United States Smart Cities Market Size, Share, Trends and Forecast by Focus Area, Smart Transportation, Smart Buildings, Smart Utilities, Smart Citizen Services, and Region, 2026-2034

United States Smart Cities Size and Share:

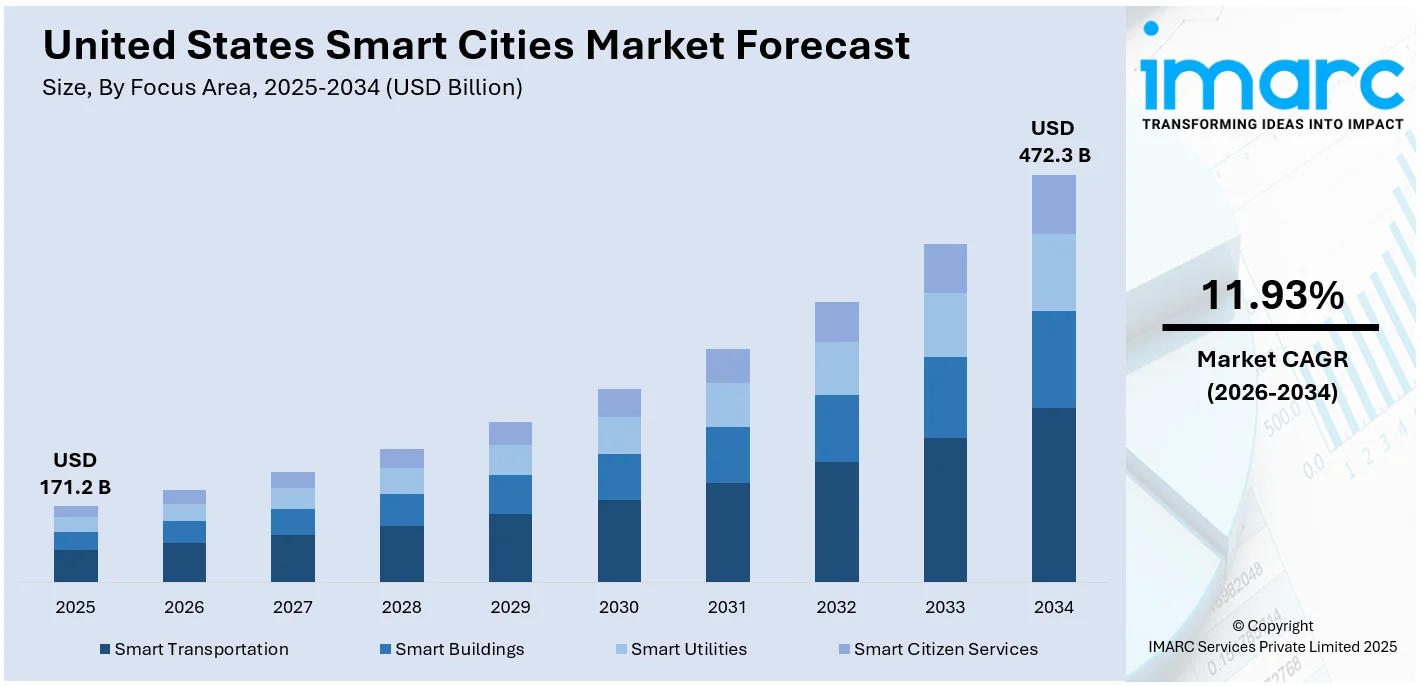

The United States smart cities market size was valued at USD 171.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 472.3 Billion by 2034, exhibiting a CAGR of 11.93% from 2026-2034. The federal and local government agencies are taking the lead in facilitating the adoption of smart city technology in the United States. This trend, along with the heightened usage of the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and big data analytics to modernize urban infrastructure, is impelling the market growth. Besides this, the growing demand for sustainable infrastructure is expanding the United States smart cities market share.

United States Smart Cities Market Analysis:

- Rapid adoption of IoT, AI, and 5G enables real-time data collection, smart infrastructure, and automation, driving efficient energy, transport, and public safety systems across urban environments.

- Smart utilities stand as the largest component in 2025, holding around 28.5% of the market owing to rising demand for smart grids, energy management, and water monitoring to ensure efficiency and sustainability.

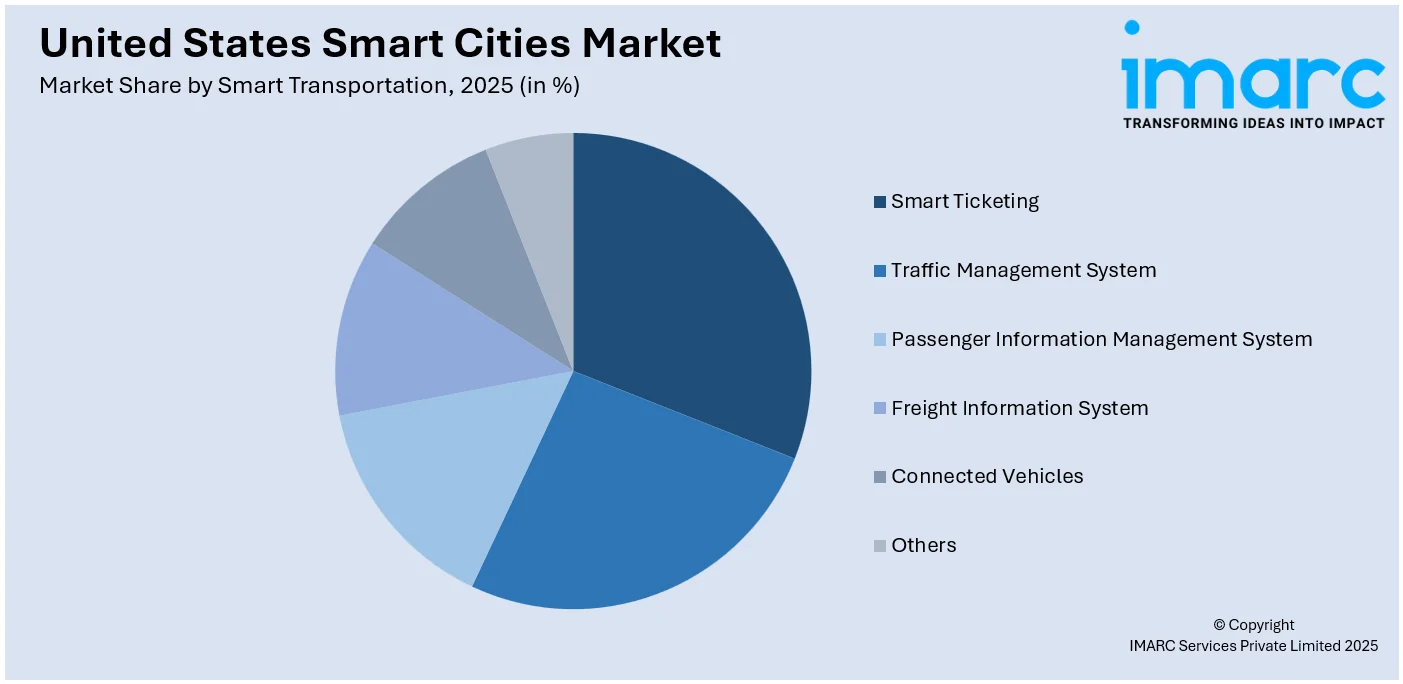

- Traffic management systems lead the market with around 25.7% of the market share in 2025 due to cities prioritizing congestion reduction, road safety, and real-time vehicle flow optimization for urban mobility improvements.

- Emergency management system leads the market with around 20.6% of the market share in 2025 driven by the enhancing disaster response, fire safety, and occupant protection in commercial and residential infrastructures.

- Smart public safety leads the market with around 30.0% of market share in 2025 owing to smart public safety tops with technologies improving crime detection, surveillance, and emergency response, ensuring urban security and citizen protection.

- Northeast holds 35.0% of the United States smart cities market share. This region is facing a dramatic growth of smart city developments as cities are adopting sophisticated technologies to enhance infrastructure, service delivery, and sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 171.2 Billion |

| Market Forecast in 2034 | USD 472.3 Billion |

| Market Growth Rate 2026-2034 | 11.93% |

The market is undergoing rapid change as urban areas are becoming more inclined towards embracing digital infrastructure and smart solutions to make livability, sustainability, and governance better. Urban areas across the United States are incorporating Internet of Things (IoT) devices, data analytics, and artificial intelligence (AI) to enhance services like traffic management, energy supply, and public safety. This phenomenon is being driven by an increasingly strong focus on sustainability, as cities are installing smart grids, energy-efficient buildings, and electric vehicle (EV) charging centers in a bid to curb carbon emissions.

To get more information on this market Request Sample

Federal and state governments are increasingly offering funding and policy assistance to drive smart city development. The US Department of Transportation and the Department of Energy are introducing initiatives and pilot programs encouraging the deployment of connected infrastructure and clean technologies. Concurrently, private firms are investing in urban tech startups and partnering with city governments to introduce innovative urban mobility, waste management, and water conservation solutions. Moreover, expectations are changing, with citizens increasingly expecting more responsive, efficient, and transparent public services. Cities are reacting by upgrading communications infrastructure, deploying smart street lighting, and using real-time monitoring tools that improve responsiveness and resource allocation. In addition, the deployment of 5G setups is facilitating constant and more reliable connectivity, which is vital for scaling up smart city applications.

United States Smart Cities Market Trends:

Government Initiatives and Policy Support

One of the key United States smart cities market trends is the federal and local government agencies. They are constantly providing funding, initiating grant programs, and creating public-private partnerships that help improve urban infrastructure through digital innovation. For example, the US Department of Transportation is encouraging smart mobility solutions by funding initiatives that include advanced traffic systems, autonomous cars, and smart public transit systems. The US Department of Transportation (USDOT) hosted its second SMART Grantee Summit for the Strengthening Mobility and Revolutionizing Transportation (SMART) Grants program on July 10th and 11th, 2024. The Summit took place at the Volpe Center in Cambridge, MA and had more than 220 attendees, which included USDOT leadership and 83 SMART grant recipients representing 39 states.

Technological Advancements and IoT Integration

Cities across the United States are increasingly leveraging advancements in technologies such as the artificial intelligence (AI), machine learning (ML), Internet of Things (IoT), and big data analytics to modernize urban infrastructure. IoT devices are continuously being deployed in public utilities, transportation systems, and environmental monitoring units to collect real-time data that enables better decision-making. For example, smart sensors are monitoring air quality, traffic flow, and energy consumption, thereby allowing city administrators to respond proactively to issues. AI and ML algorithms are analyzing this data to optimize service delivery, predict maintenance needs, and allocate resources more efficiently. Moreover, the proliferation of 5G networks is providing the high-speed, low-latency connectivity necessary for the seamless functioning of smart city applications. These technological advancements are enhancing operational efficiency, reducing environmental footprints, and improving quality of life, thereby impelling the United States smart cities market growth. The IMARC Group predicts that the United States AI market size is expected to reach USD 1,09,514.9 Million by 2033.

Growing Demand for Sustainable Infrastructure

The United States is experiencing continuous urban population growth, which is placing immense pressure on existing city infrastructure. To accommodate this increment, urban centers are adopting smart city solutions that focus on sustainability, efficiency, and resilience. Cities are implementing intelligent transportation systems to reduce congestion, deploying energy-efficient buildings to cut emissions, and integrating renewable energy sources into the urban power grid. As urban dwellers are demanding cleaner, safer, and more responsive living environments, city planners are investing in green infrastructure, such as smart waste management and water recycling systems. Moreover, the increasing popularity of electric vehicles (EVs) is encouraging the development of smart EV charging networks. These measures are not only addressing current urban challenges but are also ensuring long-term environmental and economic sustainability, thereby offering a favorable United States smart cities market outlook. Sales of electric vehicles in the United States increased by 11 percent in the first quarter of 2025, reaching roughly 300,000 cars and light trucks, as reported by Cox Automotive.

United States Smart Cities Market Opportunities:

Ongoing Technological Innovations are Bolstering the Market Growth

The U.S. smart cities market has high growth prospects fueled by urbanization and technology. IoT, AI, and 5G are being used by cities to build efficient, sustainable, and habitable spaces. Potential comes in upgrading transportation, energy management, and public services through the application of intelligent data. Smart grids, intelligent traffic systems, and energy-efficient buildings are capable of lowering costs and reducing environmental footprint while enhancing quality of life. Government, private companies, and startups are collaborating and forming new business models and services like autonomous mobility and telemedicine. Smaller cities are also looking at smart solutions to attract talent and investment. Additionally, green initiatives like EV infrastructure and renewable energy integration provide new directions for growth. In total, U.S. smart cities can change the way people live in cities, improve safety, and spur long-term economic and social development.

United States Smart Cities Market Challenges:

Data Privacy and Cybersecurity to Impede the Market Growth

Data protection and cyber security are ongoing concerns, with greater connectivity creating risks for breaches and public skepticism. There is no standardization among technologies, leading to integration challenges that make citywide systems difficult to consolidate. Upfront expenditure is high, and future returns are unguaranteed, making investments challenging for smaller cities. Regulatory complexity, as state and local policies vary, hinders adoption and makes compliance challenging. Moreover, most cities do not possess the technical capacity and digital infrastructure for effective running and management of smart systems. Resistance or mistrust on the part of the public regarding surveillance and data usage can slow things down further. Lacking proper strategies for governance, equity, and public inclusion, smart city initiatives may end up leaving out vulnerable groups or intensifying digital divides.

United States Smart Cities Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States smart cities market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on focus areas, smart transportation, smart buildings, smart utilities, and smart citizen services.

Analysis by Focus Area:

- Smart Transportation

- Smart Buildings

- Smart Utilities

- Smart Citizen Services

Based on the United States smart cities market forecast, the smart utilities stand as the largest component in 2025, holding around 28.5% of the market. The United States market is witnessing a dramatic change as cities are increasingly embracing digital technologies to make energy, water, and waste management systems more efficient. Utility companies are installing smart meters and sophisticated grid management systems to track and regulate energy distribution in real time, thus minimizing losses and enhancing efficiency. Water utilities are incorporating sensor-based monitoring equipment to identify leaks, regulate consumption, and maintain water quality compliance. At the same time, waste management facilities are adopting IoT-based bins and route optimization software to maximize collection and cut costs. Renewable integration is also growing, with intelligent grids supporting solar and wind feed-in while ensuring stability. Utilities are persistently using data analytics and AI to predict demand, handle outages, and optimize customer engagement.

Analysis by Smart Transportation:

Access the comprehensive market breakdown Request Sample

- Smart Ticketing

- Traffic Management System

- Passenger Information Management System

- Freight Information System

- Connected Vehicles

- Others

United States smart cities market analysis highlights, traffic management systems as the leading market with around 25.7% of the market share in 2025. Traffic management in the United States is changing very fast as cities are implementing smart transportation solutions to manage congestion, improve safety, and enhance mobility. Governments are installing adaptive traffic signals that adapt in real-time according to traffic flow, which minimizes wait times and fuel usage. Sophisticated traffic cameras and sensors are tracking intersections, highways, and pedestrian crossings to collect data for predictive analysis and real-time response. Cities are adding such systems to command centers of central control with integrated traffic observation and emergency management. Urban transport systems also apply real-time position tracking and adaptive scheduling for increased efficiency and rider's satisfaction. By making use of data-based technologies, cities are building transport infrastructure, optimizing road utilization, and making more secure, efficient urban transportation networks part of their smart city efforts.

Analysis by Smart Buildings:

- Building Energy Optimization

- Emergency Management System

- Parking Management System

- Others

According to the United States smart cities market forecast, Emergency management system leads the market with around 20.6% of the market share in 2025. These systems in smart buildings are becoming increasingly sophisticated as property developers and facility managers are integrating intelligent technologies to enhance safety and responsiveness. Buildings are continuously embedding sensor-based fire alarms, smoke detectors, and gas leak monitors that trigger automated alerts and initiate evacuation protocols in real-time. Integrated control systems are enabling centralized monitoring of all emergency functions, allowing quicker decision-making and coordination with first responders. Surveillance systems equipped with AI-driven facial recognition and behavior analysis are identifying potential threats and initiating preemptive security measures. Moreover, smart communication platforms are sending instant alerts to occupants through mobile apps and public address systems, ensuring timely evacuation and safety instructions. Backup power systems and automated access controls are maintaining critical operations during emergencies. These intelligent emergency management solutions are significantly improving situational awareness, response time, and occupant safety, thereby reinforcing the resilience of smart buildings in urban environments.

Analysis by Smart Utilities:

- Advanced Metering Infrastructure

- Distribution Management System

- Substation Automation

- Others

Advanced metering infrastructure is reshaping how utilities measure, collect, and analyze consumption data for electricity, gas, and water. This segment focuses on two-way communication networks between smart meters and utility providers, enabling real-time data acquisition and remote service capabilities. Utilities are using AMI to enhance billing accuracy, detect outages swiftly, and reduce operational costs. Consumers are also benefiting through greater visibility into usage patterns and better control over their energy consumption.

The distribution management system segment encompasses software-based platforms designed to optimize the operation of electrical distribution networks. These systems are enabling utilities to monitor, analyze, and control grid performance in real-time. With the increasing integration of renewable energy sources and distributed energy resources, DMS is helping maintain grid reliability, automate fault detection, and manage voltage levels.

Substation automation is a critical segment within smart utilities, involving the use of intelligent electronic devices, communication networks, and SCADA systems to automate control within substations. This automation enables real-time monitoring and faster fault isolation, which significantly reduces downtime and improves service reliability. The integration of digital relays, programmable logic controllers, and advanced sensors is enhancing the efficiency and responsiveness of power delivery systems.

Analysis by Smart Citizen Services:

- Smart Education

- Smart Healthcare

- Smart Public Safety

- Smart Street Lighting

- Others

Smart public safety leads the market with around 30.0% of market share in 2025. Intelligent public safety systems in the United States are transforming as cities are more pervasively embracing innovative technologies to make communities safer and emergency responses quicker. Police departments are utilizing AI-based surveillance cameras, facial recognition technology, and real-time crime mapping software to keep urban environments under proactive surveillance. These systems are constantly collecting and analyzing data to identify potential threats and streamline patrol deployment. Smart communication platforms and location services are being utilized by emergency response teams to coordinate quicker and more efficient responses. Cities are also installing gunshot detection systems and networked alarm systems in public spaces to act immediately on alerts. Community interaction platforms are making it possible for citizens to provide tips and get safety information in real time.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Based on the United States smart cities market analysis, the Northeast holds 35.0% of the market share. This region is facing a dramatic growth of smart city developments as cities are adopting sophisticated technologies to enhance infrastructure, service delivery, and sustainability. Cities like New York, Boston, and Philadelphia are continuously making data-driven decisions to transform transportation systems, enhance efficiency in energy usage, and improve digital connectivity. The convergence of Internet of Things (IoT) devices, cloud-based platforms, and artificial intelligence (AI) is empowering cities to track and manage urban systems in real-time, hence enhancing responsiveness and resource optimization. Such cities are readily rolling out smart traffic lights, smart lighting, and networked public transportation systems to optimize urban mobility and minimize environmental footprint. Government incentives and regulatory policies are also driving United States smart cities market demands. State and local governments are providing grants, introducing pilot projects, and promoting partnerships among public agencies and private technology firms. These programs are spurring investment in smart grids, green infrastructure, and cybersecurity solutions.

Competitive Landscape:

Major market participants are heavily investing in innovation, collaborations, and technology implementation to enhance their market positions and respond to changing urban needs. They are constantly diversifying their offerings by incorporating AI, IoT, and data analytics into smart city solutions. These companies are creating intelligent platforms that enable energy management, predictive maintenance, and real-time decision-making for public infrastructure. Major players also are entering strategic partnerships with city governments, startups, and research institutions to jointly develop and test new technologies. Besides this, they are participating in public-private partnerships to implement intelligent transport systems, smart grid utilities, and urban safety networks. Moreover, according to the United States smart cities market forecast, by collaborating closely with local governments, these companies are expected to tailor solutions for city-specific requirements and regulatory needs.

The report provides a comprehensive analysis of the competitive landscape in the United States smart cities market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Peachtree Corners integrated NVIDIA L4 GPUs with NxGo's traffic system at Curiosity Lab, boosting real-time AI for smart city functions. The upgrade supported intelligent transport, video analytics, and digital twin technologies.

- April 2025: US Ignite and Signify launched the BrightSites pilot to transform streetlights into gigabit-speed Wi-Fi hubs. The program enabled smart city advancements in public safety, traffic monitoring, internet access, and environmental sensing, offering up to 80% lower deployment costs and reduced CO₂ emissions using existing lighting infrastructure.

- January 2025: Smart Oregon Solutions and NetZero merged to accelerate smart city and renewable energy initiatives. NetZero became a subsidiary, enhancing capabilities to deliver scalable, sustainable urban infrastructure, supporting net-zero transitions, and expanding smart solutions across US and global markets through integrated clean technology strategies.

- December 2024: LG CNS partnered with SomeraRoad and Mastern America to launch smart building DX projects in the US, starting in Kansas City and Nashville. Using its Cityhub Building platform, LG CNS said it would implement AI, IoT, and smart poles to support smart city infrastructure and efficient urban development.

- November 2024: L&T Technology Services partnered with the Colorado Smart Cities Alliance to advance smart city projects across Colorado. The collaboration targeted smart transportation, intelligent infrastructure, and energy management, leveraging LTTS’ engineering expertise to drive sustainability, efficiency, and urban innovation through pilot projects and data-driven civic solutions.

United States Smart Cities Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Focus Areas Covered | Smart Transportation, Smart Buildings, Smart Utilities, Smart Citizen Services |

| Smart Transportations Covered | Smart Ticketing, Traffic Management Systems, Passenger Information Management Systems, Freight Information Systems, Connected Vehicles, Others |

| Smart Buildings Covered | Building Energy Optimization, Emergency Management System, Parking Management System, Others |

| Smart Utilities Covered | Advanced Metering Infrastructure, Distribution Management System, Substation Automation, Others |

| Smart Citizen Services Covered | Smart Education, Smart Healthcare, Smart Public Safety, Smart Street Lighting, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States smart cities market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States smart cities market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States smart cities industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States smart cities market was valued at USD 171.2 Billion in 2025.

The United States smart cities market is projected to exhibit a CAGR of 11.93% during 2026-2034, reaching a value of USD 472.3 Billion by 2034.

The market is being driven by strong government support, rising use of AI, IoT, ML, and data analytics, and increasing demand for sustainable urban infrastructure to address environmental and livability challenges.

Smart utilities hold the largest focus area market share, accounting for approximately 28.5% in 2025, due to widespread adoption of smart meters, advanced grid systems, and energy efficiency solutions across urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)