United States Orthopedic Braces and Support Market Report by Product (Lower Extremity Braces and Supports, Spinal Braces and Supports, Upper Extremity Braces and Supports), Type (Soft and Elastic Braces and Supports, Hinged Braces and Supports, Hard and Rigid Braces and Supports), Application (Ligament Injury, Preventive Care, Post-Operative Rehabilitation, Osteoarthritis, and Others), End User (Orthopedic Clinics, Hospitals and Surgical Centers, Over-the-Counter (OTC) Platforms, and Others), and Region 2026-2034

Market Overview:

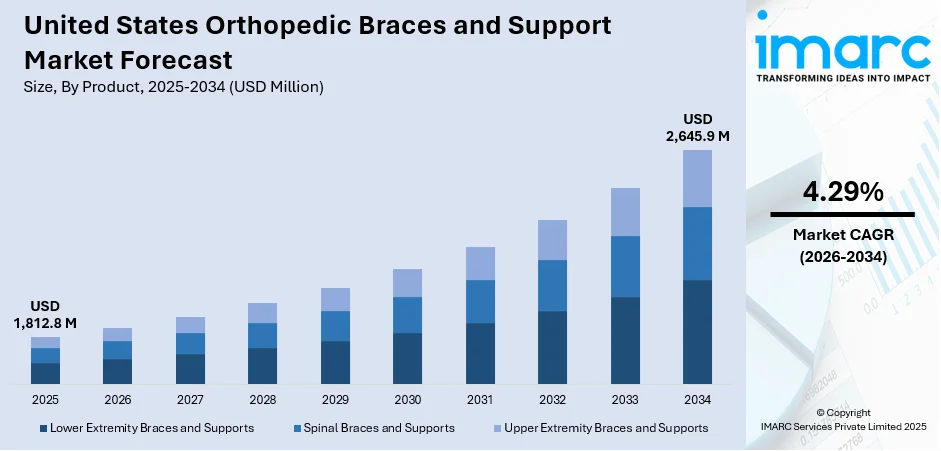

The United States orthopedic braces and support market size reached USD 1,812.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 2,645.9 Million by 2034, exhibiting a growth rate (CAGR) of 4.29% during 2026-2034.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,812.8 Million |

| Market Forecast in 2034 | USD 2,645.9 Million |

| Market Growth Rate (2026-2034) | 4.29% |

Access the full market insights report Request Sample

United States Orthopedic Braces and Support Market Analysis:

- Major Market Drivers: The factors driving the share of the United States Orthopedic Braces and Support Market are the rise in the prevalence of musculoskeletal disorders, sports injuries, and post-operative rehabilitation needs. Growing awareness of non-invasive treatments and advances in materials for braces that improve patient comfort and mobility drive continued United States Orthopedic Braces and Support Market Growth.

- Key Market Trends: The market is influenced by growing demand for personalized and lightweight orthopedic braces. For instance, 3D printing and integration of smart sensors allow for personalized designs that improve functionality and comfort. It reflects broader healthcare trends for restoration of mobility, preventive care, and better adherence among patients with ergonomically developed products.

- Competitive Landscape: The market has several participants engaged in various orthopedic support products. Companies also focus on product innovation, the expansion of distribution networks, and clinical collaborations. Partnerships with healthcare professionals and sports organizations are expected to promote visibility and acceptance of the product, fostering steady growth in both clinical rehabilitation and consumer wellness applications.

- Challenges and Opportunities: Challenges include limited reimbursement policies and inconsistent patient compliance with long-term brace wear. However, opportunities will arise regarding technology innovation, telehealth integration, and digital monitoring that tracks patient performance. Increased emphasis on comfort, performance, and data-driven treatment optimization is a sound basis for future market growth.

Orthopedic braces and support are durable medical instruments designed to alleviate chronic pain or temporary discomfort in case of road accidents and sports injuries. They are used to hold, align, correct, or support external body parts while healing from an injury. Orthopedic braces and support are made from specialized materials with intelligent designs that offer intense targeted support to the knees, spine, shoulder, hips, ankle, foot, and other body parts. In the United States, patients prefer orthopedic braces and support as they help safeguard joints after surgery and provide mobility to the patient suffering from musculoskeletal problems.

To get more information on this market Request Sample

The United States orthopedic braces and supports market is primarily driven by the sedentary habits and hectic lifestyles of the working population, resulting in the increasing instances of lower back pain among them. The rising geriatric population, which is more susceptible to osteoporosis, osteomalacia, osteogenesis and injuries, is also providing a positive thrust to the market. Along with this, manufacturers are launching new products, which is escalating the demand for braces and supports. For example, Breg Inc. launched a new product called the Ultra Aurora Ankle Brace, which combines the comfort of an ankle cuff with the stability and control of a rigid hinged footplate.

United States Orthopedic Braces and Support Market Trends

Smart Orthopaedic Braces

The incorporation of smart orthopedic braces is leading the United States orthopedic braces and support market into a technology transformation. These braces incorporate motion sensors, pressure gauges, and Bluetooth connectivity to monitor in real time the movement of a patient, the stability of joints, and progress during rehabilitation. Data gathered from this enables health professionals to alter therapy protocols even from a distance, thus personalizing care and improving the chances of better recovery. Mobile applications connected to such devices facilitate better engagement among patients through visual feedback, reminders, and tracking of progress. This digital integration helps value-based healthcare models that also emphasize prevention and efficient management of treatment. Growing demand for wearable medical technologies and telehealth solutions accelerates this adoption further. Smart orthopedic braces ensure better compliance and measurable results, adding to their desirability for both clinicians and consumers. This trend essentially points toward a technologically enabled, data-driven orthopedic shift that enhances functionality and improves patient experience.

Material Science and Design Advancements

Material innovation is transforming the United States orthopedic braces and support market with a growing focus on comfort, durability, and flexibility. The development of lightweight composites, advanced thermoplastics, and breathable fabrics minimizes irritation without sacrificing optimal support and enhances the ability to stay mobile longer, allowing wearers to use the products for more hours each day. It allows superior performance in fitting and functioning because ergonomic designs are tailored through 3D scanning and computer-aided modeling. Eco-friendly, sustainable, and recyclable materials are being researched by industry players, which would mean aligning with environmental objectives and also offering solutions to patients who show a preference for environmentally friendly healthcare options. Modular brace designs enable easy customization for different body types and conditions, improving treatment precision and compliance. Moreover, the growing use of 3D printing technology accelerates production and enables patient-specific configuration. This advancement in material and design standards contributes toward ensuring patient satisfaction, encouraging preventive use, thereby continuing to drive growth in the United States orthopedic braces and support market through differentiation based on innovation.

Increasing Interest in Preventive Orthopedic Solutions

The United States orthopedic braces and support market is thus shifting toward preventive orthopedic care due to the increasing consumer focus on long-term musculoskeletal health. Today, braces and supports are used for not just recovery after injury but also for everyday posture correction, stabilization of joints, and prevention of injuries. The trend is driven by an upsurge in the fitness culture and rising awareness about chronic disorders like arthritis and degeneration of joints. Elderly people and athletes increasingly incorporate supportive orthopedic accessories into their wellness regimen for flexibility maintenance and reduction of stress during physical endeavors. Easy availability through online channels in user-friendly and aesthetically appealing braces further encourages adoption. Education campaigns by healthcare professionals raise awareness of the need for early intervention, encouraging this trend. Preventive orthopedic solutions thus stand in tune with the larger transition in healthcare from reactive to proactive management, ensuring continued United States orthopedic braces and support market share growth because consumers increasingly accept these solutions and integrate them into their lifestyles.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States orthopedic braces and support market report, along with forecasts at the country and regional levels from 2026-2034. Our report has categorized the market based on product, type, application and end user.

Breakup by Product:

- Lower Extremity Braces and Supports

- Spinal Braces and Supports

- Upper Extremity Braces and Supports

Breakup by Type:

- Soft and Elastic Braces and Supports

- Hinged Braces and Supports

- Hard and Rigid Braces and Supports

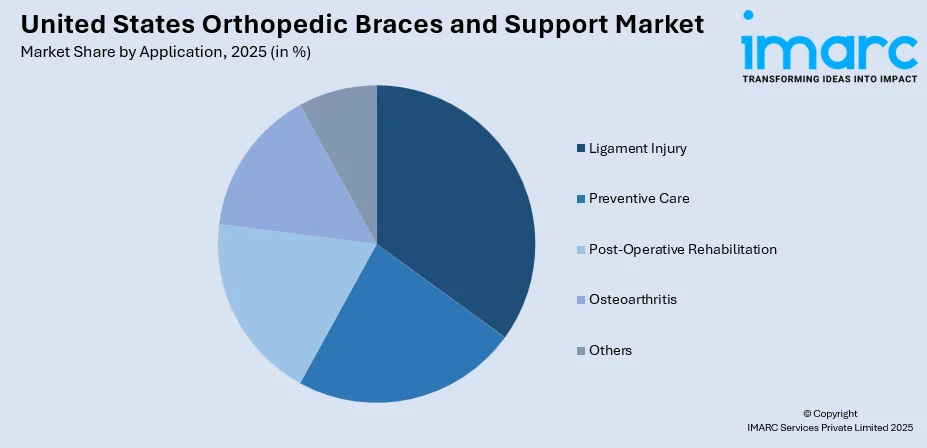

Breakup by Application:

To get detailed segment analysis of this market Request Sample

- Ligament Injury

- Preventive Care

- Post-Operative Rehabilitation

- Osteoarthritis

- Others

Breakup by End User:

- Orthopedic Clinics

- Hospitals and Surgical Centers

- Over-the-Counter (OTC) Platforms

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Segment Coverage | Product, Type, Application, End User, Region |

| Region Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States orthopedic braces and supports market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United States orthopedic braces and supports market?

- What are the key regional markets?

- What is the breakup of the market based on the product?

- What is the breakup of the market based on the type?

- What is the breakup of the market based on the application?

- What is the breakup of the market based on the end user?

- What are the various stages in the value chain of the industry?

- What are the key driving factors and challenges in the industry?

- What is the structure of the United States orthopedic braces and Supports market and who are the key players?

- What is the degree of competition in the industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)