U.S. Oil and Gas Market Size, Share, Trends and Forecast by Type, Application, and Region 2025-2033

U.S. Oil and Gas Market Size and Share:

The U.S. oil and gas market size was valued at USD 252.6 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 339.5 Billion by 2033, exhibiting a CAGR of 3.26% from 2025-2033. The market is driven by ongoing technological changes in extraction techniques such as hydraulic fracturing, increased investment in renewable energy integration, developing infrastructure for liquefied natural gas (LNG) exportation, and increasing applications of digital solutions to improve the operational efficiency and safety of operations in the industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 252.6 Billion |

| Market Forecast in 2033 | USD 339.5 Billion |

| Market Growth Rate (2025-2033) | 3.26% |

The market is primarily driven by rising energy demand from various sectors, including manufacturing, transportation, and power generation. As per US Energy Information Administration, consumption of energy estimates in the United States is between 0% and 15% from 2022 to 2050. Moreover, in the industrial sector, energy consumption will increase between 5% and 32% between 2022 and 2050. Industries rely on oil and natural gas as primary energy sources, particularly for processes requiring high energy input. Increased economic activities amplify energy needs, prompting higher oil and gas consumption. Additionally, urban expansion and infrastructure development further stimulate demand, reinforcing oil and gas as essential energy sources for both commercial and residential needs. This growing reliance keeps the U.S. market dynamic and resilient.

Supportive policies and favorable regulations play a crucial role in driving the U.S. oil and gas market. Federal and state-level incentives, including tax breaks and streamlined permitting processes, make investments in exploration and production more attractive. These measures lower operational costs and encourage both domestic and foreign players to increase their market participation. Regulations that support the expansion of infrastructure projects and energy export facilities contribute to a more integrated and efficient supply chain, boosting market resilience and growth. Additionally, government collaboration with industry stakeholders ensures that potential challenges are mitigated effectively. This partnership helps address concerns related to environmental impact and sustainability, allowing for the adaptation of practices that align with both economic and ecological priorities. By maintaining a balance between advancing production capabilities and adhering to environmental standards, the regulatory landscape supports ongoing innovation and long-term viability in the U.S. oil and gas sector, fostering sustainable progress within the industry.

U.S. Oil and Gas Market Trends:

Technological Advancements in Extraction

Advancements in extraction technologies like hydraulic fracturing and horizontal drilling are significantly beneficial for the U.S. oil and gas market. Unlocking previously inaccessible reserves, technology has increased production, mainly through production growth in key regions, such as the Permian Basin. Improved efficiencies with enhanced recovery techniques as well as improved drilling efficiency increase output and thus lower operational costs, making the market more competitive globally. Integration of technology also involves other digital solutions and automation, making monitoring easier and optimizing the processes of production. With this technological advantage, the United States has been the world's leading crude oil producer for the last several consecutive years, keeping market growth and energy independence sustainable.

Rising Demand for LNG Exports

The expansion of liquefied natural gas (LNG) infrastructure is driving growth in the US oil and gas market. As per the US Energy Information Administration, the United States exported more liquefied natural gas (LNG) than any other country in 2023. US LNG exports averaged 11.9 billion cubic feet per day (Bcf/d)—a 12% increase (1.3 Bcf/d) compared with 2022. With a growing demand for cleaner sources of energy across the globe, LNG is poised to become the preferred alternative, and the country is capitalizing on the same by enhancing its export capacity. Strategic investments by the country in LNG terminals and export facilities are catering to the escalated international energy demand. Being a major player in the international trade in energy, supply of LNG to these energy-starved markets in Asia and Europe sets up the U.S. for even more supply. Economic growth, international partnership, and a diversified energy export portfolio are the only ways this bodes well.

Focus on Energy Independence

Energy independence has been one of the main drivers in the growth of this industry, due to increased domestic production and fewer imports from abroad, especially oil, that- enhance energy security as well as economic stability in the country. Consequently, major investments in exploration and production projects have ensured that the supply chain within the country is solid and strong. In addition, energy independence tends to promote political and economic leverage from the global scene, with more control over energy prices and less vulnerability to worldwide disruptions. Pursuing self-sufficiency has also fueled innovations in extraction and production technologies and further driven market expansion.

U.S. Oil and Gas Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the U.S. oil and gas market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Upstream

- Midstream

- Downstream

The upstream segment includes all exploration and production activities regarding oil and gas, from finding an oil and gas reserve, to drilling for it. The upstream is marked by considerable investments in the development of new technologies like seismic imaging, enhanced recovery techniques, and hydraulic fracturing, which have increased production, especially in fields like the Permian Basin. The upstream market remains a critical component within the country's capacity to remain a global crude oil producer, hence a significant enabler of energy independence. It also goes through cyclical shifts influenced by fluctuations in oil prices, affecting exploration and drilling activity levels.

Transportation, storage, and distribution of oil and natural gas constitute the midstream segment. Pipelines, tanker ships, and storehouses are those infrastructure components in this stream to make energy flow smoothly across regions. The midstream sector has grown rapidly as a result of improvement in liquefied natural gas (LNG) infrastructure and export capacity expansion. This is because there is an increase in the demand for natural gas globally. Also, the development of new pipeline and storage infrastructures is improving the country's energy network for distributing its products, thereby aiding growth in the overall market.

The downstream segment involves the refining, processing, and marketing of oil and gas products. Refining and processing crude oil and natural gas generate usable products such as gasoline, diesel, jet fuel, and petrochemicals. Improvements in refining technology result in more efficiency and lower environmental damage to meet regulatory demands and sustainability goals. Also included in the downstream market are retail distribution through gas stations and other outlets of fuel products. It is also affected by fluctuations in consumer demand and price volatility; however, strategic investment in refining capacity and product diversification helps ease such challenges and is supportive of growth.

Analysis by Application:

- Offshore

- Onshore

The US offshore oil and gas segment represents an area of exploration, drilling, and production in deep water and shallow-water areas. This segment is motivated by the vast potential for high-volume reserves of oil and gas trapped under the seabed. Advances in deep-sea drilling and in engineering designs for offshore platforms have made it possible to extract oil and gas more efficiently and safely, thereby providing support for further investment in offshore projects. The Gulf of Mexico has been an important region for performing offshore operations with substantial contributions to national oil production. Despite the high operational cost and regulatory standards, offshore projects remain very important in terms of maintaining output levels and tapping into extensive reserves.

The onshore segment includes the exploration, drilling, and production of oil and gas onshore. This segment is additionally benefited by lower production costs and easier access to infrastructure relative to offshore operations. The shale formations-hydraulic fracturing and horizontal drilling-have provided a big boost to onshore production in regions such as Texas and North Dakota. Onshore projects have become crucial to the country's ongoing effort to achieve energy independence and become the world's largest crude oil producer. This also makes the segment more agile toward changes in oil prices, thus it is more capable of scaling up and down with market conditions, meaning that part, again, is resilient and continuously expanding.

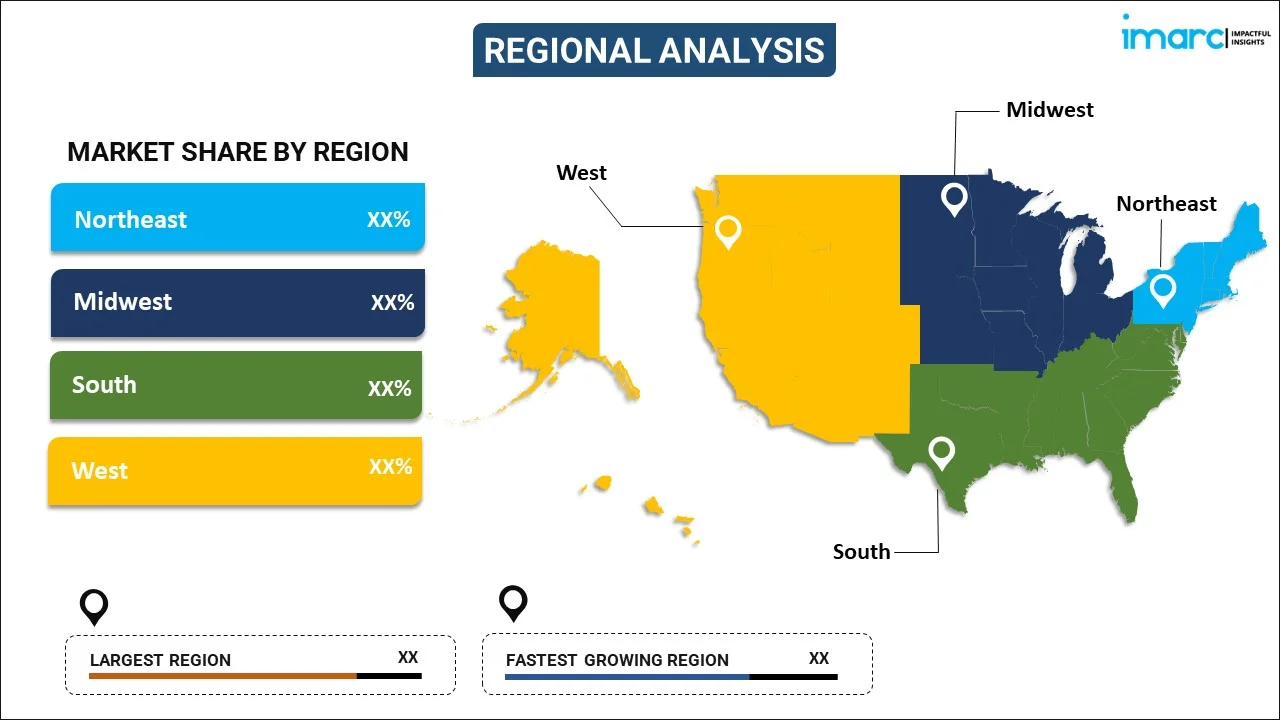

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast US oil and gas market is largely driven by natural gas production, particularly from the Marcellus and Utica Shale formations. This region is a major contributor to the country’s natural gas output, leveraging advanced extraction techniques like hydraulic fracturing to tap into vast shale gas reserves. The extensive pipeline network in the Northeast facilitates efficient distribution to both domestic markets and export facilities. The region’s proximity to significant energy-consuming markets also supports demand, making the Northeast a key area for natural gas production and distribution.

The Midwest US oil and gas market is characterized by a mix of oil production and refining activities. While it does not produce as much oil as the South or West, the region hosts important refining infrastructure that processes crude oil from both domestic sources and imports. The Midwest benefits from pipeline connectivity that supplies refineries with crude from areas like the Permian Basin and Canadian oil sands. Additionally, the region plays a role in distributing refined products, such as gasoline and diesel, across various states and contributes to the broader national energy supply chain.

The South is a powerhouse in the US oil and gas market, led by states such as Texas and Louisiana. This region is home to the prolific Permian Basin, one of the largest and most productive oil and natural gas fields in the world. The South's robust infrastructure includes extensive networks of pipelines, storage facilities, and refineries, supporting both upstream and downstream activities. Offshore production in the Gulf of Mexico also bolsters the South’s contribution, making it a critical region for national energy output. The South’s strategic importance is further highlighted by its major role in LNG exports, serving global markets.

The West US oil and gas market includes significant onshore oil and gas production, particularly from California and Alaska. California's oil industry is known for its complex refining capacity, which processes various types of crude oil to supply a large consumer base. Alaska’s North Slope region contributes notably through its oil reserves, despite the logistical challenges posed by its remote location and harsh climate. The region is also seeing increased focus on balancing production with environmental regulations, prompting investments in cleaner technologies and sustainable practices. The West’s market dynamics are influenced by state policies and a strong emphasis on environmental sustainability.

Competitive Landscape:

Major players in the market are implementing several strategies to strengthen their positions. For instance, in July 2024, Devon Energy entered into a purchase agreement to acquire the Williston Basin business of Grayson Mill Energy. The acquisition of Grayson Mill allows Devon to expand oil production and operating scale while capturing highly economic drilling inventory. Additionally, these firms are investing in technological advancements to improve extraction methods and reduce costs, thereby increasing profitability. There is also a concerted effort to diversify energy portfolios by investing in low-carbon technologies and renewable energy sources, aligning with global sustainability trends. Furthermore, companies are optimizing supply chains and expanding export capabilities to meet growing international demand, particularly for liquefied natural gas (LNG). These combined efforts aim to solidify their market dominance and ensure long-term growth in a competitive and evolving energy landscape.

The report provides a comprehensive analysis of the competitive landscape in the U.S. oil and gas market with detailed profiles of all major companies.

Latest News and Developments:

- In May 2024, ConocoPhillips and Marathon Oil Corporation announced a definitive agreement in which ConocoPhillips will acquire Marathon Oil through an all-stock deal valued at $22.5 Billion, including $5.4 Billion in net debt. Marathon Oil, which operates in key United States oil-producing regions brings assets to the table as these regions are sought after by oil producers to expand their inventory.

U.S. Oil and Gas Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Upstream, Midstream, Downstream |

| Applications Covered | Offshore, Onshore |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the U.S. oil and gas market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the U.S. oil and gas market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the U.S. oil and gas industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The oil and gas market encompasses the exploration, production, refining, transportation, and distribution of petroleum and natural gas. It drives energy supply, powering industries, transportation, and households. Upstream (extraction), midstream (transportation and storage), and downstream (refining and sales) sectors are the key components of the industry. Some of the common oil and gas products include fuels like gasoline, diesel, kerosene, and jet fuel, as well as heating oil and natural gas. Other products include lubricants, asphalt, and petrochemicals used to make plastics, fertilizers, and synthetic materials.

The U.S. oil and gas market was valued at USD 252.6 Billion in 2024.

IMARC estimates the U.S. oil and gas market to exhibit a CAGR of 3.26% during 2025-2033.

The U.S. oil and gas market is driven by rising energy demand across sectors, technological advancements in extraction (e.g., hydraulic fracturing), and increased LNG exports. Supportive policies, such as tax incentives and streamlined regulations, are encouraging investments in the market, while a focus on energy independence and urban development is strengthening domestic production.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)