United States Orthodontics Market Size, Share, Trends and Forecast by Type, Age Group, End User, and Region, 2025-2033

United States Orthodontics Market Size and Share:

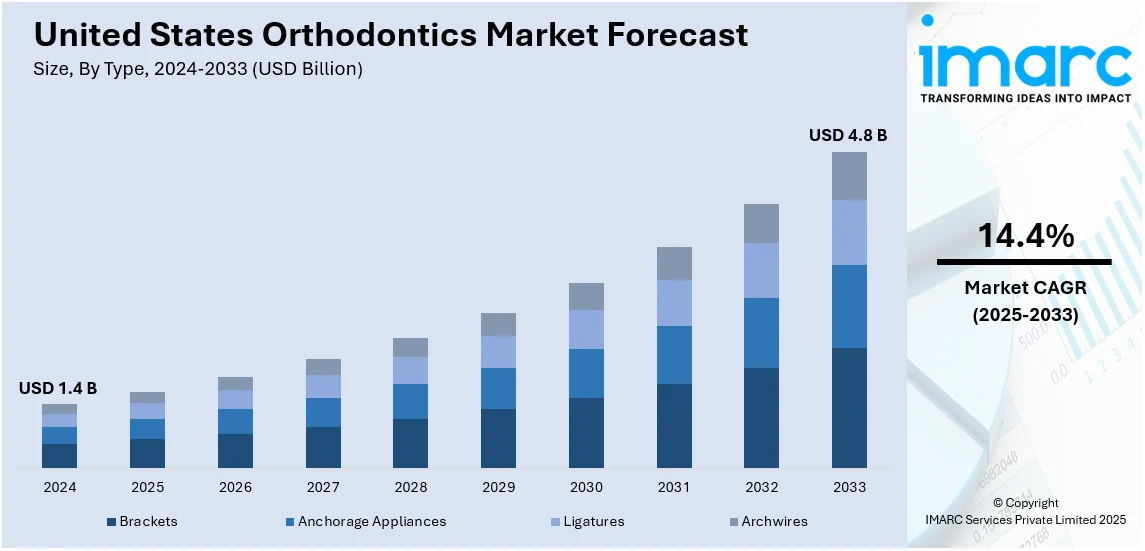

The United States orthodontics market size was valued at USD 1.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.8 Billion by 2033, exhibiting a CAGR of 14.4% from 2025-2033. The market is experiencing rapid growth driven by technological advancements like 3D printing, AI-powered treatment planning, and digital scanning. The market is also seeing increased personalization through advanced digital technologies, enhancing treatment accuracy and patient experience, which are reshaping orthodontic care, emphasizing efficiency, convenience, and customization.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 4.8 Billion |

| Market Growth Rate (2025-2033) | 14.4% |

The United States orthodontics market is driven by continual advancements in dental technologies, such as 3D printing, digital impressions, and AI-powered treatment planning, enhancing precision and efficiency. Align Technology’s January 3, 2024, acquisition of Cubicure GmbH strengthens its 3D printing capabilities, benefiting U.S. orthodontists with innovative products like the Invisalign Palatal Expander System. These advancements are meeting the growing demand for efficient, customized solutions. These advancements cater to the increasing demand for efficient, customized solutions. Also, growing consumer awareness regarding oral health and malocclusion are also adding strength to the market. Growing popularity of clear aligners and discreet treatments make adults favor aesthetics and convenience, hence solidifying market expansion.

In addition, the market is supported through strong R&D investments by the market that fuel such innovations as self-ligating braces and advanced archwire systems. Insurance coverage and flexible financing options are making orthodontic treatments more accessible. On June 24, 2024, Vyne Dental introduced Vyne Trellis platform to streamline orthodontic and dental practice operations with automated billing, integrated payment solutions, and efficient insurance claims processing. This innovation reduces administrative burdens, accelerates reimbursements, and enhances patient satisfaction while supporting insurance-backed care. The rising demand for pediatric orthodontics, emphasizing early intervention, and a highly skilled workforce paired with a strong network of clinics ensure the availability of specialized care, fueling the market growth.

United States Orthodontics Market Trends:

Rapid Integration of Artificial Intelligence (AI)

The United States orthodontics market is embracing AI-powered technologies to enhance treatment accuracy and efficiency. AI tools analyze dental scans to create precise treatment plans, minimizing manual input. These technologies improve patient engagement through virtual consultations and progress tracking. Practices increasingly use automated systems for customized aligner production and workflow optimization. A key development is DentalMonitoring’s FDA-approved AI software, introduced on November 20, 2024. It enables remote monitoring through smartphone scans, validated by an extensive clinical study. Features like SmartSTL allow aligner corrections without in-office scans, streamlining treatment. This innovation enhances precision, convenience, and efficiency while reducing chair time. AI adoption ensures faster diagnoses and superior outcomes, attracting patients and providers to advanced orthodontic solutions, setting a new standard for personalized and efficient care in the orthodontics market.

Growing Popularity of Clear Aligners and At-Home Solutions

The rising demand for aesthetically pleasing and convenient orthodontic options is fueling the growth of clear aligners and at-home treatment solutions. Direct-to-consumer aligner kits are reshaping the market by offering cost-effective alternatives to traditional braces. A notable innovation is Solventum’s 3M Clarity Precision Grip Attachments, launched on November 14, 2024. These 3D-printed attachments ensure durable, stain-resistant, and precisely shaped solutions, reducing variability and enhancing treatment efficiency. The trend is further driven by a growing number of adults seeking discreet, comfortable orthodontic treatments. Advances in materials and 3D printing technology are significantly improving aligner functionality, catering to patient needs. Orthodontists increasingly collaborate with aligner brands to meet this demand, emphasizing patient-centric, flexible, and affordable solutions, highlighting a market shift toward modern, innovative orthodontic care.

Personalization Through Advanced Digital Scanning and Treatment Planning

The U.S. orthodontics market is shifting toward personalized treatments driven by advanced digital scanning and 3D imaging technologies. Modern intraoral scanners such as Dentsply Sirona's Primescan 2, launched on September 5, 2024, which revolutionizes digital dentistry with enhanced workflow efficiency, real-time scanning, and seamless data sharing through DS Core integration. Primescan 2 offers faster scans, ergonomic design, advanced hygiene features, and supports practice growth and patient care. This technology enables orthodontists to create bespoke aligners and braces tailored to individual needs, improving fit, comfort, and outcomes. Digital platforms streamline communication between practitioners and laboratories, speeding up production timelines and optimizing efficiency. Patients benefit from increased transparency with digital simulations that visualize expected results, augmenting confidence in treatments. This demand for innovative and personalized solutions is reshaping orthodontic care, enhancing both clinical practices and patient experiences.

United States Orthodontics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States orthodontics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, age group, and end user.

Analysis by Type:

- Brackets

- Fixed Brackets

- Removable Brackets

- Anchorage Appliances

- Bands and Buccal Tubes

- Miniscrews

- Ligatures

- Elastomeric Ligatures

- Wire Ligatures

- Archwires

Fixed brackets in orthodontics are securely bonded to the teeth and remain in place throughout the treatment. They serve as anchors for the archwires and provide precise control over tooth movement. In contrast, removable brackets are designed to be detached, offering convenience for cleaning and maintenance. The use of both types of brackets in orthodontic treatments in the United States reflects the need for versatile solutions to accommodate patient-specific requirements.

Anchorage appliances play a crucial role in stabilizing braces and facilitating controlled tooth movement. Bands and buccal tubes are commonly used, with bands encircling the teeth for added strength and buccal tubes securing the archwires. Miniscrews, or temporary anchorage devices (TADs), are another innovation, providing minimally invasive yet effective support for complex orthodontic procedures, highlighting their growing demand in the U.S. orthodontics market.

Ligatures are essential components that secure archwires to brackets. Elastomeric ligatures, made of flexible rubber-like materials, are popular for their ease of use and variety of colors. Wire ligatures, typically made of stainless steel, offer superior strength, and are preferred for cases requiring precise force application. The choice between these ligatures in the U.S. is influenced by the specific treatment needs and patient preferences, enhancing their market appeal.

Analysis by Age Group:

- Adults

- Children

The adult segment in the United States orthodontics market is experiencing significant growth as more individuals seek orthodontic treatments for aesthetic and functional reasons. Adults are increasingly opting for discreet options like clear aligners and ceramic braces, driven by the desire to improve their appearance and oral health. The availability of advanced technologies and flexible payment plans is making orthodontic care more accessible, augmenting adoption among this demographic.

Children represent a foundational segment in the market, as early orthodontic interventions are often recommended to correct developing issues and ensure proper jaw alignment. Traditional metal braces remain popular for their effectiveness in addressing complex dental problems. Growing awareness among parents about the long-term benefits of early treatment, coupled with advancements in pediatric orthodontic techniques, continues to drive the market's focus on this age group.

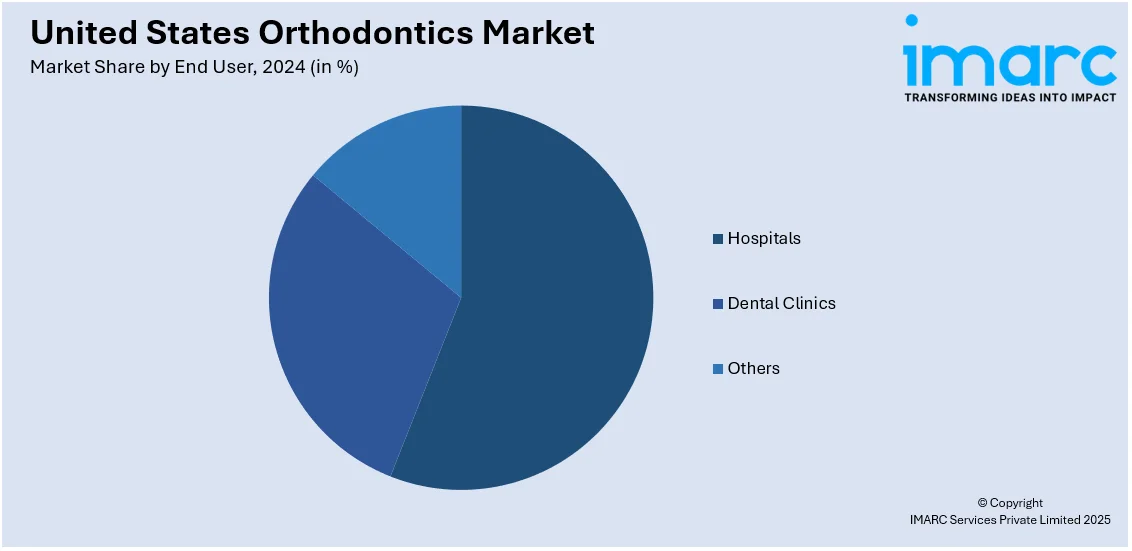

Analysis by End User:

- Hospitals

- Dental Clinics

- Others

Hospitals in the market play a vital role in providing comprehensive orthodontic care, particularly for complex cases requiring interdisciplinary expertise. Equipped with advanced diagnostic tools and specialized professionals, hospitals cater to patients needing integrated treatment plans. Their ability to handle severe dental conditions, coupled with access to cutting-edge technologies, makes them a critical component of the orthodontics landscape in the country.

Dental clinics dominate the United States orthodontics market, offering a more personalized and patient-centric approach to orthodontic care. With their focus on routine orthodontic procedures, clinics provide accessible options for braces, aligners, and other appliances. The widespread presence of clinics and the availability of flexible appointment schedules render them a preferred choice for many patients, reinforcing their prominence in the orthodontics market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the United States orthodontics market is characterized by a high concentration of urban centers and affluent populations seeking advanced orthodontic treatments. This region experiences strong demand for aesthetic solutions like clear aligners and ceramic braces, driven by consumer preferences for discreet options. Access to top-tier orthodontists and cutting-edge technology further supports the growth of the orthodontics market in this area.

In the Midwest, the orthodontics market benefits from a combination of growing awareness and increasing accessibility to dental care. Family-oriented communities emphasize early orthodontic interventions for children, fostering steady demand for traditional braces. The availability of affordable treatment options and the expansion of dental insurance coverage in the region are driving market adoption, particularly in suburban and rural areas.

The South represents a rapidly growing segment of the U.S. orthodontics market due to its large and diverse population base. Increased investments in dental infrastructure and the rising adoption of orthodontic care among children and adults contribute to market growth. Affordable treatment options and targeted outreach programs are expanding access, particularly in underserved areas, boosting the market’s overall performance in the region.

The West is a hub for innovation in the orthodontics market, driven by a tech-savvy population and high demand for advanced treatments. The popularity of clear aligners and other minimally invasive solutions is strong in this region, reflecting a focus on convenience and aesthetics. A robust network of orthodontic specialists and clinics, coupled with a proactive approach to oral health, supports market expansion in the western United States.

Competitive Landscape:

The United States orthodontics market features a competitive landscape dominated by the presence of key players offering innovative solutions. Various companies are focusing on advanced technologies, and AI-driven treatment planning. Smaller specialized firms and dental clinics also play a vital role by addressing the niche market needs. Strategic collaborations, research, and development (R&D) investments, and marketing initiatives are also intensifying competition. The rise of direct-to-consumer orthodontics is further disrupting traditional market dynamics. Additionally, partnerships with dental professionals and technological advancements in diagnostics and treatment are critical strategies for players aiming to strengthen their market presence.

The report provides a comprehensive analysis of the competitive landscape in the United States orthodontics market with detailed profiles of all major companies.

Latest News and Developments:

- July 8, 2024: Biolux Technology launched OrthoPulse 2.0 in the United States, a cutting-edge orthodontic optimization platform backed by strong clinical evidence. The enhanced device uses photobiomodulation to stimulate bone around teeth roots, enabling faster, more predictable, and comfortable orthodontic treatments for aligner and bracket patients. This milestone highlights the company’s commitment to innovation and customer satisfaction. OrthoPulse 2.0 is set to redefine orthodontic care with its advanced, reliable, and non-invasive technology.

- December 14, 2023: The American Association of Orthodontists (AAO) has issued guidance to SmileDirectClub (SDC) patients following the company's abrupt closure, emphasizing the need for in-person orthodontic care. The AAO advises former SmileDirectClub patients to schedule exams with licensed orthodontists for proper evaluation and treatment. Concerns about mail-order orthodontics are addressed with a focus on the importance of x-rays and in-person consultations. Patients are also guided to state dental boards for unresolved issues. The AAO remains committed to patient health and safety, providing resources through its 19,000 members to ensure quality orthodontic care.

United States Orthodontics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Age Groups Covered | Adults, Children |

| End Users Covered | Hospitals, Dental Clinics, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States orthodontics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States orthodontics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States orthodontics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Orthodontics is a dental specialty focused on diagnosing and treating teeth and jaw alignment issues, such as overcrowding, gaps, overbites, and underbites. Using tools such as braces, aligners, and retainers, it improves oral function, aesthetics, and overall dental health. Orthodontic care enhances smiles, corrects bite problems, and prevents complications including tooth decay, gum disease, and excessive tooth wear.

The United States orthodontics market was valued at USD 1.4 Billion in 2024.

IMARC estimates the United States orthodontics market to exhibit a CAGR of 14.4% during 2025-2033.

Advancements in AI, 3D printing, and digital imaging, rising demand for clear aligners, increased oral health awareness, innovative solutions, accessible financing, and robust R&D investments are some of the key factors that are driving the U.S. orthodontics market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)