United States Sugar Substitutes Market Size, Share, Trends and Forecast by Product Type, Application, Origin, and Region, 2026-2034

United States Sugar Substitutes Market Size and Share:

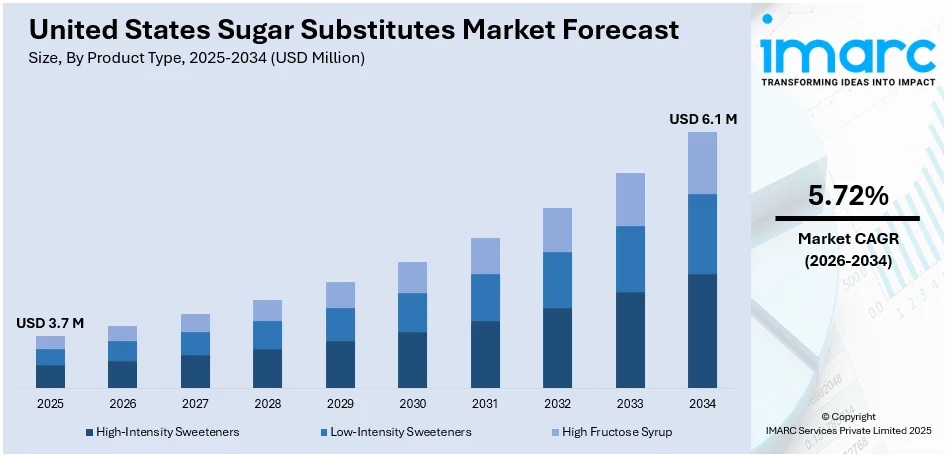

The United States sugar substitutes market size was valued at USD 3.7 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.1 Million by 2034, exhibiting a CAGR of 5.72% during 2026-2034. The market is driven by rising health concerns linked to excessive sweetener intake, prompting consumers to seek alternatives aligned with metabolic and dietary goals. Growing awareness around preventive nutrition and the broader shift toward clean-label formulations are expected to deepen penetration across mainstream and specialty segments, further augmenting the United States sugar substitutes market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.7 Million |

| Market Forecast in 2034 | USD 6.1 Million |

| Market Growth Rate (2026-2034) | 5.72% |

The market is primarily driven by the rising focus on healthier eating habits and balanced nutritional intake. In line with this, the growing popularity of products with low or no added sweetening agents is also providing an impetus to the market. Moreover, the heightened concern regarding lifestyle-related disorders is also acting as a significant growth-inducing factor for the market. In addition to this, the expanding interest in plant-derived ingredients among consumers with specific dietary preferences is resulting in the increased use of non-synthetic alternatives., creating a favorable United States sugar substitutes market outlook.

To get more information on this market Request Sample

Besides this, the shift toward clean-label offerings and simpler ingredient lists is creating lucrative opportunities in the market. Also, enhanced marketing tactics of wellness-focused formulations are impacting the market positively. The market is further driven by supportive advisories from public health institutions encouraging moderated intake of certain nutrients. Apart from this, extensive availability of low-calorie and specialized formulations across food and beverage categories is propelling the market. Some of the other factors contributing to the market include evolving consumer lifestyles, growing demand for options suitable for individuals with dietary restrictions, and continual product development efforts.

United States Sugar Substitutes Market Trends:

Rising Obesity Rates Fuel Demand for Sugar Alternatives

The sugar substitutes market in the United States is witnessing significant traction as obesity reaches alarming levels. The 2023 CDC data revealed that in 23 states, over 35% of adults have obesity, a significant increase from before 2013 when no state had such a high prevalence. Currently, at least 20% of adults in every U.S. state are living with obesity. This surge has led consumers to re-evaluate their sugar intake and embrace healthier diets. Sugar alternatives such as stevia and monk fruit are becoming key components of wellness-driven consumption. Their ability to offer sweetness without contributing to caloric or glycemic spikes makes them ideal for weight management and metabolic health. This consumer pivot toward health-conscious eating is encouraging brands to introduce sugar-reduced or sugar-free variants across product lines, ensuring sustained market momentum for sugar substitutes in the years ahead.

Consumer Preference Shifting Toward Low-Sugar Products

One of the major United States sugar substitutes market trends is a pronounced shift in dietary behavior is contributing to the rapid growth of sugar substitutes in the U.S. market. According to an industry report, more than 40% of consumers in the United States are actively seeking low-sugar products. Consumers are increasingly drawn to clean-label and wellness-positioned offerings, from functional snacks to zero-calorie drinks. As label transparency becomes more important, brands are reformulating products using natural sweeteners like erythritol, xylitol, and allulose. These ingredients deliver the expected taste while aligning with health goals. Additionally, rising interest in diabetic-friendly and keto-compatible items has further cemented sugar alternatives as a necessary feature in modern food formulations, positioning them as key drivers of innovation and retail differentiation.

Federal Guidelines Accelerate Market Adoption

Public health recommendations are significantly accelerating the adoption of sugar substitutes across the food and beverage industry. The CDC reported that federal guidelines advise Americans aged 2 and older to limit added sugars to less than 10% of daily calories, which equates to no more than 200 calories (about 12 teaspoons) in a 2,000-calorie diet. As per the United States sugar substitutes market forecast, these recommendations are shaping school nutrition standards, foodservice offerings, and packaged food development. Manufacturers are responding by replacing traditional sugar with alternatives that preserve sweetness but cut calories and metabolic risk. The trend is visible across product categories such as dairy, baked goods, sauces, and beverages. As regulatory frameworks continue to align with preventive healthcare, sugar substitutes are becoming indispensable in meeting compliance and consumer expectations. Their growing role reflects a synergy between public policy and market innovation in addressing chronic health challenges.

United States Sugar Substitutes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States sugar substitutes market, along with forecasts at the regional, and country levels from 2026-2034. The market has been categorized based on product type, application, and origin.

Analysis by Product Type:

- High-Intensity Sweeteners

- Stevia

- Aspartame

- Cyclamate

- Sucralose

- Saccharin

- Others

- Low-Intensity Sweeteners

- D-Tagatose

- Sorbitol

- Maltitol

- Xylitol

- Mannitol

- Others

- High Fructose Syrup

High-intensity sweeteners are vital to the U.S. sugar substitutes market due to their exceptional sweetness, hundreds of times stronger than regular sugar, allowing minimal quantities to deliver the desired taste. Products like stevia, sucralose, and aspartame are popular in diet beverages, packaged snacks, and health foods. Their widespread use by major F&B companies supports calorie-reduction goals without sacrificing flavor. As obesity and diabetes rates climb, demand for these zero-calorie sweeteners is rising. Regulatory approval and increasing consumer trust in plant-based variants, like stevia, are further accelerating the United States sugar substitutes market growth.

Low-intensity sweeteners are crucial for food applications requiring bulk and texture similar to traditional sugar. Compounds such as xylitol, sorbitol, and maltitol are widely used in chewing gum, bakery products, and confectionery due to their mild sweetness and mouthfeel. Unlike high-intensity options, these sweeteners provide body and viscosity, making them ideal for replacing sugar in functional or sugar-free items. Additionally, many offer dental health benefits or have a low glycemic index, increasing their appeal to diabetic consumers. Their versatility and safety profile drive continued inclusion across product categories.

High fructose syrup plays a complex yet significant role in the U.S. sugar substitutes market, particularly as a cost-effective sweetener for processed foods and beverages. While its health implications are under scrutiny, it remains popular due to its functional properties—offering consistency, shelf life extension, and sweetening power. Its inclusion is most prevalent in sodas, condiments, and ready-to-eat snacks. However, growing health consciousness has prompted reformulations and reduced usage in some brands, creating opportunities for natural alternatives. Nonetheless, high fructose syrup remains a notable segment due to its longstanding industrial utility.

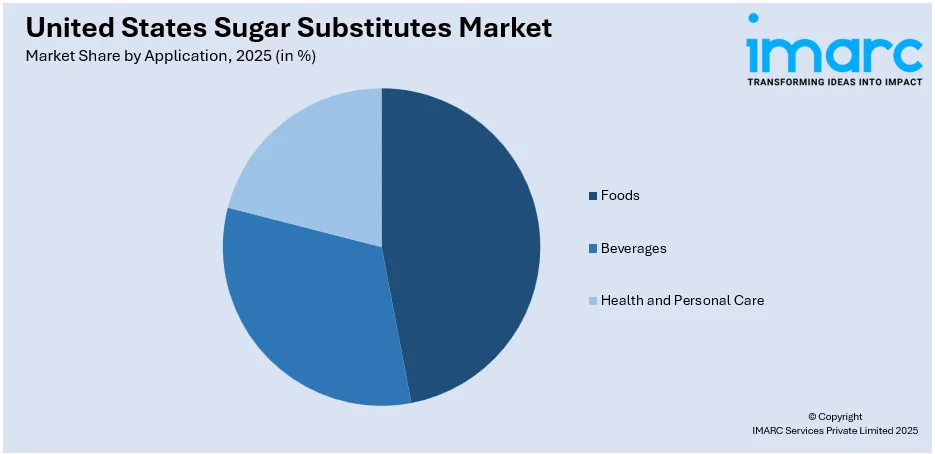

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Foods

- Beverages

- Health and Personal Care

The food segment is a core application area for sugar substitutes, as consumers increasingly seek healthier everyday meals and snacks. Sugar alternatives are used in baked goods, dairy products, sauces, and confectionery to reduce sugar content without compromising taste. This segment is influenced by rising obesity rates and consumer demand for “better-for-you” foods. Natural sweeteners are favored in organic and clean-label foods, while artificial options dominate cost-sensitive processed items. The widespread use of sugar in packaged foods creates a robust demand for functional replacements, making this segment indispensable to market growth.

Beverages represent a major driver of sugar substitutes demand, as companies reformulate soft drinks, flavored waters, and sports drinks to reduce sugar content. Consumers are highly responsive to low-calorie and sugar-free claims, especially amid rising concerns about obesity and diabetes. High-intensity sweeteners like sucralose and aspartame are popular in diet sodas, while natural options like stevia are gaining traction in wellness beverages. The beverage industry’s broad reach and frequent consumption patterns amplify the impact of sugar reduction efforts, making this segment a leading contributor to sugar substitutes market expansion.

Sugar substitutes are increasingly integrated into health and personal care products, particularly in oral hygiene items like toothpaste and mouthwash. Ingredients like xylitol offer anti-cavity benefits, making them popular among dental professionals and manufacturers. Additionally, sugar-free formulations in pharmaceuticals, dietary supplements, and functional foods cater to diabetic patients and health-conscious consumers. The demand for clean-label, sugar-free, and low-calorie products in the health and wellness sector is driving innovation in this space. As consumers extend sugar reduction efforts beyond food and drink, this segment is poised for strong market relevance.

Analysis by Origin:

- Artificial

- Natural

Artificial sugar substitutes such as aspartame, sucralose, and saccharin remain popular in the U.S. market due to their low cost, high intensity, and extensive FDA approval history. These sweeteners are widely used in mass-market products like diet sodas, processed snacks, and pharmaceuticals. Their long shelf life and stability under heat make them ideal for large-scale manufacturing. Despite growing demand for natural alternatives, artificial variants continue to account for a substantial share due to their functional versatility. They offer a cost-efficient way to comply with sugar reduction goals without altering product taste or performance.

Natural sugar substitutes are gaining rapid traction as consumers seek clean-label, plant-based alternatives to traditional sugar. Options like stevia, monk fruit, and agave are perceived as healthier and safer, aligning with broader trends in organic and non-GMO product development. These sweeteners are especially favored in premium and wellness-oriented brands. Their appeal lies in delivering sweetness with fewer health concerns, attracting both diabetic and weight-conscious consumers. Though costlier than artificial variants, natural sweeteners are increasingly used in food, beverage, and supplement industries, driven by rising demand for transparent, health-forward ingredient profiles.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region represents a significant market for sugar substitutes, largely due to high urbanization, dense populations, and widespread awareness of health trends. Consumers in states like New York and Massachusetts actively seek low-sugar and natural food options, making the region a hub for innovation in health and wellness products. Additionally, strong regulatory compliance and presence of premium grocery retailers amplify product visibility. With leading universities and R&D centers nearby, the Northeast also supports formulation advancements, making it a critical zone for testing and launching new sugar-reduction solutions.

The Midwest plays a vital role in the U.S. sugar substitutes market due to its deep ties to food processing and agricultural manufacturing. Home to major food companies and ingredient suppliers, the region has seen widespread adoption of sugar alternatives in packaged food production. Consumers are increasingly focused on preventive health, and regional obesity trends are encouraging the uptake of sugar-free options. With strong distribution networks and manufacturing infrastructure, the Midwest is well-positioned to support large-scale product reformulations and innovation. Its central location also makes it key for national market penetration.

The South holds substantial potential for sugar substitute adoption due to its high prevalence of lifestyle-related diseases, particularly obesity and diabetes. Public health campaigns and government nutrition programs have intensified in states like Texas and Georgia, promoting reduced sugar intake. As a result, demand for diabetic-friendly and low-calorie products is on the rise. Additionally, expanding urbanization and growing awareness among younger demographics are creating fertile ground for health-forward brands. Manufacturers targeting this region are reformulating traditional Southern favorites—like sweet tea and baked goods—using natural or low-calorie sweeteners.

The Western U.S., especially states like California and Washington, leads in health-conscious consumer behavior, clean-label trends, and natural product innovation. This region exhibits strong demand for organic, plant-based, and sugar-free foods and beverages. The local population actively reads nutrition labels and prefers products with low or no added sugar. Natural sweeteners like stevia and monk fruit see high uptake due to preference for sustainable and non-GMO ingredients. Additionally, the presence of wellness-centric startups, retailers, and tech-savvy consumers makes the West a hotbed for early adoption of sugar substitute innovations.

Competitive Landscape:

Key players in the market are actively investing in product innovations, strategic partnerships, and consumer education to drive market growth. Leading companies are expanding their natural sweetener portfolios, focusing on stevia, monk fruit, and allulose to meet rising demand for clean-label ingredients. Several firms are forming collaborations with food and beverage manufacturers to develop tailored formulations that maintain taste and functionality while reducing sugar content. Investments in R&D are targeting improved taste profiles, heat stability, and cost-efficiency. Additionally, brands are leveraging marketing campaigns to promote sugar-reduced products as part of healthier lifestyles, aligning with consumer preferences for wellness, transparency, and regulatory compliance across diverse application segments.

The report provides a comprehensive analysis of the competitive landscape in the United States sugar substitutes market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: The Institute of Food Technologists (IFT) released two free resources on sugar reduction strategies for food and beverage professionals. The resources, including "Sugar Alternatives at A Glance," provide key information on various sweeteners, their regulatory status, and sweetness levels, aiding product developers in reducing added sugars.

- February 2025: Oobli partnered with Ingredion to scale production of its sweet protein-based sugar alternatives. With regulatory approval for its proteins, Oobli aims to offer low-cost, healthier sweeteners for food and beverages. The company also raised USD 18 Million in funding as consumer demand for protein-focused sweeteners grows.

- October 2024: Tate & Lyle and Manus formed The Natural Sweetener Alliance to expand access to bioconverted stevia Reb M. Sourced and manufactured in the Americas, the partnership aims to accelerate sugar reduction by providing high-quality, traceable stevia solutions for global customers in food and beverage industries.

- September 2024: Howtian launched SoPure Dorado, an unrefined golden stevia extract. This minimally processed, zero-calorie sweetener retains its natural golden color and high steviol glycoside concentration, making it ideal for clean label applications such as syrups, sauces, and sugar blends for health-conscious consumers.

- July 2024: Roquette and Bonumose partnered to scale tagatose production, a natural sweetener that offers health benefits like reduced calories and a low glycemic index. The collaboration combines Roquette's sweetener expertise with Bonumose's enzymatic technology to meet growing demand for healthier sugar alternatives in food and beverages.

United States Sugar Substitutes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered |

|

| Applications Covered | Foods, Beverages, Health and Personal Care |

| Origins Covered | Artificial, Natural |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States sugar substitutes market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States sugar substitutes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States sugar substitutes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The United States sugar substitutes market was valued at USD 3.7 Million in 2025.

The United States sugar substitutes market is projected to exhibit a CAGR of 5.72% during 2026-2034, reaching a value of USD 6.1 Million by 2034.

Rising obesity and diabetes rates, growing consumer preference for low-sugar and clean-label products, favorable regulatory guidelines, and increased use of natural sweeteners like stevia and monk fruit are propelling market growth in the United States.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)