United States Pulse Oximeter Market Size, Share, Trends and Forecast by Type, Sensor Type, End Use, and Region, 2026-2034

United States Pulse Oximeter Market Summary:

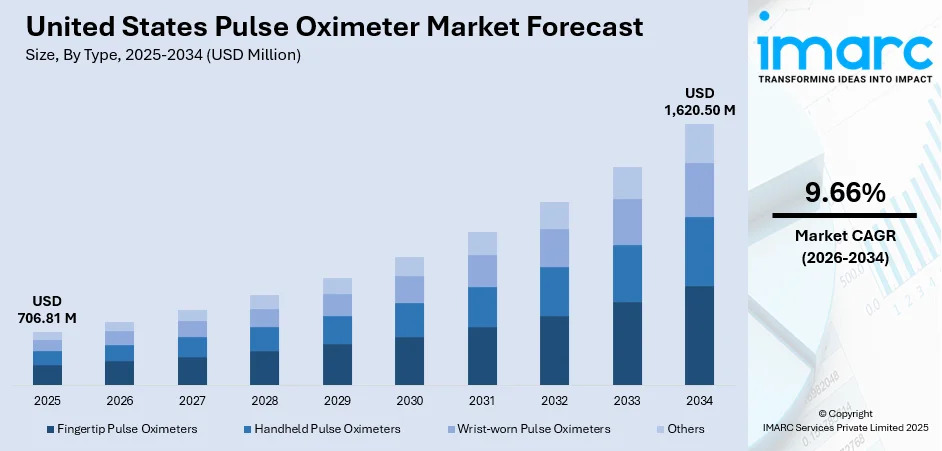

The United States pulse oximeter market size was valued at USD 706.81 Million in 2025 and is projected to reach USD 1,620.50 Million by 2034, growing at a compound annual growth rate of 9.66% from 2026-2034.

The United States pulse oximeter market is experiencing sustained growth driven by the rising prevalence of chronic respiratory diseases including COPD and asthma, an expanding geriatric population requiring continuous health monitoring, and increasing adoption of remote patient monitoring solutions. The growing emphasis on early disease detection, technological advancements in portable monitoring devices, and heightened consumer awareness regarding oxygen saturation monitoring are collectively propelling market expansion, strengthening the United States pulse oximeter market share.

Key Takeaways and Insights:

-

By Type: Handheld pulse oximeters dominate the market with a share of 40% in 2025, driven by their versatility in professional healthcare settings and emergency care applications.

-

By Sensor Type: Reusable sensors lead the market with a share of 68% in 2025, attributed to cost-effectiveness and environmental sustainability initiatives in healthcare facilities.

-

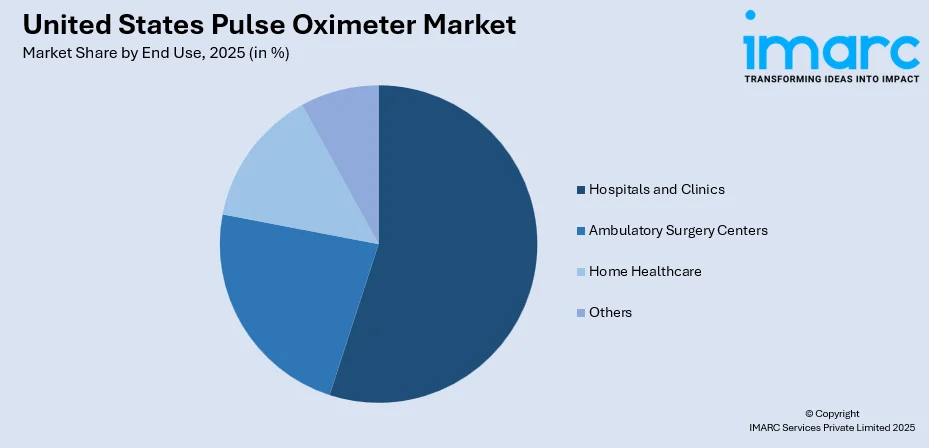

By End Use: Hospitals and clinics represent the largest segment with a market share of 55% in 2025, supported by high patient volumes and integration into multi-parameter monitoring systems.

-

Key Players: The United States pulse oximeter market shows a moderately consolidated competitive environment, where established medical tech companies utilize advanced R&D skills, wide distribution channels, and strategic alliances to preserve their market dominance. Key players emphasize product advancement, adherence to regulations, and broadening clinical uses.

To get more information on this market Request Sample

The United States represents the largest national market for pulse oximeters globally, underpinned by advanced healthcare infrastructure, high healthcare expenditure, and stringent quality standards. The market has witnessed significant evolution following heightened awareness of blood oxygen monitoring during respiratory health emergencies. Technological innovations are driving product differentiation, with manufacturers integrating artificial intelligence capabilities, wireless connectivity, and enhanced algorithms for improved accuracy across diverse patient populations. In February 2024, Masimo announced that MightySat Medical has received FDA approval, making it the first and only FDA-approved medical fingertip pulse oximeter that is sold directly to consumers over-the-counter (OTC) without a prescription. This regulatory milestone reflects the market's trajectory toward democratized access to medical-grade monitoring devices while maintaining clinical accuracy standards.

United States Pulse Oximeter Market Trends:

Advancement in Connected and Smart Pulse Oximetry Technology

The integration of Bluetooth connectivity, smartphone applications, and cloud-based data management is transforming pulse oximeter functionality. Smart devices now enable real-time data transmission to healthcare providers, supporting telehealth expansion and remote patient monitoring programs. In May 2024, Masimo has collaborated with Medable Inc., the top technology provider for contemporary clinical trials. Masimo's MightySat Rx pulse oximeter has been incorporated by Medable into its evidence-generation platform for eight clinical trials sponsored by major pharmaceutical companies that span 25 countries and involve more than 3,000 patients in two oncology indications, including lung and breast cancer. This collaboration exemplifies the convergence of pulse oximetry with digital health ecosystems.

Growing Focus on Accuracy Enhancement Across Skin Pigmentations

Regulatory attention toward ensuring pulse oximeter accuracy across diverse patient populations has intensified significantly. Manufacturers are developing advanced sensor technologies and calibration algorithms to address measurement disparities. The FDA has released updated draft guidance recommending expanded clinical study requirements with greater participant diversity and objective skin tone assessment methods. This regulatory evolution reflects broader healthcare industry commitments to reducing measurement bias and ensuring equitable device performance across all patient demographics and skin pigmentation levels.

Rising Adoption in Home Healthcare and Consumer Wellness Settings

The home healthcare segment is experiencing accelerated adoption as patients increasingly manage chronic conditions outside traditional clinical environments. Fingertip and wearable pulse oximeters are becoming essential components of home health monitoring kits, particularly for patients with respiratory and cardiovascular conditions. In August 2024, Prevounce Health launched its first remote patient monitoring (RPM) blood oxygen device, the Pylo OX1-LTE. This clinically validated, cellular-connected pulse oximeter is designed to seamlessly monitor patients with chronic respiratory conditions like COPD and asthma.

Market Outlook 2026-2034:

The United States pulse oximeter market demonstrates robust growth prospects supported by favorable demographic trends, expanding clinical applications, and technological innovation. The integration of pulse oximetry into comprehensive patient monitoring ecosystems, coupled with increasing remote care adoption, positions the market for sustained expansion. Value-based care models emphasizing continuous monitoring and early intervention are driving institutional procurement. Additionally, advancements in wireless connectivity and artificial intelligence capabilities are enhancing device functionality, while growing consumer awareness of respiratory health monitoring continues to expand addressable market opportunities. The market generated a revenue of USD 706.81 Million in 2025 and is projected to reach a revenue of USD 1,620.50 Million by 2034, growing at a compound annual growth rate of 9.66% from 2026-2034.

United States Pulse Oximeter Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Handheld Pulse Oximeters | 40% |

| Sensor Type | Reusable | 68% |

| End Use | Hospitals and Clinics | 55% |

Type Insights:

- Fingertip Pulse Oximeters

- Handheld Pulse Oximeters

- Wrist-worn Pulse Oximeters

- Others

The handheld pulse oximeters dominate the market with a 40% share of the total United States pulse oximeter market in 2025.

Handheld pulse oximeters have established market leadership through their versatility and clinical utility across diverse healthcare environments. These devices deliver professional-grade accuracy while offering portability advantages that support point-of-care applications, emergency response scenarios, and outpatient services. Healthcare facilities increasingly prefer handheld configurations for their durability, extended battery life, and compatibility with multiple sensor types. The growing demand has encouraged key market players to launch advanced handheld pulse oximetry devices with enhanced monitoring capabilities.

The segment's dominance is further reinforced by growing adoption in first-response environments, long-term care facilities, and wellness clinics where reliable portable monitoring is essential. Handheld devices bridge the gap between stationary bedside monitors and basic fingertip units, providing clinicians with comprehensive vital sign assessment capabilities in a compact form factor. The ongoing development of ruggedized handheld units with extended functionality, including respiration rate monitoring and advanced alarm systems, continues to strengthen this segment's market position as healthcare delivery models evolve toward more mobile and decentralized care approaches.

Sensor Type Insights:

- Reusable

- Disposable

The reusable sensor leads the market with a 68% share of the total United States pulse oximeter market in 2025.

Reusable pulse oximetry sensors maintain commanding market presence driven by their superior cost-effectiveness over extended operational periods and alignment with healthcare sustainability initiatives. Hospitals and clinical facilities favor reusable sensors for continuous patient monitoring applications where long-term utilization justifies the initial investment. These sensors deliver reliable performance across thousands of patient applications when properly maintained, supporting operational efficiency in high-throughput environments. A 2024 study published in Anesthesia & Analgesia demonstrated that transitioning from single-use to reusable pulse oximetry sensors across all US operating rooms could generate annual savings between $510.5-519.3 Million while diverting approximately 587-589 tons of waste from landfills.

The segment's strength is further supported by technological improvements in sensor durability, cleaning compatibility, and measurement accuracy under challenging conditions. Healthcare facilities are increasingly recognizing the environmental benefits of reducing single-use medical device consumption, particularly in operating rooms and intensive care units where pulse oximetry is continuously employed. Reusable sensors also offer greater flexibility in sensor placement options and patient size accommodation, making them particularly valuable in facilities serving diverse patient populations including pediatric and neonatal units.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals and Clinics

- Ambulatory Surgery Centers

- Home Healthcare

- Others

The hospitals and clinics hold the highest revenue with a 55% share of the total United States pulse oximeter market in 2025.

Hospitals and clinics represent the cornerstone of pulse oximeter demand, driven by the criticality of oxygen saturation monitoring in acute care settings. These facilities integrate pulse oximetry into centralized monitoring systems across emergency departments, intensive care units, surgical suites, and general wards. The high prevalence of chronic respiratory diseases requiring hospitalization, combined with standardized monitoring protocols, ensures consistent demand for both equipment and sensors. Growing emphasis on continuous patient monitoring further reinforces institutional procurement.

The segment's dominance extends beyond traditional inpatient settings to encompass outpatient clinics, physician offices, and specialty care centers where pulse oximetry supports diagnostic and treatment decisions. Healthcare facilities are increasingly upgrading legacy monitoring systems with advanced pulse oximeters featuring improved accuracy, connectivity, and integration capabilities. The emphasis on reducing hospital-acquired infections and improving patient outcomes through continuous monitoring reinforces institutional investment in reliable pulse oximetry solutions, while value-based care initiatives encourage adoption of connected devices that support remote monitoring and early intervention strategies.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast benefits from higher per capita healthcare spending and early adoption of digital health solutions. Academic medical centers and teaching hospitals in this region frequently pioneer advanced monitoring technologies and AI-enhanced respiratory algorithms, driving demand for sophisticated pulse oximetry systems.

The Midwest maintains steady demand driven by its extensive network of community hospitals and long-term care facilities. Industrial air-quality challenges and agricultural dust exposure contribute to respiratory health concerns, sustaining consistent device replacement cycles and new equipment procurement.

The South represents a significant market share supported by its large population base and substantial hospital network infrastructure. Higher COPD prevalence rates in several southern states drive sustained demand for monitoring equipment across both institutional and home healthcare settings.

The West demonstrates strong growth momentum driven by technology-forward health systems and consumer affinity for digital health solutions. Wildfire smoke concerns in western states have accelerated adoption of respiratory monitoring devices, while technology hubs in California and Washington foster early trials of connected wearable oximeters.

Market Dynamics:

Growth Drivers:

Why is the United States Pulse Oximeter Market Growing?

Rising Prevalence of Chronic Respiratory Diseases

The escalating burden of chronic respiratory conditions represents a primary catalyst for pulse oximeter market expansion. COPD affects approximately 16 million diagnosed adults in the United States. These conditions necessitate regular oxygen saturation monitoring for disease management and early detection of exacerbations. The aging population demographic further amplifies this driver, as elderly patients experience higher incidence rates of respiratory and cardiovascular conditions requiring continuous monitoring. Healthcare systems increasingly recognize pulse oximetry as an essential component of comprehensive chronic disease management protocols, driving sustained institutional and home healthcare procurement.

Expansion of Remote Patient Monitoring Programs

The accelerated adoption of telehealth and remote patient monitoring has created substantial demand for connected pulse oximetry devices capable of transmitting data to healthcare providers. Remote patient monitoring users in the United States already number approximately 50 million and are expected to double by the end of the decade as reimbursement structures align with value-based care incentives. Healthcare organizations are integrating pulse oximeters into comprehensive remote monitoring ecosystems that enable proactive intervention and reduce unnecessary hospitalizations. New Healthcare Common Procedure Coding System codes for multi-function respiratory devices effective January 2025 have expanded the eligible equipment roster, creating favorable reimbursement conditions that encourage provider investment in advanced pulse oximetry solutions.

Technological Advancements and Product Innovation

Continuous innovation in pulse oximetry technology is expanding clinical applications and driving device upgrades across healthcare settings. Manufacturers are developing advanced algorithms that improve measurement accuracy under challenging conditions including patient motion, low perfusion, and diverse skin pigmentations. The integration of artificial intelligence enables pattern recognition and predictive analytics that enhance clinical decision-making. This milestone reflects the broader trend toward democratized access to medical-grade monitoring devices while maintaining clinical accuracy standards that support meaningful health management.

Market Restraints:

What Challenges the United States Pulse Oximeter Market is Facing?

Accuracy Concerns Across Diverse Skin Pigmentations

Documented measurement disparities in pulse oximeter performance across different skin pigmentations present significant challenges for manufacturers and healthcare providers. Studies have demonstrated that pulse oximeters may overestimate oxygen saturation levels in patients with darker skin tones, potentially affecting clinical decision-making and patient outcomes. Addressing these accuracy concerns requires substantial investment in research, device redesign, and expanded clinical validation studies.

Market Saturation in Consumer Segment

The proliferation of low-cost consumer pulse oximeters has created market saturation in the direct-to-consumer segment. Many available devices lack FDA clearance for medical use, creating consumer confusion regarding device reliability. This competitive pressure from unregulated devices challenges manufacturers of medical-grade equipment to differentiate their products and justify premium pricing.

Stringent Regulatory Requirements

Evolving FDA requirements for pulse oximeter validation, particularly regarding testing across diverse patient populations, increase development costs and time-to-market for new devices. The 2025 draft guidance significantly expanded recommended study participant numbers and diversity requirements, creating additional compliance burdens for manufacturers seeking clearance for medical pulse oximeters.

Competitive Landscape:

The United States pulse oximeter market exhibits a moderately consolidated competitive structure with established medical technology corporations maintaining significant market presence through continuous product innovation, regulatory expertise, and extensive distribution networks. Leading players leverage advanced research and development capabilities to introduce differentiated products featuring enhanced accuracy, connectivity, and clinical utility. Competition intensifies around technological differentiation, particularly in areas of measurement accuracy across diverse patient populations, wireless connectivity, and integration with electronic health record systems. Strategic partnerships between device manufacturers and digital health platforms are reshaping competitive dynamics, as companies seek to position pulse oximeters as integral components of comprehensive remote patient monitoring ecosystems.

Recent Developments:

-

January 2025: The US Food and Drug Administration released new draft guidance intended to enhance the accuracy and performance of pulse oximeters that are crucial devices for patient care that estimate the oxygen levels in the blood, regardless of skin pigmentation.

United States Pulse Oximeter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fingertip Pulse Oximeters, Handheld Pulse Oximeters, Wrist-worn Pulse Oximeters, Others |

| Sensor Types Covered | Reusable, Disposable |

| End Uses Covered | Hospitals and Clinics, Ambulatory Surgery Centers, Home Healthcare, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States pulse oximeter market size was valued at USD 706.81 Million in 2025.

The United States pulse oximeter market is expected to grow at a compound annual growth rate of 9.66% from 2026-2034 to reach USD 1,620.50 Million by 2034.

Handheld pulse oximeters dominated the market with a 40% share in 2025, driven by their versatility in professional healthcare settings, emergency care applications, and compatibility with multiple sensor types across diverse clinical environments.

Key factors driving the United States pulse oximeter market include rising prevalence of chronic respiratory diseases, expansion of remote patient monitoring programs, technological advancements in connected devices, and favorable reimbursement policies supporting home healthcare monitoring.

Major challenges include accuracy concerns across diverse skin pigmentations, market saturation from unregulated consumer devices, stringent regulatory requirements for clinical validation, and competitive pressure affecting premium device pricing.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)