United States Specialty Fertilizer Market Size, Share, Trends, and Forecast by Specialty Type, Crop Type, Application, and Region, 2025-2033

United States Specialty Fertilizer Market Size and Share:

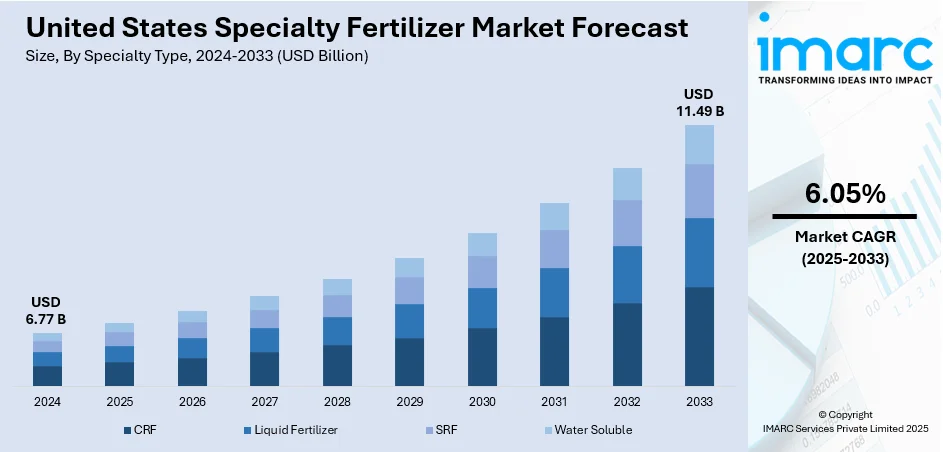

The United States specialty fertilizer market size was valued at USD 6.77 Billion in 2024. Looking forward, the market is expected to reach USD 11.49 Billion by 2033, exhibiting a CAGR of 6.05% during 2025-2033. The increasing demand for precision agriculture, growing awareness about sustainable farming practices, continuous advancements in fertilizer technologies, rising population leading to higher food production needs, and the adoption of nutrient-specific fertilizers for optimized crop yield are some of the key factors strengthening the United States specialty fertilizer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.77 Billion |

| Market Forecast in 2033 | USD 11.49 Billion |

| Market Growth Rate 2025-2033 | 6.05% |

The market is experiencing steady growth, primarily driven by multiple agricultural, environmental, and technological factors. One of the key drivers is the rising demand for higher agricultural productivity to meet domestic food requirements and global export demand. With limited arable land and a growing population, farmers are increasingly adopting crop protection chemicals to maximize yields and safeguard crops against pests, weeds, and diseases. Another significant factor is the increasing prevalence of invasive pests and crop diseases, which threaten staple crops such as corn, soybeans, and wheat. This has encouraged widespread adoption of herbicides, fungicides, and insecticides to ensure crop resilience and minimize economic losses. In addition, climate change has intensified pest pressures and created new challenges for growers, further boosting the need for effective chemical solutions.

To get more information on this market, Request Sample

The United States specialty fertilizer market growth is also driven by technological advancements in precision farming. The integration of crop protection chemicals with precision application techniques reduces waste, enhances efficiency, and minimizes environmental impact. Alongside this, the shift toward sustainable agriculture has encouraged greater demand for bio-based and eco-friendly crop protection products, complementing conventional chemical use. For instance, in June 2023, ICL introduced a new portfolio of foliar and fertigation solutions for the North American market under its well-recognized Nova brand of water-soluble fertilizers. Commenting on the launch, Ithamar Prada, Vice President of Marketing and Innovation at ICL South America, expressed excitement that ICL America do Sul’s water-soluble products are now part of the Nova line under ICL Growing Solutions. This expansion aims to broaden access to advanced foliar and fertigation technologies across the United States.

United States Specialty Fertilizer Market Trends:

Increasing demand for sustainable agricultural practices

The demand for sustainable agriculture and the increased awareness of environmental issues are positively impacting the specialty fertilizer market in the United States. Traditional fertilizers often lead to nutrient runoff, which contributes to water pollution and environmental degradation. In contrast, specialty fertilizers are designed to improve nutrient use efficiency, thereby minimizing environmental impact. Farmers are increasingly adopting these fertilizers to align with sustainable farming practices. The demand for organic and bio-based fertilizers is also on the rise, driven by consumer preferences for organic food and the need to maintain soil health. Accordingly, in December 2024, the USDA announced a USD 116 Million Fertilizer Production Expansion Program investment to boost domestic output across nine states, including organic and bio-based fertilizers, aiming to lower farm costs, create 1,300 jobs, and enhance sustainability. These fertilizers provide essential nutrients without the adverse effects associated with chemical-based products, supporting long-term agricultural sustainability. In line with this, regulatory pressures and policies encouraging sustainable farming methods are also bolstering the market growth as farmers seek to comply with these regulations and reduce their environmental footprint.

Advancements in fertilizer technology

Ongoing innovations in fertilizer formulations and delivery methods have led to the development of controlled-release fertilizers, water-soluble fertilizers, and micronutrient fertilizers. These products offer enhanced nutrient availability and uptake, allowing for more precise nutrient management. Controlled-release fertilizers release nutrients gradually over time, matching the nutrient uptake patterns of crops, thereby reducing nutrient loss and improving crop yields. Water-soluble fertilizers are designed for easy application and quick absorption by plants, making them ideal for high-value crops and greenhouse applications. Additionally, there has been an increased focus on the development of specialty fertilizers that cater to specific crop needs or soil types, ensuring optimized nutrient management and boosting productivity, which is further contributing to the market growth. As such, in November 2024, Innovafeed secured an USD 11.8 Million USDA grant to build a Decatur insect-based fertilizer plant, producing sustainable frass with 71% lower CO₂ emissions than synthetic fertilizers and supporting organic farming applications.

Rising popularity of precision farming

The surging adoption of precision farming practices is another major factor driving the United States specialty fertilizer market trends. An industry report states that the United States leads in operations-focused technology adoption, with 51% of farmers using precision agriculture hardware. Precision farming leverages modern tools like GPS, remote sensing, and advanced data analytics to optimize crop management and address soil variability with high accuracy. By integrating these technologies, farmers can make informed decisions, ensuring efficient resource use and improved agricultural productivity. This approach allows farmers to apply fertilizers in a targeted manner, optimizing the use of inputs and enhancing crop performance. Specialty fertilizers are particularly well-suited for precision farming because they can be tailored to meet the specific nutrient requirements of different crops and soil conditions. The integration of precision farming techniques with specialty fertilizers enables farmers to improve nutrient use efficiency, reduce waste, and increase profitability. The ability to precisely manage nutrient application also aligns with environmental sustainability goals, providing additional motivation for farmers to adopt specialty fertilizers.

United States Specialty Fertilizer Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States specialty fertilizer market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on specialty type, crop type, and application.

Analysis by Specialty Type:

- CRF

- Polymer Coated

- Polymer-Sulfur Coated

- Others

- Liquid Fertilizer

- SRF

- Water Soluble

Controlled-release fertilizers (CRF) dominate the market due to their ability to provide nutrients gradually, matching crop requirements throughout the growth cycle. This reduces nutrient losses caused by leaching or volatilization and ensures better efficiency compared to conventional fertilizers. CRFs are widely used in high-value crops such as fruits, vegetables, and ornamentals, where consistent nutrient supply is critical for yield and quality. With increasing focus on sustainability, resource optimization, and compliance with environmental regulations, US farmers are increasingly adopting CRFs, further consolidating their strong market position.

Liquid fertilizers hold a significant share in the US market as they are highly efficient, easy to apply, and compatible with modern irrigation techniques such as fertigation. According to the United States specialty fertilizer market forecast, their fast absorption rates make them especially valuable for addressing nutrient deficiencies quickly in crops. Liquid fertilizers are widely used in row crops, fruits, and greenhouse farming due to their precision application capabilities. Additionally, the trend toward mechanized farming and precision agriculture has boosted demand, as liquid forms allow uniform nutrient distribution. Their adaptability for both large-scale farming and small operations makes liquid fertilizers a preferred choice across the US agricultural sectors.

Slow-release fertilizers (SRF) hold a strong market share in the United States because of their ability to deliver nutrients over an extended period, reducing the need for frequent applications. This not only lowers labor and operational costs for farmers but also enhances nutrient uptake efficiency. SRFs are particularly popular in turf management, landscaping, and horticulture, where consistent growth and appearance are important. Their role in reducing nutrient runoff aligns with US environmental regulations and sustainability goals, encouraging adoption across both commercial farming and non-agricultural applications. This balance of efficiency, cost savings, and eco-friendliness drives their strong market presence.

Analysis by Crop Type:

- Field Crops

- Horticultural Crops

- Turf and Ornamental

Field crops account for the largest share as they cover vast agricultural acreage in the United States, including corn, wheat, and soybeans. Specialty fertilizers are increasingly used to enhance nutrient efficiency, improve soil health, and support higher yields. With rising food demand and the push for sustainable farming practices, farmers are adopting controlled-release and liquid fertilizers for precise nutrient delivery. Government support for advanced crop nutrition and the integration of precision farming technologies further fuel demand. Given the scale and importance of field crops in US agriculture, this segment dominates specialty fertilizer consumption.

Horticultural crops, including fruits, vegetables, and greenhouse plants, hold a significant market share due to their high economic value and sensitivity to nutrient management. Specialty fertilizers are critical in ensuring optimal yield, appearance, and quality, especially in crops requiring balanced micronutrients. Controlled-release and water-soluble fertilizers are preferred for these crops as they provide consistent nutrient availability. With growing consumer demand for fresh, high-quality produce and increasing adoption of greenhouse and hydroponic farming, horticultural crops continue to drive specialty fertilizer use. Their contribution to food security and exports strengthens this segment’s importance in the US market.

Turf and ornamental plants are major consumers of specialty fertilizers in the US, driven by demand from landscaping, golf courses, and residential lawns. These crops require precise nutrient management for consistent growth, vibrant color, and aesthetic appeal. Slow-release and eco-friendly fertilizers are popular as they minimize nutrient leaching and reduce environmental impact. The strong landscaping industry, coupled with consumer preference for well-maintained green spaces, supports fertilizer demand, creating a positive United States specialty fertilizer market outlook. Additionally, regulatory emphasis on sustainable practices has encouraged the use of advanced fertilizers in this segment, reinforcing its strong market position. Turf and ornamental applications remain a vital non-agricultural driver of growth.

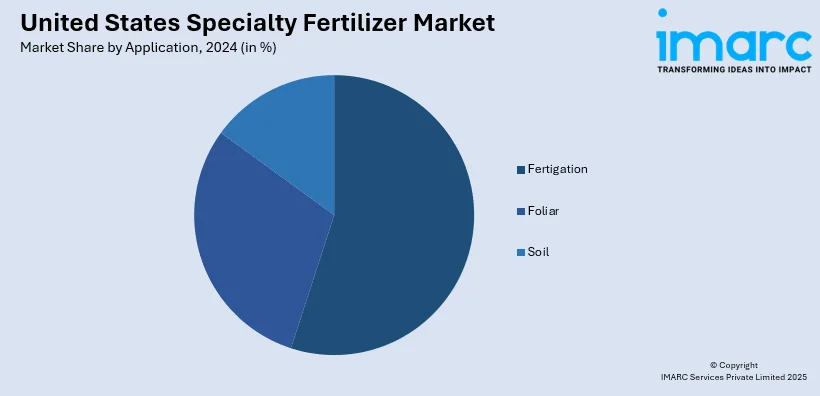

Analysis by Application:

- Fertigation

- Foliar

- Soil

Fertigation is anticipated to hold a major share as it combines irrigation with fertilizer application, ensuring efficient nutrient use and water conservation. Widely adopted in precision farming, it delivers nutrients directly to the root zone, improving crop yields while reducing input waste. With US farmers increasingly embracing drip and sprinkler irrigation systems, fertigation has become vital for field and horticultural crops. Its compatibility with liquid and water-soluble fertilizers, alongside sustainability initiatives promoting resource-efficient agriculture, makes fertigation a preferred method. As climate change intensifies the need for water-smart farming, fertigation continues to gain traction across US agriculture.

Foliar application is expected to maintain a strong market share due to its ability to deliver nutrients directly through plant leaves, ensuring rapid absorption and immediate correction of deficiencies. This method is particularly beneficial for micronutrient management in high-value crops such as fruits, vegetables, and ornamentals. US farmers prefer foliar sprays for their effectiveness in enhancing crop resilience against stress, diseases, and changing climatic conditions. Additionally, foliar feeding reduces dependence on soil conditions and improves fertilizer efficiency. With growing adoption of precision spraying equipment and demand for quick, visible crop improvements, foliar application remains a key driver in specialty fertilizer use.

Soil application dominates specialty fertilizer usage in the US as it remains the most traditional and widely accepted method for field and row crops. Fertilizers applied directly to soil ensure long-lasting nutrient availability and support crop growth over extended periods. This method is especially critical for large-scale farming operations involving corn, soybeans, and wheat, which represent the backbone of US agriculture. Advances in controlled-release and stabilized fertilizers have improved soil application efficiency, reducing leaching and environmental risks. With rising food demand and reliance on major field crops, soil application continues to account for a substantial share of fertilizer practices.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In the Northeast, specialty fertilizer market demand is driven by a strong focus on horticulture, greenhouse farming, and high-value fruit and vegetable crops. The region’s smaller farm sizes encourage intensive cultivation methods where nutrient efficiency is critical. Organic farming practices and rising consumer demand for locally grown, premium-quality produce further stimulate the adoption of controlled-release and water-soluble fertilizers. Urban farming initiatives, coupled with government support for sustainable agriculture, also boost market growth. With limited arable land but high productivity goals, farmers in the Northeast rely heavily on innovative fertilizers to maximize yields while addressing soil fertility challenges unique to this densely populated region.

The Midwest, known as the US agricultural heartland, drives specialty fertilizer demand through its vast production of field crops such as corn, soybeans, and wheat. Farmers in this region are adopting precision agriculture technologies that enhance nutrient efficiency and minimize waste. The push for sustainable farming practices and soil health improvement supports the use of controlled-release fertilizers. Additionally, government incentives for reducing nitrogen runoff and environmental impact encourage adoption of advanced fertilizer solutions. Rising demand for bio-based and eco-friendly products also plays a role. With large-scale mechanized farming and growing food demand, the Midwest continues to dominate specialty fertilizer consumption.

In the Southern US, specialty fertilizer growth is supported by diverse crop cultivation, including cotton, rice, fruits, and vegetables. The region’s warm climate and longer growing seasons create higher nutrient demands, making controlled-release and liquid fertilizers essential for crop performance. Growing adoption of fertigation in irrigated farming and turf management, especially in states with strong landscaping and golf course industries, drives further demand. Additionally, rising export potential for fruits and vegetables encourages farmers to prioritize crop quality through advanced nutrient solutions. Government programs promoting sustainable water and soil management also support specialty fertilizer adoption across the South’s agricultural sector.

The Western US specialty fertilizer market is driven by intensive fruit, nut, and vegetable production, particularly in California, which leads national agriculture. Water scarcity challenges have accelerated adoption of fertigation and drip irrigation systems, where specialty fertilizers integrate seamlessly. High-value crops demand precision nutrient management, fueling demand for liquid and water-soluble fertilizers. Strong export orientation of produce such as almonds, grapes, and citrus reinforce the need for consistent quality and yield. Furthermore, the region’s emphasis on sustainable and organic farming has created opportunities for eco-friendly fertilizers. Government initiatives supporting efficient irrigation and nutrient practices further accelerate specialty fertilizer adoption in the West.

Competitive Landscape:

The United States specialty fertilizer market features a competitive landscape shaped by global leaders and regional players focused on innovation, sustainability, and efficiency. Key companies such as Nutrien Ltd., Yara International, ICL Group, CF Industries, and The Mosaic Company dominate through extensive product portfolios and strong distribution networks. These players are investing in controlled-release, water-soluble, and eco-friendly fertilizers to align with precision agriculture and sustainability goals. Partnerships with agri-tech firms and expansions in production capabilities further strengthen their market positions. Meanwhile, smaller regional companies compete by offering customized solutions for local crops and soil conditions. Intense competition encourages continuous product innovation, strategic collaborations, and a stronger emphasis on environmentally responsible fertilizers across the US market.

The report provides a comprehensive analysis of the competitive landscape in the United States specialty fertilizer market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Phoenix Partners, with Fonds de solidarité FTQ, acquired Ferti Technologies, a Quebec-based specialty turf fertilizer manufacturer operating five North American facilities. The partnership aims to expand the company’s market presence and adapt its products to evolving industry requirements.

- April 2025: Wastech Group partnered with US-based Pursell Agri-Tech to build a controlled-release fertilizer (CRF) coating facility in Malaysia. The venture aims to boost sustainable agriculture, create local jobs, and serve Australia, Southeast Asia, South Korea, Japan, and New Zealand.

- March 2025: BiOWiSH Technologies announced its BiOWiSH Crop Liquid surpassed application on 10 million acres globally. The microbial-based enhanced fertilizer, backed by an 86%-win rate and 7.7% average yield increase, augments productivity, nutrient efficiency, and sustainability through partnerships with major fertilizer companies.

- March 2025: Waterloo, Iowa, received a USD 3.95 Million USDA Fertilizer Production Expansion Program grant to augment Hydrite Chemical Co.’s capacity, producing 10 million pounds of potassium thiosulfate and 2 million pounds of low-salt fertilizers annually by 2027, lowering costs and supporting sustainable agriculture.

- November 2024: Tessenderlo Kerley, a Tessenderlo Group subsidiary, acquired Tiger-Sul Products from Platte River Equity. The deal expands its sulphur-based specialty fertilizer portfolio, maintaining Tiger-Sul’s operations in California, Alabama, and Alberta, aiming to enhance crop yields, soil health, and farmer control.

United States Specialty Fertilizer Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Specialty Types Covered |

|

| Crop Types Covered | Field Crops, Horticultural Crops, Turf and Ornamental |

| Applications Covered | Fertigation, Foliar, Soil |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States specialty fertilizer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States specialty fertilizer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States specialty fertilizer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty fertilizer market in the United States was valued at USD 6.77 Billion in 2024.

The United States specialty fertilizer market is projected to exhibit a CAGR of 6.05% during 2025-2033, reaching a value of USD 11.49 Billion by 2033.

The United States specialty fertilizer market is driven by the rising need for sustainable farming, increasing adoption of precision agriculture, and growing demand for high-value crops. Technological advancements in fertilizer formulations and the shift toward eco-friendly, efficient nutrient management solutions further accelerate market expansion across diverse agricultural sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)