United States Perlite Market Size, Share, Trends and Forecast by Form, Application, and Region, 2025-2033

United States Perlite Market Size and Share:

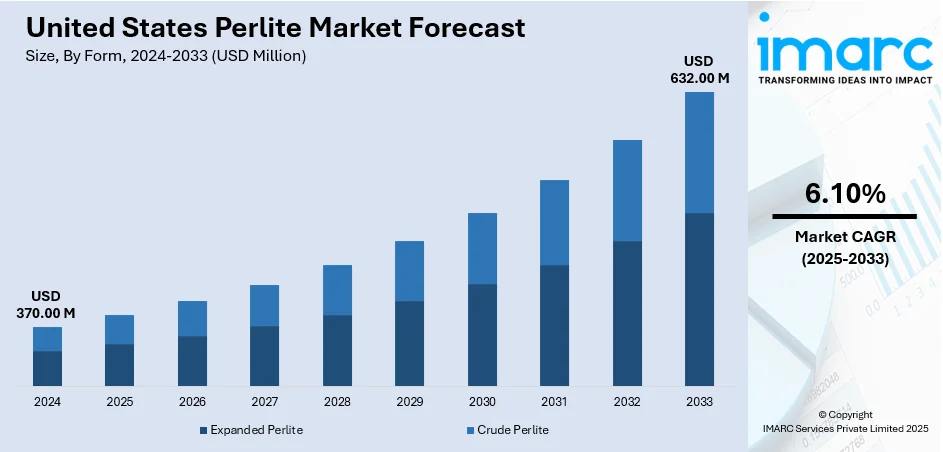

The United States perlite market size was valued at USD 370.00 Million in 2024. Looking forward, the market is expected to reach USD 632.00 Million by 2033, exhibiting a CAGR of 6.10% during 2025-2033. The growing demand for materials that enhance the thermal efficiency of buildings while reducing structural loads, rising focus on enhancing the performance and sustainability of agricultural processes, and increasing adoption of exfoliating scrubs and masks represent some of the key factors fueling the United States perlite market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 370.00 Million |

| Market Forecast in 2033 | USD 632.00 Million |

| Market Growth Rate (2025-2033) | 6.10% |

A key factor propelling market growth is the rising preference for construction materials that are both lightweight and energy efficient. This growing demand reflects the industry's shift toward sustainable building solutions that reduce structural load while enhancing energy performance and overall construction efficiency. Perlite’s thermal insulation, fire resistance, and low density make it a preferred additive in plaster, mortar, concrete, and insulation panels used in green and sustainable building projects. As the US construction sector embraces eco-friendly practices, perlite's role in reducing energy consumption and enhancing structural performance is becoming more prominent. For instance, in September 2024, the US sustainable construction market was valued at $99.8 Billion in 2023 and has continued to expand throughout 2024. Substantial funding is currently available for these initiatives, with additional allocations expected as Congress prioritizes the upkeep of public infrastructure. Sustainable building practices deliver strong returns, offering high-performance structures, long-term energy savings, and greater resilience to extreme weather events.

To get more information on this market, Request Sample

The United States perlite market growth is also driven by the extensive use of perlite in agriculture and horticulture as a soil amendment and hydroponic medium due to its excellent aeration, water retention, and drainage properties. The rising trend of organic farming, greenhouse cultivation, and urban gardening has further expanded its use in controlled-environment agriculture. For instance, in March 2025, Oasthouse Ventures is pleased to confirm that construction has officially commenced on what will be the largest greenhouse ever developed in the United States, following the successful acquisition of necessary funding. Additionally, perlite serves as a non-toxic and inert filtration aid in the food, beverage, and pharmaceutical industries, where purity and efficiency are critical.

United States Perlite Market Trends:

Expanding Demand from the Construction Industry

The construction sector is a major driver of perlite demand in the US, as the material is widely used in lightweight concrete, plasters, insulation boards, and fireproofing products. With growing emphasis on sustainable and energy-efficient buildings, perlite’s natural properties, such as thermal insulation, fire resistance, and low density, make it an ideal choice for green construction. Infrastructure development, building retrofits, and increased adoption of environmentally friendly materials in residential and commercial projects continue to fuel its usage. For instance, in April 2025, The US Green Building Council (USGBC) has launched LEED v5, the latest version of its widely recognized Leadership in Energy and Environmental Design (LEED) program. Building on a 25-year foundation of global impact, this updated edition strengthens and modernizes the industry's leading framework for sustainable building practices. This updated version reinforces environmental performance standards and also incorporates improved digital tools and technologies, making it more accessible and efficient for building owners and project teams to achieve certification. According to the United States perlite market trends, government regulations promoting energy conservation and carbon footprint reduction further support the integration of perlite into modern construction practices.

Rising Adoption in Horticulture and Agriculture

Perlite plays a critical role in the horticultural and agricultural sectors, especially with the rise of sustainable and controlled-environment farming. It enhances soil aeration, improves drainage, and helps retain moisture, making it a valuable component in potting mixes and hydroponic systems. For instance, in 2023, agriculture, food, and related sectors contributed an estimated $1.537 Trillion to the US gross domestic product (GDP), representing 5.5% of the nation's overall economic activity, according to figures released by the Bureau of Economic Analysis. This highlights the significant role these industries play in the US economy. With increasing demand for organic food, urban farming, and vertical agriculture, the use of perlite in greenhouses and indoor farms is expanding rapidly. Its inert and sterile nature also supports disease-free crop production. According to the United States perlite market forecast, as growers seek cost-effective, high-yield solutions that align with environmental standards, perlite is becoming increasingly popular in modern agricultural practices across the United States.

Growth in Industrial and Filtration Applications

Perlite is in high demand across various industrial sectors due to its lightweight, non-toxic, and chemically inert characteristics. It serves as an effective filtration aid in food and beverage processing, pharmaceuticals, and water treatment industries. Perlite is also used in cryogenic insulation, refractory linings, and foundry applications, where high-temperature resistance is critical. With growing industrial output and strict quality standards, industries are favoring filtration and insulation materials like perlite that offer reliability and environmental safety. Its cost-effectiveness and versatility further strengthen its role in diverse applications, supporting the steady growth of the market in the US.

United States Perlite Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States perlite market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on form and application.

Analysis by Form:

- Expanded Perlite

- Crude Perlite

Expanded perlite stand as the largest component in 2024, holding 70.7% of the market due to its versatile properties and wide-ranging applications across multiple industries. When heated, raw perlite expands significantly, resulting in a lightweight, porous material ideal for insulation, filtration, and soil conditioning. In the construction sector, expanded perlite is widely used in lightweight concrete, plaster, and insulation materials, aligning with the growing demand for energy-efficient and fire-resistant building solutions. In agriculture, its ability to retain moisture and improve aeration makes it a preferred soil additive. Additionally, its use as a filtration aid in food, beverage, and pharmaceutical industries further boosts demand. Its low cost, recyclability, and non-toxic nature make expanded perlite a highly sought-after material across the U.S. market.

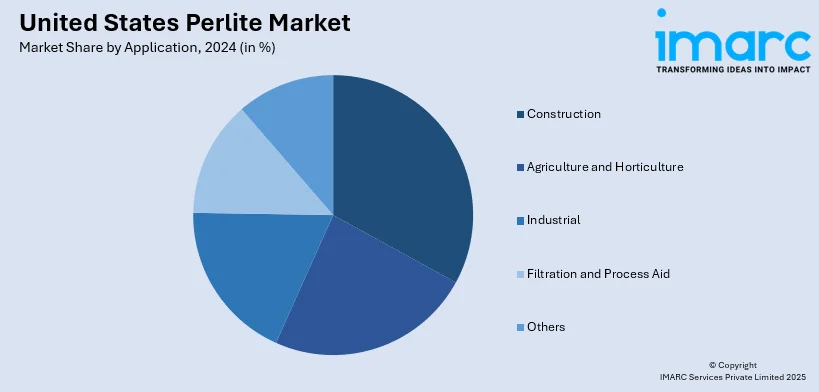

Analysis by Application:

- Construction

- Agriculture and Horticulture

- Industrial

- Filtration and Process Aid

- Others

Construction leads the market with 37.5% of market share in 2024 due to the material’s extensive use in energy-efficient and sustainable building solutions. Perlite’s lightweight, fire-resistant, and thermally insulating properties make it ideal for applications such as lightweight concrete, insulating plasters, masonry blocks, and cavity wall insulation. With growing emphasis on green building practices, perlite is increasingly favored in residential, commercial, and infrastructure projects aiming to meet energy codes and environmental standards like LEED. Additionally, rising renovation and retrofitting activities, particularly for enhancing thermal efficiency, further drive its demand. The material’s durability, cost-effectiveness, and contribution to reducing building energy consumption solidify its dominance in the construction segment of the US perlite market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northeast, the United States perlite market demand is driven by high-density urban construction and a strong emphasis on sustainable building practices. Cities like New York and Boston are investing heavily in energy-efficient infrastructure, where perlite is used for thermal insulation, fireproofing, and lightweight concrete. The region’s aging buildings also fuel renovation projects that require insulation upgrades. Additionally, limited arable land has led to increased interest in indoor and rooftop gardening, boosting perlite use in horticulture. Supportive state policies around green buildings and energy codes further promote the use of eco-friendly construction materials like expanded perlite in both residential and commercial sectors.

The Midwest’s perlite market growth is largely driven by its strong agricultural base and rising adoption of modern farming practices. Perlite is increasingly used in horticulture, hydroponics, and greenhouse cultivation to improve soil structure, aeration, and water retention. The region also sees steady demand from the construction sector, especially in residential developments and infrastructure projects in expanding suburban areas. Harsh winter conditions create additional need for effective insulation materials, further boosting perlite’s role in energy-efficient building systems. The Midwest’s manufacturing and food processing industries also use perlite for filtration applications, contributing to its growing industrial demand.

In the Southern US, rapid urbanization, population growth, and ongoing commercial and residential construction are key drivers of perlite demand. The region’s hot and humid climate increases the need for energy-efficient building materials, where perlite plays a role in thermal insulation and moisture-resistant plasters. Additionally, agriculture remains a vital industry in the South, with perlite widely used to enhance soil in large-scale farming and greenhouse operations. The region's growing interest in sustainable and hurricane-resilient construction also supports perlite use due to its fire resistance and durability. State incentives for green building further promote perlite adoption in new developments.

The Western US leads in environmental innovation and sustainable construction, making it a strong market for perlite. California, in particular, enforces strict energy efficiency standards, driving demand for perlite in insulation, lightweight concrete, and fire-resistant materials. The region's susceptibility to wildfires and extreme weather also increases the need for durable, fire-retardant construction components. In agriculture, the West has a robust horticulture industry, especially in California and Oregon, where perlite is essential for soil conditioning and hydroponics. Additionally, the rise of vertical farming, cannabis cultivation, and tech-driven agribusinesses further expands perlite's role in the region's modern agricultural practices.

Competitive Landscape:

The United States perlite market outlook is moderately fragmented, with a mix of established domestic manufacturers and global players competing across various end-use sectors. Key companies such as Imerys S.A., Supreme Perlite Company, Cornerstone Industrial Minerals Corporation, and Dicalite Management Group dominate the landscape through extensive product portfolios and regional distribution networks. Competition is driven by innovation in expanded perlite applications, cost efficiency, and sustainability standards. Many players focus on vertical integration and raw material sourcing to maintain supply stability and pricing advantage. As demand rises in construction, agriculture, and industrial filtration, companies are investing in capacity expansion, research and development (R&D), and strategic partnerships to strengthen market share and respond to evolving regulatory and environmental demands across the US market.

The report provides a comprehensive analysis of the competitive landscape in the United States perlite market with detailed profiles of all major companies.

Latest News and Developments:

- July 2024: US Silica Holdings, a provider of diversified minerals, including perlite, was successfully acquired by Apollo Funds. The US Silica name and brand will remain the company's operating name.

- May 2024: US Silica Holdings, Inc. confirmed price increases for the majority of its mineral products, including perlite, as well as its cellulose products under its Industrial and Specialty Products segment. Depending on the product, prices are expected to increase by as much as 20%.

United States Perlite Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Expanded Perlite, Crude Perlite |

| Applications Covered | Construction, Agriculture and Horticulture, Industrial, Filtration and Process Aid, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States perlite market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States perlite market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States perlite industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The perlite market in the United States was valued at USD 370.00 Million in 2024.

The United States perlite market is projected to exhibit a CAGR of 6.10% during 2025-2033, reaching a value of USD 632.00 Million by 2033.

The United States perlite market is driven by the increasing demand for energy-efficient, fire-resistant construction materials, expanding use in horticulture and hydroponics for improved soil structure, and growing industrial applications in filtration, insulation, and cryogenics due to its lightweight, non-toxic properties.

Construction holds the largest share in the United States perlite market due to its demand for lightweight, fire-resistant, and insulating materials. Perlite is widely used in energy-efficient buildings, concrete, and plaster, aligning with sustainable construction trends and growing infrastructure development across the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)