Unmanned Marine Vehicles Market Size, Share, Trends and Forecast by Type, Control Type, Application, and Region, 2026-2034

Unmanned Marine Vehicles Market Size and Share:

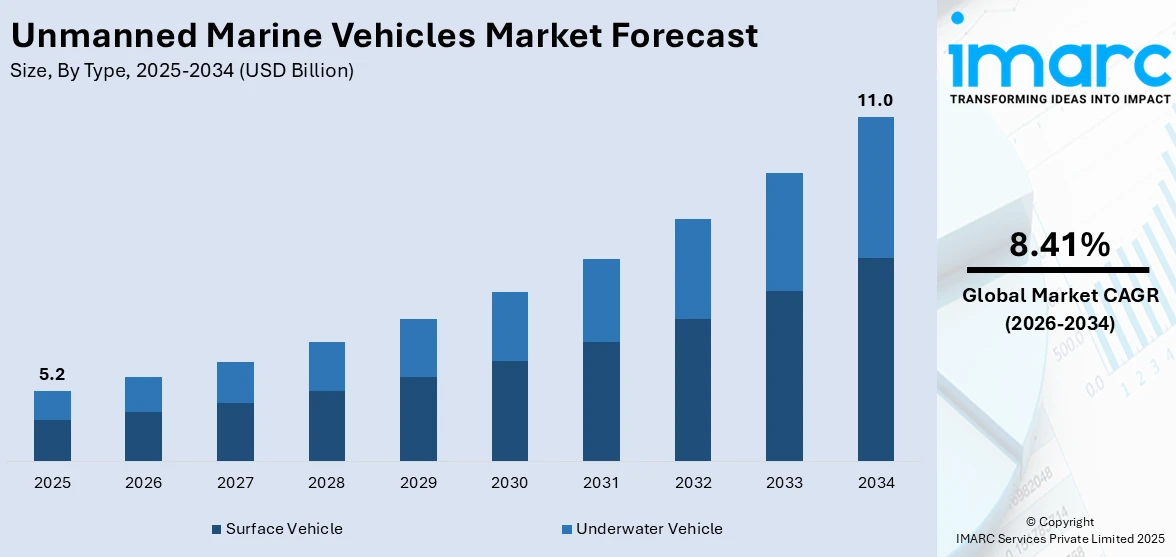

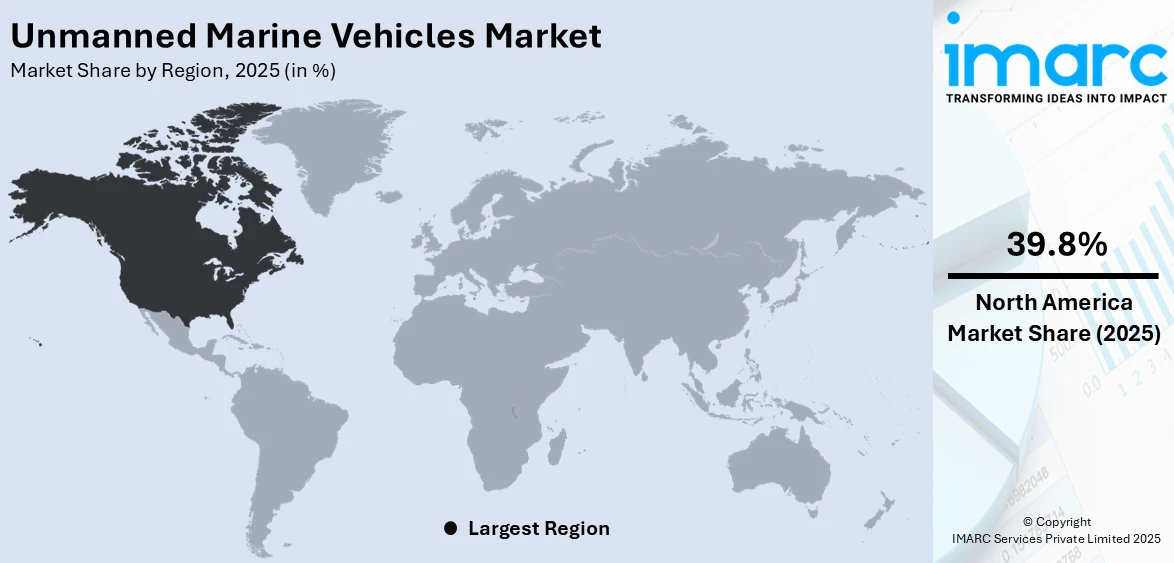

The global unmanned marine vehicles market size was valued at USD 5.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.0 Billion by 2034, exhibiting a CAGR of 8.41% during 2026-2034. North America currently dominates the market, holding a significant market share of 39.8% in 2025. The market is growing due to the US Navy's strategic emphasis on unmanned systems, including Large Unmanned Surface Vehicles (LUSVs) and Extra-Large Unmanned Undersea Vehicles (XLUUVs), which increases surveillance and mine countermeasure capabilities. Advances in artificial intelligence, sensor integration, and autonomy also enhance operational efficiency. Offshore energy and environmental monitoring, among other commercial sectors, increasingly utilize UMVs for efficient and cost-saving operations, while government initiatives in terms of research funding and regulation further increases the unmanned marine vehicles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 5.2 Billion |

|

Market Forecast in 2034

|

USD 11.0 Billion |

| Market Growth Rate 2026-2034 | 8.41% |

The market is growing at a fast pace, fueled by a combination of technological, strategic, and economic drivers. Growing demand for sophisticated maritime surveillance, reconnaissance, and underwater exploration in defense and commercial markets is another significant growth driver. Militaries globally, especially in the United States, are spending heavily on UMVs to improve naval capabilities while minimizing human risk, especially in mine detection, anti-submarine warfare, and border patrol. In the industrial market, oil and gas operations offshore employ UMVs for environmental monitoring, seabed mapping, and pipeline inspection because these unmanned vehicles can explore hard-to-approach environments and dangerous locales more economically and safely than crewed ships. Moreover, advances in autonomous technology, AI, sensor integration, and batteries have dramatically increased vehicle performance, endurance, and real-time analytics capabilities. Additionally, growing environmental issues and governmental regulations pertaining to marine conservation are stimulating the implementation of UMVs for eco-friendly oceanographic exploration and pollution detection, further driving the unmanned marine vehicles market growth internationally.

To get more information on this market Request Sample

The United States stands out as a key market disruptor, driven by its large defense budget, technological superiority, and strategic maritime interests. The United States Navy's focus on embedding autonomous systems can be seen through initiatives such as the Orca Extra-Large Unmanned Undersea Vehicle (XLUUV), intended for operations like surveillance and mine sweeping. Orca is a product developed by Lockheed Martin and Boeing and boasts modular build and long-endurance, supporting operational flexibility. Further, the cost-effective unmanned warships, such as Blue Water Autonomy is developing them to overcome limited fleet size and strained shipbuilding capacity, can fill gaps where manned warships cannot. Built for long-distance ocean missions, they augment the traditional manned warships, enlarging the operating envelope of the Navy. In addition, the Copperhead autonomous underwater vehicle family of Anduril Industries are reusable, high-speed systems, deployable from multiple platforms that present a budget-friendly option relative to the usual torpedoes.

Unmanned Marine Vehicles Market Trends:

Increased Demand for AUVs and ROVs for Intelligence and Underwater Operations

One of the most important trends in the unmanned marine vehicles (UMVs) market is increasing dependence on Autonomous Underwater Vehicles (AUVs) and Remotely Operated Vehicles (ROVs) for gathering intelligence, surveillance, and niche underwater operations. According to the IISS, global defense spending rose sharply in 2024 amid mounting security challenges, reaching USD 2.46 Trillion, up from USD 2.24 Trillion in 2023. This rise pushed defense budgets to an average of 1.9% of global GDP, compared to 1.8% in 2023 and 1.6% in 2022. Hence, as geopolitical tensions and territorial conflicts over maritime areas intensify, governments and private enterprises are looking toward these sophisticated systems to gather important information covertly and effectively. AUVs and ROVs are increasingly used for oceanographic surveys, monitoring the environment, and deep-sea exploration because they can act independently in difficult and inaccessible underwater conditions. These platforms provide increased operational stamina, accuracy in data acquisition, and versatility to different payloads, making them invaluable in contemporary naval and research missions. Furthermore, the quick integration of sophisticated sensors, AI processes, and real-time communication technology is improving the capacity of AUVs and ROVs to aid multi-domain intelligence operations without human intervention.

Strategic Government Investments to Enhance Maritime Defense

Governments in technologically developed countries, are investing heavily in unmanned maritime technologies to enhance their naval defense capabilities, which is further transforming the unmanned marine vehicles market outlook. The changing face of sea security threats ranging from underwater mines and enemy submarine operations to illegal smuggling and border violations calls for flexible and endurance-based surveillance solutions. In turn, defense agencies are spending large percentages of their military budgets to create and deploy UMVs that can conduct reconnaissance, mine countermeasures, and surveillance missions over large ocean areas. As such, in 2024, India approved an INR 21,772 Crore defense package, including 151 naval boats and 6 ALH helicopters, to enhance maritime security. In line with this, the widespread uptake of autonomous marine vehicles in hydrographic surveys to produce navigational charts for safer transit of vessels and understand the freshwater environment for port and harbor development is one of the prominent unmanned marine vehicles market growth factors. Consequently, in 2025, Seasats raised USD 10 Million, led by Shield Capital, to expand its autonomous maritime solutions. Its 11ft solar-powered Lightfish ASV, operational since 2023, completed 7,000- and 2,500-mile missions, showcasing reliability in defense and commercial applications like subsea mapping and border protection. These vehicles minimize the risks to human life in hostile environments while allowing for longer mission times and enhanced situational awareness. Defense industries and naval research bodies are coming together to expand the operational envelope of UMVs through modular payloads and greater autonomy.

Transition Toward Multi-Role and Modular UMV Platforms

One of the significant trends influencing the unmanned marine vehicles market forecast is the development of multi-role and module vehicle platforms that can be tailored to various missions. This trend is based on the demand for versatile systems that can shift between commercial and military uses with little reconfiguration. Whether it is inspecting undersea cables, oil and gas infrastructure, or naval reconnaissance, end-users now require vehicles that provide flexibility and quick responsiveness. Modular UMVs, with the ability to swap payloads and scale architecture, are becoming more popular because they lower the total cost of ownership and make logistics easier. These platforms enable operators to re-skin their systems in the field, maximizing mission performance without the necessity of having multiple vehicles for individual tasks. As defense forces and industries seek more cost-efficient and sustainable solutions, the emphasis on modularity also enables simpler maintenance and faster technological updates, which will keep technology up to date in fast-changing operating environments.

Unmanned Marine Vehicles Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global unmanned marine vehicles market, along with forecasts at the global, regional, and country levels from 2026-2034. The market has been categorized based on type, control type, and application.

Analysis by Type:

- Surface Vehicle

- Underwater Vehicle

Surface vehicles represent the leading unmanned marine vehicles market segment due to their versatility, advanced technological integration, and broad applicability across defense, commercial, and research sectors. Unmanned Surface Vehicles (USVs) are increasingly favored for tasks such as maritime surveillance, anti-submarine warfare, mine detection, port security, and environmental monitoring. Their ability to operate autonomously or via remote control enables extended missions without exposing human operators to risk. In defense, surface vehicles offer force-multiplying capabilities, acting as forward surveillance units or decoys. Commercially, they are used for hydrographic surveys, offshore infrastructure inspections, and marine data collection. Technological advancements in autonomous navigation, real-time communication, and AI-based decision-making have enhanced their efficiency and reliability. Unlike underwater vehicles, surface units benefit from constant GPS access and easier communication with control stations, making them highly efficient for continuous monitoring. This adaptability and performance edge have positioned surface vehicles at the forefront of the UMV market.

Analysis by Control Type:

- Remotely Operated

- Autonomous

Remotely operated leads the market with around 72.6% of market share in 2025. Remotely operated vehicles (ROVs) are the dominant control type segmentation in the unmanned marine vehicles (UMVs) market because of their accuracy, real-time control, and general applicability to a wide range of marine operations. Human pilots control ROVs from a remote-control station tended to be on a vessel or on land making them the general favorite choice for operations in complicated underwater situations where the presence of humans is risky or impossible. Fields like offshore oil and gas, defense, marine science, and subsea facilities largely depend on ROVs for inspection, maintenance, and repair activities. Due to their capacity to transport high-resolution cameras, manipulator arms, and sensors, ROVs play a crucial role in providing detailed underwater inspections. In military applications, ROVs have been deployed for mine detection, hull inspection, and intelligence. The need for accurate control in deep-water conditions, combined with increasing mission complexity in water, has kept ROVs the market leaders, even as autonomous systems pick up traction in concurrent applications.

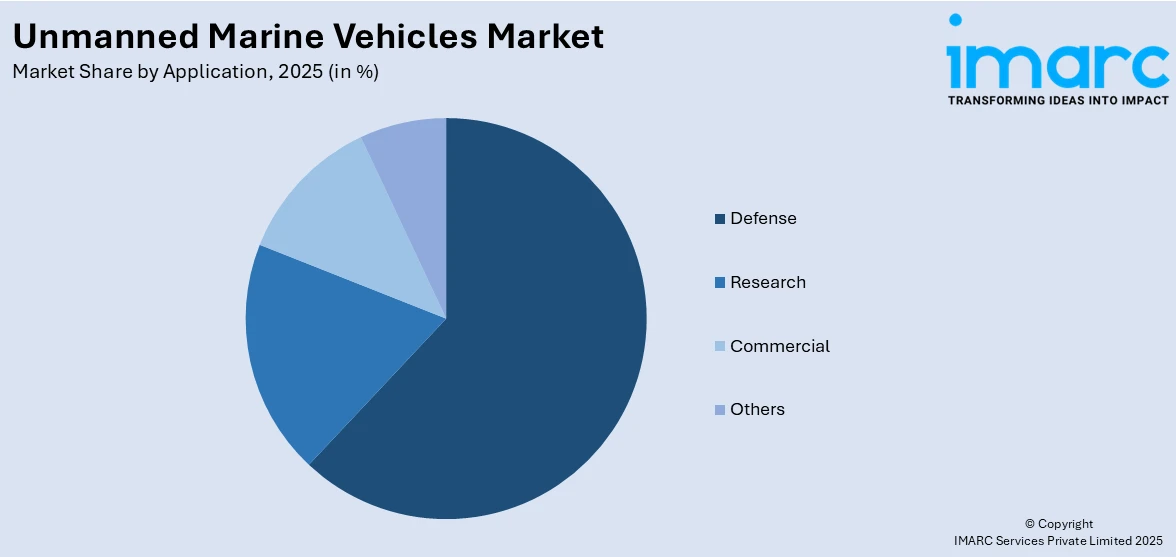

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Defense

- Research

- Commercial

- Others

Defense leads the market with around 62.3% of market share in 2025. Defense is the prime application segment in the unmanned marine vehicles (UMVs) market, spurred by increasing demand for improved maritime security, surveillance, and operational effectiveness. UMVs, especially unmanned surface vehicles (USVs) and autonomous underwater vehicles (AUVs), are being used more and more by global military forces for intelligence gathering, reconnaissance, mine detection, anti-submarine warfare, and border patrol. They provide considerable benefits in minimizing human personnel risks and supporting sustained operations in hostile situations without loss of life. AUVs are used primarily for deep-sea missions such as mine hunting or intelligence gathering, while USVs undertake surveillance operations in adversarial waters. With the increasing sophistication of modern warfare and the necessity for ongoing, real-time data, the military forces are integrating the UMVs into larger defense strategies, including fleet protection and threat warning. With nations placing greater emphasis on modernization and affordable solutions to defense, demand for UMVs for military use continues to increase, making defense the leading sector for the market.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, North America accounted for the largest market share of over 39.8%. North America is the dominant regional segment of the unmanned marine vehicles (UMVs) market, led by aggressive technological developments, high defense expenditure, and growing demand from commercial and research markets. The United States, specifically, is at the forefront of developing and deploying unmanned marine systems, with considerable investment from the government as well as the private sector. The continuous efforts of the US Navy, including the inclusion of autonomous underwater vehicles (AUVs) and unmanned surface vehicles (USVs) in defense operations, are behind this dominance. Additionally, the offshore oil and gas sectors of North America, combined with its focus on environmental monitoring and sea research, greatly contribute to the market development. Favorable regulatory conditions in the region and high research investments in autonomous maritime technologies spur innovation, with North America being a hub for the UMV market. North America thus remains at the forefront both in technological advancements and market leadership.

Key Regional Takeaways:

United States Unmanned Marine Vehicles Market Analysis

In 2025, the United States accounted for 96.70% of the unmanned marine vehicles market in North America. The United States unmanned marine vehicles market is primarily driven by the growing emphasis on maritime domain awareness necessitating persistent surveillance capabilities. In line with this, increased geopolitical tensions and contested maritime zones leading to expanded defense budgets focused on undersea and surface autonomy, are propelling market growth. Similarly, the rapid integration of advanced communication networks such as 5G and satellite-based systems enhancing real-time data transmission, is augmenting operational efficiency and product sales. Furthermore, climate change research intensifying the need for extended-duration oceanographic missions supported by UMVs, is bolstering market development. The continual advancements in miniaturized sensors and AI algorithms enabling more intelligent, adaptive behavior in dynamic marine environments, are stimulating market appeal. Additionally, the rise in commercial shipping and offshore energy sectors relying on UMVs for asset inspection and maintenance, is strengthening market demand. According to the United States Trade Representative, ships are essential to U.S. economic security and global commerce, transporting over 80% of goods worldwide. Specifically, 61% of U.S. international trade with Asia and 45% with Europe is conducted via sea. Moreover, favorable naval modernization initiatives accelerating procurement of autonomous platforms, are providing an impetus to the market.

Europe Unmanned Marine Vehicles Market Analysis

The European unmanned marine vehicles market is majorly influenced by the commitment to sustainable maritime operations promoting the adoption of low-emission autonomous vessels. Similarly, increasing investments in marine robotics under EU research programs, such as Horizon Europe, supporting innovation in UMV development, are fostering market expansion. As such, in February 2025, the UK’s National Oceanography Centre awarded GBP 4 million to develop three advanced sensor projects targeting 10 essential ocean variables. These sensors will be integrated into autonomous platforms like gliders and Autosub Long Range (ALR) vehicles, enhancing national marine research infrastructure and capabilities. Furthermore, heightened focus on securing maritime borders against illegal trafficking and migration elevating demand for autonomous surveillance platforms, is impelling the market. The growing need for infrastructure monitoring in offshore wind farms and subsea pipelines is encouraging higher UMV integration in the market. Additionally, favorable naval modernization initiatives across NATO member states prioritizing unmanned capabilities for marine countermeasures and intelligence gathering, are bolstering market development. Besides this, various collaborations between academia and industry fostering continuous innovation, are supporting market growth. The growing emphasis on digital sovereignty is hence one of the significant unmanned marine vehicles market drivers, fueling domestic production and development of strategic autonomous marine systems.

Asia Pacific Unmanned Marine Vehicles Market Analysis

The Asia Pacific market is advancing attributed to the rising territorial disputes in the South and East China Seas. In accordance with this, growing demand for real-time environmental and oceanographic data supporting climate resilience efforts is encouraging higher product adoption. Furthermore, the growth in the shipbuilding industry, fostering innovation in autonomous systems, is strengthening market demand. An industry report indicates that China’s total shipbuilding output increased by 12% in 2024, reaching 47.8 million deadweight tons (dwt). The orderbook-to-annual output ratio also hit a record high of 5.5 in 2024, up from 3.8 in 2023 and 3.2 in 2022. Additionally, rising funding in maritime infrastructure, particularly under initiatives such as China’s Belt and Road, necessitating advanced marine monitoring tools, is enhancing market accessibility. Apart from this, heightened government-backed modernization of naval fleets, particularly in countries like India, Japan, and South Korea, is accelerating market deployment. Likewise, strong collaboration between academic institutions and industry players fueling research in smart ocean technologies across the region, is expanding the market scope.

Latin America Unmanned Marine Vehicles Market Analysis

In Latin America, the unmanned marine vehicles market is progressing due to the increasing investments in coastal surveillance to address illegal fishing and maritime trafficking, particularly in regions such as the Pacific coasts of Colombia and Peru. In 2024, Peruvian fishing industry representatives reported that 70 foreign ships entered Peru, many allegedly linked to illegal fishing and crew human rights violations. In addition to this, rising interest in deep-sea resource exploration, including offshore hydrocarbons and minerals, is also fueling market demand. Furthermore, governments are expanding partnerships with international defense firms to modernize naval fleets with autonomous technologies, thereby significantly driving the market. Besides this, heightened focus on climate monitoring and marine biodiversity preservation is accelerating the adoption of UMVs for scientific and environmental research across regional waters.

Middle East and Africa Unmanned Marine Vehicles Market Analysis

The market in the Middle East and Africa is experiencing growth, attributed to increasing maritime border security requirements driven by regional conflicts and piracy threats. Furthermore, the growing interest in offshore oil and gas exploration, necessitating autonomous systems for deep-sea surveys and monitoring is impelling the market. Accordingly, in 2024, ADNOC announced a 25% production boost at the SARB offshore field, raising output to 140,000 bpd. Enabled by AI and digital technologies, remote operations reduced emissions and costs, supporting ADNOC's 5 MMbopd goal by 2027. Additionally, governments are enhancing naval modernization programs, incorporating UMVs to reduce human risk and operational costs, thereby bolstering market reach. Moreover, rising investments in marine research to assess climate impacts fueling the deployment of advanced data-gathering and monitoring technologies, are positively influencing the market.

Competitive Landscape:

Several companies in the unmanned marine vehicles (UMVs) industry are exerting considerable efforts to spur innovation, market growth, and technological developments. Major players such as Boeing, Lockheed Martin, Ocean Infinity, and others are investing significantly in research and development to improve autonomous system capabilities, extending the limits of artificial intelligence, sensor technology, and vehicle endurance. Such developments are aimed at enhancing the reliability and autonomy of both autonomous underwater vehicles (AUVs) and unmanned surface vehicles (USVs). An example is Boeing's Orca XLUUV (Extra-Large Unmanned Underwater Vehicle), a game-changer in delivering extended-duration missions for military use, including anti-submarine warfare and mine countermeasures. On the other hand, Ocean Infinity is developing AUVs to explore the deep sea and perform offshore surveying, with use cases varying from environmental monitoring to seabed mapping. Additionally, industry leaders are working together with government defense departments to deploy UMVs into national defense policy, enhancing military preparedness and operational effectiveness. Commercial companies are also investigating opportunities for partnerships with energy corporations, providing solutions for offshore oil and gas inspection while, at the same time, mitigating environmental issues through oceanographic exploration. Apart from this, firms are concentrating on cost-efficient, modular solutions that can be easily customized for varied mission profiles, bringing UMVs within reach of various industries. The ongoing quest for greater performance, reliability, and versatility by these players is essentially defining the future of the UMV market.

The report provides a comprehensive analysis of the competitive landscape in the unmanned marine vehicles market with detailed profiles of all major companies, including:

- Atlas Elektronik GmbH (ThyssenKrupp AG)

- Fugro

- General Dynamics Mission Systems Inc. (General Dynamics Corporation)

- Kongsberg Gruppen

- L3harris Technologies Inc.

- Lockheed Martin Corporation

- QinetiQ

- Rafael Advanced Defense Systems Ltd.

- Saab AB

- Teledyne Technologies Inc.

- Textron Inc.

- The Boeing Company

Latest News and Developments:

- April 2025: HD Hyundai Heavy Industries secured a contract to develop a next-gen combat unmanned Surface Vessel (USV) for South Korea’s Navy. This initiative was part of South Korea's broader strategy to integrate unmanned ships, submarines, and aircraft into its military operations by the 2040s, addressing both technological advancements and troop shortages.

- April 2025: The US Pentagon’s Defense Innovation Unit issued a call for proposals for the Combat Autonomous Maritime Platform (CAMP), a large unmanned underwater vessel. CAMP aimed to deliver long-range, high-payload autonomous capabilities for missions like intelligence collection and sea-floor payload deployment in contested, GPS-denied environments.

- April 2025: Anduril unveiled its Copperhead unmanned undersea vehicle (UUV). Designed for deployment from larger UUVs like Dive-LD and Dive-XL, Copperhead supported modular payloads and combat missions. A variant, Copperhead-M, also functioned as a torpedo, enhancing undersea warfare capabilities against shifting maritime threats.

- March 2025: Turkey announced the upcoming delivery of two new ULAQ unmanned sea vehicle variants to its navy. The ULAQ 12 reportedly supports anti-surface warfare with (AI) and missile systems, while ULAQ KAMA is a kamikaze drone boat with autonomous targeting and ISR capabilities, both currently in testing.

- February 2025: UK-based Zero USV launched the Oceanus12, a fully autonomous 12-meter USV designed for over-the-horizon missions. Powered by a hybrid-electric system and MarineAI’s Guardian software, it supported diverse operations and marked the start of a charter fleet of autonomous USVs.

- June 2024: DRDO awarded Pune-based Sagar Defence a contract to develop India’s first underwater-launched unmanned aerial vehicle (ULUAV). Designed for deployment from submarines, the ULUAV is expected to enhance underwater surveillance and intelligence capabilities.

Unmanned Marine Vehicles Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Surface Vehicle, Underwater Vehicle |

| Control Types Covered | Remotely Operated, Autonomous |

| Applications Covered | Defense, Research, Commercial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Elektronik GmbH (ThyssenKrupp AG), Fugro, General Dynamics Mission Systems Inc. (General Dynamics Corporation), Kongsberg Gruppen, L3harris Technologies Inc., Lockheed Martin Corporation, QinetiQ, Rafael Advanced Defense Systems Ltd., Saab AB, Teledyne Technologies Inc., Textron Inc., The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the unmanned marine vehicles market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global unmanned marine vehicles market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the unmanned marine vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The unmanned marine vehicles market was valued at USD 5.2 Billion in 2025.

The unmanned marine vehicles market is projected to exhibit a CAGR of 8.41% during 2026-2034, reaching a value of USD 11.0 Billion by 2034.

The unmanned marine vehicles market is driven by rising demand for maritime surveillance, underwater exploration, and naval defense operations. Technological advancements in autonomy, sensor integration, and communication systems enhance operational efficiency. Increased offshore oil and gas activities, environmental monitoring needs, and reduced human risk further propel market growth and investment.

North America currently dominates the unmanned marine vehicles market, driven by strong defense spending, particularly from the US Navy, advancements in autonomous technology, and increased demand for underwater surveillance and offshore energy exploration. Government support, environmental monitoring needs, and the push for cost-effective, risk-reducing maritime operations further boost regional market growth.

Some of the major players in the unmanned marine vehicles market include Atlas Elektronik GmbH (ThyssenKrupp AG), Fugro, General Dynamics Mission Systems Inc. (General Dynamics Corporation), Kongsberg Gruppen, L3harris Technologies Inc., Lockheed Martin Corporation, QinetiQ, Rafael Advanced Defense Systems Ltd., Saab AB, Teledyne Technologies Inc., Textron Inc., The Boeing Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)