United States Team Collaboration Software Market Size, Share, Trends and Forecast by Components, Software Type, Deployment, Industry Vertical, and Region, 2025-2033

United States Team Collaboration Software Market Size and Share:

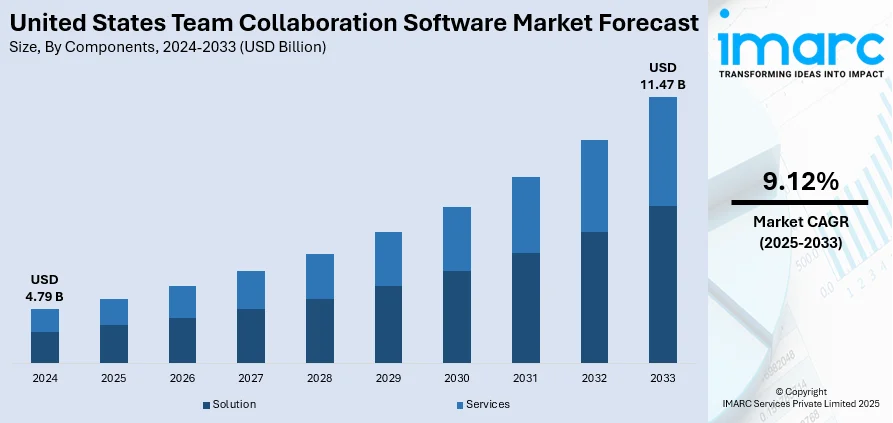

The United States team collaboration software market size was valued at USD 4.79 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 11.47 Billion by 2033, exhibiting a CAGR of 9.12% from 2025-2033. The market is experiencing steady growth, driven by the widespread adoption of hybrid work models, increased demand for real-time communication, and the need for integrated digital tools that enhance productivity. Businesses across various industries investing in platforms that offer seamless messaging, video conferencing, and workflow management. Along with technological advancements and cloud-based solutions, continue to support the expansion of the United States team collaboration software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.79 Billion |

| Market Forecast in 2033 | USD 11.47 Billion |

| Market Growth Rate (2025-2033) | 9.12% |

A significant factor driving the growth of the United States team collaboration software market is the growing adoption of hybrid and remote work arrangements across various sectors. As organizations embrace more flexible work structures, the necessity for real-time communication, task management, and centralized information sharing has become crucial. Companies are investing in digital solutions that facilitate seamless collaboration among distributed teams to uphold productivity and efficiency. This shift has also heightened the demand for tools that combine video conferencing, messaging, and file sharing in a single, cohesive interface, promoting smoother workflows and improving team connectivity regardless of their locations, which in turn contributes positively to the United States team collaboration software market growth. For instance, in April 2024, Eptura unveiled new worktech innovations aimed at enhancing connectivity, collaboration, and security within organizations. These features include improved asset maintenance, AI-driven workspace reservations, and automated check-ins, enabling businesses to optimize resource allocation and enhance employee experiences in hybrid work environments.

To get more information on this market, Request Sample

Another important catalyst is the growing demand for operational agility and automation within business processes. As organizations handle complex projects and cross-functional teams, they need platforms that can enhance communication and reduce inefficiencies. Team collaboration software featuring AI-driven capabilities such as intelligent task assignment, predictive analytics, and process automation enables teams to operate more efficiently. For instance, in January 2025, Celonis, in partnership with Rollio, launched the Process Collaboration Agent to enhance decision-making and optimize processes. This AI-powered tool facilitates teamwork through natural language interactions and seamless integration with tools like Microsoft Teams, enabling companies like Campari Group to improve operational efficiency and manage process exceptions more effectively. Moreover, the need for tailored integrations with CRM, ERP, and project management systems is propelling the adoption of these software solutions. This rising demand to boost productivity while minimizing manual labor is driving the utilization of collaboration platforms among both small businesses and large enterprises in the United States.

United States Team Collaboration Software Market Trends:

Emphasis on Data Security and Compliance

With increasing worries about data breaches and regulatory oversight, organizations are prioritizing secure communication and compliance-focused solutions. Sectors such as healthcare, finance, and legal services require collaboration platforms that adhere to stringent data protection standards, including encryption, audit trails, and role-based access controls. The necessity for GDPR, HIPAA, and other regulatory compliance has prompted vendors to enhance their security frameworks. Companies are now choosing platforms that boost and protect sensitive information. This trend towards trust-centric tools is influencing purchasing decisions and shaping significant United States team collaboration software market trends. For instance, in May 2025, Credo AI launched an integration with Microsoft Azure AI Foundry to enhance AI governance in enterprises. This collaboration enables seamless communication between developers and governance teams, facilitating real-time evaluations of AI systems. The initiative aims to accelerate AI innovation while ensuring compliance, safety, and trust in AI applications.

Shift Toward Hybrid and Remote Work Models

The movement towards hybrid and remote work arrangements is a major factor influencing the United States team collaboration software market outlook. As organizations adjust to flexible work settings, the demand for efficient and real-time collaboration tools has escalated. Software solutions that facilitate smooth communication, project tracking, and document sharing across time zones are increasingly sought after. Businesses now place a premium on platforms that ensure productivity, transparency, and accessibility for both remote and in-office teams. This trend is likely to persist as enterprises invest in scalable, cloud-based collaboration technologies that enhance employee engagement and operational efficiency in a decentralized work environment.

Integration with AI and Automation

AI integration is having a significant impact on the United States team collaboration software market demand. Companies are implementing platforms equipped with AI-driven features like smart scheduling assistants, automated task prioritization, and real-time language translation. These functionalities minimize manual workloads and improve productivity, particularly for teams involved in cross-functional and multilingual projects. AI also aids data-driven decision-making by providing intelligent suggestions and performance analytics. As competition intensifies, vendors are increasingly incorporating automation to tailor user experiences and streamline workflows. For instance, in August 2024, ViewSonic announced the launch of TeamOne, an AI integrated collaboration software designed to enhance productivity in business and education. The browser-based platform features real-time whiteboarding, note summarization, and digital handwriting conversion. TeamOne integrates seamlessly with ViewSonic's visual displays, aiming to improve teamwork efficiency and streamline workflows in hybrid environments. This trend indicates a broader movement toward intelligent collaboration tools that connect teams and enhance how they work and interact on a daily basis.

United States Team Collaboration Software Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States team collaboration software market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on components, software type, deployment, and industry vertical.

Analysis by Components:

- Solution

- Services

The solution segment of the team collaboration software market in the United States encompasses essential platforms and applications designed for communication, task management, file sharing, and video conferencing. These tools play a critical role in facilitating distributed workforces and enhancing team productivity across various sectors. Organizations are increasingly in search of comprehensive, user-friendly solutions that seamlessly integrate with existing workflows while providing secure, real-time collaboration features. The demand for scalable, cloud-based software is growing, spurred by the necessity for continuous connectivity, increased productivity, and streamlined operations in hybrid and remote work settings.

The services segment focuses on the implementation, customization, and maintenance of team collaboration software across various business environments. This includes professional services such as system integration, training, and technical support, ensuring that software solutions are specifically designed to meet the needs of each organization. As more businesses embrace digital collaboration tools, they depend on service providers for efficient onboarding and problem resolution. These services are vital for maximizing software performance, enhancing user adoption, and improving return on investment. The increasing complexity of business communication requirements has made support services a crucial element of the overall value proposition within the collaboration software market.

Analysis by Software Type:

- Conferencing

- Communication and Co-Ordination

The conferencing sector within the US team collaboration software market focuses on applications that facilitate virtual meetings, video conferencing, and webinars, enabling real-time visual communication. These tools have become vital for remote and hybrid work arrangements, featuring capabilities such as screen sharing, breakout rooms, and meeting recording. Organizations across various industries utilize conferencing software for team discussions, client interactions, and training sessions. The increasing focus on visual communication and reliable connectivity is driving continuous advancements and greater adoption in this area.

Communication and coordination tools are essential for everyday operations, assisting teams in managing conversations, tasks, and collaborative projects across different departments. This category encompasses messaging applications, task management systems, shared calendars, and file-sharing tools. These platforms enable both asynchronous and real-time communication, ensuring that dispersed teams remain aligned and effective. Businesses are increasingly seeking integrated solutions that merge messaging, document collaboration, and project management into a single interface. The demand for adaptable, cloud-based tools that enhance workflow visibility and team collaboration is steadily rising throughout the United States.

Analysis by Deployment:

- On-Premises

- Cloud-based

The on-premises deployment model is favored by organizations in the US team collaboration software market that emphasize control over data, adherence to internal security measures, and compliance with regulations. This model enables businesses to host software on their own IT infrastructure, providing extensive customization and management options. It is particularly popular among government agencies, large corporations, and sectors with stringent data governance needs. While there is an increasing trend towards cloud adoption, many companies still prefer the on-premises model for its perceived security advantages and its compatibility with existing IT systems.

The cloud-based deployment model is quickly becoming more prevalent in the US team collaboration software market, owing to its scalability, accessibility, and lower initial costs. It facilitates real-time collaboration from any location, making it well-suited for remote and hybrid work settings. Key benefits contributing to its popularity include automatic updates, data backup, and minimized IT maintenance requirements. Both small and medium enterprises, as well as large corporations, are increasingly embracing cloud-based solutions for enhanced flexibility and smooth integration with other cloud services.

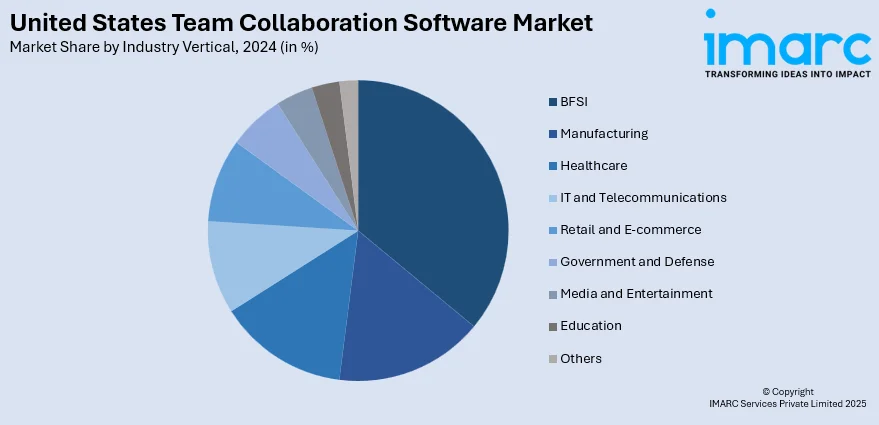

Analysis by Industry Vertical:

- BFSI

- Manufacturing

- Healthcare

- IT and Telecommunications

- Retail and E-commerce

- Government and Defense

- Media and Entertainment

- Education

- Others

In the BFSI sector, collaboration software enhances secure communication, compliance monitoring, and workflow alignment across various departments. Tools that facilitate real-time data sharing, integrate customer service, and support internal teamwork enable financial institutions to optimize their operations. Strong security features and audit trails are essential, making these collaboration platforms a fundamental part of digital transformation efforts in banking and finance.

The manufacturing industry employs collaboration software to facilitate coordination among production units, supply chain partners, and management teams. By providing real-time information on inventory, scheduling, and quality control, these tools boost efficiency. Integrated communication systems aid in quicker decision-making, minimize delays, and ensure adherence to safety regulations, proving vital for productivity in distributed manufacturing settings.

In healthcare, collaboration tools are crucial for managing patient information, coordinating care among teams, and enabling telehealth services. Features like secure messaging, file sharing, and immediate communication enhance response times and treatment coordination. Moreover, the software ensures compliance with healthcare regulations while maintaining patient confidentiality, benefiting hospitals, clinics, and research facilities in both administrative and clinical processes.

The IT and telecommunications sector significantly depends on collaboration software for agile project management, product development, and teamwork across functions. These platforms aid in connecting distributed teams, help manage intricate tasks, and speed up product development cycles. Their integration with code repositories, cloud services, and customer support tools is vital for sustaining productivity and fostering innovation in tech-driven fields.

Retail and e-commerce companies utilize collaboration software to link headquarters with store operations, oversee supply chains, and manage marketing initiatives. These tools allow for real-time updates, inventory management, and efficient communication across departments. In a dynamic, customer-centric environment, effective collaboration promotes prompt decision-making and enhances customer service, improving operational agility and responsiveness to the market.

Government and defense agencies leverage collaboration software to oversee internal communication, coordinate public services, and enhance project execution. Given stringent data security and compliance standards, these platforms provide encrypted communication and access controls. Collaboration tools also improve workflows between departments, facilitate document sharing, and aid crisis management, leading to more efficient and transparent government functions.

The media and entertainment industry benefits from collaboration software for content planning, creative processes, and production management. Teams utilize these tools for real-time communication, project timeline tracking, and sharing large volumes of digital content. Collaboration platforms enable remote collaboration among editors, producers, and marketing teams, allowing for quicker content delivery and increased creative adaptability.

In the education sector, collaboration software supports remote learning, administrative functions, and engagement between faculty and students. Platforms that offer virtual classrooms, shared documents, and live discussions significantly improve the educational experience. These tools also aid faculty collaboration, assignment management, and student evaluations, allowing institutions, from schools to universities, to maintain continuity in both teaching and academic activities.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region demonstrates a strong uptake of team collaboration software, largely due to the dense presence of financial institutions, technology firms, and educational organizations. The demand is fueled by hybrid work environments, ongoing digital transformation efforts, and regulatory requirements. Urban areas such as New York and Boston play a crucial role in market expansion, driven by significant enterprise deployments and innovation-centric tech ecosystems.

In the Midwest, the adoption of team collaboration software is steadily increasing across sectors like manufacturing, education, and healthcare. Organizations are investing more in digital tools to support remote teams and boost productivity in distributed settings. The focus on modernizing the workforce, along with the growth of remote learning and virtual healthcare, continues to elevate the need for collaborative digital solutions in this region.

The South sees substantial uptake of team collaboration software across various sectors including retail, telecommunications, and government. Growth is propelled by urban development, corporate relocations, and the rise of technology hubs. As businesses in states like Texas, Georgia, and Florida adopt flexible work models, the demand for secure, scalable, and integrated collaboration tools continues to rise.

The West region, particularly led by technology and media centers in California and Washington, is a key player in driving innovation and adoption of team collaboration software. Startups and established enterprises in this area utilize advanced digital platforms to manage remote teams, streamline development processes, and maintain competitive flexibility. The high-tech industry and creative sectors significantly contribute to the vibrant market growth in this region.

Competitive Landscape:

The landscape of team collaboration software in the United States is marked by ongoing innovation, shifting user demands, and strong industry-wide interest. Companies are focused on improving user experience by integrating features such as messaging, video calls, file sharing, and automation of workflows. Additionally, vendors are emphasizing security, scalability, and compatibility with existing enterprise systems to maintain their competitive edge. The shift towards hybrid work environments and an increasing reliance on digital communication platforms have further ramped up activity in this market. As adoption continues to rise across various sectors, the United States team collaboration software market forecast suggests a trajectory of sustained growth, driven by enhanced functionalities and adaptable deployment options.

The report provides a comprehensive analysis of the competitive landscape in the United States team collaboration software market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Volie launched Pulse, an AI-powered call intelligence tool that analyzed 100% of BDC calls to provide real-time summaries, sentiment analysis, and performance dashboards. Integrated into existing workflows, Pulse streamlined training, enhanced team productivity, and improved customer engagement for automotive dealerships across the United States.

- March 2025: Helport AI launched an upgraded Insurance Edition, partnering with five U.S. insurance agencies to pilot the platform. The AI-powered software enhanced team collaboration through real-time compliance monitoring, smart marketing, and AI-driven expertise, streamlining operations, improving service quality, and enabling data-driven decision-making across distributed insurance teams.

- February 2025: Boxlight launched the Clevertouch Max 2 in the U.S., offering customizable interfaces and collaboration software like LYNX Whiteboard and CleverShare. Integrated with the ATTENTION! System for communication and safety, Max 2 enhanced team collaboration through responsive 4K touch, powerful audio, and seamless connectivity across educational and business environments.

- February 2025: Nvidia launched "Signs," an AI-powered sign-language learning platform featuring a 3D avatar tutor and real-time video feedback. Developed with the American Society for Deaf Children, Signs aimed to enhance accessibility and team collaboration by enabling ASL learning and sign recognition for inclusive communication across digital platforms.

United States Team Collaboration Software Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered | Solution, Services |

| Software Types Covered | Conferencing, Communication and Co-Ordination |

| Deployments Covered | On-Premises, Cloud-based |

| Industry Verticals Covered | BFSI, Manufacturing, Healthcare, IT and Telecommunications, Retail and E-commerce, Government and Defense, Media and Entertainment, Education, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States team collaboration software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States team collaboration software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States team collaboration software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The team collaboration software market in the United States was valued at USD 4.79 Billion in 2024.

The United States team collaboration software market is projected to exhibit a CAGR of 9.12% during 2025-2033, reaching a value of USD 11.47 Billion by 2033.

Key factors driving the United States team collaboration software market include the rise of hybrid and remote work models, growing demand for real-time communication tools, increased focus on productivity and workflow efficiency, and the integration of advanced features like AI, automation, and secure cloud-based access across organizations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)