United States Small Bone and Joint Devices Market Size, Share, Trends and Forecast by Device Type, End User, and Region, 2026-2034

United States Small Bone and Joint Devices Market Summary:

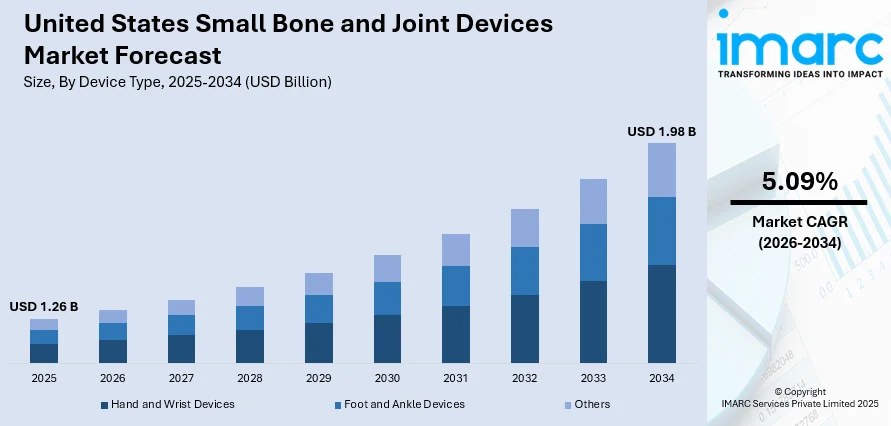

The United States small bone and joint devices market size was valued at USD 1.26 Billion in 2025 and is projected to reach USD 1.98 Billion by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

The United States small bone and joint devices market is experiencing robust expansion driven by the increasing prevalence of orthopedic disorders, particularly osteoarthritis and degenerative joint diseases affecting extremities. The expanding geriatric population across the country is contributing significantly to market growth as older adults are more susceptible to bone and joint conditions requiring surgical intervention. Rising healthcare expenditure enables greater patient access to advanced orthopedic technologies, while ongoing advancements in minimally invasive surgical techniques enhance procedural outcomes and recovery times, collectively strengthening the United States small bone and joint devices market share.

Key Takeaways and Insights:

- By Device Type: Foot and ankle devices dominate the market with a share of 42% in 2025, driven by high incidence of sports injuries, diabetic foot complications, and increasing demand for reconstructive procedures.

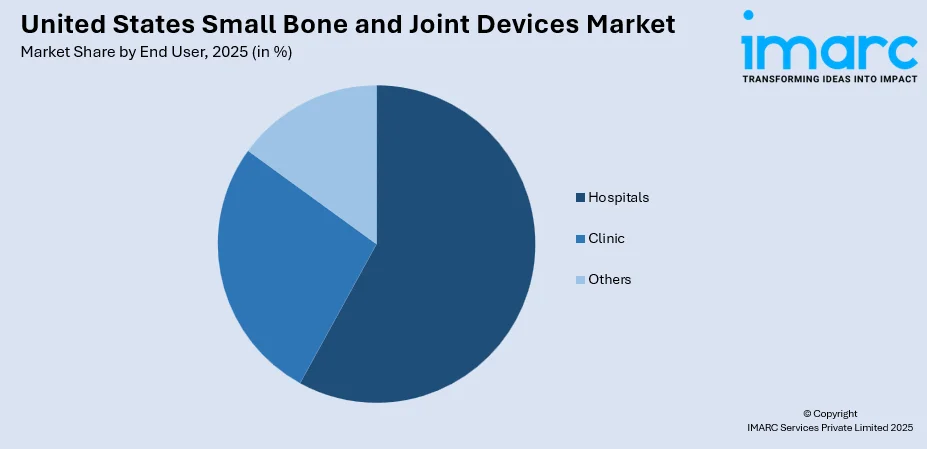

- By End User: Hospitals lead the market with a share of 58% in 2025, owing to comprehensive surgical infrastructure, specialized orthopedic departments, and ability to handle complex procedures.

- Key Players: The United States small bone and joint devices market exhibits a consolidated competitive landscape, with leading multinational orthopedic corporations competing through technological innovation, product portfolio expansion, and strategic acquisitions to strengthen market positioning.

To get more information on this market Request Sample

The market is undergoing a notable transformation driven by advancements in materials science, robotics, and imaging technologies, which collectively improve device performance and surgical precision. For example, in 2025 CustoMED announced it raised US$6 million to scale an AI‑powered platform that converts medical imaging into patient‑specific surgical guides and implants, enabling implants and tools to be produced on‑demand, quickly and with high precision. Innovations in biocompatible materials, such as advanced polymers and ceramics, have enhanced implant durability and integration with bone tissue. The aging population is creating increased demand as orthopedic conditions like osteoarthritis, osteoporosis, and fractures become more prevalent. Companies are introducing cutting-edge solutions, including three-dimensional-printed implants that replicate the trabecular structure of bone for better fixation. In parallel, the growing preference for minimally invasive surgeries and value-based care models is encouraging the development of more efficient, patient-centered, and cost-conscious treatment options.

United States Small Bone and Joint Devices Market Trends:

Adoption of Three-Dimensional Printing and Personalized Implants

The integration of three-dimensional printing technology is revolutionizing small bone and joint device manufacturing by enabling patient-specific orthopedic solutions tailored to individual anatomical requirements. This personalized approach allows for precise anatomical fit and improved surgical outcomes, with custom implants demonstrating enhanced stability and faster fusion rates. According to reports, in September 2024 Exactech completed the first total‑ankle replacement surgeries using its new 3D‑printed tibial implants (the Vantage® Ankle 3D and 3D+ systems), highlighting how additive manufacturing is moving from experimental procedures into mainstream ankle‑replacement clinical practice. Leading manufacturers have introduced novel three-dimensional-printed systems for complex ankle fusions, with initial clinical data showing exceptional fusion rates within weeks, underscoring the transformative potential of additive manufacturing in orthopedic applications.

Shift Toward Ambulatory Surgical Centers

Healthcare delivery patterns are evolving as small bone and joint procedures increasingly migrate from traditional hospital settings to ambulatory surgical centers. This transition is driven by procedure bundling incentives, patient preference for same-day discharge, and evidence confirming significant cost reductions for outpatient procedures without increased complications. For example, a 2024 AAOS study found hand and upper-extremity surgeries in ambulatory surgical centers cost significantly less than in hospital outpatient departments across total, facility, Medicare, and patient payments. Device suppliers are responding by developing compact instrument kits, sterile-packed single-use options, and customizable disposables aligned with strict ambulatory center turnover schedules, improving operational efficiency and procedure volumes.

Advancement in Bioabsorbable Materials

Innovation in bioabsorbable implant materials is gaining significant momentum as manufacturers develop devices that provide temporary fixation and gradually resorb within the body. Major companies have launched new lines of bioabsorbable screws made from proprietary polymer blends, with early studies demonstrating comparable fixation strength to traditional metal screws and complete resorption within approximately two years. For example, in January 2025, Bioretec received CE‑mark approval for its RemeOs™ bioabsorbable metal screw line, which uses a magnesium‑calcium‑zinc alloy that safely dissolves over time, offering an alternative to permanent titanium implants. These advancements eliminate the need for secondary removal procedures and reduce long-term implant-related complications.

Market Outlook 2026-2034:

The United States small bone and joint devices market is positioned for sustained growth through the forecast period, driven by favorable demographic trends, technological innovation, and expanding treatment indications. Rising incidences of sports-related injuries, diabetic foot complications, and age-related degenerative conditions will sustain procedure volumes across foot and ankle, hand and wrist segments. The market generated a revenue of USD 1.26 Billion in 2025 and is projected to reach a revenue of USD 1.98 Billion by 2034, growing at a compound annual growth rate of 5.09% from 2026-2034.

United States Small Bone and Joint Devices Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Device Type | Foot and Ankle Devices | 42% |

| End User | Hospitals | 58% |

Device Type Insights:

- Hand and Wrist Devices

- Foot and Ankle Devices

- Others

The foot and ankle devices dominate with a market share of 42% of the total United States small bone and joint devices market in 2025.

The foot and ankle devices segment holds a leading position in the market, driven by the widespread occurrence of lower extremity injuries and conditions that often require surgical intervention. Demand is fueled by sports-related trauma, complications from diabetic foot conditions, and age-related degenerative disorders, sustaining steady growth across trauma fixation, reconstruction, and joint replacement procedures. In September 2025, U.S.-listed Zimmer Biomet, through Paragon 28, launched advanced foot and ankle devices, including a low-profile fusion plating system and power system to enhance outcomes in complex trauma cases. Continuous innovation in implants, such as patient-specific three-dimensional-printed devices and advanced plating systems, enhances anatomical fit and supports better surgical outcomes, making these solutions increasingly preferred by surgeons and patients alike.

The segment’s prominence is reinforced by supportive reimbursement frameworks and a growing trend toward outpatient surgical care. Companies are strengthening their portfolios with advanced offerings, exemplified by new product launches like osteotomy and ankle truss systems, which provide more precise and effective treatment options. In addition, the rise in sports participation and athletic careers contributes to higher injury incidence, with ankle sprains remaining among the most common lower extremity injuries globally.

End User Insights:

Access the comprehensive market breakdown Request Sample

- Hospitals

- Clinic

- Others

The hospitals lead with a share of 58% of the total United States small bone and joint devices market in 2025.

Hospitals retain a leading role in the small bone and joint devices market due to their comprehensive infrastructure, specialized orthopedic departments, and capacity to handle complex procedures requiring extended care. They function as key referral centers for acute trauma, diabetic limb salvage, and advanced joint reconstruction surgeries, all of which rely on sophisticated equipment and multidisciplinary care teams. The expertise of experienced orthopedic surgeons, supported by skilled medical staff, ensures high-quality outcomes even in challenging cases, reinforcing hospitals’ central position in patient management.

Ongoing investments in hospital-based orthopedic capabilities strengthen this dominance, with strategic collaborations enhancing service delivery and access to advanced care. Hospitals also maintain strong ties with medical device manufacturers, facilitating early adoption of innovative technologies and participation in clinical trials for next-generation implants. This combination of infrastructure, expertise, and access to cutting-edge solutions continues to make hospitals the preferred choice for small bone and joint procedures.

Regional Insights:

- Northeast

- Midwest

- South

- West

The Northeast region represents a significant market for small bone and joint devices, driven by the concentration of leading academic medical centers and specialized orthopedic institutions in major metropolitan areas including New York, Boston, and Philadelphia. The region benefits from a high concentration of orthopedic specialists compared to the national average, driving demand for advanced surgical devices and innovative techniques that enhance patient outcomes and procedural efficiency.

The Midwest market demonstrates steady growth in small bone and joint devices adoption, supported by expanding healthcare infrastructure across major urban centers including Chicago, Detroit, and Minneapolis. Regional hospitals and orthopedic centers are gradually adopting advanced implant technologies and robotic-assisted systems to address the rising prevalence of joint disorders and mobility restoration demands among the population, with manufacturers expanding distribution networks across urban and semi-urban healthcare facilities.

The South region exhibits the largest market value for small bone and joint devices, driven by favorable demographic trends including rapid population growth and an expanding elderly population susceptible to degenerative orthopedic conditions. Healthcare infrastructure development has accelerated significantly, with substantial increases in ambulatory surgical centers specializing in small bone and joint procedures, positioning the region as a leading contributor to national procedure volumes.

The West region leads in market growth rate, projected to expand at the fastest compound annual growth rate through the forecast period. Strong orthopedic service availability, higher surgical volumes, and a large aging population seeking treatment for mobility-related conditions drive regional demand. The presence of innovative medical technology companies and research institutions in California and other western states fosters adoption of cutting-edge small bone and joint devices and procedural techniques.

Market Dynamics:

Growth Drivers:

Why is the United States Small Bone and Joint Devices Market Growing?

Rising Prevalence of Orthopedic Disorders and Sports Injuries

The growing incidence of musculoskeletal disorders, including osteoarthritis, rheumatoid arthritis, and degenerative joint diseases, is driving demand for small bone and joint devices. Lifestyle factors such as sedentary behavior and obesity contribute to accelerated joint deterioration, expanding the patient population requiring intervention. At the same time, increasing participation in sports and recreational activities leads to higher rates of acute injuries, particularly to the ankle and other lower extremities. In May 2025, Osteoboost Health, Inc. launched Osteoboost, the first FDA-cleared drug-free prescription wearable for low bone density, targeting spine and hips in postmenopausal women. Over 1,000 physicians prescribed it pre-launch, backed by AARP, HBS Angels, and Esplanade Ventures. The combined pressure from chronic orthopedic conditions and sports-related injuries supports a consistent need for surgical procedures, trauma fixation, and reconstructive devices, sustaining ongoing growth in device utilization across healthcare facilities.

Expanding Geriatric Population and Age-Related Conditions

The shift toward an aging population is a key driver of the small bone and joint devices market. Age-related declines in bone density, joint flexibility, and musculoskeletal function increase susceptibility to conditions such as osteoporosis, arthritis, and fractures, often necessitating surgical intervention. Older patients are increasingly receptive to advanced medical devices and innovative treatments that improve mobility and reduce recovery time. The United States orthopedic braces and support market, which reached USD 1,812.8 Million in 2025, is also expanding, with IMARC Group projecting it to reach USD 2,645.9 Million by 2034 at a CAGR of 4.29% during 2026‑2034, reflecting the rising demand for non-surgical orthopedic support solutions among the aging population. Coupled with wider patient access to specialized orthopedic care, this demographic trend fuels ongoing demand for small bone and joint implants, reconstruction systems, and related surgical solutions, reinforcing long-term market growth and healthcare adoption.

Technological Innovations in Device Design and Surgical Techniques

Advances in materials science, robotics, and imaging technologies are transforming small bone and joint orthopedic devices. Biocompatible materials like advanced polymers, ceramics, and titanium alloys enhance implant durability and integration with surrounding bone tissue. Patient-specific solutions, enabled by three-dimensional printing, allow implants to be tailored to individual anatomical and clinical needs, improving surgical precision and outcomes. For example, in April 2024, a study showed that 3D‑printed bioresorbable polymer implants, including meshes, plates, and bone grafts, are feasible, offer precise fit, reduce reliance on standard implants, and enable faster patient-specific surgery. The integration of smart technologies, including sensors that monitor load and joint motion post-surgery, expands treatment capabilities and enables more personalized care. These technological innovations drive adoption across hospitals and specialty clinics, improving procedure efficiency and patient recovery while supporting market growth.

Market Restraints:

What Challenges the United States Small Bone and Joint Devices Market is Facing?

High Procedural Costs and Reimbursement Complexities

The substantial costs associated with small bone and joint device procedures create accessibility barriers for certain patient populations seeking complex reconstructive surgeries. Varying reimbursement policies across insurance providers and complex approval processes can delay or limit patient access to advanced orthopedic treatments, particularly for innovative technologies commanding premium pricing.

Stringent Regulatory Approval Requirements

The extensive regulatory pathways required for medical device approval in the United States present significant challenges for manufacturers seeking to introduce innovative orthopedic solutions. Obtaining FDA clearance involves lengthy clinical trials, substantial documentation requirements, and considerable financial investment, potentially extending time-to-market and limiting the pace of innovation in the small bone and joint devices sector.

Skilled Surgeon Availability and Training Requirements

The specialized nature of small bone and joint procedures requires extensive surgeon training and expertise, creating potential constraints on procedure volumes in regions with limited orthopedic specialist availability. Advanced technologies including robotic-assisted systems and patient-specific implants necessitate additional training investments, potentially slowing adoption rates in certain healthcare facilities and geographic areas.

Competitive Landscape:

The United States small bone and joint devices market features a consolidated competitive landscape dominated by leading multinational orthopedic firms and specialized device manufacturers. Market leaders rely on technological innovation, broad product portfolios, and extensive distribution networks to sustain their positions. Strategic acquisitions and partnerships are commonly employed to expand capabilities and strengthen segment offerings. Companies are increasingly focusing on the development of three-dimensional-printed patient-specific implants, bioabsorbable materials, and smart devices with embedded sensors, enhancing surgical precision and patient outcomes. Continuous innovation in materials and device design allows manufacturers to differentiate their products, meet evolving clinical needs, and capture a larger share of the market. The emphasis on advanced solutions and customized care continues to drive competition and market growth.

Recent Developments:

- In July 2025, Overture Orthopaedics launched its OvertureTi Knee Resurfacing System in the U.S., featuring 3D‑printed titanium baseplates and Vitamin E-treated polyethylene for partial knee resurfacing, preserving healthy cartilage. The system had FDA 510(k) clearance since March 2023. In October 2025, the company won a High Tech Award for “Best Innovation in Medical Device.”

United States Small Bone and Joint Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Device Types Covered | Hand and Wrist Devices, Foot and Ankle Devices, Others |

| End Users Covered | Hospitals, Clinic, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States small bone and joint devices market size was valued at USD 1.26 Billion in 2025.

The United States small bone and joint devices market is expected to grow at a compound annual growth rate of 5.09% from 2026-2034 to reach USD 1.98 Billion by 2034.

Foot and ankle devices dominated the market with a share of 42%, driven by the high prevalence of sports injuries, diabetic foot complications, and increasing demand for reconstructive and trauma fixation procedures.

Key factors driving the United States small bone and joint devices market include the increasing prevalence of orthopedic disorders, expanding geriatric population, technological innovations in device design and materials, rising sports injury incidence, and advancing minimally invasive surgical techniques.

Major challenges include high procedural costs limiting patient accessibility, complex reimbursement policies across insurance providers, stringent regulatory approval requirements extending product development timelines, and the need for specialized surgeon training on advanced technologies and innovative devices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)