United States Seafood Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, and Region, 2026-2034

United States Seafood Market Summary:

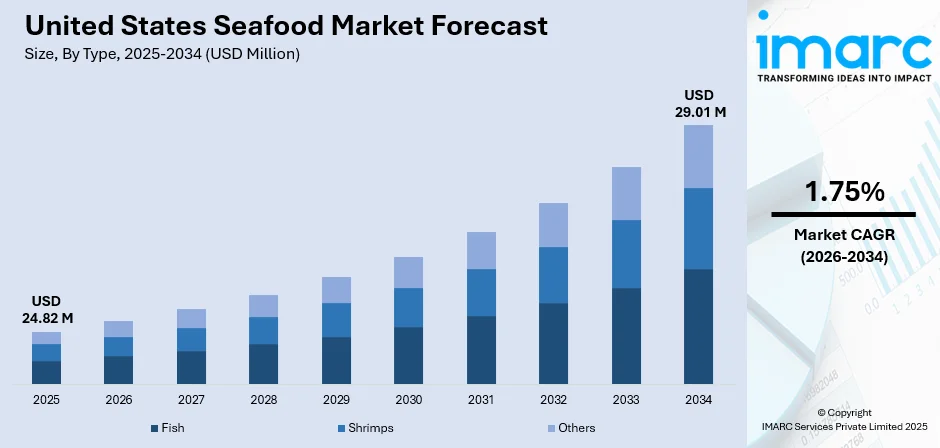

The United States seafood market size was valued at USD 24.82 Million in 2025 and is projected to reach USD 29.01 Million by 2034, growing at a compound annual growth rate of 1.75% from 2026-2034.

The United States seafood market is experiencing steady expansion, propelled by increasing consumer awareness regarding the nutritional benefits of seafood consumption, including high protein content and essential omega-3 fatty acids. The growing preference for healthier dietary alternatives over traditional red meat options continues to drive demand across the nation. Additionally, the expansion of retail distribution channels, enhanced cold-chain logistics capabilities, and the rising popularity of convenient frozen and processed seafood products are strengthening market accessibility. The foodservice sector, encompassing restaurants and quick-service establishments, remains a significant contributor to market growth as Americans increasingly incorporate seafood into their dining experiences, thereby reinforcing the United States seafood market share.

Key Takeaways and Insights:

-

By Type: Fish dominates the market with a share of 58% in 2025, driven by strong consumer preference for salmon, tuna, and other omega-3 rich varieties.

-

By Form: Frozen/Canned leads the market with a share of 45% in 2025, owing to extended shelf life, convenience, and cost-effectiveness for consumers.

-

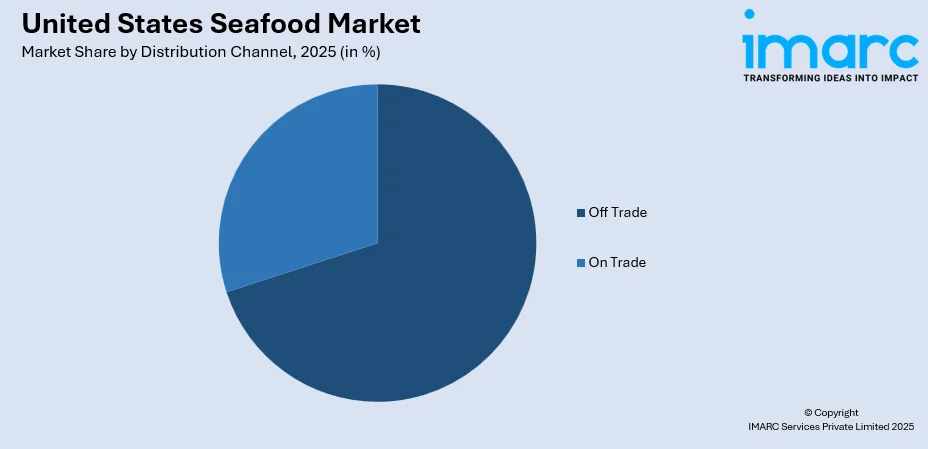

By Distribution Channel: Off Trade represents the largest segment with a market share of 70% in 2025, attributed to the expansion of supermarkets, hypermarkets, and online retail platforms.

-

By Region: South exhibits a clear dominance with a 32% share of the market in 2025, supported by extensive Gulf Coast fisheries and strong aquaculture production.

-

Key Players: The United States seafood market features a moderately fragmented structure where national corporations, regional processors, and specialized distributors compete across diverse segments. These players utilize multiple distribution channels to satisfy varied consumer demands throughout the country.

To get more information on this market Request Sample

The United States seafood market is undergoing a significant transformation, driven by health-conscious consumers prioritizing protein-rich diets and the cardiovascular benefits of marine nutrition. Sustainability and traceability have emerged as foundational pillars, with MSC and ASC certifications increasingly dictating retail strategies and consumer loyalty. To meet the demands of time-constrained lifestyles, the industry has pivoted toward value-added products, such as pre-seasoned fillets and ready-to-cook meal kits, merging high quality with preparation convenience. Simultaneously, the surge of e-commerce and direct-to-consumer platforms has redefined traditional distribution. Supported by sophisticated cold-chain logistics, these digital channels deliver fresh, premium seafood to inland regions previously underserved by existing networks. This powerful synergy of nutritional awareness, ethical sourcing, and technological integration ensures a robust and sustained growth trajectory for the national seafood sector.

United States Seafood Market Trends:

Rising Health Consciousness Driving Seafood Consumption

American consumers are increasingly incorporating seafood into their diets as awareness regarding nutritional benefits expands across demographic segments. The documented association between regular seafood consumption and reduced cardiovascular disease risk continues to influence dietary choices, particularly among aging populations and health-focused millennials. The U.S. Dietary Guidelines for Americans recommend consuming at least 8 ounces of seafood weekly, prompting public health initiatives that promote fish and shellfish as essential components of balanced nutrition. Physicians and nutritionists increasingly recommend omega-3-rich seafood varieties, contributing to sustained market demand expansion.

E-Commerce and Direct-to-Consumer Distribution Expansion

Digital transformation is reshaping seafood distribution channels as online platforms and subscription-based delivery services gain consumer acceptance. Advanced cold-chain logistics infrastructure enables doorstep delivery of fresh and frozen seafood products, extending market reach to inland regions previously dependent on limited retail availability. In February 2024, the Seafood Nutrition Partnership launched its Shipped Direct program under the Fall In Love With Seafood campaign, promoting direct-to-consumer seafood businesses through web, email, and social media channels to enhance consumer engagement and accelerate online sales growth.

Growing Focus on Sustainability and Traceability

Consumer demand for responsibly sourced seafood products is intensifying as environmental consciousness influences purchasing decisions. Retailers and foodservice operators are expanding certified sustainable seafood offerings to meet evolving expectations regarding ethical sourcing practices. Major supermarket chains increasingly require suppliers to maintain third-party certifications such as MSC and ASC, while blockchain-based traceability systems are gaining adoption to provide consumers with detailed sourcing information. Premium wild-caught products from Alaska and other domestic fisheries benefit from strong provenance credentials, commanding price premiums among environmentally conscious consumers.

Market Outlook 2026-2034:

The United States seafood market outlook remains positive through the forecast period, supported by sustained consumer demand for healthy protein alternatives and ongoing distribution channel innovation. The market is anticipated to benefit from continued aquaculture production expansion, improved processing technologies, and enhanced supply chain efficiencies that ensure product freshness and availability. Additionally, the growing integration of value-added products and convenient meal solutions addresses evolving consumer lifestyles, while digital transformation of retail channels expands market accessibility across geographic regions. The market generated a revenue of USD 24.82 Million in 2025 and is projected to reach a revenue of USD 29.01 Million by 2034, growing at a compound annual growth rate of 1.75% from 2026-2034.

United States Seafood Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Fish | 58% |

| Form | Frozen/Canned | 45% |

| Distribution Channel | Off Trade | 70% |

| Region | South | 32% |

Type Insights:

- Fish

- Shrimps

- Others

The fish dominates with a market share of 58% of the total United States seafood market in 2025.

The fish segment maintains its leading position within the United States seafood market, driven by widespread consumer recognition of its nutritional advantages and culinary versatility. Species including salmon, tuna, cod, and tilapia remain particularly popular among American households, offering high-quality protein with beneficial omega-3 fatty acids essential for cardiovascular and cognitive health. The growing availability of fresh and frozen fish products across retail channels, combined with increasing restaurant menu offerings, continues to reinforce segment dominance. Premium varieties such as wild-caught Alaskan salmon command strong demand among health-conscious consumers seeking traceable, sustainably sourced products.

Consumer preferences for fish products reflect evolving dietary patterns emphasizing lean protein sources with lower saturated fat content compared to traditional meat alternatives. The expansion of value-added fish products, including pre-marinated fillets, breaded portions, and ready-to-cook meal kits, addresses convenience requirements of time-constrained consumers. According to Power of Seafood 2024 research from FMI, home-cooked seafood consumption increased to 59% of total seafood consumption, up from 53% the previous year, indicating sustained household demand for fish products suitable for home preparation. Retailers continue investing in enhanced seafood counter offerings and improved product presentation to capture premium segment opportunities.

Form Insights:

- Fresh/Chilled

- Frozen/Canned

- Processed

The frozen/canned leads with a share of 45% of the total United States seafood market in 2025.

The frozen/canned seafood segment commands the largest market share, reflecting consumer prioritization of extended shelf life, convenience, and cost-effectiveness. Frozen products preserve nutritional quality through advanced processing technologies while enabling year-round availability regardless of seasonal fishing patterns. The category benefits significantly from the United States reliance on imported seafood, with frozen formats facilitating efficient international supply chain operations. Canned tuna and salmon maintain strong positions as pantry staples, offering affordable protein options with minimal preparation requirements.

Consumer demand for frozen seafood accelerated as busy lifestyles increased preference for convenient meal solutions requiring minimal cooking time. Technological advancements in freezing techniques, including flash-freezing at sea, preserve product freshness and nutritional integrity comparable to fresh alternatives. In 2024, frozen seafood accounted for nearly half of total retail seafood sales in the United States, reflecting sustained consumer confidence in frozen product quality. Supermarkets and specialty retailers continue expanding frozen seafood assortments, incorporating premium varieties and value-added products such as pre-seasoned fillets and microwavable meal options.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Off Trade

- On Trade

The off trade segment holds the largest share of 70% of the total United States seafood market in 2025.

The off trade distribution channel encompasses retail establishments including supermarkets, hypermarkets, specialty fish markets, and online platforms, collectively representing the primary seafood purchasing avenue for American consumers. Supermarket chains maintain extensive seafood departments offering diverse product assortments spanning fresh, frozen, and shelf-stable categories. The growing emphasis on sustainability certifications and product traceability has prompted retailers to enhance sourcing transparency, with prominent displays of MSC and ASC certified products attracting environmentally conscious consumers.

E-commerce platforms represent the fastest-growing component within the off trade segment, enabling direct-to-consumer seafood delivery with guaranteed freshness through sophisticated cold-chain logistics. Online seafood retailers and subscription services cater to consumers seeking convenience and access to specialty products unavailable through traditional retail channels. In February 2024, Gorton's Seafood announced plans to invest USD 89.3 Million in a new 110,000-square-foot production facility in Lebanon, Kentucky, expected to create 163 jobs by 2029, demonstrating continued industry commitment to meeting expanding retail demand. The shift toward home-prepared seafood meals continues driving off trade channel growth across geographic markets.

Regional Insights:

- Northeast

- Midwest

- South

- West

The South region represents the largest market with a 32% share of the total United States seafood market in 2025.

The South region maintains its leading position within the United States seafood market, benefiting from extensive Gulf Coast fisheries that supply significant quantities of shrimp, oysters, crabs, and various finfish species. States including Texas, Louisiana, Florida, and Mississippi possess established commercial fishing industries with deep-rooted cultural traditions emphasizing seafood consumption. The region dominates domestic aquaculture production, primarily due to freshwater catfish farming concentrated around the Mississippi River watershed, complemented by Gulf shrimp and oyster cultivation operations.

The majority of saltwater recreational fishing in the United States is concentrated in the Southeast. According to NOAA Fisheries, the Southeast region generates more than USD 15 Billion annually in recreational fishing sales alone. The region's favorable climate enables year-round fishing operations across diverse marine ecosystems, while proximity to major population centers ensures efficient distribution of fresh seafood products. Gulf Coast ports facilitate substantial seafood imports supplementing domestic harvests, positioning the South as the primary hub for seafood distribution throughout the United States market.

Market Dynamics:

Growth Drivers:

Why is the United States Seafood Market Growing?

Increasing Health Consciousness and Nutritional Awareness

Rising consumer awareness regarding the health benefits associated with regular seafood consumption represents a primary catalyst driving market expansion. Seafood products offer high-quality protein with essential omega-3 fatty acids documented to support cardiovascular health, cognitive function, and overall wellness. Medical professionals increasingly recommend seafood as a nutritious alternative to red meat, particularly for individuals managing cholesterol levels or seeking weight management solutions. The U.S. Dietary Guidelines for Americans recommend consuming at least eight ounces of varied seafood weekly, reinforcing institutional support for increased seafood intake. According to CDC National Health and Nutrition Examination Survey data from 2021-2023, approximately 24.3% of American adults consumed seafood at least twice weekly, indicating substantial growth potential as health education initiatives expand consumer awareness regarding dietary guidelines and associated wellness benefits.

Expansion of Retail Distribution and E-Commerce Channels

The rise of retail distribution channels such as e-commerce sites as well as direct-to-consumer delivery services has greatly improved the accessibility of the markets geographically. Conventional supermarkets are also investing in upscale seafood departments with better offerings, point-of-sale displays, and experts providing advice on the preparation of such products. E-commerce sites and other seafood home-delivery services have enhanced the possibility of consumers getting doorstep delivery with an absolute guarantee of the freshness of the products as a result of superior cold logistics. Subscription-based seafood box services as well as traceability-centric brands have become accepted by consumers, especially millennials, who value the concepts of convenience, sustainable seafood, and transparency.

Aquaculture Development and Supply Chain Improvements

Increased production of farmed aquatic organisms in the domestic aquaculture industry, combined with better supply chain infrastructure, are key drivers for industry growth. More advanced technologies in aquaculture, such as recirculating aquaculture systems (RAS), promote sustainable production of salmon, catfish, and other shellfish, which have less of an environmental impact than fishing. The Seafood Import Monitoring Program (SIMP) imposes requirements for exporters to report the export of listed species of seafood, thus securing the supply chain by keeping any fishing products of an illicit nature out of commerce. Increased support for cold-chained logistics, such as more advanced refrigeration systems along with dedicated transportation infrastructure, ensures product freshness at the retail and food service levels for the sale of quality seafood products.

Market Restraints:

What Challenges the United States Seafood Market is Facing?

Supply Chain Volatility and Price Fluctuations

The seafood value chain is ever vulnerable to disruptions that come about due to climate change variability, geopolitical instabilities, and transport infrastructure congestion, thereby creating price instabilities that affect consumer demand. Fluctuations due to seasons, fuel prices, and labor costs further exacerbate difficulties associated with running the seafood value chain, thereby affecting retail prices that can keep cost-sensitive customers away.

Environmental Sustainability and Regulatory Pressures

With the rise in concerns over overfishing, bycatch, and preserving marine habitats, there has been an escalation in regulation compliance costs for fishing ventures and processors. But environmental groups and consumer advocacy organizations continue to exert pressure on those in the fishing industry to implement sustainably and to provide sourcing documentation, adding still further to the complexities for smaller firms that cannot support an effective compliance program.

Import Dependence and Trade Policy Uncertainties

The United States mainly depends on other countries for all its seafood demands, and currently, only a small percentage of total demand is being met by domestic production. Any escalation in trade tariffs on critical supplying countries such as China, Thailand, Vietnam, and Indonesia can have a substantial effect on their availability and pricing in the market and can limit growth during times of increased trade tensions.

Competitive Landscape:

The degree of market fragmentation, competing power, and market forces within the United States seafood market are moderately fragmented, with the presence of major international corporations, regional processors, and specialized distributors who are involved in a wide range of market segments and geographic territories across the industry. The major players within the industry enjoy sustained competitive advantages as a result of integrated business operations across the supply chain, a wide range of market products, and wide-reaching market distributions networks, including both retail and foodservice market segments. The major industry players continue to undertake numerous research and development programs, such as innovative product formulation and enhanced processing technologies to support sustained improvement in overall market quality, including market freshness, by improving market quality and market shelf life.

Recent Developments:

-

February 2025: CenSea expanded its market presence by acquiring Ocean Garden Products' shrimp portfolio, strengthening its position in the US retail seafood market and enhancing its competitive capabilities in the shrimp category.

-

January 2024: Acme Smoked Fish, a smoked salmon producer based in Brooklyn, New York, opened a new production facility in Florida to meet rising demand in the Southeast United States region.

United States Seafood Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Fish, Shrimps, Others |

| Forms Covered | Fresh/Chilled, Frozen/Canned, Processed |

| Distribution Channels Covered | Off Trade, On Trade |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States seafood market size was valued at USD 24.82 Million in 2025.

The United States seafood market is expected to grow at a compound annual growth rate of 1.75% from 2026-2034 to reach USD 29.01 Million by 2034.

Fish dominated the segment with approximately 58% market share in 2025, driven by strong consumer preference for omega-3 rich varieties including salmon, tuna, and cod that offer proven cardiovascular and cognitive health benefits.

Key factors driving the United States seafood market include rising health consciousness among consumers, expansion of retail distribution and e-commerce channels, growing demand for convenient frozen and processed products, and increasing emphasis on sustainable sourcing practices.

Major challenges include supply chain volatility and price fluctuations, environmental sustainability concerns and regulatory pressures, heavy import dependence exposing the market to trade policy uncertainties and rising operational costs impacting industry profitability.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)