United States Supply Chain Management Software Market Size, Share, Trends and Forecast by Solution Type, Deployment Mode, Organization Size, Industry Vertical, and Region 2026-2034

United States Supply Chain Management Software Market Overview:

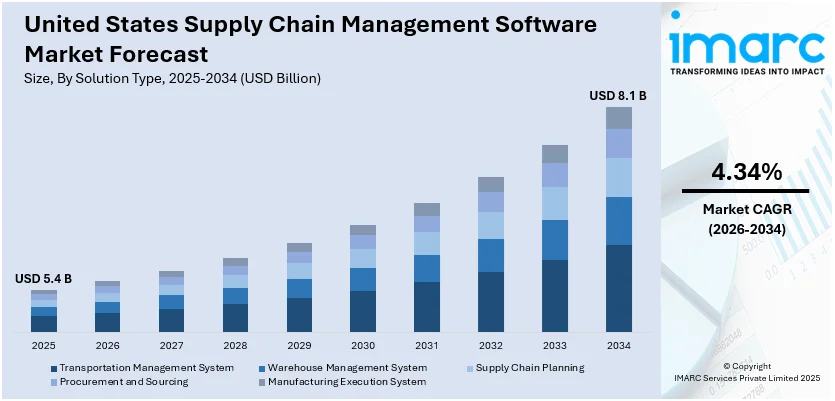

The United States supply chain management software market size was valued at USD 5.4 Billion in 2025. Looking forward, the market is expected to reach USD 8.1 Billion by 2034, exhibiting a CAGR of 4.34% during 2026-2034. The market is characterized by technological innovation, sophisticated regulatory landscapes, and changing consumer expectations. Factors such as enormous domestic infrastructure, varied regional regulation, and cross-border commerce with Mexico and Canada further accelerate the demand for agile and effective supply chain systems. The intensifying role of real-time data, automation, and the integration of AI also drive the market toward accelerated evolution, which further shape the United States supply chain management software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.4 Billion |

| Market Forecast in 2034 | USD 8.1 Billion |

| Market Growth Rate (2026-2034) | 4.34% |

Among the United States supply chain management software market's most dominant drivers is the country's solid basis in technological innovation and its extensive regional infrastructure. Many of the biggest supply chain software developers in the world are based in the US, and their advancements in cloud computing, artificial intelligence, and the Internet of Things (IoT) continuously raise the bar for supply chain optimization. Such technologies are more deeply integrated into platforms that support logistics-intense industries like manufacturing, healthcare, and retailing, allowing for real-time decision-making and predictive analytics. The sheer size and complexity of the US economy, spanning industrial centers in the Midwest to technology hubs in Silicon Valley and vast port operations along the Gulf and Pacific coasts, require supply chain systems with high volumes and diverse regulatory environments. Moreover, the geographic reach and multiple time zones of the country engender special logistics needs, fostering route planning, delivery scheduling, and intermodal transport management innovation. This blend of cutting-edge technology development and physical logistics complexity of domestic operations continues to fuel the United States supply chain management software market demand, making it a strategic imperative for US businesses operating in global and domestic markets.

To get more information on this market Request Sample

Regulatory adherence and changing consumer needs are two other forces that are driving the dynamics of US supply chain management. Companies in the US are required to comply with a wide range of regulations across state and industry lines, like food safety regulations monitored by the FDA, environmental regulations monitored by the EPA, and import/export regulations controlled by Customs and Border Protection. These regulatory intricacies necessitate software that guarantees traceability, documentation, and audit readiness, particularly for businesses engaged in cross-border trade with Canada, Mexico, or foreign partners. Meanwhile, American consumers increasingly demand quick, dependable, and sustainable product delivery—fueled by the hegemony of e-commerce titans and the conventionalization of two-day or same-day shipping business models. In response to these demands while staying compliant and cost-efficient, companies are resorting to supply chain platforms that provide real-time visibility, responsive logistics planning, and integrated access with retail and delivery networks. In addition, disruptions resulting from shortages of labor, geopolitical risks, and environmental events have led companies to adopt software solutions that provide enhanced resilience and contingency planning functionality. These regional pressures highlight the necessity for flexible, smart supply chain systems that are capable of responding to a changing US business landscape.

United States Supply Chain Management Software Market Trends:

Wide Extent of Supply Chain Software Solutions

Planning solutions, transportation management systems (TMS), warehousing management systems (WMS), and manufacturing execution systems (MES) are all part of the robust ecosystem that makes up the US supply chain management software market. Most US organizations invest in combined platforms that handle demand forecasting, inventory optimization, order orchestration, and real‐time visibility across several levels of suppliers. US manufacturers, distributors, and retailers often implement best‐of‐breed supply chain planning applications that utilize sophisticated algorithms to forecast and balance inventory, in addition to using transportation management solutions to plan, execute, and track multi‐modal shipments across large domestic and global networks. According to a survey in the US, 93% of respondents reported using some type of warehouse management system (WMS) software, highlighting the widespread adoption of such tools in optimizing inventory and warehouse operations across industries. At the same time, warehouse management software is designed to manage the high volume and seasonal spikes common in US retail and e‑commerce environments, integrating barcode scanning, automated conveyors, robotics, and slotting optimization. In tandem with manufacturing execution systems, these platforms enable US factories to monitor shop‑floor activity, impose quality controls, and synchronize production schedules in real time. Collectively, these software types show the region's focus on module-style yet interoperable systems that can scale rapidly to meet changing demand, increased global sourcing, and integration needs with transportation nodes such as ports and continental inland logistics corridors, which further contributes to the United States supply chain management software market growth.

Multifaceted Benefits of Supply Chain Software in American Enterprises

Implementing supply chain management software in America brings a number of general strategic advantages that apply across industry segments. Industry reports indicate that targeted supply-chain optimization can result in a 25% cost reduction. American businesses uniformly point to enhanced visibility, from raw material procurement through finished goods delivery, as a key benefit, whereby dashboards and alerts provide timely visibility into inventory positions, transport holdups, and supplier performance. This increased visibility enhances operational efficiency, allowing managers to eliminate redundant work, prevent stockouts, and optimize labor deployment in distribution centers. Reduced cost is a central advantage: intelligence generated from planning and TMS solutions assists companies in negotiating improved carrier rates, maximizing load planning, and having lean safety stock levels. Avoidance of risk is also an underemphasized benefit scenario modeling fueled by software assistance companies to prepare against disruptions such as port congestion, natural catastrophes, labor strikes, or swift demand spikes. In the regional context, businesses tend to use these tools to manage domestic and cross-border trade regulatory needs, including Customs compliance, trade zone management, and compliance with FDA or consumer safety standards. Therefore, US based businesses utilize supply chain software for reducing waste and expense, and also for actively managing complexity and ensuring continuity within a heterogeneous and regulated business environment, which leads to the growth and development of the United States supply chain management software market outlook.

Need for Dynamic Software

US supply chain management market growth is deeply connected with rising complexity in overseas sourcing, distribution, and regulatory compliance. US companies are confronted with multi‐tiered supply chains extending across domestic manufacturing centers, international overseas suppliers, and expansive e‑commerce fulfillment territories. For instance, asking prices for warehouse and distribution space in the US hit an all-time high of USD 9.72 per square foot in 2023, representing a 20.6% increase compared to the previous year, based on data published by real estate leader Colliers in January. In 2023, lease rates for industrial real estate per square foot rose in the New York City metro region, the San Francisco Bay area, and Chicago, according to Colliers. To coordinate these complex flows, dynamic software is needed that can reconcile varied data sources, third-party logistics providers, freight carriers, port authorities, and internal systems. American business is the only one that has the combination of cross‐border trade (e.g., with Canada and Mexico under specific trade agreements) and domestic logistics across 50 states with unique rules regarding labor, environmental regulations, and tax regimes. Moreover, US consumer expectations, including next‑day delivery and simplicity of returns, intensify the call for accurate, quick supply chain responsiveness. In addition, national infrastructure bottlenecks associated with port delay or inland rail capacity induce US companies to depend on sophisticated TMS and WMS to redirect flows and take advantage of load‑sharing opportunities. These United States supply chain management software market trends contribute to demand for integrated platforms that combine planning, execution, and analytics, fueling a market force where demand is influenced by the necessity to deal with increasingly sophisticated supply chain issues with tenacity and acumen.

United States Supply Chain Management Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States supply chain management software market, along with forecasts at the regional, and country levels from 2026-2034. The market has been categorized based on solution type, deployment mode, organization size, and industry vertical.

Analysis by Solution Type:

- Transportation Management System

- Warehouse Management System

- Supply Chain Planning

- Procurement and Sourcing

- Manufacturing Execution System

Transportation Management Systems (TMS) assist US companies in optimizing routes for shipping, controlling freight expenses, and monitoring deliveries in real time. By enhancing carrier choice, route planning, and regulatory compliance, TMS systems are vital for directing domestic and international logistics within the vast US transportation network.

Warehouse Management Systems (WMS) automate inventory management, order fulfillment, and labor planning at US distribution centers. WMS solutions, through their support of real-time tracking, automation, and space optimization, improve operational efficiency and accuracy, particularly in e-commerce and retail that operate high-volume, fast-moving products across multiple geographic regions.

Supply Chain Planning software helps US businesses predict demand, match supply, and manage resources efficiently. Such software uses predictive analytics and scenario modeling, making it possible for companies to take pre-emptive action despite market uncertainty, seasonality, and intricate multi-tier vendor networks common in the US market.

Procurement and Sourcing software automates supplier choice, contract administration, and procurement procedures for US companies. These applications ensure compliance with US and foreign trade regulations, enable cost control, and increase cooperation with vendors, enabling companies to achieve secure, ethical, and economical sourcing in a globally connected supply network.

Manufacturing Execution System (MES) reconciles enterprise resource planning and shop-floor operations in American factories. They track real-time production processes, impose quality standards, and maintain regulatory compliance, allowing manufacturers to retain agility, efficiency, and traceability in an automated and data-driven production environment.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises deployment, according to the United States supply chain management software market analysis, is favored by organizations that desire complete control over data, security, and system tailoring. Large enterprises, with their own IT infrastructure, normally embrace this approach. It is highly secure regarding data but entails high initial investment and long-term maintenance, making it ideal for highly regulated or legacy-based sectors.

Cloud-based deployment is increasingly popular among the US supply chain management software industry because it is scalable, cheaper upfront, and easier to integrate. It provides companies with real-time data access, collaboration across geographies, and fast responsiveness to market dynamics. Cloud offerings especially entice mid-sized businesses looking for flexibility and fast digital transformation with minimal infrastructure investments.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Small and Medium-sized Enterprises (SMEs) in the United States are more and more using supply chain management software to become more efficient, cut costs, and stay ahead. Cloud-based solutions are most attractive to SMEs because they are economical and scalable. These applications help to better manage inventory, predict demand, and collaborate with suppliers without significant IT investments or intricate processes.

Large companies in the US invest significantly in sophisticated supply chain management software to coordinate intricate operations, worldwide supplier networks, and multinational logistics. Such companies usually implement integrated, on-premises or hybrid systems that facilitate automation, compliance, and data-driven decision-making. Their size requires high customization, real-time analytics, and strong security to ensure operational continuity and strategic agility.

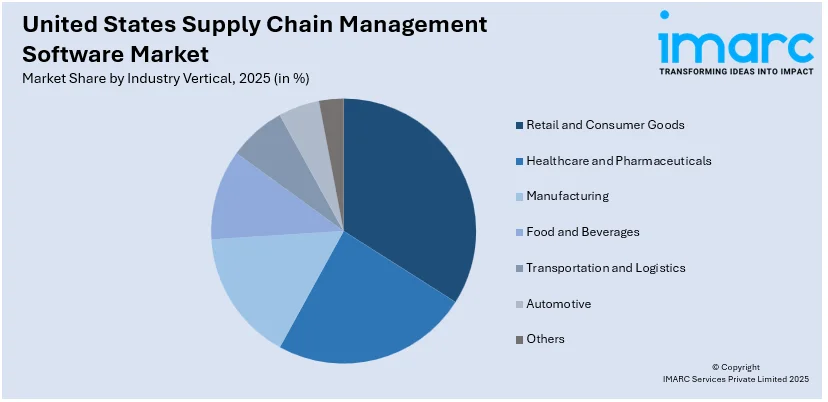

Analysis by Industry Vertical:

Access the comprehensive market breakdown Request Sample

- Retail and Consumer Goods

- Healthcare and Pharmaceuticals

- Manufacturing

- Food and Beverages

- Transportation and Logistics

- Automotive

- Others

Retail and consumer goods organizations in the US leverage supply chain software to optimize high-turnover inventory, streamline fulfillment, and drive high customer satisfaction across multiple channels while maintaining agility and efficiency in competitive and seasonal market environments.

The American healthcare and pharmaceutical industry depends on supply chain management software for regulatory adherence, cold chain monitoring, and inventory accuracy to provide timely delivery of life-critical medical supplies and pharmaceuticals to hospitals, clinics, and distributors.

US manufacturers embrace supply chain software to maximize production planning, monitor raw materials, and manage global supply chains. Such software creates operational efficiency, real-time visibility, and responsiveness in a highly automated and competitive industrial environment.

The US food and beverage sectors use supply chain software for demand planning, compliance monitoring, and perishability management. This software helps with distribution through supermarket chains, eateries, and processing facilities while ensuring food safety and reducing waste.

The logistics and transportation industry in the US utilizes supply chain software for route optimization, real-time tracking of shipments, and control of freight costs, facilitating efficient transportation of goods over long distances and intricate multi-modal networks.

American automotive manufacturers rely on supply chain software to coordinate just-in-time manufacturing, international supplier coordination, and inventory of parts. The software is essential to ensure quality, reduce delays, and cope with the intricacies of vehicle manufacturing and distribution.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast supply chain software market is fueled by a high concentration of population, robust finance and retail industries, and proximity to major seaports. Companies here have a focus on software solutions for urban logistics, quick delivery, and warehousing in constrained space.

The Midwest, America's manufacturing center, drives demand for supply chain software that is production planning, supplier coordination, and transportation optimization oriented. Its middle location facilitates distribution efficiency and is therefore suitable for businesses looking to have regional logistics networks and manufacturing responsiveness.

The Southern US is favored by significant ports, car manufacturing, and increasing e-commerce, fueling the adoption of supply chain software for multi-modal shipping, cross-border trade with Mexico, and warehouse automation. Companies here require scalability and visibility in real time across sophisticated logistics operations.

The Western United States, which houses key tech centers and Pacific ports of trade, is at the forefront of implementing cutting-edge, cloud-based supply chain solutions. Strong import volume, technology-focused retailing, and environmental laws fuel demand for applications that facilitate sustainability, automation, and global supply chain visibility.

Competitive Landscape:

As observed through the United States supply chain management software market forecast, several major companies in the United States supply chain management software market are making strategic moves to catalyze growth and innovation by investing in innovative technologies, strategic collaborations, and industry-specific solutions. Oracle, SAP, IBM, and Manhattan Associates are incorporating artificial intelligence, machine learning, and real-time analytics into their platforms to improve forecasting, risk management, and end-to-end visibility. These companies are also creating cloud-based offerings that deliver scalability and flexibility, serving businesses ranging from small to large across industries like retail, manufacturing, healthcare, and logistics. With growing supply chain disruptions, top players are concentrating on creating resilient ecosystems by enabling multi-tiered supplier mapping, inventory optimization, and scenario planning capabilities. Integration with logistics providers, third-party vendors, and e-commerce platforms further improves integration and interoperability. In addition to this, the companies are also moving towards sustainability objectives by providing carbon footprint tracking tools and resource efficiency enhancing tools. With the continuous issue of labor shortages, port congestion, and changing patterns in demand, the industry leaders are also providing customized consulting services to enable the companies to rebuild their supply chain strategies. By enabling businesses to react swiftly, maintain their competitiveness, and satisfy evolving regulatory requirements, these coordinated efforts strengthen the US market and validate the general stability and expansion of the supply chain management landscape.

The report provides a comprehensive analysis of the competitive landscape in the United States supply chain management software market with detailed profiles of all major companies, including:

Latest News and Developments:

- February 2025: Flexport launched over 20 AI-powered products aimed at modernizing global supply chains. Key tools include Flexport Intelligence, which offers natural language insights, and Flexport Control Tower for managing third-party shipments. The company aims to simplify global commerce and enhance operational efficiency using AI and proprietary data.

- February 2025: A two-year strategic relationship was announced by Blue Yonder and the University of Arkansas's Sam M. Walton College of Business to promote the Master of Science in Supply Chain Management program. By utilizing Blue Yonder's technologies and experience, the collaboration will improve supply chain education for upcoming leaders.

- December 2024: Huron purchased AXIA Consulting in order to improve its technological solutions and supply chain expertise. The purchase enables more robust and agile operations for clients by bolstering Huron's Oracle SCM services and growing its Microsoft technologies, especially in the manufacturing, retail, healthcare, and industrial sectors.

- November 2024: ID8 Global, a joint venture between Jabil and Cyferd, introduced a supply chain platform that is totally autonomous and powered by artificial intelligence. The platform transforms global logistics and operations for enterprises by combining Cyferd's AI capabilities with Jabil's supply chain knowledge to provide real-time disruption control and optimal procurement.

- September 2024: Amazon launched its fully-managed "Supply Chain by Amazon" service, streamlining seller operations and optimizing inventory placement. The service offers faster delivery speeds, reducing costs, and increasing sales by 20%. It includes features like AI-driven optimization, Multi-Channel Distribution, and significant discounts on storage and transportation fees.

United States Supply Chain Management Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solution Types Covered | Transportation Management System, Warehouse Management System, Supply Chain Planning, Procurement and Sourcing, Manufacturing Execution System |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | Retail and Consumer Goods, Healthcare and Pharmaceuticals, Manufacturing, Food and Beverages, Transportation and Logistics, Automotive, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States supply chain management software market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States supply chain management software market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the supply chain management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The supply chain management software market in the United States was valued at USD 5.4 Billion in 2025.

The United States supply chain management software market is projected to exhibit a CAGR of 4.34% during 2026-2034, reaching a value of USD 8.1 Billion by 2034.

The United States supply chain management software market is driven by technological advancements, complex logistics needs, and evolving consumer demands. Regulatory compliance, cross-border trade, and the need for real-time visibility push businesses to adopt advanced software solutions, enhancing efficiency and resilience across diverse industries and regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)