United States Vegetable Seed Market Size, Share, Trends and Forecast by Type, Crop Type, Cultivation Method, Seed Type, and Region, 2025-2033

United States Vegetable Seed Market Size and Share:

The United States vegetable seed market size was valued at USD 1.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 1.8 Billion by 2033, exhibiting a CAGR of 4.09% from 2025-2033. The market is driven by rising consumer demand for healthy, organic produce and increasing interest in home gardening. Additionally, the shift towards sustainable farming practices, influenced by environmental concerns and government support for eco-friendly agriculture, is driving demand for resilient, climate-adapted seed varieties.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Market Growth Rate (2025-2033) | 4.09% |

The market in the United States is experiencing significant growth driven by escalating consumer demand for fresh, organic produce. According to a research report by IMARC Group, the global organic food market size reached USD 207.4 Billion in 2023. The market is expected to reach USD 528.9 Billion by 2032, exhibiting a growth rate (CAGR) of 10.97% during 2024-2032. The rising awareness of health-conscious eating habits has prompted consumers to seek more nutritious alternatives, leading to greater demand for vegetables. This shift towards healthier diets, coupled with the growing popularity of home gardening and urban farming, is accelerating the need for diverse and high-quality vegetable seeds. Additionally, continual technological advancements in seed breeding, such as the development of hybrid varieties, are improving crop yield and disease resistance. These innovations enable farmers to grow more resilient and high-quality produce, further propelling market growth.

.webp)

In addition, the rising interest in sustainable agricultural practices is significantly supporting the market. As environmental concerns over climate change and soil depletion grow, farmers are increasingly turning to eco-friendly farming methods. Vegetable seed producers are responding by offering varieties that are more resistant to pests, drought, and other climate-related challenges. Moreover, governmental initiatives aimed at promoting sustainable farming, such as subsidies for organic agriculture, are encouraging the adoption of environmentally friendly seed varieties. This shift is driving market demand as farmers seek seeds that can help them maintain productivity while reducing their environmental footprint.

United States Vegetable Seed Market Trends:

Rising Demand for Organic and Non-GMO Seeds

A significant trend in the U.S. vegetable seed market is the growing consumer demand for organic and non-GMO seeds. As health-conscious eating habits continue to gain traction, more consumers are opting for organic produce, which is perceived as more natural and nutritious. This has driven seed companies to invest in organic seed production to meet the needs of both hobbyist gardeners and commercial growers. On 1st August 2024, Mahyco Seeds entered into a 50-50 joint venture with a US-based company Ricetec, named 'Paryan', which will develop and introduce non-GMO, herbicide-tolerant (HT) rice and wheat varieties to Indian farmers. The partnership will concentrate on granting seed firms licenses for HT characteristics and hybrids. These seed companies can incorporate these technologies into their varieties. The hybrids that would be developed are imazethapyr-resistant herbicides. Additionally, concerns regarding the environmental and health impact of genetically modified organisms (GMOs) are further fueling the preference for non-GMO seeds. As consumer awareness increases, the demand for organic and non-GMO vegetable varieties is reshaping the product landscape, prompting producers to adapt and innovate in response to these preferences.

Integration of Digital Technologies in Seed Production

The adoption of digital technologies is reshaping the vegetable seed market in the U.S. modern tools such as data analytics, drones, and precision agriculture are increasingly used to enhance seed production and distribution processes. On 8th April 2024, AGCO Corporation introduced PTx, an umbrella brand to bring a family of technologies under precision agriculture portfolio of Precision Planting and its joint venture, Trimble. This company will further the technological shift to speed up its technological transformations and develop the next set of ag techs intended for farmers and OEMs. PTx will provide for three market approaches: namely, retrofitting existing equipment through specialized dealers, further broadening partnerships with over 100 OEMs, as well as integration into factory production directly. By collecting real-time data on environmental factors such as soil health, weather conditions, and crop growth, these technologies help optimize seed performance and overall yield. Moreover, digital platforms, particularly e-commerce, are revolutionizing seed distribution, allowing consumers to easily access a wide variety of seeds. This shift toward digital solutions is improving operational efficiency for seed producers and expanding the market by making vegetable seeds more accessible to a broader consumer base.

Focus on Sustainability and Climate-Resilient Varieties

Sustainability is becoming a central focus within the U.S. market, particularly with an emphasis on climate-resilient seed varieties. As climate change intensifies, farmers are facing increasing challenges from extreme weather conditions such as droughts, floods, and pest infestations. In response, seed companies are investing heavily in the development of drought-resistant, pest-tolerant, and high-yielding varieties that can thrive under these stressful conditions. Moreover, regenerative agricultural practices, which aim to restore soil health and biodiversity, are gaining popularity. This trend toward sustainability is shaping the market, with a growing demand for seeds that can help reduce environmental impact while maintaining high productivity in the face of changing climatic conditions. On 25th January 2024, Olam Agri launched a regenerative agriculture program within the U.S. cotton belt that will help fulfill the rising demand for traceable, sustainably grown cotton. "The buyer receives cotton goods from the program that can be tracked from harvest to ginning, storage, and delivery.". All farms and beginning facilities that will participate are regenagri certified. Olam Agri has already certified 15,000 hectares of farmland and three ginning facilities with the production of 20,000 metric tons of cotton. To ensure wide coverage and sustainability, the company will reward farmers by adopting regenerative practices.to heavy rainfall. Additionally, the uncertainty caused by climate change encourages farmers to adopt more resilient seed varieties to safeguard their yields. This shift in farming practices boosts the demand for specialized seeds that can perform well under diverse and challenging conditions.

United States Vegetable Seed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States vegetable seed market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, crop type, cultivation method, and seed type.

Analysis by Type:

- Open Pollinated Varieties

- Hybrid

Open pollinated (OP) varieties are preferred for their ability to reproduce true-to-type seeds, making them popular among organic farmers and home gardeners. These varieties rely on natural pollination methods, and their seeds can be saved for replanting each season, offering a sustainable and cost-effective option. While they may have lower yields and fewer uniform traits than hybrids, OP varieties are recognized for their genetic diversity, resilience, and adaptability. They are a popular choice in regions that prioritize environmental sustainability and low-input farming practices.

Hybrid vegetable seeds are widely favored for their superior traits, such as increased yield, disease resistance, and faster growth. These seeds result from the crossbreeding of two distinct plant varieties, combining the best attributes of each parent. Although hybrids do not produce identical seeds for future planting, they offer high performance and reliability, making them ideal for commercial farmers seeking consistent, high-quality crops. Their robust nature and productivity have made hybrids the go-to choice for large-scale agricultural production.

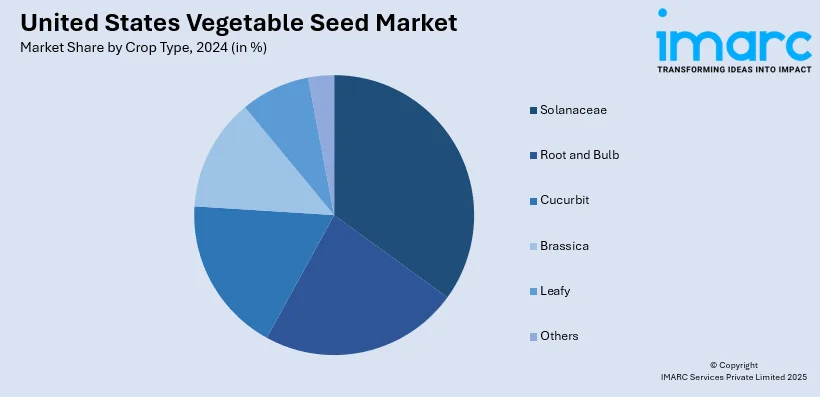

Analysis by Crop Type:

- Solanaceae

- Root and Bulb

- Cucurbit

- Brassica

- Leafy

- Others

Solanaceae crops, such as tomatoes, peppers, and eggplants, are crucial to the U.S. vegetable seed market due to their high consumption rates and culinary versatility. These vegetables are known for their nutritional benefits and are often a focus for innovation in breeding for enhanced disease resistance and yield.

Root and bulb vegetables such as carrots, onions, and garlic are valued for their long shelf life, nutritional content, and adaptability to various climates. The demand for high-quality seeds in this segment is driven by the need for disease resistance and the increasing popularity of sustainable, organic farming practices.

Cucurbit vegetables, including cucumbers, pumpkins, and melons, are widely consumed and are increasingly popular in home gardening practices. With a focus on improved yield and disease resistance, these crops are seeing rising demand in both commercial agriculture and the growing urban farming sector.

Analysis by Cultivation Method:

- Protected

- Open Field

Protected cultivation involves growing vegetables under controlled conditions in greenhouses, tunnels, or shade houses to produce throughout the year. It is especially beneficial for crops sensitive to weather and pests. With protected cultivation, farmers can optimize the conditions for growth, thus ensuring higher yields and better-quality produce. As consumers continue to seek fresh, locally grown vegetables, protected cultivation is becoming more popular as a sustainable way to meet the demand without increasing the negative environmental impact.

An open field cultivation system is referred to as a traditional or 'conventional method of crop production by cultivating vegetables under natural outdoor environmental conditions; It is widely utilized by a large-scale agricultural production company for crops including cucumbers and tomatoes. While open-field farming is more exposed to changes in weather and pests, it is still cheaper and the most common practice across the U.S. However, research in pest management and irrigation methods is improving its efficiency and sustainability.

Analysis by Seed Type:

- Conventional

- Genetically Modified Seeds

Conventional seeds are marketed for organic farming as well as traditional crop planting. The seeds are raised in open-pollinated, genetically unaltered crops with no chemical enhancements. For many consumers and producers, conventional seeds carry connotations of being "more natural" and less hazardous to the environment. While they may not offer the same resistance to pests or high yields as genetically modified varieties, conventional seeds remain a staple due to their availability, cost-effectiveness, and compatibility with organic farming standards.

Genetically modified, or GM seeds have been engineered to possess such specific traits as resistance to herbicides, pests, diseases, and provides improved nutritional content. Among the benefits for the commercial sector of farming, increased yields, and reduced need for chemical treatments are of prime advantage. Despite the environmental and health concerns, GM seeds continue to dominate large-scale farming because they increase the efficiency and productivity of these crops, which helps to meet the growing food demands sustainably.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region of the U.S. is primarily characterized by diverse agricultural practices, which have placed importance on organic farming and local production of vegetables. Consumers seeking fresh, locally grown produce are fueling sales for vegetable seeds, especially cooler-climate crops. An increase in urban farming and community gardens is also an enhancer of seed demand.

The Midwest is the world's largest producer of vegetables, mainly for both home consumption and export. Its vast agricultural land makes up the majority of open-field cultivation, where farmers focus on producing high-yielding, disease-resistant varieties. Advanced farming technologies are being adopted in the region to improve productivity and sustainability.

In the South, the warmer climate favors a wide diversity of vegetable crops, especially tomatoes, peppers, and leafy greens. Hybrid seeds are increasingly in demand by farmers in that region to maximize yields as well as disease resistance. Specialty crops and organic farming are also growing in this region, increasing the need for high-quality vegetable seeds.

The West region has a relatively mild climate that allows for year-round vegetable production and, thus, is an ideal region for commercial farming as well as home gardening. Demand for drought-resistant and climate-adapted seed varieties is growing, especially as water conservation becomes a concern. The West region is also a leader in adopting sustainable farming practices, leading to innovations in vegetable seed development.

Competitive Landscape:

The market in the United States has a competitive landscape with well-established players alongside new entrants who continue to emphasize innovation, quality, and sustainability. The pursuit of resilient crops leads to a need for high-yielding, disease-resistant, and climate-adapted seed varieties. Key players are heavily investing in research and development to continue building their businesses. Many of the companies are also focusing on organic and non-GMO seeds as a new addition to their product lineup due to consumers' healthy and sustainable preferences. The digitalization of the world also means that e-commerce platforms are increasingly becoming the tool of necessity for seed distribution, helping companies reach more consumers. Strategic partnerships, mergers, and acquisitions become common as companies look at this as a means to build up their market and capture new technologies, including the ones related to precision agriculture and sustainable farming practices. Therefore, this dynamic competition leads to continuous innovation within the market.

The report provides a comprehensive analysis of the competitive landscape in the United States vegetable seed market with detailed profiles of all major companies.

Latest News and Developments:

-

September 23, 2024: Organic Seed Alliance, launched the "OSPREY" project as part of its commitment towards advancement in organic seed production to better the quality availability of high-quality organic seeds. OSPREY focuses on economics and yield production with funds from the USDA National Institute of Food and Agriculture for which there is nationally led research, and education team that works together on identified problems for the organic seed industry.

United States Vegetable Seed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Open Pollinated Varieties, Hybrid |

| Crop Types Covered | Solanaceae, Root and Bulb, Cucurbit, Brassica, Leafy, Others |

| Cultivation Methods Covered | Protected, Open Field |

| Seed Types Covered | Conventional, Genetically Modified Seeds |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States vegetable seed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the United States vegetable seed market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States vegetable seed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

A vegetable seed is a small, viable plant embryo within a protective outer coating that has the potential to grow into a mature vegetable plant. These seeds are essential for agricultural production and are used to grow various vegetable crops like tomatoes, cucumbers, and peppers. They are also important for home gardening and sustainable farming.

The United States vegetable seed market was valued at USD 1.2 Billion in 2024.

IMARC estimates the United States vegetable seed market to exhibit a CAGR of 4.09% during 2025-2033.

The key factors driving the United States vegetable seed market include rising consumer demand for organic and healthy produce, the increasing popularity of home gardening, technological advancements in seed breeding, and the growing adoption of sustainable and eco-friendly farming practices. Additionally, government support for sustainable agriculture plays a crucial role in boosting market demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)