United States Probiotics Market Size, Share, Trends and Forecast by Ingredient, Distribution Channel, Application, Form, and Region, 2026-2034

United States Probiotics Market Size and Share:

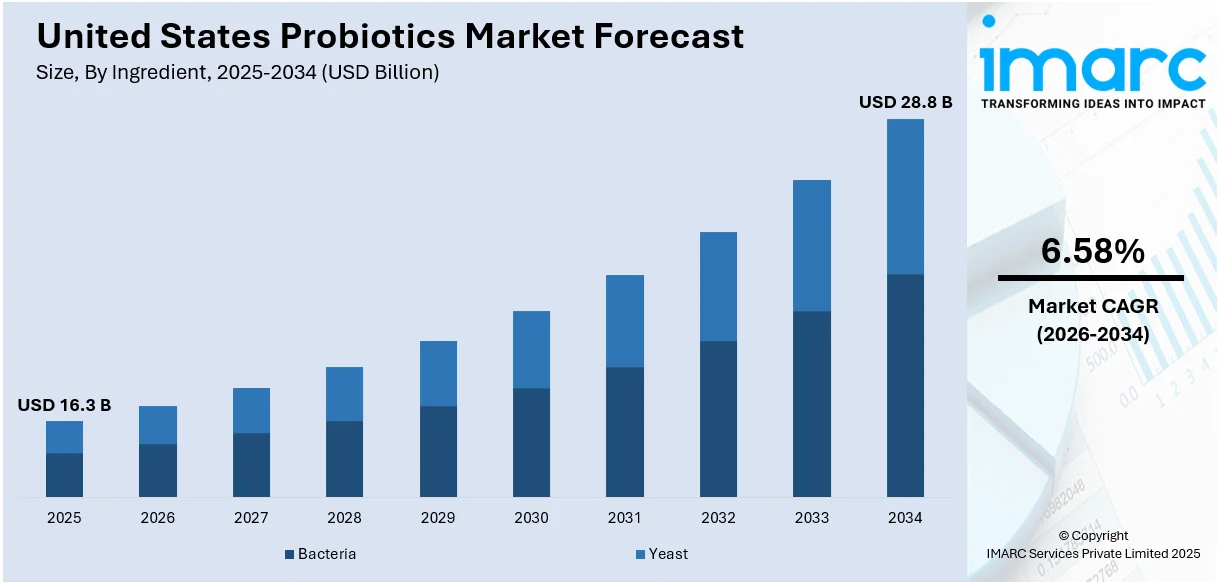

The United States probiotics market size was valued at USD 16.3 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 28.8 Billion by 2034, exhibiting a CAGR of 6.58% from 2026-2034. The market is experiencing steady growth, driven by increasing consumer awareness of gut health, expanding applications in food and beverage, and rising interest in preventive healthcare. Innovation in product formulations and the popularity of functional foods further support demand. The market also benefits from advancements in microbiome research and personalized nutrition trends. These dynamics continue to shape the competitive landscape of the United States probiotics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16.3 Billion |

| Market Forecast in 2034 | USD 28.8 Billion |

| Market Growth Rate 2026-2034 | 6.58% |

Americans are taking a more active role in their digestive well-being, aware of how it contributes to overall health. This increased attention is causing many to seek out natural, food-sourced solutions such as probiotics to ensure a healthy gut microbiome. With digestive ailments on the rise, individuals are using probiotics as a daily aid to digestion, immune system support, and mental focus. With a broad move towards preventive self-care, probiotics are becoming popular as an easy means of maintaining long-term health. Increasing acceptance and recognition have resulted in increased daily consumption of probiotic supplements and food fortification in all age groups.

To get more information on this market Request Sample

Probiotics are being added to an ever-wider range of foods and beverages, becoming more convenient and consumer-friendly. Traditional pills and powders are increasingly being replaced by probiotics integrated into yogurts, beverages, snacks, and a variety of other everyday products, enabling individuals to support their gut health without significantly altering their lifestyle. This trend tracks with consumers' increasing demand for convenient, health-promoting products that are less like medicine and more like food. The clean-label trend has further contributed to this trend, as consumers look for transparency and natural ingredients in what they eat. Consequently, probiotic-fortified functional foods have become an increasingly popular and convenient option for bringing nutrition and wellness into everyday life. This interest can be seen in the dramatic increase in consumer interaction with probiotic-related content, including a 1, 400% increase in article views on probiotics on EatingWell.com in 2023, mirroring increased emphasis on gut health and functional nutrition.

United States Probiotics Market Trends:

Clean Label and Plant-Based Preferences

As consumers become increasingly health-aware and environmentally conscious, they are scrutinizing product labels more carefully, demanding more transparency. Increasingly, consumers prefer probiotics that are clean, plant-based, and minimally processed, containing no artificial additives, preservatives, or typical allergens. Brands are reacting by creating probiotic products based on ingredients such as oats, almonds, and coconut, to meet vegan, dairy-free, and ethically conscious consumers' needs. This trend is part of a larger cultural movement towards simplicity and natural living. Interestingly, 75% of consumers would pay extra for products with ingredients they know and trust. This product trend has had a big impact on product development, with companies focusing on clean-label formats and procuring probiotics in a manner consistent with sustainable, ethical principles. Consumers now demand products that are effective as well as natural, ethically sourced.

Rise of Functional Foods and Beverages

Consumers are increasingly drawn to foods and beverages (F&B) that support health beyond basic nutrition, and probiotics are becoming a staple in this trend. Rather than relying solely on pills or capsules, people now prefer probiotic-infused everyday products like yogurts, drinks, snacks, and even cereals. These offerings allow individuals to incorporate gut-friendly bacteria into their regular meals without changing their routines. This convenience, combined with the desire for natural wellness solutions, has led to a boom in functional food innovation. Companies are focusing on taste, texture, and nutritional value to ensure their products appeal to a wide audience, helping to normalize probiotics as part of mainstream eating habits rather than niche health routines.

Personalization and Microbiome-Driven Innovation

Increased interest in personalized health has given rise to personalized probiotic products, with consumers increasingly looking for solutions that are specifically suited to their individual gut microbiome. Also, the United States probiotics market growth is driven by greater awareness of how gut bacteria affect digestion, immunity, mood, and overall health. As the understanding of the gut-brain connection grows, more individuals are opting for probiotics that fit their individual wellness objectives. New products, such as gut health kits and personalized probiotic strain recommendations according to individual profiles, prove this trend. Surveys, in fact, indicate that 50% of consumers are already aware of the term "gut microbiome," proving elevated awareness. Brands are reacting by launching more specialized, science-formulated supplements, marking a departure from generic items to extremely tailored, preventative wellness solutions that respond to specific needs.

United States Probiotics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States probiotics market, along with forecast at the regional, and country levels from 2026-2034. The market has been categorized based on ingredient, distribution channel, application, and form.

Analysis by Ingredient:

- Bacteria

- Yeast

Probiotics primarily consist of beneficial bacteria, such as Lactobacillus and Bifidobacterium. These strains support gut health by balancing the microbiome, improving digestion, and boosting immunity. They can also enhance nutrient absorption and may contribute to mental health by influencing the gut-brain connection, offering a wide range of health benefits.

Additionally, the probiotic yeast, like Saccharomyces boulardii, helps maintain a healthy gut environment. Unlike bacteria, yeast probiotics work by restoring balance to the gut microbiota, promoting digestive health, and preventing harmful pathogens. They are also used to manage conditions like diarrhea and irritable bowel syndrome, offering a natural remedy for gastrointestinal issues.

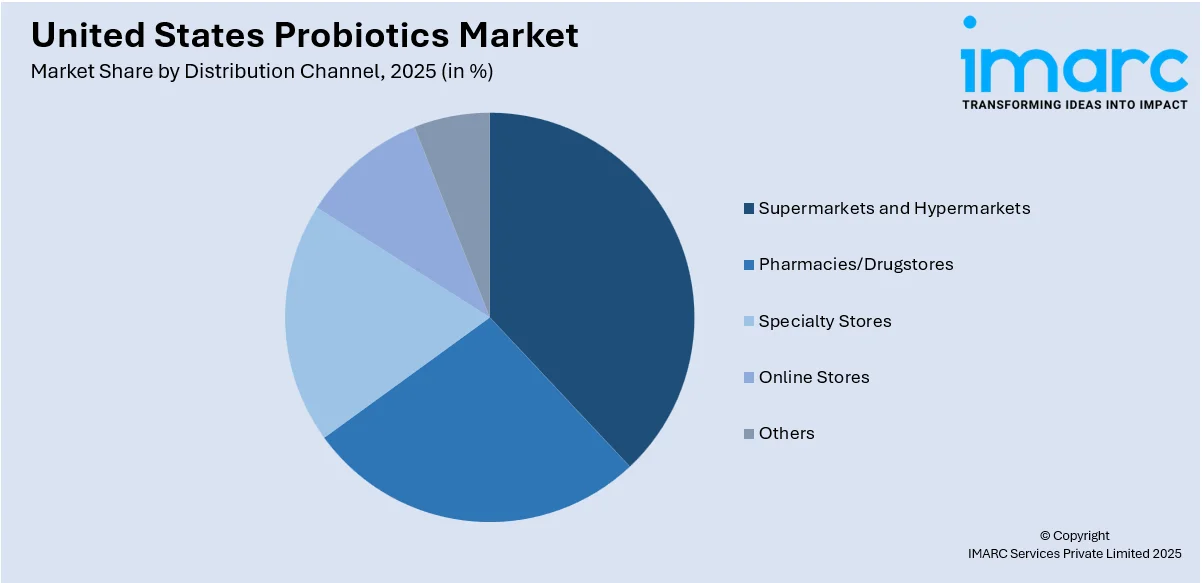

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

Supermarkets and Hypermarkets are key distribution channels for probiotics, offering a wide variety of probiotic-rich products like yogurts, drinks, and supplements. They attract mass-market consumers who prefer the convenience of shopping for probiotics alongside their regular grocery needs, ensuring accessibility and broad product availability.

Moreover, the pharmacies and drugstores serve as major points of sale for probiotic supplements. These locations appeal to health-conscious consumers seeking expert advice or specific therapeutic probiotic products, often used to address digestive or immune system concerns. They offer a trusted, easy-to-access setting for health-related purchases.

Besides this, the specialty stores focus on niche health products, including high-quality probiotic supplements and functional foods. These stores cater to consumers looking for premium, plant-based, or specific strain formulations, offering a more curated selection of probiotics to meet specialized health needs, such as vegan or gluten-free options.

Furthermore, the online platforms are rapidly growing as key distribution channels for probiotics, offering convenience and access to a wide range of products. Consumers can easily compare brands, read reviews, and have probiotics delivered directly to their homes, which appeals to those seeking variety and personalized options.

Along with this, the others category includes non-traditional outlets such as direct sales, health clubs, and wellness centers. Probiotics sold through these channels often target specific groups, like fitness enthusiasts or individuals seeking personalized health regimens, offering tailored products or expert guidance in a more specialized retail environment.

Analysis by Application:

- Food and Beverages

- Dietary Supplements

- Animal Feed

Probiotics are increasingly incorporated into food and beverages like yogurts, drinks, and snacks. These products offer a convenient way to support digestive and overall health, catering to consumers seeking functional nutrition. The growing trend reflects a shift toward incorporating probiotics into everyday diets for wellness benefits.

In line with this, the probiotic dietary supplements, available in forms like capsules, tablets, and powders, are popular for those seeking targeted gut health support. They provide concentrated doses of beneficial bacteria to balance the microbiome, improve digestion, and strengthen immunity. Supplements are favored for their convenience and effectiveness in addressing specific health concerns.

Apart from this, the probiotics are also used in animal feed to promote gut health, enhance digestion, and improve immunity in livestock and pets. By introducing beneficial microorganisms into the digestive systems of animals, probiotics help maintain balanced microbiota, improve nutrient absorption, and reduce the need for antibiotics in animal farming.

Analysis by Form:

- Dry

- Liquid

Dry probiotics, available in powders, capsules, or tablets, are the most common form. They are convenient, have a longer shelf life, and are easier to transport. Dry forms are often preferred for supplements, as they allow for precise dosing and are less susceptible to spoilage compared to liquid forms.

Based on the United States probiotics market outlook, the liquid probiotics are typically found in drinks or liquid supplements. They offer rapid absorption and are often easier for people to consume, especially those who have difficulty with pills. Liquid forms may require refrigeration and have a shorter shelf life, but they provide a more direct and potent dose of probiotics.

Analysis by Region:

- Northeast

- Midwest

- South

- West

The Northeast region is a significant market for probiotics, with high consumer awareness and demand for health and wellness products. Major urban centers in this region, like New York, drive interest in functional foods and supplements. There’s a strong preference for premium and organic probiotic options.

According to the United States probiotics market forecast, the Midwest has seen steady growth in probiotic consumption, driven by a growing focus on wellness and preventive healthcare. Consumers here are increasingly adopting probiotics, particularly in rural and suburban areas. Dairy-based probiotic products, such as yogurt, are especially popular due to the region's strong dairy farming heritage.

However, in the South, the probiotics market is expanding as health-conscious consumers increasingly seek gut health solutions. There's a rising preference for probiotics in functional foods and beverages, with yogurt, smoothies, and supplements gaining popularity. The region’s growing health trend is seen in diverse consumer demographics.

Also, the West region is a leader in the probiotics market, with a highly health-conscious population embracing alternative wellness products. California, in particular, drives trends for plant-based and vegan probiotics. There’s a high demand for clean-label, organic, and sustainably sourced probiotic products, reflecting the region’s eco-conscious values.

Competitive Landscape:

The competitive landscape of the U.S. probiotics market is dynamic and rapidly evolving, driven by increasing consumer demand for digestive and overall health solutions. Companies are focusing heavily on innovation, expanding their product lines to include a wider range of delivery formats such as capsules, gummies, drinks, and fortified foods. Branding, health claims, and ingredient transparency play a crucial role in gaining consumer trust. With rising health awareness, businesses are investing in research and development to create more targeted, effective, and personalized products. Market players also face pressure to keep up with clean-label trends, plant-based preferences, and regulatory standards. Competition is intensifying not only among traditional health brands but also new entrants offering niche or premium probiotic solutions.

The report provides a comprehensive analysis of the competitive landscape in the United States Probiotics market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: By combining FrieslandCampina's prebiotic Biotis GOS-OP High Purity with Lallemand's probiotic B. lactis Lafti B94 to improve gut comfort, Lallemand Health Solutions and FrieslandCampina Ingredients deepened their collaboration on the synbiotic Natural PRO-Digest. Using SIFR technology to simulate the colon, the collaboration demonstrated that the synbiotic combination works synergistically, boosting gut microbiota and promoting short-chain fatty acid (SCFA) production.

- November 2024: The Probiotic Smoothie + Collagen, created with kefir cultures, is the latest functional beverage from Lifeway Foods Inc. Every serving of the beverage, available in four flavors—Tropical Fruit, Berry Blast, Matcha Latte, and Plain—contains five grams of collagen. The beverage is lactose-free, too, tapping into increasing consumer demand for lactose-free dairy drinks.

- September 2024: California-based Flore by Sun Genomics introduced its new range of probiotics that have been specially designed for neurodivergent individuals. The novel products, Mood Support and Pathways Support, are a revolutionary introduction to the company’s line of probiotic products and have been developed after extensive research conducted in collaboration with Arizona State University.

- September 2024: ZBiotics launched its new Sugar-to-Fiber Probiotic Drink Mix. Sugar-to-Fiber is a genetically modified probiotic created by a team of PhD microbiologists with the express purpose of addressing nutritional deficiencies in the United States. It does this by continuously transforming dietary sugar into a unique kind of prebiotic fiber (levan).

- February 2024: Boston-based Verb Biotics LLC entered into a partnership with Evogene Ltd., a renowned computational biology firm based in Israel, to focus on the discovery and development of new probiotic bacterial strains, which generate an exceptionally sustainable amount of microbial metabolites that enhance human wellness and health. The partnership will concentrate on locating and improving the as-yet-undiscovered genetic pathways in microorganisms that facilitate the synthesis of new metabolites.

United States Probiotics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Ingredients Covered | Bacteria, Yeast |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies/Drugstores, Specialty Stores, Online Stores, Others |

| Applications Covered | Food and Beverages, Dietary Supplements, Animal Feed |

| Forms Covered | Dry, Liquid |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States probiotics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States probiotics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States Probiotics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States Probiotics market was valued at USD 16.3 Billion in 2025.

The United States probiotics market is projected to exhibit a CAGR of 6.58% during 2026-2034, reaching a value of USD 28.8 Billion by 2034.

The U.S. probiotics market is driven by growing interest in digestive wellness, increased availability of probiotic-enriched foods and beverages, and a shift toward natural health solutions. Consumers are prioritizing products that support gut health, align with clean-label values, and fit easily into daily routines, fueling ongoing demand and innovation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)