United States Precision Farming Software Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

United States Precision Farming Software Market Summary:

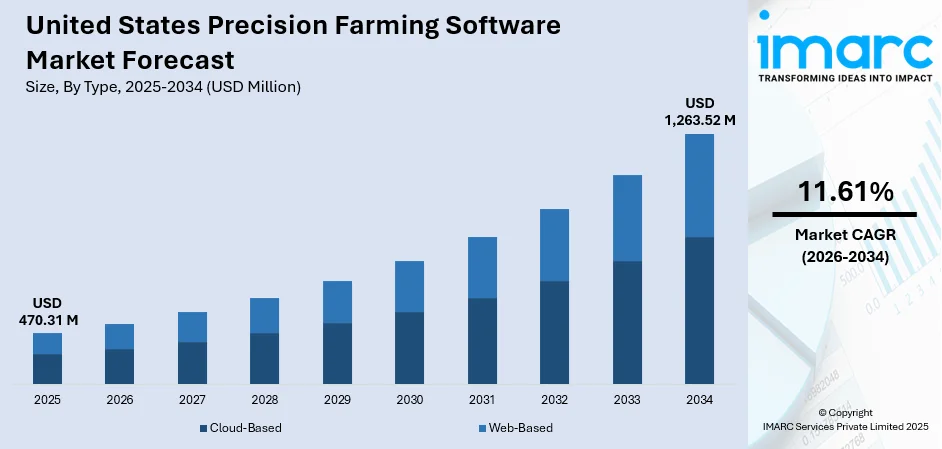

The United States precision farming software market size was valued at USD 470.31 Million in 2025 and is projected to reach USD 1,263.52 Million by 2034, growing at a compound annual growth rate of 11.61% from 2026-2034.

The United States precision farming software market is experiencing robust expansion, as agricultural operations increasingly embrace digital transformation to enhance productivity and sustainability. Rising adoption of cloud-based platforms, artificial intelligence (AI) analytics, and Internet of Things (IoT)-enabled solutions is reshaping farm management practices across the nation. Technological advancements in satellite imagery, drone monitoring, and predictive analytics are enabling farmers to optimize resource utilization while reducing operational costs. Government initiatives supporting climate-smart agriculture and sustainable farming practices are further accelerating software adoption, positioning the market for continued growth as precision agriculture becomes integral to modern farming operations.

Key Takeaways and Insights:

- By Type: Cloud-based dominates the market with a share of 72% in 2025, driven by scalability advantages, real-time data accessibility, and reduced information technology (IT) infrastructure requirements. The Software-as-a-Service (SaaS) model enables farmers to access critical analytics from any location, facilitating responsive decision-making and seamless integration with existing farm equipment.

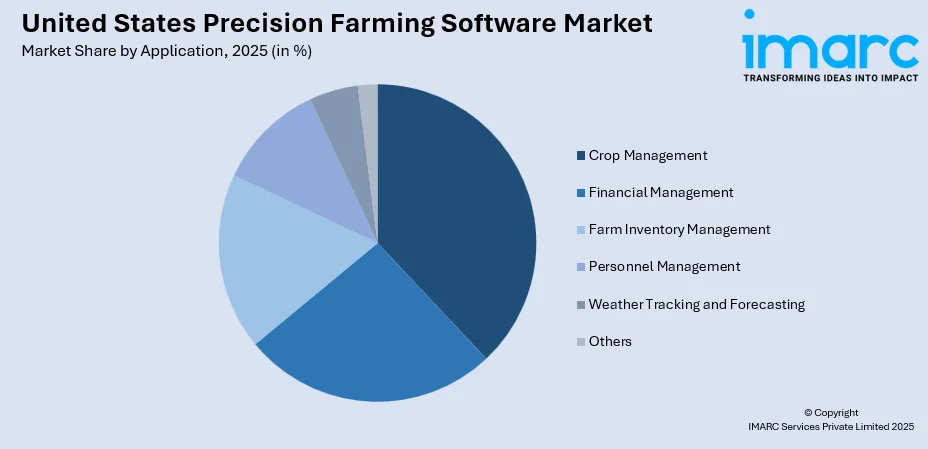

- By Application: Crop management leads the market with a share of 38% in 2025, reflecting the fundamental importance of yield optimization and input management in agricultural operations. Advanced monitoring capabilities for soil health, pest detection, and irrigation scheduling drive sustained demand across diverse farming operations.

- By End User: Farmers represent the largest segment with a 69% share in 2025, underscoring direct adoption of precision technologies by agricultural producers seeking competitive advantages through data-driven farming practices and operational efficiency improvements.

- Key Players: Leading companies drive market advancement through strategic acquisitions, technology partnerships, and continuous innovation in analytics capabilities. Major players invest heavily in AI integration, machine learning (ML) algorithms, and mixed-fleet compatibility solutions to expand market presence and address evolving farmer requirements across diverse agricultural operations.

To get more information on this market Request Sample

The United States precision farming software market is advancing rapidly, as agricultural stakeholders embrace data-driven approaches to address mounting challenges in modern farming. In August 2025, AEM, alongside the American Farm Bureau Federation, American Soybean Association, CropLife America, and National Corn Growers Association, released an updated study emphasizing the extensive advantages of precision agriculture throughout the United States. According to the report, ‘the Benefits of Precision Ag in the United States,’ implementing precision agriculture led to a 5% increase in yearly crop yield, with a further potential rise of 6% if adoption escalates. Cloud-based platforms are enabling seamless integration of satellite imagery, IoT sensor networks, and AI analytics, providing farmers with unprecedented visibility into field conditions and crop performance. The convergence of government support through various programs, technological innovations from established equipment manufacturers, and growing farmer awareness of precision agriculture benefits is creating a favorable environment for sustained market expansion throughout the forecast period.

United States Precision Farming Software Market Trends:

AI and ML Integration

The integration of AI and ML capabilities into precision farming software is transforming agricultural decision-making across the United States. Advanced AI algorithms analyze vast datasets from multiple sources, including satellite imagery, drone surveys, and ground-based sensors, to deliver actionable insights for crop management, disease detection, and yield prediction. In June 2024, Sentera, based in Minnesota, US, introduced its Early Access Program, utilizing AI-powered drone technology to identify weeds and generate herbicide application recommendations, promising potential reductions of up to 70% in herbicide usage through targeted spot-spray applications. The program encompassed more than 10,000 acres throughout Illinois, Iowa, Minnesota, North Dakota, and South Dakota in 2024.

Expansion of Cloud-Based Platform Adoption

Cloud-based farm management platforms are experiencing accelerated adoption as farmers recognize the advantages of SaaS delivery models for agricultural operations. These platforms enable real-time data synchronization across devices, facilitate collaborative decision-making with agronomists, and eliminate substantial upfront hardware investments. Cloud deployment represents the majority of new precision farming software installations, driven by improved rural connectivity, enhanced data security protocols, and the flexibility to scale services according to seasonal demands and operational requirements.

Rising Utilization of IoT

The adoption of IoT systems is propelling the market expansion by enabling data-driven farm management and improved decision-making. As per IMARC Group, the United States IoT integration market size reached USD 1.1 Billion in 2024. IoT sensors placed in fields, soil, and equipment collect continuous data on moisture, temperature, nutrients, and crop health, which is analyzed through software platforms. Real-time insights help farmers optimize irrigation, fertilization, and pest control, reducing input costs and improving yields. This integration increases reliance on advanced software solutions for efficient, sustainable, and profitable agricultural operations.

Market Outlook 2026-2034:

The United States precision farming software market is positioned for sustained expansion, as technological innovations converge with increasing demands for agricultural efficiency and sustainability. Continued advancements in AI capabilities, edge computing, and autonomous systems will enhance software functionality while improving accessibility for small and medium-sized operations. The market generated a revenue of USD 470.31 Million in 2025 and is projected to reach a revenue of USD 1,263.52 Million by 2034, growing at a compound annual growth rate of 11.61% from 2026-2034. Government incentives supporting climate-smart practices, coupled with intensifying labor shortages and rising input costs, will accelerate farmer adoption of precision solutions across all regions.

United States Precision Farming Software Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Cloud-Based | 72% |

| Application | Crop Management | 38% |

| End User | Farmers | 69% |

Type Insights:

- Cloud-Based

- Web-Based

Cloud-based dominates with a market share of 72% of the total United States precision farming software market in 2025.

Cloud-based solutions lead the United States precision agriculture software market because they offer scalability, flexibility, and easy access to data across farms of all sizes. Farmers can monitor fields, equipment, and crop conditions remotely through connected devices, enabling real-time decision-making. Cloud platforms support seamless integration with IoT sensors, drones, and global positioning system (GPS)-enabled machinery, improving data accuracy and operational efficiency. Lower upfront costs and reduced need for on-site IT infrastructure further encourage adoption among both small and large agricultural operations.

Additionally, cloud-based software enables continuous updates, advanced analytics, and secure data storage without disrupting farm activities. Centralized data management allows historical analysis, predictive modeling, and collaboration with agronomists or service providers. Strong data backup, disaster recovery, and multi-device compatibility enhance reliability. As United States farms increasingly adopt digital and data-driven practices, cloud-based platforms remain the preferred choice for delivering scalable, efficient, and future-ready precision agriculture solutions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Crop Management

- Financial Management

- Farm Inventory Management

- Personnel Management

- Weather Tracking and Forecasting

- Others

Crop management leads with a share of 38% of the total United States precision farming software market in 2025.

Crop management applications represent the foundation of precision farming software adoption, addressing core agricultural requirements for yield optimization, input management, and growth monitoring. Rising crop disease has increased the need for digital tools that help farmers monitor crop conditions and respond quickly to emerging risks. In 2024, crop diseases lowered wheat harvests by 8.3% in the surveyed United States states and by 27.0% in Alberta and Ontario. Precision farming software solutions integrate satellite imagery, drone surveys, and ground-based sensor data to provide comprehensive visibility into crop health, pest pressures, and nutrient deficiencies across entire farm operations.

Farmers prioritize tools that directly improve productivity, consistency, and profitability across growing cycles. Crop management software solutions help track planting schedules, crop growth stages, weather impacts, and field performance in a centralized platform. By offering actionable insights for timely interventions, crop management software reduces yield variability and operational risk. Its compatibility with farm equipment, ease of use, and ability to support long-term planning make it essential for both large-scale commercial farms and mid-sized operations focused on efficient resource utilization.

End User Insights:

- Farmers

- Agricultural Cooperatives

- Research Institutions

Farmers exhibit a clear dominance in the market with 69% share of the total United States precision farming software market in 2025.

Farmers lead the market in the United States because they are the primary decision-makers in adopting technologies that directly impact crop productivity, cost control, and farm profitability. Precision software helps farmers manage inputs, monitor field conditions, and respond quickly to weather or soil variability. With rising input costs and tighter margins, farmers increasingly rely on digital tools to improve efficiency, reduce waste, and make informed, data-driven decisions at the field level.

Additionally, growing digital literacy and increased access to connected equipment encourage farmers to adopt precision agriculture platforms. Many farmers value real-time visibility into operations, historical performance tracking, and predictive insights that support planning and risk management. Government support programs, dealer-led training, and strong equipment integration further reduce adoption barriers. As farms continue to modernize and scale operations, farmers remain the dominant end users driving demand for advanced precision agriculture software solutions.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast precision farming software market is driven by diversified crop production, smaller farm sizes, and strong adoption of technology for efficiency. Farmers in the region use software to manage variable weather conditions, soil variability, and high land costs. Demand is supported by specialty crops, dairy operations, and sustainability-focused practices that benefit from data-driven planning and resource optimization.

The Midwest holds prominence in the precision farming software market due to large-scale row crop farming and high technology adoption. Extensive corn and soybean cultivation drives demand for advanced software to manage planting, harvesting, and input efficiency. Strong equipment integration, data-driven decision-making, and emphasis on yield optimization make precision software essential across large commercial farms in the region.

The South shows strong growth in precision farming software adoption due to diverse crops, longer growing seasons, and increasing mechanization. Software helps manage irrigation, pest pressure, and soil variability across cotton, rice, and specialty crops. Rising focus on water efficiency and climate resilience further supports demand for digital farm management solutions.

In the West, the market is driven by high-value crops, water scarcity, and advanced irrigation practices. Farmers rely on software to optimize water use, monitor crop health, and improve productivity. Strong adoption in fruit, vegetable, and vineyard operations, along with technology-focused farming practices, supports consistent market growth in the region.

Market Dynamics:

Growth Drivers:

Why is the United States Precision Farming Software Market Growing?

Surging adoption of data-driven farming practices

The United States agriculture sector is increasingly shifting from traditional, experience-based decision-making to data-driven farm management, strongly driving demand for precision agriculture software. Farmers are using digital platforms to collect, integrate, and analyze data from soil sensors, weather stations, GPS-enabled equipment, and satellite imagery. These tools help optimize planting schedules, irrigation timing, fertilizer application, and pest control with greater accuracy. As farm sizes continue to increase, managing large and geographically dispersed fields manually becomes inefficient, making software-based solutions essential. Precision agriculture software enables real-time monitoring and historical data comparison, allowing farmers to improve yield consistency while reducing input waste. The growing comfort of farmers with mobile apps, cloud platforms, and digital dashboards further supports adoption. This transition towards measurable, trackable, and predictive farming outcomes is a major factor accelerating market growth across row crops, specialty crops, and livestock-integrated farming systems.

Rising crop disease risks and climate variability

Growing climate uncertainty and rising crop disease risks are key drivers of the United States precision agriculture software market. Unpredictable weather patterns, temperature fluctuations, and changing rainfall cycles increase the likelihood of pest outbreaks and plant diseases. Overall damages to crops and rangeland (including beekeeping) from significant weather and fire occurrences in 2024 surpassed USD 20.3 Billion in the United States, representing 11.1% of NOAA’s overall economic impact from disasters. Precision agriculture software helps farmers track micro-climate conditions, soil moisture levels, and crop health indicators in real time, enabling early detection of stress and disease. Using predictive analytics and historical trend analysis, farmers can take preventive action rather than relying on reactive treatments. Rising crop disease concerns also encourage targeted pesticide and fungicide application, reducing chemical overuse while protecting yields. Software-based alerts and decision-support tools allow farmers to respond quickly to emerging threats, minimizing losses. As climate challenges intensify, growers increasingly depend on precision platforms to maintain yield stability and reduce production risks, making climate resilience a strong long-term growth driver for this market.

Integration with advanced farm equipment and digital ecosystems

The growing integration of precision agriculture software with advanced farm machinery is a major factor driving market growth in the United States. Modern tractors, harvesters, sprayers, and planters are increasingly equipped with IoT sensors and telematics systems that rely on software platforms for full functionality. Precision agriculture software acts as the central hub, connecting equipment data with agronomic insights and operational planning tools. This seamless integration enables automated steering, real-time equipment diagnostics, and performance optimization. As equipment manufacturers continue to embed digital capabilities into machinery, software adoption becomes a natural extension rather than a separate investment. Additionally, compatibility with cloud platforms and farm management systems allows data sharing across the agricultural value chain. This ecosystem-driven approach enhances efficiency, simplifies operations, and strengthens long-term reliance on precision agriculture software among farmers.

Market Restraints:

What Challenges the United States Precision Farming Software Market is Facing?

High Initial Technology Investment Requirements

The substantial upfront costs associated with implementing precision farming software systems, including hardware sensors, compatible equipment, and subscription fees, present significant barriers for small and medium-sized agricultural operations. Many farmers require extended payback periods to justify technology investments, particularly during periods of commodity price volatility that constrain available capital for modernization initiatives.

Rural Connectivity and Digital Infrastructure Limitations

Inadequate broadband and cellular network coverage throughout rural agricultural regions limits real-time data transmission capabilities essential for cloud-based precision farming platforms. Government agencies identify connectivity gaps as a key barrier to precision farming growth, with many remote farming areas lacking reliable internet access required for continuous sensor monitoring and immediate decision support functionality.

Data Security Concerns and Interoperability Challenges

Farmer concerns regarding ownership, privacy, and security of sensitive operational data collected through precision farming systems impede adoption among cautious agricultural producers. Integration barriers between legacy equipment and modern software ecosystems complicate data synchronization across mixed-fleet operations, while the absence of uniform standards hampers interoperability between different precision agriculture technologies and vendors.

Competitive Landscape:

The United States precision farming software market features an increasingly competitive environment, as established agricultural equipment manufacturers, specialized software providers, and technology startups compete for market share. Industry consolidation is accelerating through strategic acquisitions that combine hardware expertise with advanced software capabilities. Companies are investing substantially in AI development, mixed-fleet compatibility solutions, and cloud platform infrastructure to differentiate their offerings. Strategic partnerships between equipment manufacturers, data analytics firms, and telecommunications providers are expanding solution capabilities while addressing connectivity limitations. Competition intensifies, as players focus on subscription-based recurring revenue models, open application programming interface (API) ecosystems, and value-added services that enhance customer retention and expand market presence.

United States Precision Farming Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cloud-Based, Web-Based |

| Applications Covered | Crop Management, Financial Management, Farm Inventory Management, Personnel Management, Weather Tracking and Forecasting, Others |

| End Users Covered | Farmers, Agricultural Cooperatives, Research Institutions |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States precision farming software market size was valued at USD 470.31 Million in 2025.

The United States precision farming software market is expected to grow at a compound annual growth rate of 11.61% from 2026-2034 to reach USD 1,263.52 Million by 2034.

Cloud-based dominated the market with a share of 72%, driven by scalability advantages, real-time data accessibility, reduced IT infrastructure requirements, and the flexibility of SaaS delivery models enabling seamless farm data management.

Key factors driving the United States precision farming software market include government support through climate-smart agriculture initiatives, rising adoption of AI and IoT technologies, chronic labor shortages compelling automation adoption, increasing input costs driving precision application demand, and growing farmer awareness about technology ROI.

Major challenges include high initial technology investment requirements, inadequate rural broadband and cellular connectivity, data security and privacy concerns, interoperability issues between legacy equipment and modern software, technical complexity requiring specialized training, and fragmented data standards limiting system integration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)