greater adoption of preventive nematicide applications and integrated management programs that combine multiple control strategies for enhanced effectiveness. The economic calculations demonstrating the return on nematicide investments are convincing more farmers to incorporate these products into their standard crop protection programs.

Expansion of High-Value Crop Production

The growth of vegetable, fruit, and specialty crop acreage across the United States is creating expanded demand for nematicide products that protect these high-investment plantings. These crops typically generate greater revenue per acre than commodity grains, justifying the additional input costs associated with comprehensive nematode management programs. The intensive cultivation practices and continuous cropping systems common in specialty agriculture create conditions favorable for nematode population buildup that requires active suppression. The premium quality requirements for fresh market produce necessitate protection against nematode damage that can cause cosmetic defects and reduce marketable yields. The concentration of specialty crop production in regions with favorable climates but persistent nematode pressure supports sustained nematicide utilization. According to the industry reports, California's farms and ranches received USD 61.2 Billion in cash receipts for their 2024 output, representing a 3.6% increase from the previous year, with nearly half of the country's vegetables and over three-quarters of the country's fruits and nuts grown in the state.

Development of Innovative Biological Solutions

The advancement of biological nematicide technologies is opening new market segments and attracting growers who prioritize sustainable pest management approaches. Microbial-based products containing beneficial bacteria and fungi offer effective nematode suppression while maintaining compatibility with organic production standards and integrated pest management programs. The regulatory approval pathway for biological products typically requires less extensive toxicology data than synthetic chemicals, enabling faster market introduction of innovative solutions. These biological options appeal to farmers seeking to reduce chemical inputs while maintaining effective crop protection against nematode damage. The combination of biological nematicides with conventional products in rotation or tank-mix programs provides complementary modes of action that enhance overall pest control durability. In January 2025, American Vanguard Corporation, through its crop business unit AMVAC, entered into a regional distribution agreement with DPH Biologicals to expand its GreenSolutions portfolio, including BellaTrove Companion Maxx, an EPA-approved biocontrol product that provides both fungicidal and nematicidal activity for sustainable crop protection.

Market Restraints:

What Challenges the United States Nematicides Market is Facing?

Regulatory Restrictions on Chemical Fumigants

The tightening environmental regulations governing soil fumigant applications create challenges for growers dependent on these effective nematicide tools. Buffer zone requirements, application timing restrictions, and mandatory safety training increase the complexity and cost of fumigation practices, potentially limiting their accessibility for smaller farming operations.

Development of Nematode Resistance

The evolution of nematode populations capable of overcoming plant resistance genes and tolerating nematicide treatments presents ongoing challenges for crop protection. The declining effectiveness of widely used resistance sources in soybean varieties against adapted soybean cyst nematode populations exemplifies the need for diversified management approaches and continued investment in new control technologies.

High Cost of Nematicide Applications

The significant expense associated with nematicide products and application services can challenge adoption among cost-conscious farmers, particularly in lower-margin commodity crop production. Fumigation operations require specialized equipment and certified applicators, adding to the total treatment cost that must be justified by demonstrable yield benefits and economic returns.

Competitive Landscape:

The United States nematicides market exhibits a consolidated competitive structure with established multinational agrochemical companies commanding significant market presence. Major industry participants compete through product innovation, strategic partnerships with agricultural research institutions, and expansion of distribution networks reaching farmers across diverse production regions. Companies are investing substantially in biological nematicide development to address growing demand for sustainable pest management solutions that complement existing chemical portfolios. The competitive dynamics are characterized by ongoing patent activity around novel active ingredients and formulation technologies that enhance product performance and differentiation.

Recent Developments:

- In June 2024, BASF Agricultural Solutions introduced Nemasphere nematode resistance trait, described as the most significant innovation in soybean cyst nematode management in over sixty years. The biotechnology trait produces a novel Cry14 protein that interferes with nutrient uptake in nematodes, with field trials demonstrating an average yield potential increase of eight percent.

- In June 2024, Syngenta USA disclosed pending registration of two new active ingredients with the Environmental Protection Agency, including cyclobutrifluram to be marketed as TYMIRIUM technology, which serves as both a nematicide and fungicide for comprehensive crop protection applications.

United States Nematicides Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chemical Types Covered | Halogen Compounds and Other Fumigants, Organophosphate, Carbamate, Bio-Based Nematicide |

| Formulations Covered | Gaseous Formulations, Liquid, Granules or Emulsifiable Liquid, Others |

| Application Types Covered | Grains and Cereals, Pulses and Oilseeds, Commercial Crops, Fruits and Vegetables, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States nematicides market size was valued at USD 481.12 Million in 2025.

The United States nematicides market is expected to grow at a compound annual growth rate of 3.23% from 2026-2034 to reach USD 640.48 Million by 2034.

Halogen compounds and other fumigants dominated the market with a share of 31%, driven by broad-spectrum efficacy against diverse nematode species and other soilborne pathogens in high-value crop production systems.

Key factors driving the United States nematicides market include increasing awareness of nematode-related yield losses, expansion of high-value crop production, development of innovative biological solutions, and adoption of precision agriculture technologies.

Major challenges include regulatory restrictions on chemical fumigants, development of nematode resistance to existing treatments, high application costs, limited biological product efficacy consistency, and the need for specialized application equipment and certified applicators.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)