United States Software Defined Radio Market Size, Share, Trends and Forecast by Component, Type, Platform, Frequency Band, Application, and Region, 2025-2033

United States Software Defined Radio Market Size and Share:

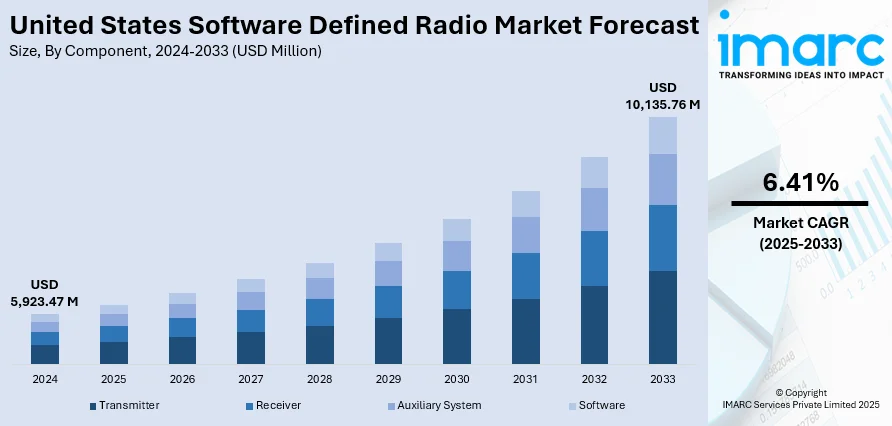

The United States software defined radio market size was valued at USD 5,923.47 Million in 2024. The market is projected to reach USD 10,135.76 Million by 2033, exhibiting a CAGR of 6.41% during 2025-2033. The market is fueled by increasing defense modernization programs and the growing integration of SDRs in commercial applications such as public safety and telecommunications. Besides that, technological advancements enabling enhanced spectral efficiency, real-time adaptability, and multi-platform interoperability further support market growth. Additionally, government investments in next-generation tactical communication infrastructure are significantly augmenting the United States software defined radio market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,923.47 Million |

| Market Forecast in 2033 | USD 10,135.76 Million |

| Market Growth Rate (2025-2033) | 6.41% |

The market is majorly driven by the increasing demand for secure, adaptable communication systems across the defense and public safety sectors continues to be a critical catalyst, especially due to rising geopolitical uncertainties and modern warfare requirements. As per industry reports, North America remains at the forefront of global 5G adoption, with 5G connections surpassing 55% of the region’s total by mid-2024. This rapid advancement in wireless communication technologies necessitates the deployment of highly flexible radio systems that can support multiple standards and protocols. Besides this, one of the emerging United States software defined radio market trends is the growing adoption of SDR in commercial applications, including cellular infrastructure, satellite communications, and connected vehicles.

To get more information on this market, Request Sample

In addition to this, government investments in military modernization programs and spectrum optimization projects are strengthening the adoption of SDR platforms across various federal agencies. A key component of this strategic push is the substantial increase in defense funding aimed at enhancing technological capabilities. Notably, on April 7, 2025, the U.S. President and Defense Secretary outlined the goal of establishing a USD 1 Trillion budget by fiscal year 2026 to support the development of a modern, agile, and globally competitive military force. Furthermore, the growing integration of artificial intelligence and machine learning into SDR for dynamic spectrum management and signal processing also enhances its appeal across use cases. Apart from this, the rising need for cost-effective, scalable, and reconfigurable communication solutions in both urban and remote environments is positioning SDR as a pivotal component in the future of wireless technology infrastructure.

United States Software Defined Radio Market Trends:

Diverse Applications Across Telecommunications

The market is witnessing substantial growth due to its expanding use in the telecommunications sector. As 5G deployment advances and private networks gain traction, SDRs are playing a crucial role in enabling flexible, multi-band, and reconfigurable communication systems. Their ability to adapt to evolving protocols and frequency bands without hardware modification makes them ideal for both current and next-generation networks. Telecom providers are increasingly leveraging SDRs for spectrum monitoring, dynamic frequency selection, and interference mitigation. Moreover, government initiatives are also contributing significantly to SDR innovations. For instance, in May 2024, the United States National Telecommunications and Information Administration (NTIA) announced the advancement of spectrum-sensing technology through NTIA's new round of financing from the USD 1.5 Billion Public Wireless Supply Chain Innovation Fund. This included the development of cutting-edge software defined radio (SDR) technology that can fulfill the requirements of modern mobile networks. Consequently, this trend is driving the United States software defined radio market growth.

Utilization in Aerospace and Defense

In the United States, the defense and aerospace sector remain a leading end-user of software defined radio technologies, driven by the need for secure, reliable, and interoperable communication systems. SDRs are extensively used across land, air, naval, and space platforms for mission-critical operations, including tactical communications, satellite command systems, and signal intelligence (SIGINT). Their ability to operate over a wide frequency range and support multiple waveforms enhances situational awareness and coordination among military units. The U.S. Department of Defense continues to invest in SDR-based solutions under modernization initiatives. Notably, in October 2024, BAE Systems secured a five-year USD 460 Million contract from the U.S. Army for the company's AN/ARC-231/A Multi-mode Aviation Radio Set (MARS). MARS is a novel technology developed to deliver exceptional performance and mission-critical information even in the most taxing conditions for the defense sector. With increasing geopolitical tensions and the growing focus on unmanned aerial systems (UAS) and space communications, SDR deployment in defense applications is set to intensify, reinforcing national security frameworks.

Strategic Acquisitions and Technological Integration

Strategic acquisitions and partnerships are significant factors positively impacting the United States software defined radio market outlook. The leading industry participants are engaging in mergers, collaborations, and acquisitions to consolidate technological expertise and expand their product portfolios. For instance, in April 2024, Illinois-based Epiq Solutions acquired the CyberRadio Solutions Division of G3 Technologies to expand Epiq’s mission-critical software defined radio product collection. With this acquisition, Epiq will be able to provide advanced software defined radio technologies for various applications, such as communications, drone detection, and remote sensing. These strategic moves often aim to integrate SDR capabilities with complementary technologies such as AI, machine learning, and advanced signal processing, facilitating the development of more intelligent and autonomous communication systems. Additionally, partnerships between SDR vendors and defense contractors or telecom equipment manufacturers are enabling end-to-end solutions tailored to specific application needs. This industry-wide focus on collaboration and innovation is fostering rapid advancement in SDR functionality, architecture, and deployment across both commercial and government sectors.

United States Software Defined Radio Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States software defined radio market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on component, type, platform, frequency band, and application.

Analysis by Component:

- Transmitter

- Receiver

- Auxiliary System

- Software

The transmitter is a critical subsystem that converts digital baseband signals to radio frequency (RF) signals appropriate for wireless transmission. As communication systems become more dependent on frequency agility and multi-band capability, SDR transmitters are designed to accommodate a broad array of modulation techniques and dynamic waveform generation. Their value lies in supporting interoperability among defense, aerospace, and commercial markets to support mission-critical missions and future wireless standards. The increasing need for tactical communication and adaptive spectrum uses fuels innovation in SDR transmitters, offering secure, reliable, and high-performance signal delivery.

The receiver is one of the most vital components of SDR systems, as it detects and processes incoming RF signals and converts them into a digital format for subsequent demodulation and analysis. In the U.S. SDR market, receivers are appreciated for their flexibility, sensitivity, and capacity to cater to a broad range of communication protocols. Their digital nature provides real-time frequency hopping, wideband monitoring of signals, and improved interference reduction. This is particularly important in military and emergency communications networks where signal purity and threat discovery are paramount. With the increased adoption of SDR across multiple industries, the adaptability of the receiver is directly responsible for system stability and data integrity within complex environments.

Auxiliary systems on SDR platforms include support components required to support necessary functionality, like power management units, cooling systems, antennas, user interfaces, and software frameworks. In the United States market, these systems are critical for maintaining optimal performance and reliability of SDR units in diverse operational environments. Their relevance also lies in facilitating mobility, energy efficiency, and ease of configuration, especially in field-deployed and automotive applications. With shrinking SDR technology and increasing integration, auxiliary systems increasingly assist with hardware-software management, signal quality preservation, and modular scalability support. Their contribution is essential to fulfilling various industry standards and mission requirements.

Analysis by Type:

- Joint Tactical Radio System (JTRS)

- Cognitive Radio

- General Purpose Radio

- Terrestrial Trunked Radio (TETRA)

- Others

The joint tactical radio system (JTRS) is an important type, specializing in the defense and homeland security markets. Developed to unify communication between branches of the military, JTRS radios deliver transparent interoperability, secure voice/data transfer, and real-time situational awareness. JTRS radios accommodate multiple waveforms and encryption standards, facilitating versatile deployment across mission environments. While military actions rely more on integrated networks and speed of communication, JTRS remains a strategic enabler. Its flexibility and performance resilience qualify it as a key investment in the U.S. modernization of tactical communications infrastructure.

Cognitive radios are becoming the focus in the market as they can dynamically sense, learn, and adapt to the environment of radio frequency around them. These smart radios maximize spectrum use by recognizing available frequencies and real-time adjustable parameters, thus minimizing interference and enhancing communication efficiency. Both commercial and defense industries are applications that take advantage of them, especially in spectrum-saturated environments. With the need for high-speed, unbroken connectivity increasing, especially in combat and urban environments, cognitive radio's self-optimization is a competitive edge. Their inclusion in next-generation technologies, including 5G and autonomous systems, highlights their growing impact in the SDR environment.

General-purpose radios offer a broad scope of non-specialized communications requirements across sectors, including public safety, transportation, and commercial wireless. These radios are valued for their flexibility and affordability, making them suitable for users who need to ensure communication without sophisticated tactical features. Their software-defined design supports simple maintenance and support for changing protocols, eliminating hardware obsolescence. With businesses and government organizations looking for scalable communication, general-purpose SDRs provide the perfect combination of performance and price, establishing their steady demand in both urban and rural operational environments.

Analysis by Platform:

- Land

- Airborne

- Naval

- Space

Land-based platforms account for a major portion of the market, stimulated mainly by their applications in military vehicles, ground control stations, base transceiver systems, and tactical communication units. These SDRs facilitate real-time, secure, and interoperable communications between ground forces and command centers. Their significance is even greater in present-day warfare situations where combined mobility, immediate response, and encrypted communication are a must. Moreover, land platforms are also supported by continuous investments in public safety and homeland security infrastructure. SDRs' flexibility in the support of multiple protocols and frequencies provides assurance of flexibility to various terrains as well as changing mission needs, rendering them invaluable in ground operations.

Airborne platforms play a pivotal role in the market as they provide seamless, high-rate communication between aircraft like drones, fighter jets, and surveillance aircraft. SDRs used in airborne systems enable enhanced features such as wideband data transmission, frequency agility, and secure satellite connectivity. Such functionalities are essential for airborne C3I functions in combat and reconnaissance operations. The need for lightweight, ruggedized, and high-performance communication systems compels SDR implementation in the aerospace industry. With growing investment in next-generation air defense systems and unmanned aerial vehicles (UAVs), airborne SDR platforms are key to improving situational awareness and mission coordination.

Naval platforms are critical to supporting naval operations such as fleet coordination, coastal surveillance, and underwater communication. SDRs on submarines, ships, and maritime patrol systems deliver strong communication capabilities that are resilient to the hostile marine environment and electronic warfare threats. They allow smooth interconnectivity with other land and air units via integrated battle networks. The Navy's focus on upgrading its communication infrastructure, particularly for engagements in contested or distant waters, drives faster deployment of SDRs. Their encryption support makes them critical to mission-critical applications like navigation, threat detection, and coordinated attack missions.

Analysis by Frequency Band:

- High Frequency

- Very High Frequency

- Ultra-High Frequency

- Others

High Frequency (HF) bands between 3 and 30 MHz are a vital segment in the market, especially in long-distance communication applications. HF SDRs are widely utilized by the military, air, and sea sectors because they can make over-the-horizon communication possible through ionospheric reflection. These systems are essential for remote or infrastructure-scarce regions where terrestrial, or satellite networks are not available. In strategic defense communications, HF SDRs provide secure, robust links over long distances and are therefore critical for peacetime as well as combat command and control operations.

Very High Frequency (VHF), from 30 MHz to 300 MHz, is of major importance in the market due to its trustworthiness in performing line-of-sight communication. VHF SDRs are extensively used by emergency services, public safety agencies, aviation, and military forces for the exchange of voice and data in field operations. The fact that they penetrate buildings and natural barriers more effectively compared to higher frequency bands makes them ideal for urban and semi-urban use. VHF radios also ensure interoperability across agencies, which makes it easier to coordinate disaster relief and crisis management. While SDRs substitute for hardware radios, the VHF band continues to be a fundamental operational frequency for varied applications.

Ultra-High Frequency (UHF), between 300 MHz to 3 GHz, is a prevalent frequency band in the market because of the wide range of applications it offers in commercial and defense markets. UHF SDRs provide high-bandwidth, short-to-medium distance communications, which are suitable for mobile systems, tactical radios, and satellite communications. Their ability to penetrate structures and support data-intensive applications guarantees higher-quality communication in crowded and dynamic settings. UHF is especially prized during urban warfare, public safety missions, and cellular network infrastructure. SDRs' versatility in using UHF bands creates higher operational efficiency and spectrum efficiency.

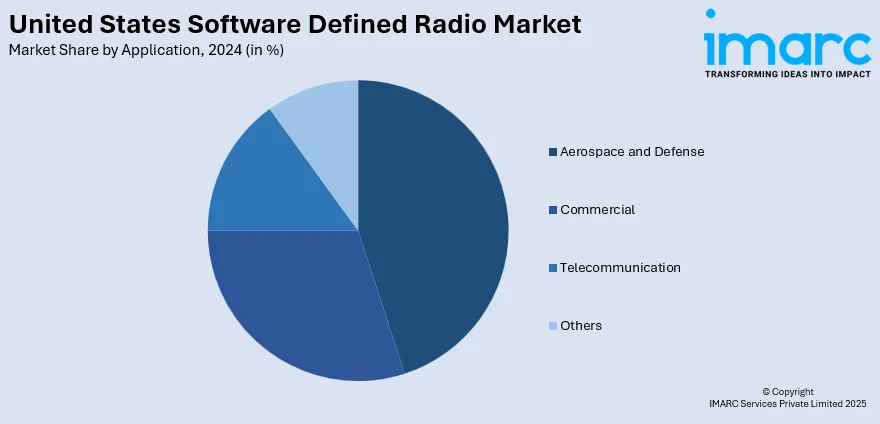

Analysis by Application:

- Aerospace and Defense

- Commercial

- Telecommunication

- Others

Aerospace and defense are crucial application segments in the market. SDRs are critical to secure, robust, and interoperable communication between military branches and allied nations. The systems carry multiple waveforms, encryption formats, and frequency bands and facilitate seamless exchange of data, voice, and situational awareness across land, air, and naval platforms. Within contemporary defense settings, where electronic warfare and cyber threats are rising, SDRs provide the security and flexibility needed for mission-critical operations. Their application in enabling network-centric warfare, intelligence collection, and instantaneous battlefield coordination accentuates their strategic value within the national defense infrastructure.

In the U.S. commercial domain, software defined radios are increasingly used for purposes like broadcasting, transportation, and public safety communications. Their programmability and multi-standard capabilities enable enterprises to eliminate hardware redundancy, streamline upgrades, and comply with changing regulatory standards. For example, SDRs provide dynamic spectrum access and multiband communication for smart transportation networks, logistics, and private enterprise. As industries transform operations and adopt IoT technologies, SDRs provide an affordable and scalable solution for delivering varied communication protocols. Their potential to deliver superior performance, flexibility, and forward-looking features makes them a sound investment for a broad spectrum of commercial markets.

The telecommunication sector is extremely dependent on SDR technology to enable enhanced wireless infrastructure such as 4G, 5G, and future standards. SDRs facilitate dynamic spectrum sharing, multiband carrier aggregation, and on-the-fly protocol switching, which are essential to increase network coverage and capacity. Telecom operators take advantage of the reconfigurability of SDRs, making it easy to upgrade infrastructure and lower operational expenses. SDRs also enable the quick rollout of base stations and mobile units in urban and rural environments. As the need for high-speed, low-latency connectivity keeps growing, SDRs become a building block for network flexibility, spectral efficiency, and wireless communication innovation.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is an essential player in the market, driven by its high concentration of defense contractors, federal government agencies, and research establishments. Massachusetts and New York are home to prominent innovation centers as well as providers of military communication technologies. Government-funded research and development (R&D) activities and partnerships with academic institutions influence the enhancement and trial of SDR systems. Additionally, the emphasis of the region on cybersecurity and modernization of tactical communications adds value to its strategic significance. With the increasing need for secure, high-performance communication, the Northeast remains an important contributor to technological leadership in the SDR environment.

The Midwest region is a strong contributor to the market due to its strong manufacturing base, defense facilities, and aerospace establishments. Regions such as Illinois and Ohio are home to electronic component manufacturers and military installations that enable SDR manufacturing and integration. The region also has research programs in digital signal processing and wireless technology conducted by universities. Additionally, the Midwest's participation in public safety communications and emergency response modernization enhances SDR demand for interoperability and reliability. With its balanced combination of industrial capacities and defense facilities, the Midwest region is crucial for both SDR innovation and deployment.

The South is steadily growing due to its vast military presence across the region, including major Army, Navy, and Air Force bases. Texas, Florida, and Georgia are some of the major states that host large-scale procurement and field deployment of SDR systems for tactical and strategic communication. The region is also home to large defense contractors and aerospace firms participating in research and development (R&D) and production. Further, increasing investments in smart infrastructure, public safety networks, and telecommunication expansion stimulate SDR adoption for commercial purposes. The region's favorable regulatory situation and emphasis on defense modernization add strength to its influence on the national SDR market landscape.

The West is a vital center for technology innovation in the industry, fueled by its high concentration of high-tech firms, defense contractors, and aerospace establishments. California, in particular, leads the way with its preeminence in SDR innovation, backed by Silicon Valley's high level of experience in software engineering, wireless communication, and AI integration. The area is also served by military bases and space command stations, where SDRs are crucial for safe satellite and airborne communication. As investments in 5G, IoT, and autonomous systems increase, the West keeps expanding the limits of SDR capabilities, shaping national and international market trends.

Competitive Landscape:

The competitive landscape of the market is characterized by intense innovations, robust government investments, and increasing demand from both defense and commercial sectors. Companies are prioritizing research and development (R&D) activities to enhance signal processing capabilities, multi-band interoperability, and secure communication protocols. Furthermore, the market is witnessing a shift toward software-centric solutions that support agile operations and reconfigurability, aligning with evolving military and public safety communication standards. Also, strategic collaborations, product customization, and modular architecture are key approaches adopted to maintain a competitive advantage. Additionally, the integration of artificial intelligence (AI) and machine learning (ML) in SDR systems is creating differentiation in performance and spectrum efficiency. The growing demand for next-generation wireless systems such as 5G, satellite communication, and tactical radios is further intensifying competition. According to the United States software defined radio market forecast, the market is expected to expand steadily over the coming years, driven by modernization initiatives, increasing defense spending, and the adoption of advanced communication infrastructure across sectors.

The report provides a comprehensive analysis of the competitive landscape in the United States software defined radio market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: CACI International Inc. and the United States Military Academy (USMA) at West Point signed a five-year Cooperative Research and Development Agreement (CRADA) in order to jointly develop electronic warfare (EW) technologies that will aid upcoming U.S. Army operations. The Academy will close the gap between theory and practice by verifying GRID data processing in the field. This practical experience will strengthen technical proficiency in software defined radio applications and EW.

- May 2025: TrellisWare Technologies, Inc. revealed the addition of new software and waveform enhancements for their Software Defined Radio (SDR) family. The TSP 1.2 software version from TrellisWare will now offer numerous new features and enhancements to improve communications and the user experience. Along with significant improvements to TrellisWare software applications, the revised package will also offer additional TSM and Katana waveform features.

- May 2025: iDirect Government confirmed that its 450 Software Defined Radio (SDR) satellite modem was successfully integrated and tested into the Ranger Flyaway Terminal of Airbus DS Government Solutions. This smooth integration is a significant step forward in providing MILSATCOM customers with increased security, flexibility, and resilience.

- April 2025: CesiumAstro entered into a partnership with the Taiwan Space Agency to deliver software-defined radio (SDR) payloads for space communications, along with ground-based user terminals. These technologies will support the development of Taiwan’s inaugural constellation of low-Earth orbit (LEO) communication satellitesAs part of this agreement, CesiumAstro will deliver Earth-based and space-based active phased array infrastructure, including its Skylark user terminal and Vireo Ka space payload, to the Beyond 5G LEO Satellite (B5G) program.

- January 2025: The United States National Telecommunications and Information Administration (NTIA) granted over USD 117 Million to support the development of open and interoperable wireless networks. A grant of USD 8,168,674 has been awarded to EpiSys Science, Inc., a California-based company, to design, demonstrate, and assess a software-defined radio system. The project will integrate 3GPP Sidelink technology with a 7.2b Open RAN architecture, specifically focusing on enhancing uplink performance through advanced split configurations.

United States Software Defined Radio Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Transmitter, Receiver, Auxiliary System, Software |

| Types Covered | Joint Tactical Radio System (JTRS), Cognitive Radio, General Purpose Radio, Terrestrial Trunked Radio (TETRA), Others |

| Platforms Covered | Land, Airborne, Naval, Space |

| Frequency Bands Covered | High Frequency, Very High Frequency, Ultra-High Frequency, Others |

| Applications Covered | Aerospace and Defense, Commercial, Telecommunication, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States software defined radio market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States software defined radio market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States software defined radio industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The software defined radio market in United States as valued at USD 5,923.47 Million in 2024.

The United States software defined radio market is projected to exhibit a CAGR of 6.41% during 2025-2033, reaching a value of USD 10,135.76 Million by 2033.

The market is driven by increasing demand for secure and reliable communication systems across defense and public safety sectors, advancements in wireless communication technologies, and the growing adoption of cognitive radio and AI-integrated SDR solutions. Additionally, rising investments in military modernization programs and the proliferation of connected devices are fueling the growth of the software defined radio market in the United States.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)