United States Polycarbonate Market Size, Share, Trends and Forecast by Product Type, Application, and Region, 2026-2034

United States Polycarbonate Market Summary:

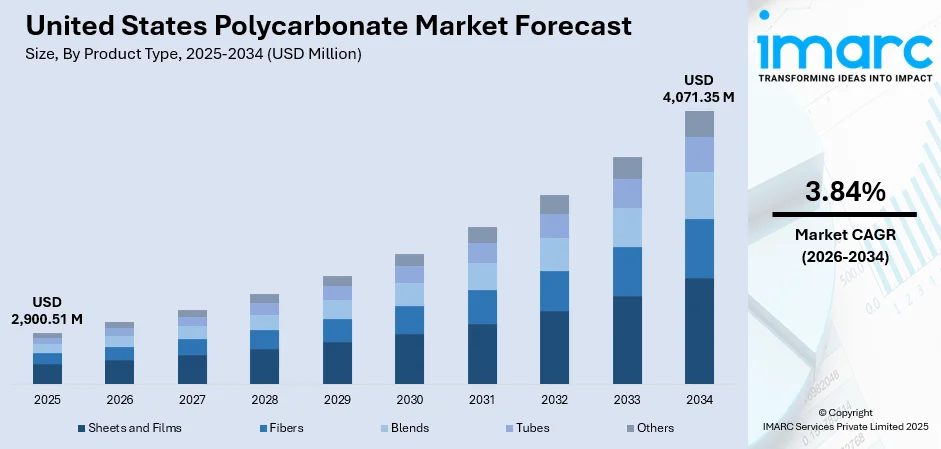

The United States Polycarbonate market size was valued at USD 2,900.51 Million in 2025 and is projected to reach USD 4,071.35 Million by 2034, growing at a compound annual growth rate of 3.84% from 2026-2034.

The United States polycarbonate market is expanding steadily, driven by rising demand for lightweight, durable, and high-performance materials across diverse industrial applications. The material's exceptional optical clarity, impact resistance, and thermal stability position it as a preferred choice in manufacturing sectors requiring superior mechanical properties and design flexibility.

Key Takeaways and Insights:

- By Product Type: Sheets and films dominate the market with a share of 38% in 2025, driven by extensive utilization in architectural glazing, protective barriers, and signage applications across commercial and residential construction sectors.

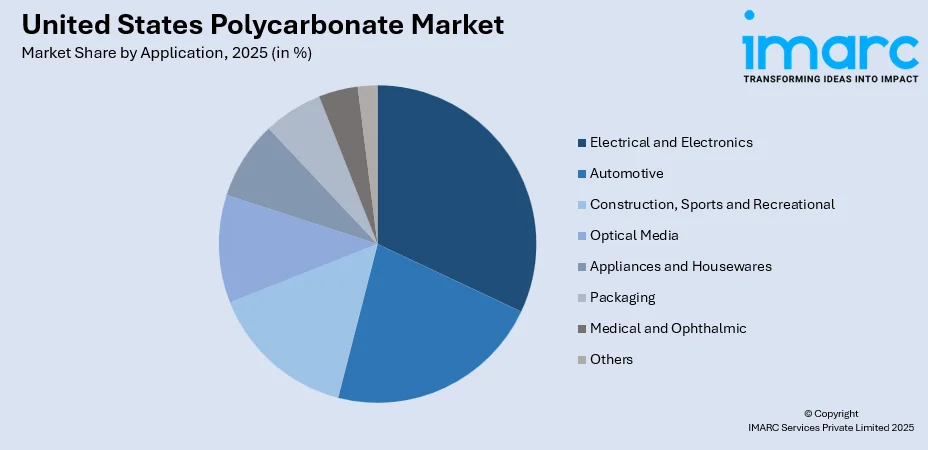

- By Application: Electrical and electronics leads the market with a share of 26% in 2025, owing to increasing demand for lightweight housings, connectors, and display components in consumer electronics and telecommunications infrastructure.

- Key Players: The United States polycarbonate market exhibits moderate competitive intensity, with established multinational polymer manufacturers competing alongside specialty chemical producers. Major players are focusing on capacity expansion, sustainable product development, and strategic partnerships to strengthen their regional market presence.

To get more information on this market Request Sample

The United States polycarbonate market is experiencing robust expansion, underpinned by the material's versatility and superior performance characteristics across multiple end-use industries. The automotive sector continues to drive significant demand as manufacturers increasingly adopt polycarbonate components for headlamp assemblies, interior trim, and lightweight glazing solutions that contribute to vehicle weight reduction and fuel efficiency improvements. For instance, battery-electric vehicles manufactured in the United States incorporate substantially higher polycarbonate content compared to conventional internal combustion engine vehicles, particularly in battery housings, sensor modules, and charging port components. The construction industry represents another key consumption segment, where polycarbonate sheets are favored for skylights, roofing systems, and safety glazing due to their exceptional impact resistance and light transmission properties. The ongoing emphasis on sustainable building practices and energy-efficient architectural designs further supports market growth.

United States Polycarbonate Market Trends:

Rising Adoption in Electric Vehicle Manufacturing

The accelerating transition toward electric mobility is reshaping polycarbonate demand patterns across the automotive supply chain. Electric vehicle manufacturers increasingly specify optical-grade polycarbonate for sensor lenses, lidar housings, and transparent battery enclosures that require exceptional clarity and weather resistance. By 2028, electric-vehicle production capacity in U.S. manufacturing plants is expected to reach roughly 4.7 million units annually. This output would represent nearly one-third of the total number of new vehicles sold nationwide in 2023. The material's lightweight properties directly contribute to extended driving range, while its design flexibility enables integration of advanced lighting and sensing technologies. Domestic EV production expansion is creating sustained demand corridors for specialized polycarbonate formulations optimized for automotive applications.

Expansion of 5G Telecommunications Infrastructure

The nationwide deployment of fifth-generation wireless networks is generating substantial demand for flame-retardant polycarbonate grades in telecommunications equipment. The United States 5G infrastructure market size is projected to exhibit a growth rate (CAGR) of 40.47% during 2025-2033. Small-cell antenna housings, edge computing enclosures, and network infrastructure components require materials offering dimensional stability, electromagnetic transparency, and outdoor durability. Each antenna installation incorporates significant quantities of specialty polycarbonate, creating multiplied demand as network densification accelerates across urban and suburban markets. The material's electrical insulation properties make it particularly suitable for high-frequency communication applications.

Growing Emphasis on Sustainable and Recycled Content Materials

Environmental sustainability considerations are increasingly influencing material selection decisions across major end-use industries. Leading polycarbonate producers are investing in chemical recycling technologies and post-consumer recycled content formulations that maintain performance characteristics while reducing environmental footprint. Brand owners in consumer electronics, automotive, and packaging sectors are specifying recycled-content polycarbonate to meet corporate sustainability commitments. Advanced recycling facilities along the Gulf Coast are establishing infrastructure to reclaim polycarbonate from post-consumer sources for reprocessing into food-contact and technical-grade resins. For instance, in November 2023, Covestro’s polycarbonate compounding plant in Newark, Ohio, earned ISCC (International Sustainability and Carbon Certification) PLUS accreditation, expanding the availability of its mass-balanced polycarbonate materials in the U.S. This milestone follows the earlier certification of the company’s Baytown, Texas, site and represents a significant advancement in strengthening circularity efforts for polycarbonates across the country.

Market Outlook 2026-2034:

The United States polycarbonate market outlook remains favorable through the forecast period, supported by structural demand growth across automotive lightweighting, electronics miniaturization, and sustainable construction applications. Continued investment in domestic manufacturing capacity, including major production expansions scheduled for completion by late 2026, will enhance supply reliability and support regional value chains. The intersection of vehicle electrification mandates, telecommunications infrastructure modernization, and energy-efficient building codes creates durable long-term demand fundamentals. The market generated a revenue of USD 2,900.51 Million in 2025 and is projected to reach a revenue of USD 4,071.35 Million by 2034, growing at a compound annual growth rate of 3.84% from 2026-2034.

United States Polycarbonate Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Sheets and Films | 38% |

| Application | Electrical and Electronics | 26% |

Product Type Insights:

- Sheets and Films

- Fibers

- Blends

- Tubes

- Others

The sheets and films segment dominates with a market share of 38% of the total United States polycarbonate market in 2025.

Polycarbonate sheets and films represent the largest product category, driven by extensive applications in architectural glazing, protective barriers, and signage systems. For instance, in September 2025, AmeriLux International and Brett Martin announced the creation of American Polycarbonate Co. (APC), a joint venture aimed at establishing domestic polycarbonate sheet manufacturing in Wisconsin. The move marks a significant boost for the North American plastics industry by strengthening regional production capabilities and reducing reliance on imported materials. The construction industry increasingly specifies polycarbonate roofing and wall panels that offer superior impact resistance compared to traditional glass while admitting natural daylight that reduces interior lighting requirements. Commercial greenhouses and agricultural facilities favor multiwall polycarbonate panels for their thermal insulation properties and hail resistance characteristics.

The segment benefits from growing adoption in safety and security applications, including protective screens, machine guards, and riot control equipment. Recent infrastructure investments in transportation hubs, sports facilities, and commercial buildings have accelerated demand for polycarbonate glazing solutions. Manufacturing advances enabling larger panel dimensions and enhanced weather resistance formulations continue expanding addressable applications for sheets and films across diverse end-use sectors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Automotive

- Electrical and Electronics

- Construction, Sports and Recreational

- Optical Media

- Appliances and Housewares

- Packaging

- Medical and Ophthalmic

- Others

The electrical and electronics segment leads with a share of 26% of the total United States polycarbonate market in 2025.

The electrical and electronics segment maintains market leadership, driven by escalating demand for lightweight device housings, connectors, and display components across consumer electronics and telecommunications infrastructure. Polycarbonate's exceptional electrical insulation properties, combined with flame-retardant formulations, make it indispensable for smartphone casings, laptop enclosures, LED lighting housings, and power distribution equipment. The proliferation of connected devices and edge computing infrastructure creates sustained demand for dimensionally stable, heat-resistant materials.

Growing semiconductor fabrication capacity in the United States is generating incremental demand for static-dissipative polycarbonate panels and cleanroom equipment components. The material's optical clarity enables integration into display applications and light guide panels, while advanced grades meet stringent flammability requirements for electrical enclosures. Ongoing miniaturization trends in consumer electronics continue driving innovation in thin-wall polycarbonate molding technologies.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast polycarbonate market is driven by strong demand from the medical, electronics, and building renovation sectors concentrated in states like New York, New Jersey, and Massachusetts. Advanced healthcare facilities increasingly use polycarbonate for medical devices, housings, and safety equipment. Urban construction activity and retrofitting projects fuel usage in glazing, roofing panels, and impact-resistant materials. Growth in consumer electronics manufacturing also supports steady adoption of high-performance polycarbonate components.

In the Midwest, polycarbonate demand is shaped by a large automotive manufacturing base, where lightweight, durable plastics are essential for interior components, lighting systems, and structural parts. The region’s industrial machinery and agricultural equipment sectors also rely on polycarbonate for protective covers and high-strength assemblies. Expanding packaging needs, increased appliance production, and investments in advanced manufacturing technologies further stimulate the adoption of polycarbonate across industrial and consumer applications.

The Southern market benefits from extensive construction activity, petrochemical production, and a rapidly expanding automotive and aerospace presence. Polycarbonate is widely used for impact-resistant glazing, skylights, safety barriers, and insulation panels in commercial and residential projects. The region’s robust manufacturing ecosystem supports demand for electronics housings, LED lighting components, and specialty packaging. Population growth and the rise of distribution hubs also drive consumption in infrastructure and facility development.

The Western US market is propelled by strong demand from high-tech industries, including consumer electronics, renewable energy, and aerospace. Polycarbonate’s thermal stability and optical clarity make it valuable for semiconductor equipment, solar applications, and advanced electronic devices. Sustainable building initiatives in states like California increase usage in energy-efficient glazing and architectural materials. Growth in outdoor recreation products and protective gear further supports regional consumption of durable polycarbonate formulations.

Market Dynamics:

Growth Drivers:

Why is the United States Polycarbonate Market Growing?

Accelerating Vehicle Electrification and Lightweighting Initiatives

The automotive industry's aggressive transition toward electric mobility is driving substantial polycarbonate demand growth across the United States. Automakers are increasingly substituting traditional materials with lightweight polycarbonate components to offset battery weight and extend driving range. Applications span headlamp assemblies, panoramic roof systems, interior lighting elements, and sensor housings that require optical clarity and impact resistance. The expanding network of domestic electric vehicle manufacturing facilities and battery production plants creates concentrated demand corridors for specialty polycarbonate grades. Federal incentives supporting clean vehicle adoption and stringent fuel economy regulations reinforce long-term demand fundamentals for lightweight automotive materials.

Robust Construction Activity and Infrastructure Modernization

The construction sector represents a significant and growing consumption segment for polycarbonate materials in the United States. According to the United States Census Bureau, Construction spending in August 2025 reached a seasonally adjusted annual rate of $2,169.5 billion, marking a 0.2 percent (±0.7 percent) increase from the revised July total of $2,165.0 billion. However, spending was 1.6 percent (±1.5 percent) lower than the August 2024 level of $2,205.3 billion. For the first eight months of the year, expenditures totaled $1,438.0 billion, down 1.8 percent (±1.0 percent) compared with $1,463.7 billion recorded over the same period in 2024. Commercial and residential building activity, combined with infrastructure modernization investments, drives demand for polycarbonate glazing, roofing panels, and protective barriers. The material's superior durability, energy efficiency characteristics, and design flexibility make it increasingly preferred over traditional glass and fiberglass alternatives. Controlled environment agriculture facilities, including commercial greenhouses and vertical farming operations, specify polycarbonate panels for their thermal insulation and light transmission properties. Renovation and retrofitting projects across commercial buildings further support consumption as property owners upgrade to energy-efficient building envelope systems.

Expanding Consumer Electronics and Smart Device Proliferation

The continued proliferation of consumer electronics, smart home devices, and connected infrastructure equipment generates sustained polycarbonate demand across the United States. Manufacturers specify polycarbonate for device housings, protective covers, and optical components that require impact resistance, thermal stability, and aesthetic appeal. The shift toward remote work and digital connectivity has expanded the installed base of laptops, monitors, smartphones, and networking equipment containing polycarbonate components. Gaming consoles, wearable devices, and audio equipment represent additional growth segments benefiting from the material's versatility. Ongoing product innovation cycles and replacement demand ensure durable consumption patterns across the consumer electronics value chain.

Market Restraints:

What Challenges the United States Polycarbonate Market is Facing?

Raw Material Price Volatility and Supply Chain Disruptions

The polycarbonate industry faces significant challenges from fluctuating raw material prices, particularly bisphenol A and phenol derivatives linked to crude oil price movements. Geopolitical tensions and global supply chain disruptions create pricing uncertainty that impacts manufacturer margins and downstream customer budgets. This volatility complicates long-term procurement planning and can constrain investment in capacity expansion projects.

Regulatory Scrutiny and Environmental Concerns

Increasing regulatory attention on bisphenol A, a key monomer in polycarbonate production, presents ongoing market challenges. Health and environmental concerns have prompted restrictions on certain food-contact and consumer applications, particularly products intended for infants. Manufacturers must invest in alternative formulations and compliance documentation while managing evolving regulatory requirements across different jurisdictions and application segments.

Competition from Alternative Engineering Plastics

Polycarbonate faces intensifying competition from alternative high-performance thermoplastics offering comparable or superior properties for specific applications. Materials, including polymethyl methacrylate, acrylonitrile butadiene styrene, and advanced composites, compete for market share across automotive, electronics, and construction sectors. Bio-based plastics and sustainable material alternatives increasingly attract specification interest from environmentally conscious brand owners.

Competitive Landscape:

The United States polycarbonate market features a moderately consolidated competitive structure, with established multinational polymer manufacturers commanding significant market presence alongside specialty compounders and regional processors. Leading producers are pursuing capacity expansion investments to address growing domestic demand and reduce import dependence, with major facilities under construction scheduled for completion in the coming years. Competitive differentiation increasingly centers on specialized formulations addressing specific application requirements, including flame-retardant grades, recycled-content products, and high-optical-clarity resins. Strategic partnerships between material suppliers and original equipment manufacturers facilitate collaborative product development and secure long-term supply agreements. The competitive environment emphasizes technical service capabilities, supply reliability, and sustainability credentials as key selection criteria.

Recent Developments:

- January 2025: Covestro announced a significant investment to expand polycarbonate production capacity at its Hebron, Ohio, facility. The expansion includes multiple new production lines for customized polycarbonate compounds and blends, scheduled to become operational by the end of 2026, strengthening domestic supply capabilities for automotive, electronics, and healthcare applications.

- December 2024: SABIC introduced its new LNP ELCRES CXL polycarbonate copolymer resins featuring exceptional chemical resistance. These advanced materials are designed to serve customers in the mobility, electronics, industrial, and infrastructure sectors, addressing increased exposure to harsh chemicals in demanding application environments.

United States Polycarbonate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Sheets and Films, Fibers, Blends, Tubes, Others |

| Applications Covered | Automotive, Electrical and Electronics, Construction, Sports and Recreational, Optical Media, Appliances and Housewares, Packaging, Medical and Ophthalmic, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States polycarbonate market size was valued at USD 2,900.51 Million in 2025.

The United States polycarbonate market is expected to grow at a compound annual growth rate of 3.84% from 2026-2034 to reach USD 4,071.35 Million by 2034.

The sheets and films segment dominated the market with a share of 38% in 2025, driven by extensive utilization in architectural glazing, protective barriers, construction applications, and safety equipment across commercial and industrial sectors.

Key factors driving the United States polycarbonate market include accelerating vehicle electrification and automotive lightweighting initiatives, robust construction activity and infrastructure modernization, expanding consumer electronics demand, and growing 5G telecommunications infrastructure deployment.

Major challenges include raw material price volatility linked to crude oil markets, regulatory scrutiny surrounding bisphenol A in certain applications, competition from alternative engineering plastics, and evolving environmental regulations affecting material selection decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)