United States Ultrasound Devices Market Size, Share, Trends and Forecast by Product Type, Device Display Type, Device Portability, Application, End Use, and Region, 2025-2033

United States Ultrasound Devices Market Size and Share:

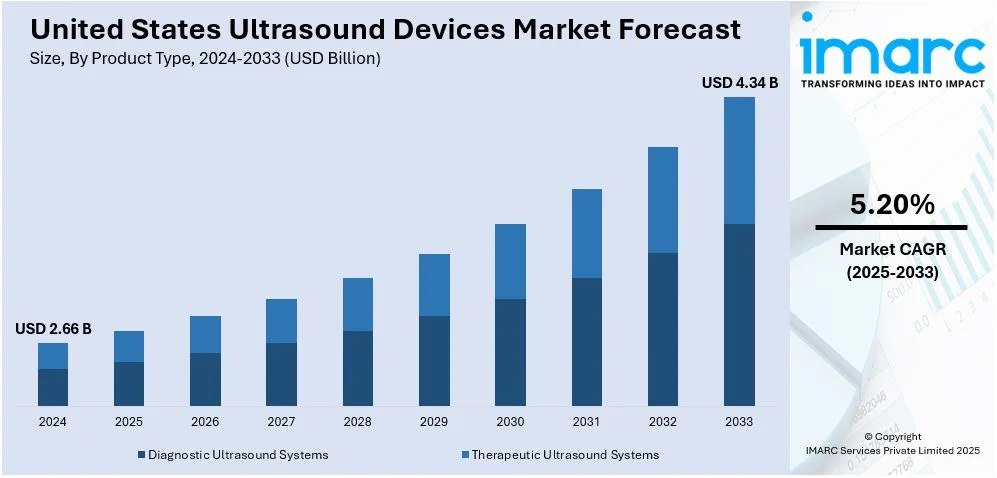

The United States ultrasound devices market size was valued at USD 2.66 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.34 Billion by 2033, exhibiting a CAGR of 5.20% from 2025-2033. The United States ultrasound devices market is driven by technological advancements, rising prevalence of chronic diseases, increased demand for minimally invasive diagnostic tools, and expanding applications in obstetrics, cardiology, and oncology. Additionally, growing healthcare expenditures, an aging population, and the adoption of point-of-care ultrasound systems are boosting the United States ultrasound devices market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.66 Billion |

| Market Forecast in 2033 | USD 4.34 Billion |

| Market Growth Rate (2025-2033) | 5.20% |

The United States ultrasound devices market is growing rapidly, driven by several factors. Advanced technologies like 3D/4D imaging, AI integration, and portable point-of-care systems are making ultrasound devices indispensable across medical fields. These innovations improve diagnostic accuracy, reduce procedure times, and enhance patient care, boosting their adoption. The rising incidence of chronic conditions like heart disease, cancer, and obesity has heightened the need for reliable diagnostic tools. According to the Centers for Disease Control and Prevention (CDC), every 40 seconds in the US, someone has a heart attack. Approximately 805,000 Americans suffer a heart attack each year. Of these, 200,000 are people who have already experienced a heart attack, and 605,000 are those who are having their first heart attack. Ultrasound devices stand out for their non-invasive nature, real-time imaging, and cost-effectiveness compared to other imaging options, making them a preferred choice.

An aging population base further fuels the United States ultrasound devices market demand, as older adults frequently require imaging for musculoskeletal and vascular conditions. Similarly, a growing focus on women’s health, especially in obstetrics and gynecology, has increased ultrasound use in prenatal care and reproductive health. Healthcare providers are increasingly turning to point-of-care ultrasound systems for bedside imaging, particularly in emergency rooms, critical care, and remote settings. The rise of telemedicine has also accelerated this trend, making these devices essential in virtual healthcare. For instance, in May 2024, SHL Telemedicine Ltd., a key provider and developer of advanced personal telemedicine solutions, announced the launch of its SmartHeart® membership program in the US.

United States Ultrasound Devices Market Trends:

Significant Technological Advancements

Technological innovations, like artificial intelligence (AI) integration, 3D/4D imaging, and portable point-of-care ultrasound devices, are significantly driving the U.S. ultrasound devices market. These advancements enhance diagnostic accuracy, reduce examination time, and improve patient outcomes. Portable devices are transformative, allowing for bedside imaging in emergency, critical care, and remote settings. AI-powered ultrasound systems streamline workflows and aid in precise image interpretation, making them valuable in various specialties. These improvements have increased adoption across obstetrics, cardiology, oncology, and musculoskeletal imaging, positioning ultrasound devices as indispensable diagnostic tools in modern healthcare, thus representing one of the key United States ultrasound devices market trends. For instance, in October 2024, HealthCare announced the launch of the Versana Premier™, the newest model in the Versana ultrasound devices product portfolio of dependable, reasonably priced, user-friendly, and adaptable ultrasound systems. While providing a seamless user experience and assisting doctors in meeting patient demands, Versana Premier offers automation and AI-enabled productivity solutions to improve workflow and clinical features intended to promote clinical efficiency and accuracy. The Versana Premier is made to meet the multifunctional requirements of medical professionals in a variety of clinical specializations and care areas, such as cardiology, musculoskeletal (MSK), general practice, and obstetrics and gynecology.

Rising Prevalence of Chronic Diseases

The growing prevalence of chronic and lifestyle-related diseases, including cardiovascular conditions, cancer, and obesity, has amplified the demand for advanced diagnostic tools. According to industry reports, in adolescent females, the prevalence of overweight/obesity was 63.0% in Mississippi, 59.4% in Alabama, and 59.0% in Oklahoma. Among male adolescents, the highest prevalence of overweight/obesity was seen in Texas (52.4%), West Virginia (52.2%), and Oklahoma (51.1%). In adult males, the prevalence of overweight/obesity was more than 80% in North Dakota, with Washington, DC, having the lowest prevalence, at 65.3%. In adult women, the prevalence ranged from 63.7% in Hawaii to 79.9% in Mississippi. In males, the prevalence of obesity alone exceeded 40% in 39 states and over 45% in 14 states. With their non-invasive nature and real-time imaging capabilities, ultrasound devices are widely used for early detection, monitoring, and treatment planning for these conditions. As compared to other imaging modalities, ultrasounds are cost-effective and versatile, making them an attractive option for healthcare providers. The increasing burden of chronic diseases necessitates reliable and accessible diagnostic solutions, contributing to the steady growth of the ultrasound devices market.

Increasing Aging Population

The aging population in the U.S. is another major driver of the ultrasound devices market. According to the Population Reference Bureau (PRB), The number of Americans 65 and older is expected to rise by 47%, from 58 million in 2022 to 82 million in 2050. It is anticipated that the proportion of the population that is 65 and older will increase from 17% to 23%. Older adults are more susceptible to chronic health conditions such as vascular diseases, musculoskeletal issues, and organ dysfunctions, which require frequent diagnostic imaging. Ultrasound devices are commonly used in diagnosing and monitoring these conditions due to their safety, affordability, and effectiveness. The geriatric population’s increasing healthcare needs have also led to a higher demand for advanced diagnostic tools, including portable and point-of-care ultrasound systems, to improve patient care outcomes.

United States Ultrasound Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States ultrasound devices market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, device display type, device portability, application, and end use.

Analysis by Product Type:

- Diagnostic Ultrasound Systems

- 2D Imaging Systems

- 3D and 4D Imaging Systems

- Doppler Imaging

- Therapeutic Ultrasound Systems

- High-Intensity Focused Ultrasound (HIFU)

- Extracorporeal Shockwave Lithotripsy (ESWL)

Diagnostic ultrasound systems are expected to hold the majority of the United States ultrasound devices market share as these systems are extensively employed in cardiology along with obstetrics, gynecology and radiology fields. The system enables real-time display of organs and tissues alongside blood flow viewing without invasive procedures. The marketplace has responded favorably to technological breakthroughs that incorporate artificial intelligence and 3D/4D imaging systems thus raising diagnostic performance and workflow speed. Healthcare facilities continue to increase their purchase of diagnostic ultrasound systems for hospitals along with clinics and outpatients because of elevated chronic disease burden and intensified early detection needs and treatment monitoring requirements.

The market for therapeutic ultrasound systems maintains substantial demand because these systems deliver successful non-invasive treatments for pain management along with physical therapy requirements and precise cancer treatments. HIFU and ESWT have become well-known therapeutic tools as they deliver focused treatment which makes them safe for tumor and kidney stone and musculoskeletal injury reduction without invasive procedures. The market adoption is fueled by people preferring minimal invasive solutions and advanced therapeutic ultrasound technologies. Therapeutic ultrasound systems in the United States market have received extra momentum from the aging population, creating healthcare necessities.

Analysis by Device Display Type:

- Color Ultrasound Devices

- Black and White (B/W) Ultrasound Devices

Color ultrasound devices are expected to maintain their position in the market because of their color Doppler technology which creates improved imaging for diagnostic purposes. The technology allows healthcare providers to observe blood movement along with vascular anatomy in different fields such as vascular imaging, obstetrics and cardiology. These devices continue to fuel the demand because of their utility in diagnostic tools for cardiovascular diseases which show rising prevalence rates. The widespread acceptance of these devices is boosted by their implementation for fetal observation, chronic disease supervision and female health diagnostic assessment. 3D/4D imaging coupled with portable color ultrasound systems have advanced to such a degree that they now provide a strong presence in different medical environments.

Black and white ultrasound devices remain a significant segment in the U.S. market due to their affordability and effectiveness in routine diagnostic procedures. These devices are widely used in primary care, rural healthcare, and smaller medical facilities where cost considerations are paramount. B/W ultrasound systems are reliable for basic imaging needs, such as abdominal scans and musculoskeletal assessments, making them an essential tool for general practitioners. Their ease of use and low maintenance requirements appeal to healthcare providers focused on cost-effective solutions. Despite advancements in color imaging, the demand for B/W systems persists due to their practical and economic advantages.

Analysis by Device Portability:

- Trolley/Cart-Based Ultrasound Devices

- Compact/Handheld Ultrasound Devices

Trolley or cart-based ultrasound devices hold a significant share in the U.S. ultrasound devices market due to their versatility and high-performance capabilities. These systems are widely used in hospitals, diagnostic imaging centers, and specialized clinics for detailed imaging in cardiology, radiology, and obstetrics. Their advanced imaging features, larger displays, and robust software make them ideal for comprehensive diagnostics and complex procedures. These devices support high patient volumes and offer reliability in diverse clinical settings. The demand is further driven by advancements in imaging technologies, such as 3D/4D and Doppler imaging, which are seamlessly integrated into trolley-based systems.

Compact and handheld ultrasound devices are gaining prominence in the U.S. market because of their ease of use and portability along with their expanding use in point-of-care facilities. These portable imaging devices offer real-time direct visualization without requiring patients to leave their beds inside emergency rooms, intensive care units and remote healthcare sites which allows healthcare professionals to make better clinical decisions to improve patient results. Smaller clinics as well as rural healthcare facilities find compact ultrasound devices attractive because they are more affordable than larger systems. The capability and clarity of handheld ultrasound devices have improved through wireless technology advancements combined with Artificial Intelligence implementations. This segment expands as the rising interest in telemedicine combined with home healthcare programs boosts market demand.

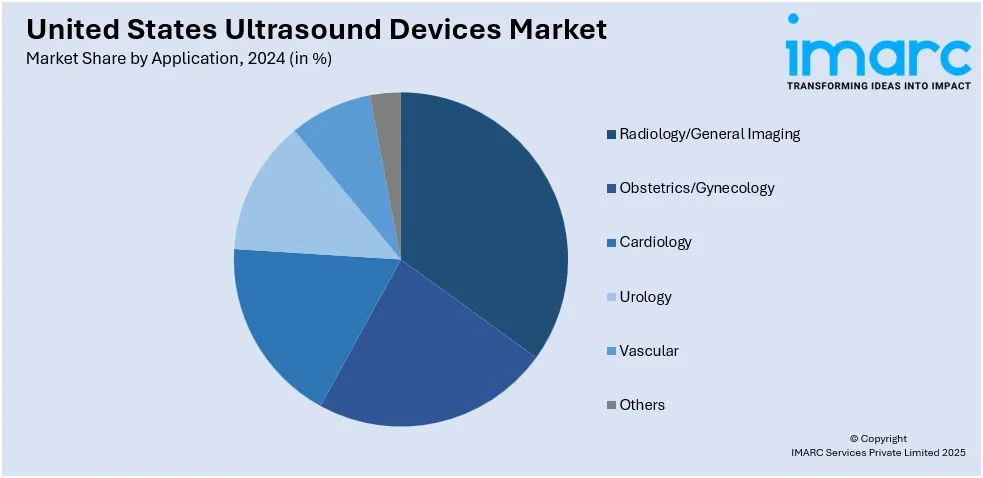

Analysis by Application:

- Radiology/General Imaging

- Obstetrics/Gynecology

- Cardiology

- Urology

- Vascular

- Others

Radiology/general imaging occupies a substantial market share of the U.S. ultrasound devices market because doctors use ultrasound frequently to diagnose abdominal and musculoskeletal system and organ-related conditions. The medical tool stands out because it combines real-time imaging with low costs and non-invasive procedures, thus establishing itself as a prominent examination instrument for basic diagnostic applications. 3D/4D imaging technologies along with AI-based analytics systems add to diagnostic accuracy because of their modern capabilities. The growing prevalence of chronic diseases, such as liver and kidney disorders, further drives demand for ultrasound in radiology/general imaging settings.

Obstetrics/gynecology leads the US ultrasound devices market as medical professionals depend heavily on ultrasound for women’s healthcare needs from prenatal to reproductive medical care. The diagnostic tool of ultrasound serves multiple purposes for fetal tracking along with pregnancy assessments and gynecological illness evaluation. Modern imaging technology can show detailed pictures of fetal development through 3D/4D imaging systems which leads to better clinical success rates. The maternal health sector experiences increased demand because of enhanced care access and broader knowledge of women’s healthcare combined with advanced gynecological diagnostic methods.

Cardiology is a key segment in the U.S. ultrasound devices market because of the increasing frequency of cardiovascular diseases. Ultrasonic echocardiography stands as the primary cardiac application that uses ultrasound for real-time non-invasive visualization of heart structure alongside functional assessment for early diagnosis and constant tracking purposes. Doppler imaging developments and portable devices allow medical professionals to use ultrasound in different emergency healthcare environments. The increasing focus on preventive cardiology and early detection of heart conditions further supports the widespread adoption of ultrasound in this specialty.

Analysis by End Use:

- Hospitals

- Imaging Centers

- Research Centers

Hospitals dominate the U.S. ultrasound devices market due to their high patient volumes and the need for advanced diagnostic tools across multiple specialties. Ultrasound is widely used in radiology, cardiology, obstetrics, and emergency care within hospitals. The availability of skilled professionals and advanced infrastructure facilitates the adoption of high-performance ultrasound systems. Hospitals also benefit from government reimbursements for diagnostic imaging, further driving demand. Additionally, the integration of portable and point-of-care ultrasound devices enhances efficiency in critical and bedside care.

Imaging centers stand as major contributors to U.S. ultrasound devices market share due to their exclusive dedication to diagnostic special services. Imaging centers serve the expanding need for non-invasive diagnostic procedures for patients suffering from cardiovascular conditions as well as cancer and musculoskeletal diseases. Advanced ultrasound technology in these centers provides quality diagnostic services while charging lower prices compared to hospital facilities. The growing number of physician referrals combined with easy outpatient services makes these facilities highly sought after by users. Continuous technological upgrades further boost their market share.

Research centers hold a substantial share in the ultrasound devices market due to their focus on technological innovation and medical advancements. These centers drive the development of cutting-edge ultrasound systems, such as AI-integrated and 3D/4D imaging devices, enhancing diagnostic accuracy and treatment planning. Government and private funding for medical research supports ultrasound adoption in studies on chronic diseases, prenatal care, and therapeutic applications. Collaboration with manufacturers for clinical trials and product development further positions research centers as key contributors to the market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast is a leading region in the U.S. ultrasound devices market, driven by its advanced healthcare infrastructure and concentration of research institutions. High healthcare spending and access to state-of-the-art diagnostic technologies fuel adoption. The region also benefits from a large aging population requiring frequent imaging for chronic and age-related conditions. Additionally, the presence of leading hospitals and medical schools promotes early adoption of innovative ultrasound technologies, further strengthening the market in this region.

The Midwest drives the U.S. ultrasound devices market due to its growing healthcare networks and emphasis on rural health services. Rising prevalence of cardiovascular diseases, obesity, and diabetes in the region increases demand for diagnostic imaging. Initiatives to improve healthcare accessibility in underserved areas boost adoption of portable and point-of-care ultrasound systems. Additionally, investments in telemedicine and diagnostic centers enhance market growth, while affordable healthcare services make ultrasound a preferred imaging modality in the Midwest.

The South leads the U.S. ultrasound devices market, supported by its large and diverse population and increasing chronic disease burden. High rates of conditions like obesity, cardiovascular diseases, and diabetes drive demand for ultrasound diagnostics. Expanding healthcare infrastructure, especially in urban and suburban areas, supports market growth. The region also sees a growing focus on maternal health and prenatal care, further increasing ultrasound adoption in obstetrics. Additionally, government programs and investments in healthcare boost accessibility and usage.

The West contributes significantly to the U.S. ultrasound devices market, driven by its advanced healthcare facilities and technology-focused medical practices. High adoption of portable and AI-integrated ultrasound systems caters to the region’s demand for cutting-edge diagnostics. Rising prevalence of lifestyle-related diseases and a focus on preventive healthcare further increase usage. The growing popularity of telemedicine and point-of-care imaging supports adoption in rural and remote areas. Research-driven institutions and collaborations also foster innovation, boosting the market in the West.

Competitive Landscape:

The United States ultrasound devices market is highly competitive, featuring key players like GE HealthCare, Siemens Healthineers, Philips, Canon Medical Systems, and Fujifilm. These companies focus on technological innovation, including AI integration, 3D/4D imaging, and portable systems, to enhance diagnostic accuracy and usability. Smaller players and startups are contributing with niche technologies, such as handheld and point-of-care ultrasound devices. Strategic partnerships, acquisitions, and R&D investments drive competition. The market is also shaped by regulatory approvals, reimbursement policies, and increasing demand for advanced imaging in radiology, obstetrics, cardiology, and emergency care. This competitive environment promotes innovation, improving accessibility and patient outcomes. For instance, in July 2024, GE HealthCare declared that it reached an agreement to pay roughly $51 million to acquire the clinical artificial intelligence (AI) software division of Intelligent Ultrasound Group PLC (Intelligent Ultrasound). Leading the way in integrated AI-powered image analysis technologies, Intelligent Ultrasound aims to improve the intelligence and effectiveness of ultrasound. By integrating these technologies throughout its ultrasound range, GE HealthCare intends to bolster its capabilities with technology that facilitates better workflows and increases patient and physician convenience.

The report provides a comprehensive analysis of the competitive landscape in the keyword market with detailed profiles of all major companies, including:

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- GE Healthcare

- Koninklijke Philips NV

- Siemens Healthineers

- Carestream Health Inc.

- Samsung Electronics Co. Ltd

- Hologic Inc.

- Mindray Medical International Limited

- Esaote SpA

Latest News and Developments:

- In February 2024, Butterfly Network declared the commercial launch of Butterfly iQ3, its third-generation handheld point-of-care ultrasound (POCUS) system, in the US. The Butterfly iQ3 system, which has been approved by the US Food and Drug Administration (FDA), is based on the P4.3 ultrasound-on-chip technology, which has the fastest digital data transfer rate in the world.

- In July 2024, The Inteleos Foundation, a global non-profit organization committed to promoting equity in healthcare technology, and Vave Health, a pioneer in the production of ultrasound devices, announced a new collaboration aimed at expanding access to ultrasound equipment in underserved and low-income communities across the globe.

- In September 2024, GE Healthcare introduced a portable ultrasound machine called Venue Sprint. By combining the popular Venue software with artificial intelligence-powered tools, the device expands on the capabilities of GE HealthCare's Venue ultrasound series and provides wireless probing capabilities and unparalleled image quality.

- In November 2024, TeleRay, a virtual care company committed to offering the most scalable, easily accessible, and user-friendly healthcare communications platform for radiology, partnered with Mindray, a leading global developer of healthcare technologies and solutions with expertise in patient monitoring, anesthesia, and ultrasound. With Mindray's Resona 7 and Resona I9 ultrasound systems, which meet the requirements of radiology, vascular, women's health, pediatric, and shared service imaging applications, the partnership seeks to revolutionize the way physicians obtain ultrasound imaging.

United States Ultrasound Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Device Display Types Covered | Color Ultrasound Devices, Black and White (B/W) Ultrasound Devices |

| Device Portability Covered | Trolley/Cart-Based Ultrasound Devices, Compact/Handheld Ultrasound Devices |

| Applications Covered | Radiology/General Imaging, Obstetrics/Gynecology, Cardiology, Urology, Vascular, Others |

| End Uses Covered | Hospitals, Imaging Centers, Research Centers |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States ultrasound devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States ultrasound devices market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States ultrasound devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ultrasound devices market in the United States was valued at USD 2.66 Billion in 2024.

The U.S. ultrasound devices market is driven by technological advancements like AI integration and portable systems, the rising prevalence of chronic diseases, and the growing demand for non-invasive diagnostics. An aging population, increased focus on women’s health, expanding telemedicine, and supportive government policies also contribute to the market's growth and adoption.

The United States ultrasound devices market is projected to exhibit a CAGR of 5.20% during 2025-2033, reaching a value of USD 4.34 Billion by 2033.

Some of the major players in the United States ultrasound devices market include Canon Medical Systems Corporation, Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips NV, Siemens Healthineers, Carestream Health Inc., Samsung Electronics Co. Ltd., Hologic Inc., Mindray Medical International Limited, Esaote SpA, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)