United States Unified Communications Market Size, Share, Trends, and Forecast by Component, Product, Organization Size, End User, and Region 2025-2033

United States Unified Communications Market Overview:

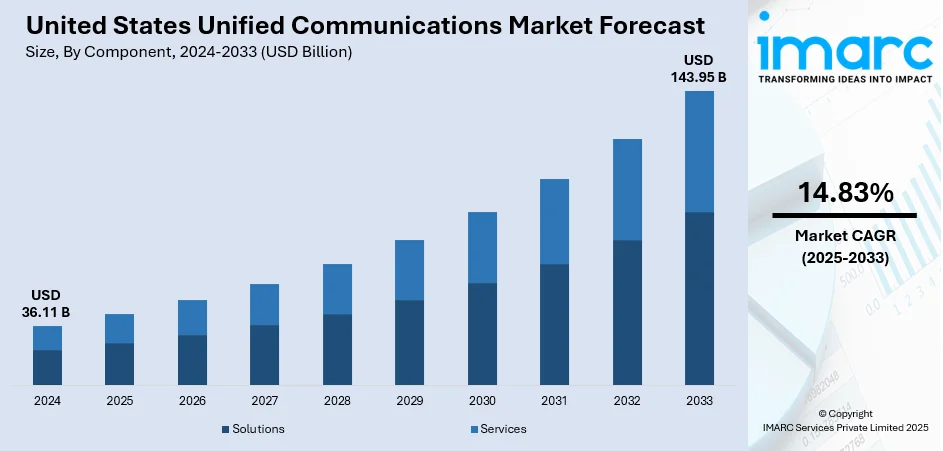

The United States unified communications market size was valued at USD 36.11 Billion in 2024. Looking forward, the market is expected to reach USD 143.95 Billion by 2033, exhibiting a CAGR of 14.83% during 2025-2033. The market is experiencing steady growth, driven by increasing remote work adoption, cloud-based collaboration tools, and demand for integrated communication platforms across enterprises. The shift toward hybrid work environments and digital transformation initiatives further fuels market expansion. Key players are focusing on innovation and scalability to stay competitive, thus supporting the United States unified communications market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 36.11 Billion |

| Market Forecast in 2033 | USD 143.95 Billion |

| Market Growth Rate (2025-2033) | 14.83% |

United States Unified Communications Market Analysis:

- Major Drivers: The U.S. unified communications industry is propelled by growing adoption of remote work, cloud-based collaboration software, and need for integrated voice, video, and messaging capabilities. Businesses require cost savings, streamlined processes, and mobility. Growing hybrid work patterns, digital transformation projects, and employee productivity driving attention boost market adoption across sectors.

- Key Market Trends: Key trends are increasing dependence on AI-enabled collaboration tools, convergence of unified communications with CRM and ERP platforms, and swift transition from on-premises to cloud platforms. Use of video conferencing, VoIP, and team messaging software increases further. Security, interoperability, and mobile-first solutions drive enterprise communication strategies substantially.

- Market Challenges: Challenges in the market include data privacy issues, interoperability between different platforms, and migrating from legacy platforms at high cost. Organizations experience difficulty in user adoption, network stability, and regulatory standards compliance. Moreover, competition from providers and changing cybersecurity threats make unified communication seamless deployments across enterprises challenging.

- Market Opportunities: Possibilities are in AI-powered automation, deeper analytics, and 5G-connected communications solutions. Small and medium-sized enterprises offer growth prospects in low-cost, scalable unified communications services. Hybrid work growth creates the demand for uninterrupted collaboration solutions. Suppliers with secure, adaptable, and sector-specific solutions can gain competitive edge in an ever-changing U.S. environment.

The rise of hybrid and remote work arrangements has fueled the demand for seamless, real-time collaboration tools. Unified communications platforms integrate video, voice, messaging, and file sharing to support productivity and team connectivity across dispersed locations. Enterprises are increasingly investing in UC to maintain operational continuity and employee engagement. The shift toward cloud-based solutions, particularly Unified Communications as a Service (UCaaS), has enabled businesses to scale communication infrastructure flexibly and affordably. Cloud platforms reduce capital expenditure, simplify deployment, and offer easier maintenance, making them attractive for both SMEs and large enterprises.

To get more information on this market, Request Sample

As organizations accelerate digital transformation, UC tools are being integrated with CRM, project management, and AI-driven analytics to streamline workflows and enhance user experience. These integrations improve responsiveness, decision-making, and customer engagement, which is driving the United States unified communications market growth. For instance, in February 2023, Zoho Corporation, a prominent global tech firm, introduced its unified communications solution, Trident, alongside enhanced collaboration tools. The launch aims to simplify cross-channel communication for businesses, minimize confusion caused by using multiple tools, and boost overall digital adoption across organizations through more streamlined and integrated technologies. With growing mobile usage and BYOD policies, companies need communication platforms that ensure secure, device-agnostic access. UC solutions support consistent performance across smartphones, tablets, and desktops, enhancing workforce flexibility while maintaining enterprise-level security.

United States Unified Communications Market Trends:

Hybrid Work and Remote Collaboration Demand

The rise in remote and hybrid work models post-COVID-19 has significantly driven the demand for unified communications (UC) solutions in the United States. Businesses are increasingly seeking tools that enable seamless collaboration among distributed teams, fostering real-time connectivity across departments and geographies. According to reports, 74% of US companies are already using or plan to implement a permanent hybrid work model, highlighting the urgent need for flexible and robust UC infrastructure. According to the United States unified communications market trends, this shift is not just a temporary adaptation but a long-term structural transformation of workplace norms, prompting investments in scalable, integrated communication systems. As a result, UC adoption is rising as organizations look to improve productivity, employee engagement, and workflow continuity in remote and hybrid setups.

Mobile, Cloud, and 5G Integration

Widespread mobile device usage, the rise of BYOD (Bring Your Own Device) policies, and cloud-based deployments are reshaping UC needs. Companies now prioritize compatibility across devices and platforms to enable seamless operations. 69% of IT decision-makers in the US believe BYOD is a positive move for their firms, pushing UC providers to create adaptable solutions. Simultaneously, cloud adoption is accelerating due to its scalability, cost-effectiveness, and ease of integration. Adding to this momentum, the growing availability of 5G networks, now reaching 90% of the US population with low-band coverage, is enhancing communication reliability and speed, making advanced UC features more accessible and practical across both urban and rural areas.

Digital Transformation and Intelligent Communication Tools

The ongoing digital transformation across industries is fueling the need for advanced UC solutions that drive efficiency and customer engagement, which is creating a positive United States unified communications market outlook. Businesses are adopting tools like AI-powered chatbots, automated workflows, and data analytics to streamline internal communication and enhance client service. As improving customer experience becomes a top priority, UC platforms are being deployed to unify channels, reduce response time, and personalize interactions. Simultaneously, the increasing demand for cybersecurity and data privacy is compelling organizations to invest in secure UC systems. With AI and ML continuing to evolve, the integration of intelligent functionalities offers lucrative opportunities for market growth by enabling smarter, faster, and more reliable enterprise communication.

United States Unified Communications Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States unified communications market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on component, product, organization size, and end user.

Analysis by Component:

- Solutions

- Instant and Unified Messaging

- Audio and Video Conferencing

- IP Telephony

- Others

- Services

- Professional Services

- Managed Services

According to the United States unified communications market analysis, solutions stand as the largest component in 2024, holding 63.2% of the market due to the widespread adoption of integrated communication tools such as VoIP, video conferencing, messaging platforms, and collaboration software. Businesses are increasingly opting for unified solutions that consolidate multiple communication channels into a single platform to enhance productivity, reduce operational complexity, and streamline IT management. These solutions offer scalability, cross-device compatibility, and integration with existing enterprise systems, making them highly attractive for organizations of all sizes. Moreover, the rise of remote and hybrid work models has accelerated demand for cloud-based UC solutions that support real-time collaboration. Continuous innovation, including AI-driven features and analytics, further boosts the dominance of the solution segment in the US market.

Analysis by Product:

- On-premises

- Hosted

The hosted segment holds the largest share in the market due to its flexibility, scalability, and cost-efficiency. Unlike on-premise systems, hosted solutions are managed off-site by service providers, eliminating the need for businesses to invest heavily in infrastructure and maintenance. According to the United States unified communications market forecast, this model is especially appealing to small and mid-sized enterprises seeking enterprise-grade communication tools without high upfront costs. Additionally, the shift toward remote and hybrid work has accelerated demand for cloud-based hosted platforms, which enable seamless communication from any location or device. Hosted UC solutions also offer easier upgrades, integration with other cloud services, and rapid deployment. These advantages make the hosted model the preferred choice across various industries, driving its market leadership in the US.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises hold the largest share in the market due to their extensive communication needs, global operations, and large workforce. These organizations require robust, secure, and scalable communication solutions to manage internal collaboration across departments and geographical locations. Unified communications platforms help streamline workflows, improve productivity, and support integrated voice, video, and messaging services, key for maintaining operational efficiency. Moreover, large enterprises have the financial resources to invest in comprehensive UC systems and advanced features such as AI integration, data analytics, and enhanced security protocols. Their growing focus on digital transformation and employee experience further accelerates the adoption of unified communication tools, solidifying their dominant market position.

Analysis by End User:

- Enterprises

- Education

- Government

- Healthcare

- Others

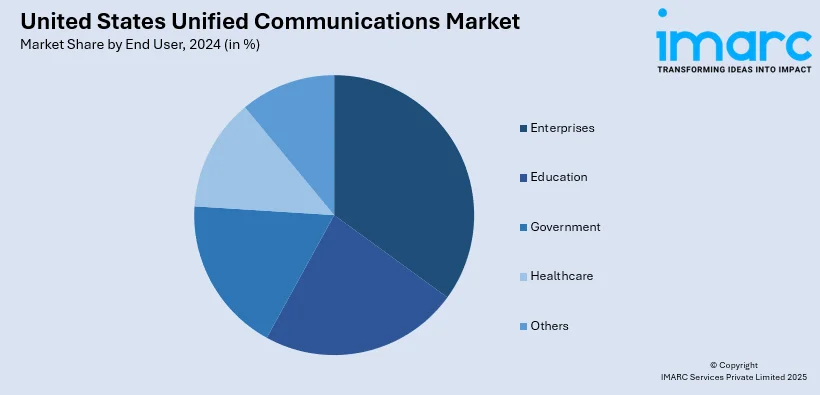

Enterprises hold the largest share in the market due to their high demand for integrated communication tools that enhance collaboration, productivity, and customer engagement. With large, often distributed workforces and complex operational needs, enterprises require unified platforms that consolidate voice, video, messaging, and conferencing services. These organizations prioritize scalability, security, and seamless integration with existing IT systems, making unified communications an essential component of their digital strategy. Additionally, enterprises are more likely to invest in advanced UC features such as AI-powered analytics, cloud-based services, and mobile compatibility. This widespread adoption across various industries drives their dominant presence in the US unified communications market.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is driven by a high concentration of financial institutions, educational bodies, and healthcare organizations, all requiring secure and seamless communication systems. The region’s early adoption of remote and hybrid work models post-COVID has further accelerated UC adoption. Dense urban centers like New York and Boston foster strong demand for mobile and cloud-based communication tools. Additionally, innovation hubs and universities support the integration of advanced features like AI and real-time collaboration. The region’s focus on digital transformation and regulatory compliance also fuels investment in robust, scalable, and secure unified communication solutions.

The Midwest's growing manufacturing, automotive, and logistics sectors are fueling demand for unified communications to enhance supply chain coordination, remote equipment monitoring, and operational efficiency. With increasing digital adoption among mid-sized businesses and local enterprises, there’s a strong push for cost-effective UCaaS platforms. Educational institutions and healthcare networks are also key adopters, leveraging UC tools for online learning and telemedicine. Government support for broadband expansion in rural areas is improving infrastructure, encouraging cloud-based communication investments. This combination of industrial modernization and digital connectivity in the Midwest region is further driving the United States unified communications market demand.

The South’s unified communications market is propelled by the region’s booming tech startups, business process outsourcing (BPO) centers, and rapidly expanding healthcare sector. Cities like Atlanta, Dallas, and Austin have become innovation hubs where businesses embrace hybrid work environments and advanced cloud communications. The region’s cost-effective real estate and labor markets attract new enterprises, increasing demand for scalable and mobile UC solutions. Additionally, rising investments in 5G infrastructure and data centers are enabling smoother video conferencing, virtual collaboration, and cloud migration. Cultural and economic diversity across the South also drives multilingual and omnichannel communication needs.

The West, particularly California, leads in unified communications adoption due to its dominance in the technology and entertainment industries. The presence of tech giants, startups, and remote-first companies creates a fertile ground for innovative UC deployment. High-speed internet penetration and widespread use of mobile and smart devices further support seamless multi-platform communication. The region’s focus on environmental sustainability and cost-efficiency also encourages the adoption of cloud-based and virtual communication tools. In addition, the entertainment sector utilizes UC for real-time collaboration in media production, while education and telehealth growth in the West expand the scope of UC adoption.

Competitive Landscape:

The United States unified communications (UC) market features intense competition among global tech leaders and specialized providers. Microsoft dominates the space with its Teams platform, widely adopted across enterprises due to seamless Microsoft 365 integration and robust collaboration tools. Cisco Webex and Zoom follow closely, leveraging strong brand presence, secure platforms, and expanding UCaaS and CCaaS offerings. RingCentral and 8x8 are prominent pure-play UCaaS providers, gaining traction with scalable cloud-based solutions and AI-powered communication features. Companies are increasingly investing in AI, cloud migration, and industry-specific integrations to differentiate themselves. Mergers, partnerships, and innovation are driving market evolution, while security, user experience, and interoperability remain key competitive factors in sustaining the market share.

The report provides a comprehensive analysis of the competitive landscape in the United States unified communications market with detailed profiles of all major companies, including:

Latest News and Developments:

- June 2025: VitalPBX launched its enhanced Complete Call Center Plan in the U.S., offering advanced features like intelligent call routing, omnichannel support, CRM integration, analytics, and security. Tailored for industries like healthcare and retail, the solution improved agent productivity and customer experience, positioning businesses for future-ready, efficient communication strategies.

- April 2025: Mitel and L-SPARK launched the Unified Communications Accelerator to support early-stage AI, IoT, and AR/VR startups from Canada and Europe. The program enabled integration with Mitel’s solutions, targeting healthcare, retail, and hospitality sectors, and aimed to enhance hybrid communications through low-code tools, mentorship, and exposure to Mitel’s global ecosystem.

- March 2025: Cox Business partnered with RingCentral to launch AI-powered unified communications and contact center solutions. The offerings combined Cox’s high-speed connectivity with RingCentral’s cloud platform, enabling voice, video, chat, and contact center capabilities. These solutions enhanced business productivity, customer interactions, and operational efficiency through integrated, AI-driven features and omnichannel communication tools.

- February 2025: Forerunner Technologies completed the acquisition of NEC’s on-premises Unified Communications business in the Americas, securing product continuity, support, and development. The deal included NTAC support, inventory, and personnel. Forerunner committed to extending NEC's UC offerings while collaborating with Intermedia to offer hybrid and cloud migration paths for future flexibility.

United States Unified Communications Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Components Covered |

|

| Products Covered | On-premises, Hosted |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | Enterprises, Education, Government, Healthcare, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States unified communications market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States unified communications market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States unified communications industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The unified communications market in the United States was valued at USD 36.11 Billion in 2024.

The United States unified communications market is projected to exhibit a CAGR of 14.83% during 2025-2033, reaching a value of USD 143.95 Billion by 2033.

Key factors driving the United States unified communications market include rising demand for remote collaboration, growing adoption of hybrid work models, increased use of mobile and BYOD devices, cloud-based deployment benefits, and the integration of AI and automation technologies

Enterprises currently dominates the United States unified communications market due to their complex communication needs, large workforce, and demand for integrated, scalable solutions that enhance productivity and collaboration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)