United States Veterinary Healthcare Market Size, Share, Trends and Forecast by Product, Animal Type, End User, and Region, 2025-2033

United States Veterinary Healthcare Market Size and Share:

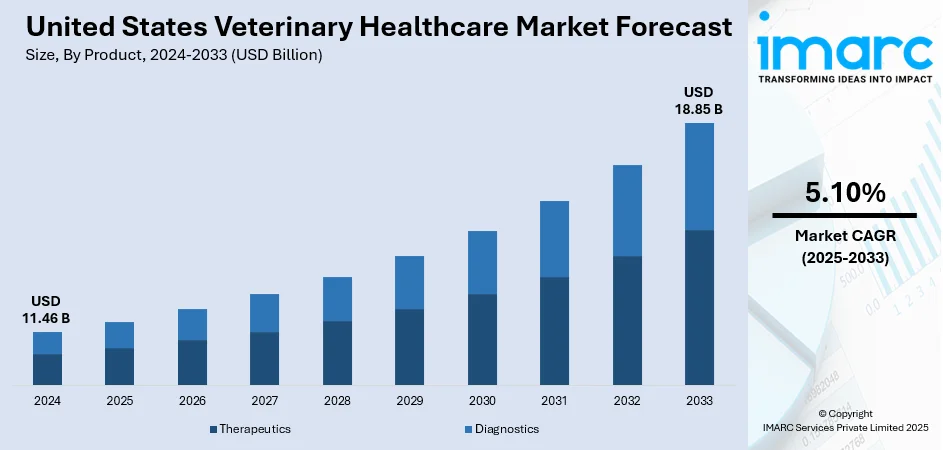

The United States veterinary healthcare market size was valued at USD 11.46 Billion in 2024. The market is projected to reach USD 18.85 Billion by 2033, exhibiting a CAGR of 5.10% from 2025-2033. The market is fueled by an increase in pet ownership, growing spending on preventive and advanced care, and greater sensitivity towards the health of animals. Increased diagnostic capacities and novel therapeutic options further enhance market demand. Further, boosting demand for premium veterinary services and insurance cover also remains supportive of long-term growth. This evolving landscape is a result of changing consumer expectations and advancements in medicine, paving the way for favorable growth prospects in the United States veterinary healthcare market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.46 Billion |

| Market Forecast in 2033 | USD 18.85 Billion |

| Market Growth Rate 2025-2033 | 5.10% |

Rising integration of cutting-edge technologies is a primary driver of the United States veterinary healthcare market. Technologies like telemedicine, wearable health monitoring devices, artificial intelligence used in diagnostic imaging, and molecular diagnostic devices are revolutionizing animal care delivery. According to the reports, in December 2024, Zoetis announced the global launch of Vetscan OptiCell™, an AI-powered point-of-care hematology analyzer, unveiled at VMX Orlando in January 2025, with rollouts planned across key international markets through 2026. Furthermore, these technologies increase diagnostic precision, enable remote consultations, and enhance preventive medicine through ongoing health monitoring. Electronic health record adoption and data platform utilization have also empowered veterinarians to follow medical histories, accelerate decision-making processes, and maximize treatment outcomes. The utilization of genomic testing and precision medicine in veterinary practice is also offering personalized treatment options for pet animals, thus enhancing recovery rates and long-term disease management. This intense drive towards digitalization and sophisticated healthcare delivery systems not only enhances productivity but also addresses growing pet owner expectations for human-grade healthcare services for their pets, supporting growth in the veterinary healthcare market.

To get more information on this market, Request Sample

The rising consciousness of zoonotic diseases and their possible public health impact is another key driver of the United States veterinary healthcare market outlook. As human-animal contact increases, the need to monitor and regulate animal diseases with the potential for transmission to humans has received extensive attention. Preventive veterinary medicine activities, such as vaccinations, regular screening, and sophisticated laboratory diagnostics, have become key components to protect animal and human populations. As per sources, in October 2024, the U.S. FDA approved Elanco Animal Health’s oral drug, Credelio Quattro, a monthly chewable tablet protecting dogs against six parasitic infections, with commercial launch expected in early 2025. Moreover, increased emphasis on animal health also closely relates to larger public health efforts, promoting good collaboration between veterinarians and healthcare officials. In addition, management of livestock health becomes a higher priority to guarantee food safety and sustain productivity in poultry, swine, and ruminant industries. Legislative measures favoring rigorous health screening and preventive care measures also boost demand for veterinary healthcare services. With increased awareness, investment in disease management, preventive programs, and research ensures constant growth in the sector, guaranteeing sustainable long-term viability and strength of the veterinary environment.

United States Veterinary Healthcare Market Trends:

Growing Pet Ownership

Pet ownership in the US has grown significantly, influencing demand for veterinary care. The American Pet Products Association (APPA) 2025 National Pet Owners Survey reported that 94 million homes now keep pets, with 97% of the owners classifying them as part of the family. The most common companions are still dogs, with 65.1 million homes keeping at least one dog, followed by 46.5 million cat owners, and fish in 11.1 million homes. This increase in pet adoption is a function of the shift in lifestyles, where pets are filling roles other than companionship, such as emotional support and wellness benefits. Increased awareness regarding animal health has resulted in rising expenditure on preventive care, wellness check-ups, immunizations, and sophisticated treatments. This United States veterinary healthcare market trend also underlines amplified adoption of pet insurance, value-added healthcare items, and formalized lifetime wellness plans. As the pet population grows, it immediately fuels demand for veterinary care, generating sustainable opportunities in hospitals, clinics, and laboratory test facilities.

Dramatic Growth of the Pet Food Industry

The United States pet food industry has seen strong growth supported by rising focus on pet health and nutrition. As cited by the World Animal Foundation, 61% of US pet owners stress the quality of food for their pets, and the organic pet food market alone is worth $2.318 million. Based on the U.S. Department of Agriculture (USDA), the value of dog and cat food exports was $2.41 billion in 2023, showing a CAGR of 6.4% from 2014. The growth is due to shifting attitudes among consumers that include spending money on quality, health-oriented products for pet owners with varied dietary requirements. The market for organic, grain-free, and breed-specific diet formulations indicates owners' increasing emphasis on prolonging pets' life quality. The trend has motivated innovation, with manufacturers launching functional foods, green packaging, and personalized meal plans. This market growth not only enhances pet health but also supports the development of the veterinary healthcare ecosystem.

Heightened Demand for Holistic Veterinary Services

As pet ownership and specialized pet diets increase, there is simultaneous momentum in veterinary services throughout the United States. More and more homes today regularly spend on regular check-ups, vaccination schemes, and newer therapies, driving growth of veterinary hospitals, clinics, and laboratory testing facilities. Preventive care is now top of mind, aided by growing popularity of zoonotic diseases and lifestyle disorders among pets. In addition, wellness programs and insurance policies are becoming popular, providing systemic, affordable health solutions that provide continuity of care across a pet's lifespan. The sector is also seeing convergence of advanced diagnostics and digital health technologies, including telemedicine, to enhance access and monitoring. The trend mirrors owners' growing expectations for whole-animal, human-grade care for their pets. All these combined determine a long-term growth path for the veterinary healthcare market, affirming its essential position in the overall pet care value chain.

United States Veterinary Healthcare Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States veterinary healthcare market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on product, animal type, and end user.

Analysis by Product:

- Therapeutics

- Vaccines

- Parasiticides

- Anti-Infectives

- Medical Feed Additives

- Others

- Diagnostics

- Immunodiagnostic Tests

- Molecular Diagnostics

- Diagnostic Imaging

- Clinical Chemistry

- Others

Therapeutics form an integral component of veterinary medicine, including vaccines, parasiticides, anti-infectives, and medical feed additives. Therapeutic products provide efficient disease prevention and treatment in animals, enhancing productivity and health. On-going innovations and increasing demand for prevention fuel the expansion of therapeutics in the veterinary healthcare industry.

Diagnostics furnish key tools for early disease detection, precise monitoring, and sound treatment planning. These comprise immunodiagnostic tests, molecular diagnostics, diagnostic imaging, and clinical chemistry. Growing usage of advanced technologies and rapid diagnostic solutions enhances veterinarians' capacity to provide early intervention, ultimately improving animal health outcomes and driving demand in veterinary facilities.

Analysis by Animal Type:

- Dogs and Cats

- Horses

- Ruminants

- Swine

- Poultry

- Others

Dogs and cats are leading the market with elevated ownership levels and growing expenditure on pet care. Increased awareness on wellness, preventive care, and lifestyle diseases drives higher demand for healthcare services. Rising adoption of companion animals further strengthens the demand for advanced diagnostics, therapeutics, and preventive healthcare solutions.

Horses make a major contribution to veterinary healthcare need, particularly in recreational, competitive, and breeding purposes. Preventive care on a regular basis, sophisticated treatments, and specialized diagnostics maintain their health as well as performance. Greater investments in equine well-being and increasing promotion of disease prevention strategies guarantee consistent growth of this segment in the entire veterinary healthcare industry.

Ruminants propel veterinary healthcare needs via livestock yields and herding. Preventative therapies, vaccinations, and disease monitoring safeguard cattle, goats, and sheep from illness while enhancing production. Heightening farmer awareness and compliance with governmental protocols buttress adoption of healthcare, guaranteeing enhanced animal health and sustained growth of this segment in the market.

Pigs are an essential livestock segment that needs proper disease control and preventative care. Therapeutic, vaccine, and diagnostic product investments lower mortality levels and increase productivity in the herd. As pork continues to be an important protein in the diet, producers turn more and more to veterinary health care services, supporting category growth and maintaining market gains in this sector.

Poultry continues to be a prime driver of veterinary healthcare need, necessitating regular vaccination, diagnosis, and treatment to assure flock health. Increasing global demand for poultry products coupled with stringent safety controls raises the dependency on veterinary services. Efficient disease control programs maintain productivity, facilitating continued growth of this market sector appreciably.

Others consist of specialty livestock, exotic pets, and small mammals that need specialized veterinary healthcare solutions. Tailored diagnostics and therapeutic methods treat varied health issues, triggering consistent growth in this category. Rising interest in non-conventional pets and technological innovation in specialized animal therapy continue to open up opportunities throughout the veterinary healthcare industry segment.

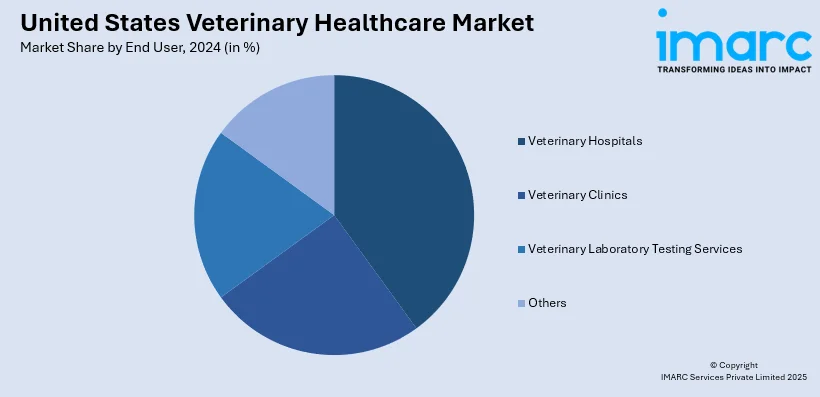

Analysis by End User:

- Veterinary Hospitals

- Veterinary Clinics

- Veterinary Laboratory Testing Services

- Others

Veterinary hospitals continue to be the core of animal healthcare delivery, with advanced diagnostic capabilities, surgical interventions, and therapeutic services. These hospitals treat sophisticated cases and complete treatments, drawing pet owners looking for quality services. The increasing number of pets and demand for preventive care continue to solidify hospitals as a dominant segment in veterinary healthcare.

Veterinary clinics offer basic care like vaccinations, regular check-ups, and minor procedures, and are extremely accessible to pet owners. Their contributions towards preventive healthcare and wellness programs help sustain growth. Increased use of advanced diagnostic equipment and pet ownership rates improve service quality, leading to constant market growth.

Veterinary laboratory testing services facilitate proper diagnosis via molecular testing, imaging, and sophisticated clinical assessments. Growing outsourcing of diagnostic services by hospitals and clinics drives dependence on these facilities. Accuracy, affordability, and better results enhance this segment's development to become an inseparable part of the veterinary healthcare environment.

Others among end users are mobile veterinary services, research facilities, and specialized centers. These segments offer specialty health care solutions, serving underserved or specialty animal populations. The increasing use of mobile health services and tailored care methods contributes to consistent United States veterinary healthcare market growth, aligning with stronger growth in veterinary healthcare provision.

Regional Analysis:

- Northeast

- Midwest

- South

- West

Northeast exhibits robust take-up of veterinary health solutions, fueled by a high density of pet ownership in urban centers and well-developed infrastructure. Preventative care, diagnosis, and therapeutic innovations lead service provision. Growing levels of awareness of companion animal health underpin steady expansion, guaranteeing this segment to continue making an important contribution to the United States veterinary health market.

Midwest veterinary healthcare is influenced by cattle farming and robust agricultural activity. Preventive healthcare protocols for ruminants, poultry, and swine are essential to sustaining productivity. Increasing use of diagnostic equipment and treatments to protect herd health supports demand, positioning this region as a significant player in the larger veterinary healthcare market.

South enjoys high animal density and increasing ownership of companion animals. Demand for preventive care, diagnostics, and therapeutic products keeps growing. Veterinary clinics and hospitals in this region see robust usage, fueled by heightened investment in animal health management, guaranteeing consistent market growth in both companion and livestock segments.

West is a vibrant market dominated by technological development and increasing pet care spending. The adoption of advanced diagnostics, digital health, and telemedicine is on the rise in veterinary clinics. High pet ownership levels coupled with rising livestock efforts place the West as a prime region for future opportunities for growth in veterinary healthcare markets.

Competitive Landscape:

The competitive market of the U.S. veterinary industry is characterized by specialization, innovation, and increasing focus on end-to-end pet care solutions. The firms are investing in improving treatment techniques, developing diagnostic facilities, and fortifying distribution channels to cater to the accelerating demand for companion and livestock animal health. One central dynamic driving this context is the growing integration of digital health technologies, telemedicine platforms, and sophisticated diagnostic tools that enhance access and accuracy in veterinary services. On the other hand, the growth of wellness-oriented care plans, preventive care options, and tailored nutrition plans is building long-term patient-provider engagement. This profile is complemented by increasing investments in research and development, intended for meeting changing animal health requirements through better therapeutics and diagnostics. The United States veterinary healthcare market forecast posits ongoing consolidation and innovation, whereby improvements in care delivery and diversification of products continue to be key to achieving competitive edge.

The report provides a comprehensive analysis of the competitive landscape in the United States veterinary healthcare market with detailed profiles of all major companies.

Latest News and Developments:

- September 2025: Boehringer Ingelheim introduced INGELVAC CIRCOFLEX® AD, a revolutionary swine vaccine that offers cutting-edge protection against porcine circovirus type 2 (PCV2). This revolutionary vaccine is the first vaccine to integrate antigens from the PCV2a and PCV2d genotypes in a single dose, delivering comprehensive protection against the most widespread strains of PCV2.

- August 2025: The U.S. Department of Health and Human Services (HHS) issued a declaration which permitted the U.S. Food and Drug Administration (FDA) to provide Emergency Use Authorizations (EUAs) for animal drugs that are intended to treat or prevent infestations brought about by the New World Screwworm (NWS). This move is particularly targeting animal drugs and is intended to safeguard livestock, pets, wildlife, and other warm-blooded animals against the devastating consequences of NWS infestations.

- August 2025: Kemin Industries has acquired Hennessy Research Associates, LLC, an action that broadens its portfolio in the animal health sector. Founded in Lenexa, Kansas, Hennessy Research Associates is a company with expertise in research and development of vaccines against infectious disease in animals. The organization is experienced in biological manufacturing processes, in vitro test development, lab animal and host animal challenge model development, and USDA ELISA Reference Requalification methods.

United States Veterinary Healthcare Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Animal Types Covered | Dogs and Cats, Horses, Ruminants, Swine, Poultry, Others |

| End Users Covered | Veterinary Hospitals, Veterinary Clinics, Veterinary Laboratory Testing Services, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various United States market segments, historical and current market trends, market forecasts, and dynamics of the United States veterinary healthcare market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States veterinary healthcare market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States veterinary healthcare industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The veterinary healthcare market in the United States was valued at USD 11.46 Billion in 2024.

The United States veterinary healthcare market is projected to exhibit a CAGR of 5.10% during 2025-2033, reaching a value of USD 18.85 Billion by 2033.

The major drivers of the market are the growing pet population, mounted demand for preventive care, and increased spending on companion animal health. Development of diagnostic technologies, growth of specialist veterinary services, and increased awareness of pet insurance also drive the market, with steady growth and innovation in therapeutic, diagnostic, and wellness-oriented veterinary care solutions throughout the country.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)