United States Streaming Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Industry Vertical, and Region, 2026-2034

United States Streaming Analytics Market Summary:

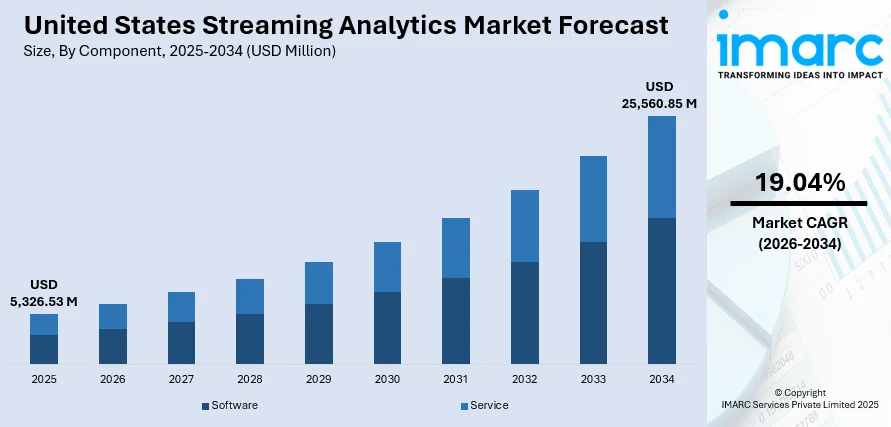

The United States streaming analytics market size was valued at USD 5,326.53 Million in 2025 and is projected to reach USD 25,560.85 Million by 2034, growing at a compound annual growth rate of 19.04% from 2026-2034.

The United States streaming analytics market is experiencing robust growth driven by the increasing demand for real-time data processing across diverse industries, including finance, healthcare, telecommunications, and retail. The exponential growth in data volume from IoT devices, social media platforms, and enterprise applications necessitates instant analysis capabilities for actionable business intelligence. Organizations are increasingly prioritizing data-driven decision-making to enhance operational efficiency, improve customer experiences, and maintain competitive advantages in rapidly evolving market conditions, strengthening the United States streaming analytics market share.

Key Takeaways and Insights:

-

By Component: Software dominates the market with a share of 65.03% in 2025, driven by the critical role of analytics platforms in enabling real-time data processing, visualization, and AI-powered insights generation.

-

By Deployment Mode: Cloud-based leads the market with a share of 60.05% in 2025, owing to its superior scalability, cost efficiency, and seamless integration with AI and machine learning models.

-

By Organization Size: Large enterprises represent the largest segment with a market share of 65.81% in 2025, attributed to substantial IT budgets and the need for enterprise-wide streaming data infrastructure.

-

By Industry Vertical: IT and telecom holds the largest share of 23.62% in 2025, driven by network optimization requirements, customer experience enhancement, and fraud detection applications.

-

Key Players: The United States streaming analytics market exhibits a competitive landscape characterized by established technology corporations, specialized data streaming vendors, and cloud service providers competing through platform innovation, strategic partnerships, and acquisition strategies.

To get more information on this market Request Sample

The market is being propelled by the convergence of streaming analytics with artificial intelligence and machine learning technologies, enabling enterprises to derive predictive and prescriptive insights from continuous data flows. The widespread adoption of cloud computing infrastructure has facilitated the scalability required for processing massive streaming data volumes. In February 2025, Confluent and Databricks announced a major partnership expansion to integrate their data streaming and data intelligence platforms, enabling enterprises to build AI applications with real-time data access and unified governance capabilities. This collaboration exemplifies the industry trend toward bridging operational and analytical systems to accelerate AI-driven decision-making across organizations.

United States Streaming Analytics Market Trends:

Integration of Artificial Intelligence and Machine Learning in Streaming Platforms

The integration of AI and ML algorithms into streaming analytics platforms represents a transformative trend enabling automated pattern recognition, anomaly detection, and predictive analytics capabilities. Context-aware models integrated with high-throughput data brokers deliver prescriptive actions in milliseconds, supporting applications from fraud detection to predictive maintenance. In May 2024, Microsoft launched Real-Time Intelligence as a new workload within Microsoft Fabric, combining Synapse Real-Time Analytics and Data Activator capabilities to provide enterprises with comprehensive real-time data ingestion, transformation, querying, and automated action capabilities.

Expansion of Cloud-Native Streaming Analytics Solutions

Cloud-native streaming analytics platforms are gaining significant traction as enterprises seek scalable, flexible solutions for processing real-time data without infrastructure management burdens. Managed cloud services simplify orchestration while enabling pay-as-you-go pricing models that reduce capital expenditure requirements. The growing adoption of hybrid and multi-cloud strategies is creating opportunities for vendors to offer seamless data streaming across diverse cloud environments, with bidirectional integrations between operational and analytical systems becoming increasingly prevalent.

Convergence of Edge Computing and IoT Data Streaming

The proliferation of IoT devices and edge computing infrastructure is driving demand for distributed streaming analytics that processes data closer to generation sources. Edge analytics reduce latency, optimize bandwidth utilization, and enable critical applications in autonomous systems, industrial automation, and smart infrastructure. Organizations are implementing hierarchical streaming architectures where edge processors filter and summarize data before transmission to central analytics platforms, supporting use cases from connected vehicle telemetry to real-time manufacturing quality control.

Market Outlook 2026-2034:

The United States streaming analytics market demonstrates strong growth potential as enterprises increasingly recognize real-time data as essential infrastructure for AI-driven operations and competitive differentiation. The market generated a revenue of USD 5,326.53 Million in 2025 and is projected to reach a revenue of USD 25,560.85 Million by 2034, growing at a compound annual growth rate of 19.04% from 2026-2034. The forecast period anticipates continued expansion driven by generative AI integration, 5G network deployment, and evolving enterprise requirements for event-driven architectures that support agentic AI applications and automated decision-making workflows.

United States Streaming Analytics Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Component |

Software |

65.03% |

|

Deployment Mode |

Cloud-based |

60.05% |

|

Organization Size |

Large Enterprises |

65.81% |

|

Industry Vertical |

IT and Telecom |

23.62% |

Component Insights:

- Software

- Service

Software dominates with 65.03% share of the total United States streaming analytics market in 2025.

Software forms the foundational backbone of streaming analytics capabilities, encompassing event streaming platforms, complex event processing engines, real-time analytics tools, and data visualization applications. The segment's dominance reflects the critical role of software in enabling enterprises to ingest, process, and analyze continuous data streams for actionable insights. Advanced analytics software powered by AI and machine learning algorithms allows businesses to automatically identify patterns, detect anomalies, and generate predictive insights without manual intervention.

The flexibility and scalability of software solutions, particularly cloud-based platforms, cater to diverse industry requirements from financial fraud detection to manufacturing predictive maintenance. In October 2024, Parrot Analytics unveiled their Streaming Metrics tool, demonstrating continued innovation in specialized analytics software that helps content providers analyze viewer engagement and make data-driven programming decisions in real time.

Deployment Mode Insights:

- Cloud-based

- On-premises

Cloud-based leads with 60.05% share of the total United States streaming analytics market in 2025.

Cloud-based streaming analytics platforms have emerged as the preferred deployment choice due to their inherent scalability, cost efficiency, and rapid implementation capabilities. Enterprises increasingly adopt cloud-based solutions to handle massive data streams generated from IoT devices, digital applications, and omnichannel customer interactions without substantial infrastructure investments. Cloud deployment enables elastic compute resources, seamless integration with AI and ML models, and global accessibility for distributed workforce requirements. The managed services model simplifies operational complexity while enabling pay-as-you-go pricing that aligns costs with actual usage patterns. Organizations benefit from automatic updates, enhanced security features, and the ability to scale processing capacity dynamically based on real-time demand fluctuations.

Organization Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises hold 65.81% share of the total United States streaming analytics market in 2025.

Large enterprises dominate the streaming analytics market owing to substantial IT budgets, complex data infrastructure requirements, and the organizational capacity to deploy enterprise-wide streaming platforms. These organizations generate massive volumes of real-time data across multiple business units, geographic locations, and customer touchpoints, necessitating sophisticated analytics capabilities for operational optimization. Large enterprises leverage streaming analytics for mission-critical applications including real-time fraud prevention, supply chain visibility, and customer experience personalization. The segment's dominance is reinforced by the ability of large organizations to invest in specialized talent, custom integrations, and comprehensive data governance frameworks.

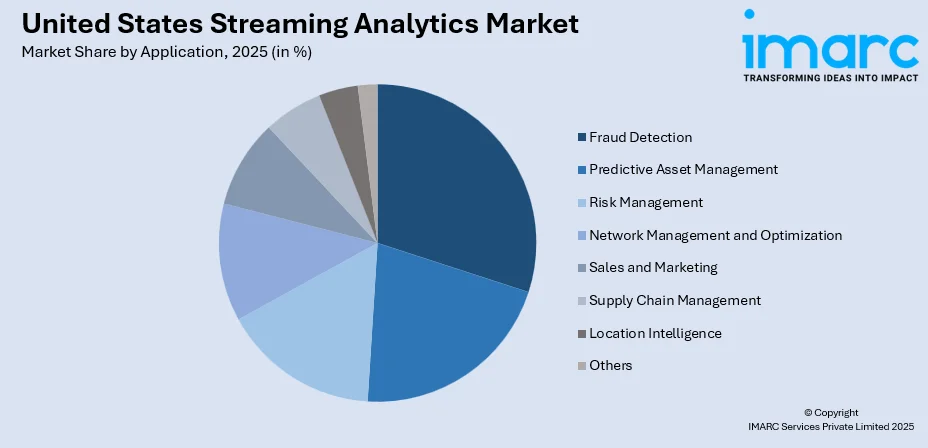

Application Insights:

Access the comprehensive market breakdown Request Sample

- Fraud Detection

- Predictive Asset Management

- Risk Management

- Network Management and Optimization

- Sales and Marketing

- Supply Chain Management

- Location Intelligence

- Others

Streaming analytics enables real-time fraud detection by analyzing transaction patterns, user behaviors, and network anomalies as they occur. Financial institutions and e-commerce platforms leverage continuous data processing to identify suspicious activities instantly, reducing financial losses and protecting customer accounts from unauthorized access.

Predictive asset management utilizes streaming analytics to monitor equipment performance and identify potential failures before they occur. Manufacturing, energy, and transportation sectors deploy real-time sensor data analysis to optimize maintenance schedules, extend asset lifecycles, and minimize costly unplanned downtime across operations.

Streaming analytics enhances risk management capabilities by providing continuous monitoring of market conditions, operational metrics, and compliance indicators. Organizations across financial services, insurance, and healthcare leverage real-time data processing to identify emerging risks, assess exposure levels, and implement timely mitigation strategies.

Network management applications leverage streaming analytics to monitor traffic patterns, detect performance degradation, and optimize resource allocation in real time. Telecommunications and IT infrastructure providers utilize continuous data analysis to ensure service quality, prevent outages, and dynamically balance network loads efficiently.

Streaming analytics empowers sales and marketing teams with real-time customer insights, enabling personalized engagement and dynamic campaign optimization. Retailers and digital platforms analyze customer behaviors, purchase patterns, and interaction data instantaneously to deliver targeted recommendations, improve conversion rates, and enhance customer experiences.

Supply chain management benefits from streaming analytics through real-time visibility into inventory levels, shipment tracking, and demand fluctuations. Organizations leverage continuous data processing to optimize logistics operations, anticipate disruptions, coordinate supplier activities, and maintain efficient product flow across global distribution networks.

Location intelligence applications utilize streaming analytics to process geospatial data from mobile devices, vehicles, and IoT sensors in real time. Businesses leverage continuous location analysis for fleet management, targeted advertising, emergency response coordination, and understanding customer movement patterns across physical locations.

Industry Vertical Insights:

- IT and Telecom

- BFSI

- Manufacturing

- Government

- Retail and E-Commerce

- Media and Entertainment

- Healthcare

- Energy and Utilities

- Others

IT and telecom accounts 23.62% share of the total United States streaming analytics market in 2025.

The IT and telecommunications sector leads streaming analytics adoption driven by its customer-centric approach and focus on delivering customized, feature-rich services. Companies in this sector utilize streaming analytics to examine massive volumes of operational data for network optimization, predictive maintenance, and enhanced customer service delivery. The sector's early technology adoption, robust data infrastructure, and existing analytics maturity provide significant advantages for implementing sophisticated streaming solutions.

Telecommunications operators apply AI-powered streaming models to 5G core metrics for congestion prediction, fraud detection, and service quality optimization. The sector's requirements for real-time network monitoring and proactive issue resolution make streaming analytics essential for maintaining service quality and customer satisfaction levels.

Regional Insights:

- Northeast

- Midwest

- South

- West

Northeast demonstrates strong streaming analytics adoption driven by the concentration of financial services headquarters, healthcare institutions, and technology companies in metropolitan areas including New York and Boston. The region's established data infrastructure and regulatory compliance requirements accelerate enterprise-grade real-time analytics implementations.

Midwest exhibits growing streaming analytics demand fueled by manufacturing digitization initiatives, agricultural technology modernization, and logistics optimization requirements. Traditional industries are increasingly adopting real-time data processing capabilities to enhance operational efficiency, predictive maintenance, and supply chain visibility across distributed facilities.

South experiences expanding streaming analytics adoption supported by emerging technology hubs, energy sector modernization, and healthcare system digitization. Growing enterprise investments in cloud infrastructure and increasing data center presence are accelerating real-time analytics capabilities across diverse industries including energy, healthcare, and retail.

West leads streaming analytics innovation driven by Silicon Valley technology leadership, entertainment industry data requirements, and advanced cloud computing infrastructure. The concentration of technology pioneers, venture capital investment, and talent pools positions the region at the forefront of real-time analytics development and adoption.

Market Dynamics:

Growth Drivers:

Why is the United States Streaming Analytics Market Growing?

Exponential Growth in Real-Time Data Generation from IoT and Digital Sources

The exponential increase in real-time data generated from diverse sources including IoT devices, social media platforms, sensors, and digital applications represents a fundamental driver of streaming analytics demand. Organizations across industries recognize that traditional batch processing methods cannot accommodate the velocity and volume of modern data flows, necessitating streaming analytics solutions that extract actionable insights as data is generated. This data deluge creates unprecedented opportunities for businesses to enhance decision-making, optimize operations, and deliver personalized customer experiences through real-time intelligence capabilities.

Increasing Enterprise Demand for AI-Powered Real-Time Decision Making

The growing enterprise requirement for immediate and proactive decision-making capabilities is fueling streaming analytics adoption across industries including finance, healthcare, and telecommunications. Organizations recognize that competitive advantage increasingly depends on the ability to respond swiftly to market changes, customer behaviors, and operational anomalies in real time rather than relying on historical analysis. The integration of artificial intelligence and machine learning into streaming platforms enables automated pattern recognition, predictive analytics, and prescriptive recommendations that support autonomous decision-making. Financial institutions combining language models with streaming telemetry report significant improvements in fraud detection accuracy while reducing false positive rates, demonstrating the tangible business value of AI-enhanced streaming analytics.

Cloud Computing Adoption Enabling Scalable Streaming Infrastructure

The widespread adoption of cloud computing has facilitated the scalability, flexibility, and accessibility required for enterprise-grade streaming analytics implementations. Cloud platforms eliminate the substantial capital expenditure traditionally associated with building streaming infrastructure while providing elastic compute resources that scale dynamically with fluctuating demand patterns. The availability of managed streaming services simplifies operational complexity, reduces time-to-value, and enables organizations of varying sizes to leverage sophisticated real-time analytics capabilities previously accessible only to technology leaders. Cloud-native architectures support seamless integration with artificial intelligence and machine learning frameworks, enabling automated insights generation and predictive analytics workflows. The pay-as-you-go pricing models align infrastructure costs with actual usage, making advanced streaming capabilities economically viable for enterprises across diverse budget constraints.

Market Restraints:

What Challenges the United States Streaming Analytics Market is Facing?

Skills Shortage and Specialized Talent Scarcity

The streaming analytics market faces significant constraints from the shortage of skilled professionals capable of implementing, maintaining, and optimizing real-time data processing systems. Research indicates that insufficient skills and expertise represent the primary challenge for IT leaders implementing advanced analytics capabilities, with specialized knowledge in stream processing frameworks, distributed systems, and AI integration commanding premium compensation.

Integration Complexity with Legacy Systems and Data Architectures

Organizations encounter substantial difficulties integrating streaming analytics solutions with existing enterprise systems and legacy data architectures. The complexity of modern data environments often requires specialized expertise for seamless integration, creating implementation delays and increased project costs. Compatibility issues between streaming platforms and traditional database systems complicate data flow management and real-time processing requirements.

Data Privacy, Security, and Regulatory Compliance Concerns

Growing concerns regarding data privacy, security vulnerabilities, and regulatory compliance requirements present challenges for streaming analytics adoption. Organizations processing sensitive real-time data must navigate complex regulatory frameworks while ensuring robust protection against cyber threats. The continuous nature of streaming data creates expanded attack surfaces that require sophisticated security measures and governance frameworks.

Competitive Landscape:

The United States streaming analytics market exhibits a dynamic competitive landscape characterized by established technology corporations, specialized data streaming vendors, and cloud service providers pursuing market leadership through continuous innovation. Major players compete through platform capability expansion, strategic acquisitions, and partnership ecosystems that extend market reach and solution depth. The competitive environment emphasizes cloud-native architectures, AI integration capabilities, and ease of deployment as key differentiators. Strategic alliances between streaming platform providers and system integrators are expanding market access while acquisition activity consolidates capabilities across the data management value chain.

United States Streaming Analytics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Fraud Detection, Predictive Asset Management, Risk Management, Network Management and Optimization, Sales and Marketing, Supply Chain Management, Location Intelligence, Others |

| Industry Verticals Covered | IT and Telecom, BFSI, Manufacturing, Government, Retail and E-Commerce, Media and Entertainment, Healthcare, Energy and Utilities, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States streaming analytics market size was valued at USD 5,326.53 Million in 2025.

The United States streaming analytics market is expected to grow at a compound annual growth rate of 19.04% from 2026-2034 to reach USD 25,560.85 Million by 2034.

Software dominated the market with a 65.03% share in 2025, driven by the critical role of analytics platforms in enabling real-time data processing, visualization, and AI-powered insights generation across enterprise applications.

Key factors driving the United States streaming analytics market include exponential growth in real-time data from IoT devices and digital sources, increasing enterprise demand for AI-powered decision-making capabilities, and widespread cloud computing adoption enabling scalable streaming infrastructure.

Major challenges include skills shortage and specialized talent scarcity for implementing streaming solutions, integration complexity with legacy systems and data architectures, and growing data privacy, security, and regulatory compliance concerns.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)