United States Retail Clinics Market Size, Share, Trends and Forecast by Location, Ownership Type, Application, and Region, 2025-2033

United States Retail Clinics Market Size and Share:

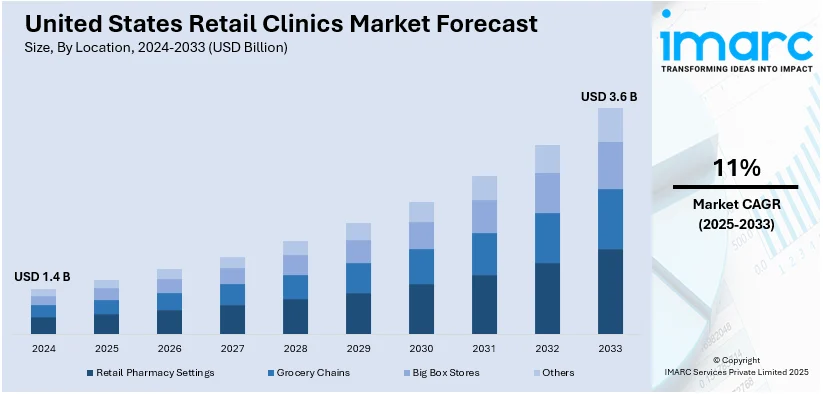

The United States retail clinics market size was valued at USD 1.4 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.6 Billion by 2033, exhibiting a CAGR of 11% from 2025-2033. The market is experiencing rapid growth driven by convenience, cost-effectiveness, and increased access to care. Rising healthcare costs, innovative partnerships, and a focus on chronic disease management is also contributing positively to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 3.6 Billion |

| Market Growth Rate (2025-2033) | 11% |

The United States retail clinics market is driven by an increasing demand for affordable and convenient healthcare solutions. With patients demanding easy access to healthcare beyond traditional medical settings, retail clinics have gained acceptance in the management of minor illnesses, preventive care, and routine check-ups. According to industry reports, as of July 2024 the U.S. has 1,733 active retail health clinics. The Southeast holds the majority at 34.5%. Texas houses 10.9% of all retail clinics nationwide. Growth in health insurance coverage and the rising out-of-pocket costs for healthcare have increased the use of retail clinics. They are strategically located in pharmacies and supermarkets making them easily accessible to busy people seeking convenient affordable health care.

Technological advancements including telemedicine integration and electronic health record (EHR) systems are also a driving force for the growth of this market. These innovations help streamline patient care and improve service efficiency thereby attracting more users. The growing emphasis on preventive healthcare and chronic disease management also contributes to the expansion of services offered by retail clinics. Supportive government policies and partnerships with healthcare providers further strengthen the growth of this market in the United States. For instance, in May 2024, Cardio Diagnostics Holdings launched its clinical blood tests Epi+Gen CHD and PrecisionCHD at the Family Medicine Specialists clinic in Walmart Supercenter Round Lake Beach, Illinois. This collaboration aims to enhance cardiovascular health management through convenient access to advanced diagnostics available to both in-clinic and telehealth patients.

United States Retail Clinics Market Trends:

Expansion of Retail Health Services

Retail health is certainly witnessing the shift with the establishment of primary care centers in retail settings. For instance, in July 2024, Humana's CenterWell announced its plans to open 23 senior-focused primary care clinics within Walmart Supercenters in Florida, Georgia, Missouri and Texas by mid-2025. This expansion allows Humana to enhance its senior primary care network amid increasing regulatory and cost challenges in Medicare Advantage. Such centers go beyond the boundaries of retail clinics which initially were mainly focused on acute care for minor ailments and injuries and deals with chronic disease management, preventive care, and general health maintenance as well. In this integration it is possible to get comprehensive services within the health space of high-traffic retail locations effectively. Primary care in association with traditional retail clinic services is offered within these models catering to the surging consumer interest in affordable and convenient highly integrated healthcare offerings within familiar retail environments.

Shortage of Primary Care Physicians

The shortage of primary care physicians in the United States particularly in rural and underserved regions leaves huge gaps in healthcare access. According to the report published by HRSA Health Workforce, by 2023 28,282 physician assistants (PAs) worked in primary care. A projected shortage of 87,150 primary care physicians by 2037 will particularly affect nonmetro areas amid rising burnout and changing demographics in healthcare. Many communities must wait long or travel great distances for basic medical care. Retail clinics fill in this gap providing accessible and affordable healthcare. These clinics located in retail stores, pharmacies, and supermarkets are staffed by nurse practitioners and physician assistants who provide quality care for non-emergency conditions. Their walk-in availability and extended hours make them a convenient option for patients to help alleviate the strain on already overburdened healthcare systems.

Growing Geriatric Population

The aging population in the United States is growing at a rapid rate. According to data from the US Census Bureau, by 2030, one in five Americans will be of retirement age. By 2034, the number of older adults will exceed that of children. This demographic shift increases the demand for accessible and affordable healthcare solutions. Retail clinics have become crucial in meeting these needs by offering convenient locations, extended hours and lower costs compared to traditional healthcare facilities. These clinics offer essential services such as preventive screenings, vaccinations, and management of chronic diseases like diabetes and hypertension. Retail clinics reduce the burden on hospitals and primary care providers thus making healthcare more accessible to elderly Americans enhancing health outcomes and increasing independence.

United States Retail Clinics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States retail clinics market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on location, ownership type, and application.

Analysis by Location:

- Retail Pharmacy Settings

- Grocery Chains

- Big Box Stores

- Others

U.S. retail clinics are mainly operated by retail pharmacies which includes CVS's MinuteClinic and Walgreens. Such clinics are easily accessible since they are already set up on existing pharmacy infrastructure within the neighborhoods. They offer extended hours of service accommodating older patients among other services including vaccinations, health screenings and chronic conditions management. A familiar pharmacy setting inspires patient confidence while facilitating a seamless flow into prescription services.

Grocery chains such as Kroger and Walmart have invested in retail clinics to be able to capitalize on the large footprint and customer base. The clinics provide an easy way to access healthcare while customers take care of their grocery needs this enhances foot traffic and customer loyalty. Services often include preventive care, treatment of minor illnesses and management of chronic diseases. By locating clinics inside grocery stores these retailers offer a convenient all-in-one solution for health and everyday needs to elderly customers looking for convenience and value in accessing health care.

The U.S. retail clinics market is gaining traction from big box stores such as Target and Costco as they try to incorporate health services into their enormous retail environments. Retail clinics can offer all-round services including physical examinations, management of chronic conditions and emergency care for simple medical conditions. Their huge accessible places are conducive for older shoppers who value the ease of convenience by making visits to their health provider together with other scheduled shopping. Big box retailers can leverage their scale to offer competitive pricing, making healthcare more affordable for the aging population.

Analysis by Ownership Type:

- Hospital Owned

- Retail Owned

Hospital owned retail clinics are an extension of established health care systems that use their medical expertise and full resources. The clinics provide an integrated service so that coordination is smooth with the services and specialists available in the hospitals. They provide a wide array of services including preventive care, chronic disease management and urgent care for minor conditions. These clinics would attract elderly patients because of a trusted reputation due to high care standards and good continuity of healthcare services.

The retail owned clinics are owned by a chain of leading retailers such as CVS's MinuteClinic, Walgreens and Walmart Health. They offer convenient access placing these clinics inside retail stores, pharmacies, and grocery chains. Convenience is emphasized with accessible healthcare services for low-cost, and this also encompasses the offering of vaccinations, health screenings, minor illnesses, and chronic diseases management. Retail owned clinics focus on extended hours, walk-in availability and lower costs compared to traditional healthcare facilities making them particularly appealing to the consumers seeking easy and cost-effective healthcare options.

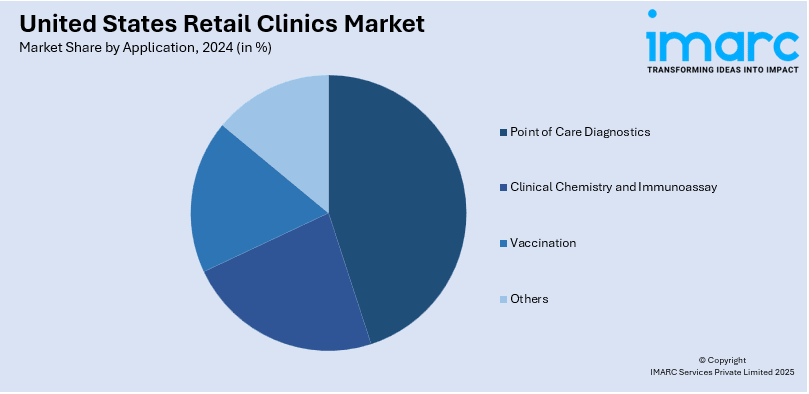

Analysis by Application:

- Point of Care Diagnostics

- Clinical Chemistry and Immunoassay

- Vaccination

- Others

United States retail clinics apply point of care diagnostics to achieve faster and more effective patient assessments. The clinics rely on portable diagnostic equipment to test for common diseases including flu, strep throat, and urinary tract infections in the same premises. Such rapid testing improves patient satisfaction due to shorter wait times and earlier decisions on the need for treatment. Point of care diagnostics also enhances clinic operations for higher patient throughput and improved delivery of healthcare services in accessible retail settings.

Clinical chemistry and immunoassay are essential aspects of the retail clinics' functions in the U.S. In these clinics advanced immunoassay is used to determine biomarkers and infectious diseases besides chronic conditions such as diabetes. Clinical chemistry tools will allow retail clinics to provide all kinds of diagnostic services without a special laboratory. Such a facility will ensure the availability of prompt and accurate results which enhances the quality of care and allows patients and providers to make better-informed decisions.

Vaccination is another very significant service of United States retail clinics market that has been dealing with the ever-growing demand for easy access to immunization. Convenient sites to receive flu vaccines, travel vaccines or just general vaccinations in adults and children include retail clinics. These settings improve accessibility for patients to obtain their vaccinations. Extended hours and walk-in appointments characterize the operation of these clinics. Preventive care services such as vaccinations contribute significantly to the United States retail clinics market share.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The market for retail clinics in the United States' Northeast region is strong because of high population density and widespread health awareness. Major metropolitan areas such as New York, Boston and Philadelphia are home to a large number of retail clinics that offer customers easy access to healthcare services. The region benefits from a network of retailing giants such as CVS MinuteClinic and Walgreens Healthcare Clinics. The preventive care and chronic disease management focus in the Northeast continues to drive the demand for vaccination and diagnostic testing services leading to steady market growth and better patient access.

The Midwest retail clinics market is growing steadily driven by both urban and suburban populations looking for convenient access to healthcare. Key states include Illinois, Ohio and Michigan which feature a growing number of clinics in retail chains and standalone locations. Affordability and convenience are the primary focus of the Midwest making retail clinics a model that appeals to patients with minor ailments, vaccinations, and routine screenings. Partnerships with local pharmacies and employers enhance market penetration and retail clinics are a vital part of the region's healthcare infrastructure.

The Southern United States is a dynamic retail clinics market characterized by rapid growth and high consumer demand. States like Texas, Florida and Georgia are the region's leaders due to large diverse populations and growing healthcare needs. Retail clinics in the South focus on services such as immunizations, point of care diagnostics and chronic disease management which can be used both in urban and rural settings. The economic growth and increased awareness of healthcare needs are factors driving the growth of retail clinics which are crucial for enhancing healthcare access and outcomes in the South.

The Western United States retail clinics market is highly competitive and innovative with states like California, Washington, and Colorado at the forefront. The region’s tech-savvy population and progressive healthcare attitudes foster the adoption of advanced services such as telehealth integration and electronic health records. Retail clinics in the West prioritize convenience offering extended hours and seamless digital appointment systems. The growing focus on holistic and preventive care will further match up with consumer preferences drive further growth in the market and make the West a leader in the evolution of retail healthcare services.

Competitive Landscape:

The United States retail clinics market competitive landscape is determined by a diversified set of players including pharmacy chains, healthcare providers and standalone operators. Competition has been driven by the ability to deliver convenient, cost-effective, and high-quality care for minor ailments, preventive services, and chronic disease management. Market participants focus on expansion of geographic reach, integration of advanced diagnostic technologies and offering value-added services like telehealth consultations. The offerings are differentiated through partnerships with employers, insurers, and local health systems while innovations in service delivery and digital tools enhance operational efficiency and patient engagement positioning retail clinics at the center of the evolving healthcare landscape.

The report provides a comprehensive analysis of the competitive landscape in the United States retail clinics market with detailed profiles of all major companies.

Latest News and Developments:

- In August 2024, CVS Health launched a new store format that features Oak Street Health's senior-focused clinics alongside pharmacies starting with three Chicago locations in 2024. This national expansion follows CVS's $10.6 billion acquisition of Oak Street aiming to enhance personalized care for seniors while competing in the retail healthcare sector.

- In April 2024, Walmart Health announced its plans to expand its presence in Texas with 18 new centers including locations in Pearland, Sugar Land and Tomball. The Sugar Land center marks the 50th nationwide. These facilities will offer affordable healthcare services including primary care and telehealth with extended hours to better serve families and seniors.

United States Retail Clinics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Locations Covered | Retail Pharmacy Settings, Grocery Chains, Big Box Stores, Others |

| Ownership Types Covered | Hospital Owned, Retail Owned |

| Applications Covered | Point of Care Diagnostics, Clinical Chemistry and Immunoassay, Vaccination, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States retail clinics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States retail clinics market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States retail clinics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Retail clinics are healthcare facilities located within retail settings like pharmacies, grocery stores, and big-box retailers. They provide walk-in medical services for minor illnesses, preventive care, vaccinations, and routine check-ups. Designed for convenience and affordability, retail clinics cater to patients seeking quick, accessible, and cost-effective healthcare solutions.

The United States retail clinics market was valued at USD 1.4 Billion in 2024.

IMARC estimates the United States retail clinics market to exhibit a CAGR of 11% during 2025-2033.

The market is driven by rising healthcare costs, growing demand for convenient and affordable care, technological advancements like telemedicine, and increasing focus on preventive care and chronic disease management.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)