United States Weight Management Market Size, Share, Trends and Forecast by Diet, Equipment, Service, and Region, 2026-2034

United States Weight Management Market Summary:

The United States weight management market size was valued at USD 87.00 Billion in 2025 and is projected to reach USD 132.87 Billion by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

The United States weight management market is experiencing sustained growth driven by increasing health consciousness, rising obesity prevalence, and growing consumer demand for personalized fitness and nutrition solutions. Expanding digital health platforms and significant investment in wellness products continue to widen market accessibility. The integration of artificial intelligence, telehealth services, and wearable technologies is transforming consumer engagement and program compliance. Advancements in pharmaceutical interventions, particularly GLP-1 receptor agonists, are reshaping treatment paradigms across the country. These dynamics collectively strengthen United States weight management market share.

Key Takeaways and Insights:

- By Diet: Functional beverages dominate the market with a share of 38% in 2025, fueled by consumers' growing need for quick, nutrient-rich hydration options that aid in hunger regulation and metabolism. Low-calorie functional waters and protein-enriched beverages are still becoming popular among health-conscious consumers looking for portable weight management solutions.

- By Equipment: Fitness equipment leads the market with a share of 62% in 2025, demonstrating a high level of consumer investment in linked fitness devices, strength training equipment, and cardiovascular training machines. The market is still growing due to the widespread use of smart gym equipment with built-in tracking features.

- By Service: Health clubs hold the largest segment with a market share of 41% in 2025, supported by record-breaking membership enrollment and growing demand for comprehensive fitness facilities. The integration of personalized training, group classes, and wellness amenities strengthens member retention across fitness centers.

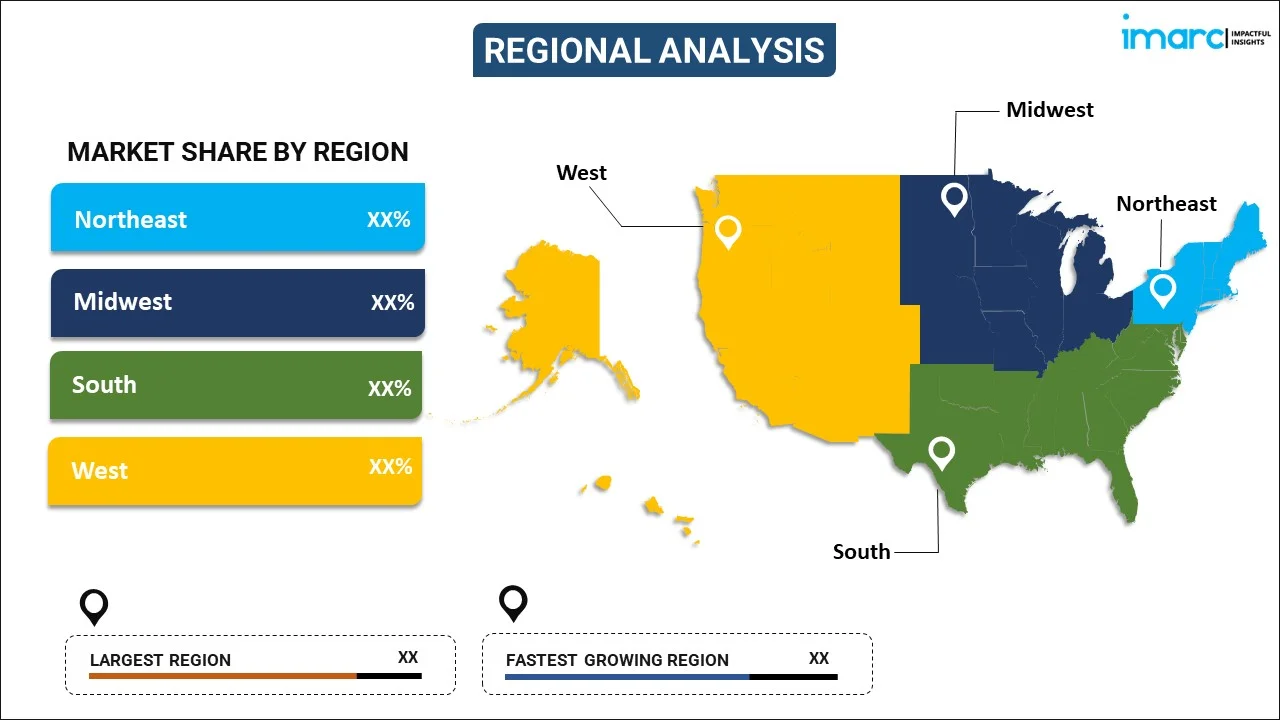

- By Region: South represents the largest region with 40% share in 2025, driven by its substantial population base, high obesity prevalence requiring intervention, and expanding fitness infrastructure. Major metropolitan areas including Texas, Florida, and Georgia continue attracting significant wellness industry investment.

- Key Players: Key industry participants drive market expansion through product innovation, strategic acquisitions, and service diversification. Companies are investing heavily in digital platforms, GLP-1 medication programs, and connected fitness technologies. Their focus on affordability, personalization, and integrated wellness solutions accelerates consumer adoption and strengthens nationwide market penetration.

The United States weight management market continues to grow as consumers shift toward comprehensive wellness approaches that combine nutrition, physical activity, and behavioral change. Innovative treatment options, including GLP-1 receptor agonist medications, have significantly altered traditional weight management strategies and expanded clinical solutions. At the same time, digital health platforms, mobile applications, and personalized coaching services are transforming how individuals engage with weight management, offering more accessible, tailored, and continuous support across diverse consumer segments. In January 2025, Noom introduced major updates to its GLP-1 companion application featuring AI-powered meal planning and medication management capabilities, reflecting broader industry convergence toward technology-enabled solutions. Digital engagement platforms, telehealth consultations, and wearable devices continue reshaping consumer participation patterns and improving long-term program adherence.

United States Weight Management Market Trends:

Integration of GLP-1 Medications with Digital Health Platforms

The convergence of pharmaceutical interventions with technology-driven support systems represents a transformative trend reshaping United States weight management market growth. Consumers increasingly seek comprehensive programs combining prescription medications with personalized coaching, nutritional guidance, and progress tracking through connected applications. In November 2024, Allurion Technologies launched AllurionMeds in the United States, introducing an AI-native compounded GLP-1 weight loss program featuring conversational AI coach, Coach Iris and virtual dietician consultations, available nationwide. This integration approach improves treatment adherence while providing patients real-time support throughout their weight management journey.

Rise of Personalized Nutrition and Behavioral Health Approaches

Consumer preference for individualized wellness solutions tailored to unique metabolic profiles, lifestyle patterns, and psychological factors continues accelerating market transformation. Data-driven platforms offering customized meal planning, genetic-based recommendations, and cognitive behavioral therapy techniques address underlying motivations behind eating behaviors. Psychology-focused applications incorporating mindfulness training and stress management components demonstrate enhanced long-term outcomes. Weight management providers increasingly recognize emotional wellness as integral to sustainable results, driving adoption of holistic methodologies combining nutritional science with mental health support across digital and in-person service channels.

Expansion of Connected Fitness Equipment and Hybrid Training Models

Smart fitness equipment featuring real-time performance tracking, virtual coaching, and community connectivity reshapes consumer exercise engagement. Connected devices enabling personalized workout recommendations based on individual progress data enhance motivation and accountability. Hybrid training models combining home-based equipment usage with facility memberships allow consumers flexibility in their fitness routines. In 2025, EGYM showcased AI-driven workout personalization and three-dimensional movement analysis capabilities, exemplifying technological advancement in commercial fitness applications. This connectivity trend supports weight management by providing continuous feedback and adapting programming to optimize individual results.

Market Outlook 2026-2034:

The United States weight management market outlook remains positive through the forecast period, supported by expanding healthcare awareness, technological innovation, and evolving consumer expectations for integrated wellness solutions. Pharmaceutical advancements including oral GLP-1 formulations will broaden treatment accessibility while reducing administration barriers. Digital health integration across fitness equipment, nutritional platforms, and medical services will enhance consumer engagement and program effectiveness. Employer-sponsored wellness programs and insurance coverage expansion create additional growth avenues. The market generated a revenue of USD 87.00 Billion in 2025 and is projected to reach a revenue of USD 132.87 Billion by 2034, growing at a compound annual growth rate of 4.99% from 2026-2034.

United States Weight Management Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Diet | Functional Beverages | 38% |

| Equipment | Fitness | 62% |

| Service | Health Clubs | 41% |

| Region | South | 40% |

Diet Insights:

To get more information on this market, Request Sample

- Functional Beverages

- Functional Food

- Dietary Supplements

Functional beverages dominate with a market share of 38% of the total United States weight management market in 2025.

Functional beverages maintain market leadership driven by consumer demand for convenient, nutrient-enhanced hydration solutions supporting weight management goals. Ready-to-drink protein shakes, metabolism-boosting teas, and low-calorie enhanced waters address multiple wellness objectives simultaneously. The segment benefits from extensive retail distribution through supermarkets, convenience stores, and rapidly expanding e-commerce channels. Manufacturers increasingly incorporate clean-label formulations and plant-based protein sources appealing to health-conscious consumers. This growth trajectory demonstrates functional beverages' effectiveness in meeting diverse nutritional needs while supporting active lifestyles across demographic segments.

Innovation within functional beverages centers on clean-label formulations, plant-based protein sources, and added functional ingredients addressing specific health concerns. Manufacturers increasingly incorporate adaptogens, prebiotics, and natural caffeine alternatives appealing to health-conscious consumers seeking holistic wellness benefits. The segment benefits from extensive retail distribution through supermarkets, convenience stores, and rapidly expanding e-commerce channels. Subscription-based delivery models enhance consumer convenience while building brand loyalty through regular product engagement and personalized recommendations.

Equipment Insights:

- Fitness

- Surgical

Fitness equipment leads with a share of 62% of the total United States weight management market in 2025.

Fitness equipment dominates the equipment segment driven by sustained consumer investment in cardiovascular machines, strength training apparatus, and connected fitness devices. Home gym adoption accelerated significantly as consumers seek convenient workout alternatives complementing traditional facility memberships. The proliferation of smart treadmills, stationary bikes, and resistance systems featuring integrated performance tracking capabilities enhances user motivation and accountability. Commercial fitness facilities simultaneously upgrade equipment offerings to attract members demanding advanced training technologies and immersive exercise experiences nationwide.

Technological integration transforms fitness equipment capabilities through artificial intelligence, motion tracking, and virtual coaching functionalities. Smart treadmills, interactive stationary bikes, and connected strength machines provide real-time performance feedback while adapting workouts to individual progress metrics. The home fitness segment continues expanding as consumers seek convenient alternatives complementing traditional gym memberships. Commercial fitness facilities simultaneously upgrade equipment offerings to attract and retain members demanding advanced training technologies and immersive exercise experiences.

Service Insights:

- Health Clubs

- Consultation Services

- Online Weight Loss Services

Health clubs exhibit a clear dominance with a 41% share of the total United States weight management market in 2025.

Health clubs maintain market leadership through comprehensive fitness offerings combining equipment access, group classes, and professional guidance. The sector achieved record membership enrollment with 77 Million Americans holding gym or studio memberships in 2024, representing 25% of individuals aged six and older according to the Health and Fitness Association. This unprecedented participation level demonstrates sustained consumer recognition of structured fitness environments as effective weight management resources. Facilities continue evolving service portfolios to address diverse member preferences and fitness objectives.

Health club operators differentiate through amenity expansion, technological integration, and community-building initiatives enhancing member experience and retention. Premium facilities offer recovery services, nutrition counseling, and specialized programming addressing specific demographic needs. Budget-friendly chains expand accessibility through affordable membership structures attracting first-time gym users. Hybrid service models combining in-person training with digital engagement platforms extend facility value beyond physical locations, demonstrating sector resilience and adaptability to evolving consumer preferences.

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northeast

- Midwest

- South

- West

South represents the leading segment with a 40% share of the total United States weight management market in 2025.

The South commands market leadership driven by its substantial population base, elevated obesity prevalence requiring intervention, and rapidly expanding wellness infrastructure. States including Texas, Florida, and Georgia contain significant metropolitan populations increasingly prioritizing health and fitness investment. Growing disposable incomes across Southern urban centers support premium fitness facility development and specialized dietary product consumption. Regional market expansion benefits from demographic growth attracting wellness industry investment and healthcare systems increasingly integrating weight management services recognizing obesity's relationship with chronic disease prevalence.

Regional market expansion benefits from demographic growth attracting wellness industry investment and facility development. Major fitness chains continue Southern market penetration through new club openings addressing underserved population segments. Healthcare systems increasingly integrate weight management services recognizing obesity's relationship with chronic disease prevalence. Corporate wellness programs and employer-sponsored health initiatives further stimulate demand across commercial and industrial sectors. The combination of population dynamics, health awareness campaigns, and infrastructure development positions the South for continued market leadership throughout the forecast period.

Market Dynamics:

Growth Drivers:

Why is the United States Weight Management Market Growing?

Rising Obesity Prevalence and Associated Health Concerns

Elevated obesity rates across the United States create substantial and sustained demand for weight management solutions spanning dietary products, fitness services, and medical interventions. The Centers for Disease Control and Prevention estimates medical care costs associated with obesity reach approximately USD 173 Billion annually in the United States. This economic impact motivates employers, insurers, and healthcare providers to invest in preventive wellness programs. Growing recognition of obesity as a chronic disease requiring multifaceted treatment approaches expands market opportunities across pharmaceutical, nutritional, and fitness sectors while encouraging insurance coverage expansion for evidence-based interventions.

Technological Advancement in Digital Health Solutions

Digital health platforms incorporating artificial intelligence, wearable integration, and personalized coaching capabilities transform weight management accessibility and effectiveness. Connected applications provide real-time nutritional guidance, exercise tracking, and behavioral support extending professional intervention beyond clinical settings. The proliferation of smartphone-based programs enables consumers to engage with weight management tools continuously throughout daily routines. In January 2026, LifeMD extended access to FDA-approved Wegovy for cash-pay patients throughout all 50 states via its virtual platform, demonstrating healthcare delivery innovation expanding pharmaceutical accessibility. Integration between medical services, fitness tracking, and nutritional platforms creates comprehensive ecosystems supporting long-term weight management success through coordinated intervention strategies.

Expanding Pharmaceutical Treatment Options

Pharmaceutical innovation, particularly GLP-1 receptor agonists demonstrating significant efficacy, expands medically-supervised weight management options attracting previously underserved patient populations. These medications address physiological aspects of appetite regulation supporting sustainable weight loss outcomes when combined with lifestyle modifications. The FDA approved the first oral GLP-1 pill for obesity from Novo Nordisk, with the company launching the treatment in January 2026 at significantly reduced cash prices ranging from USD 149 to USD 299 monthly depending on dosage. This approval represents transformation toward more accessible administration formats potentially broadening patient acceptance and treatment adherence. Pharmaceutical companies continue developing next-generation compounds with improved efficacy profiles and convenient administration schedules driving continued market expansion.

Market Restraints:

What Challenges the United States Weight Management Market is Facing?

High Costs and Limited Insurance Coverage

Premium weight management products, medications, and services often exceed affordability thresholds for significant population segments, particularly middle and lower-income households. GLP-1 medications carry substantial monthly costs when lacking insurance coverage, restricting access despite demonstrated clinical effectiveness. Limited employer-sponsored wellness benefits and inconsistent Medicaid coverage create access disparities affecting treatment adoption rates. Price sensitivity influences product selection and program compliance, challenging sustained market penetration across diverse economic demographics.

Program Adherence and Sustainability Challenges

Maintaining long-term engagement with weight management programs remains challenging despite initial enthusiasm and short-term results. Behavioral modification requires sustained commitment often conflicting with lifestyle demands and psychological barriers surrounding food relationships. Side effects associated with medications and physical discomfort during exercise initiation contribute to program discontinuation. Without ongoing support systems and gradual habit formation, consumers frequently regain lost weight following program completion, limiting perceived value and reducing willingness to invest in future interventions.

Market Fragmentation and Quality Inconsistency

The proliferation of weight management products and services creates consumer confusion regarding efficacy, safety, and value differentiation. Unsubstantiated claims and pseudoscientific marketing undermine industry credibility while potentially endangering uninformed consumers. Regulatory oversight varies across product categories allowing questionable formulations market entry. This fragmentation challenges consumers seeking evidence-based solutions while creating competitive disadvantages for clinically validated programs against lower-cost alternatives lacking comparable effectiveness.

Competitive Landscape:

The United States weight management market demonstrates intense competition across pharmaceutical, dietary product, fitness equipment, and service provider segments. Established wellness brands compete alongside emerging digital disruptors offering technology-enabled solutions targeting diverse consumer preferences. Companies differentiate through scientific validation, personalization capabilities, user experience optimization, and pricing strategies addressing various market segments. Strategic acquisitions consolidate market positions while expanding service portfolios and distribution capabilities. Partnership formations between pharmaceutical manufacturers, healthcare providers, and technology platforms create integrated ecosystems enhancing treatment comprehensiveness and consumer accessibility. Innovation remains paramount as competitors invest substantially in research, product development, and digital infrastructure to capture growing demand for effective, sustainable weight management solutions.

Recent Developments:

- In January 2025, Planet Fitness announced key year-end metrics reporting approximately 19.7 Million members and 2,722 clubs as of December 2024. The company opened 150 new locations during 2024 and achieved full-year system-wide same club sales increase of 5.0%, demonstrating sustained fitness industry growth.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Diets Covered | Functional Beverages, Functional Food, Dietary Supplements |

| Equipments Covered | Fitness, Surgical |

| Services Covered | Health Clubs, Consultation Services, Online Weight Loss Services |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The United States weight management market size was valued at USD 87.00 Billion in 2025.

The United States weight management market is expected to grow at a compound annual growth rate of 4.99% from 2026-2034 to reach USD 132.87 Billion by 2034.

Functional beverages dominated the diet segment with a share of 38%, driven by rising consumer preference for convenient, nutrient-enhanced hydration solutions supporting metabolism and appetite control while addressing diverse wellness objectives.

Key factors driving the United States weight management market include rising obesity prevalence, expanding pharmaceutical treatment options including GLP-1 medications, technological advancement in digital health platforms, and growing consumer demand for personalized nutrition and fitness solutions.

Major challenges include high product and medication costs limiting accessibility, inconsistent insurance coverage for weight loss treatments, program adherence difficulties affecting long-term outcomes, market fragmentation creating consumer confusion, and sustainability concerns regarding maintaining weight loss results.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)