United States Peer-To-Peer Lending Platforms Market Report by Type (Consumer Lending, Business Lending), Loan Type (Secured, Unsecured), End User (Consumer Credit Loans, Small Business Loans, Real Estate Loans, Student Loans, and Others), and Region 2025-2033

Market Overview:

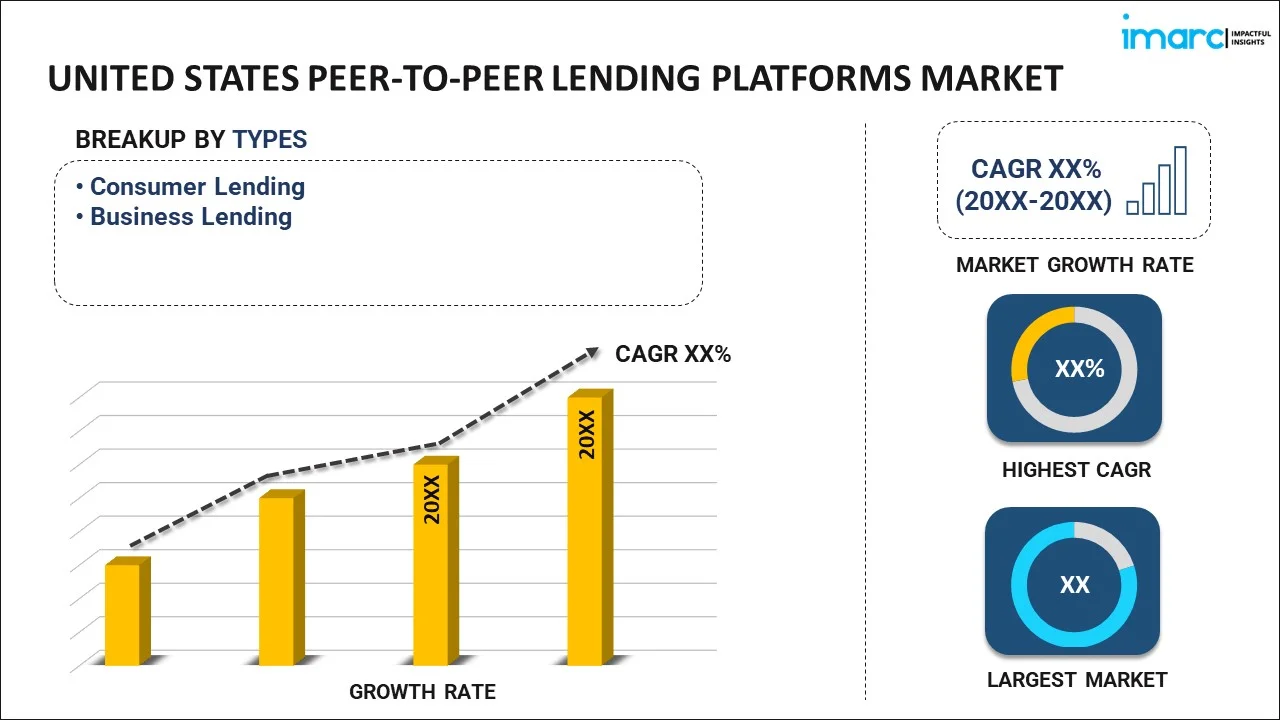

The United States peer-to-peer lending platforms market size reached USD 52.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 164.6 Billion by 2033, exhibiting a growth rate (CAGR) of 13.5% during 2025-2033. The growing convenience of online applications, instant approvals, and quick disbursals; rising opportunity to diversify the portfolios of investors and earn competitive returns; and increasing need for more accurate risk assessment represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 52.7 Billion |

| Market Forecast in 2033 | USD 164.6 Billion |

| Market Growth Rate (2025-2033) | 13.5% |

Peer-to-peer lending (P2P) platform is a modern financial model that enables individuals and businesses to lend and borrow funds directly from one another through online platforms. It bypasses traditional financial institutions, fostering a more streamlined and accessible borrowing process. It assists individuals in seeking loans that are matched with potential lenders as per their borrowing needs and credit profiles. It serves as an intermediary for facilitating the connection and managing the transaction. It allows borrowers to present their loan requirements and financial background, which is then evaluated by the platform to assign an appropriate interest rate. It also offers an opportunity to diversify the investment portfolio of investors beyond traditional assets like stocks and bonds. It helps investors to potentially earn higher returns compared to more conventional investment options by lending directly to borrowers. As it has quicker and more flexible process with potentially lower interest rates, the demand for P2P lending platform is rising in the United States.

United States Peer-To-Peer Lending Platforms Market Trends:

At present, the convenience of online applications, instant approvals, and quick disbursals appeal to borrowers seeking swift access to funds. This represents one of the key factors supporting the growth of the market in the United States. Moreover, P2P lending leverages advanced technology and digital platforms, streamlining the borrowing and lending process, which is propelling the growth of the market in the country. Besides this, P2P lending opens doors for individuals and small businesses with limited access to traditional financing avenues. This inclusivity addresses gaps left by conventional lending institutions, making capital accessible to a broader range of borrowers. In addition, the growing demand for P2P lending, as it provides investors with an opportunity to diversify their portfolios and earn competitive returns, is offering a favorable market outlook in the United States. In line with this, by cutting out intermediaries, investors can access potentially higher yields compared to traditional investment options. Additionally, P2P platforms utilize sophisticated algorithms and data analytics to assess borrower creditworthiness. This data-centric approach allows for more accurate risk assessment, potentially reducing default rates and enhancing investor confidence. Apart from this, P2P lending offers borrowers flexible loan terms, which can cater to a variety of financial needs. Furthermore, the increasing utilization of P2P lending platforms, as borrowers can often choose loan amounts, interest rates, and repayment durations that align with their preferences, is bolstering the growth of the market in the United States.

United States Peer-To-Peer Lending Platforms Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States peer-to-peer lending platforms market report, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, loan type, and end user.

Type Insights:

- Consumer Lending

- Business Lending

The report has provided a detailed breakup and analysis of the market based on the type. This includes consumer lending and business lending.

Loan Type Insights:

- Secured

- Unsecured

A detailed breakup and analysis of the market based on the loan type has also been provided in the report. This includes secured and unsecured.

End User Insights:

- Consumer Credit Loans

- Small Business Loans

- Real Estate Loans

- Student Loans

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes consumer credit loans, small business loans, real estate loans, student loans, and others.

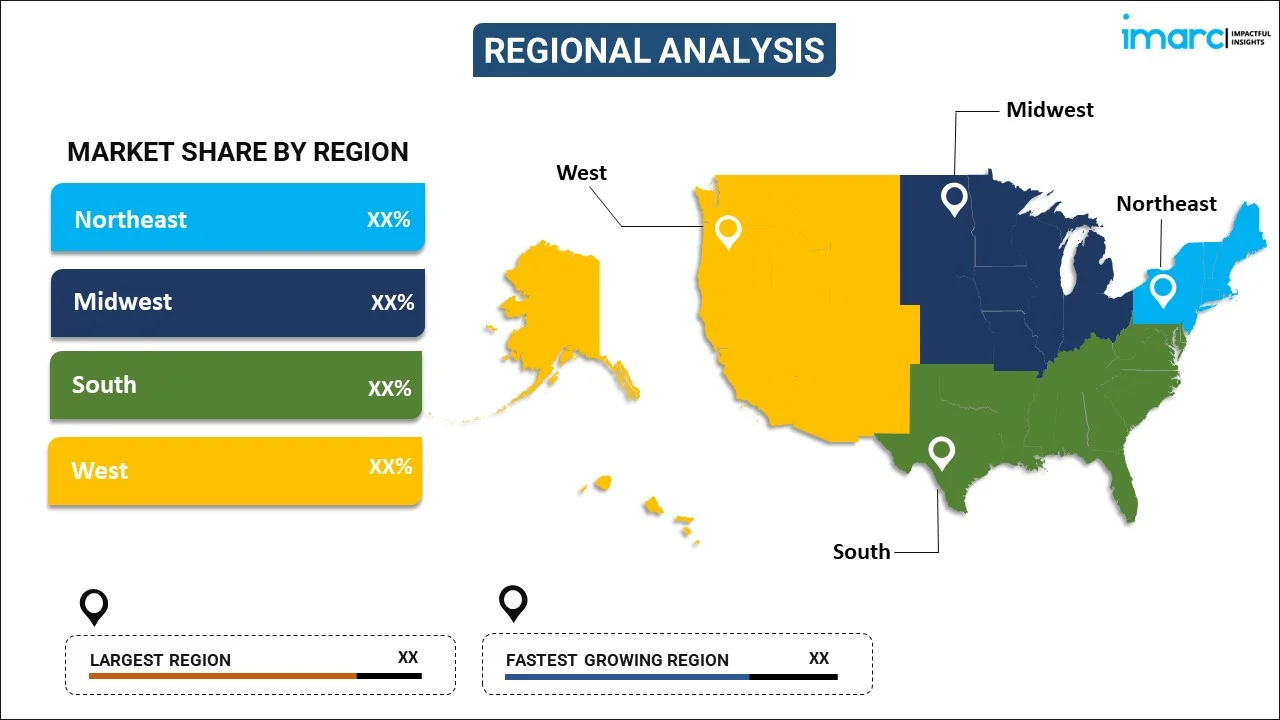

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

United States Peer-To-Peer Lending Platforms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Consumer Lending, Business Lending |

| Loan Types Covered | Secured, Unsecured |

| End Users Covered | Consumer Credit Loans, Small Business Loans, Real Estate Loans, Student Loans, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the United States peer-to-peer lending platforms market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the United States peer-to-peer lending platforms market?

- What is the breakup of the United States peer-to-peer lending platforms market on the basis of type?

- What is the breakup of the United States peer-to-peer lending platforms market on the basis of loan type?

- What is the breakup of the United States peer-to-peer lending platforms market on the basis of end user?

- What are the various stages in the value chain of the United States peer-to-peer lending platforms market?

- What are the key driving factors and challenges in the United States peer-to-peer lending platforms market?

- What is the structure of the United States peer-to-peer lending platforms market and who are the key players?

- What is the degree of competition in the United States peer-to-peer lending platforms market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States peer-to-peer lending platforms market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States peer-to-peer lending platforms market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States peer-to-peer lending platforms industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)