Upper Limb Prosthetics Market Report by Product Type (Passive Prosthetic Devices, Myoelectric Prosthetic Devices, Body Powered Prosthetic Devices, Hybrid Prosthetic Devices), Component (Prosthetic Wrist, Prosthetic Arm, Prosthetic Elbow, Prosthetic Shoulder, and Others), End Use (Hospitals, Prosthetic Clinics, and Others), and Region 2026-2034

Market Overview:

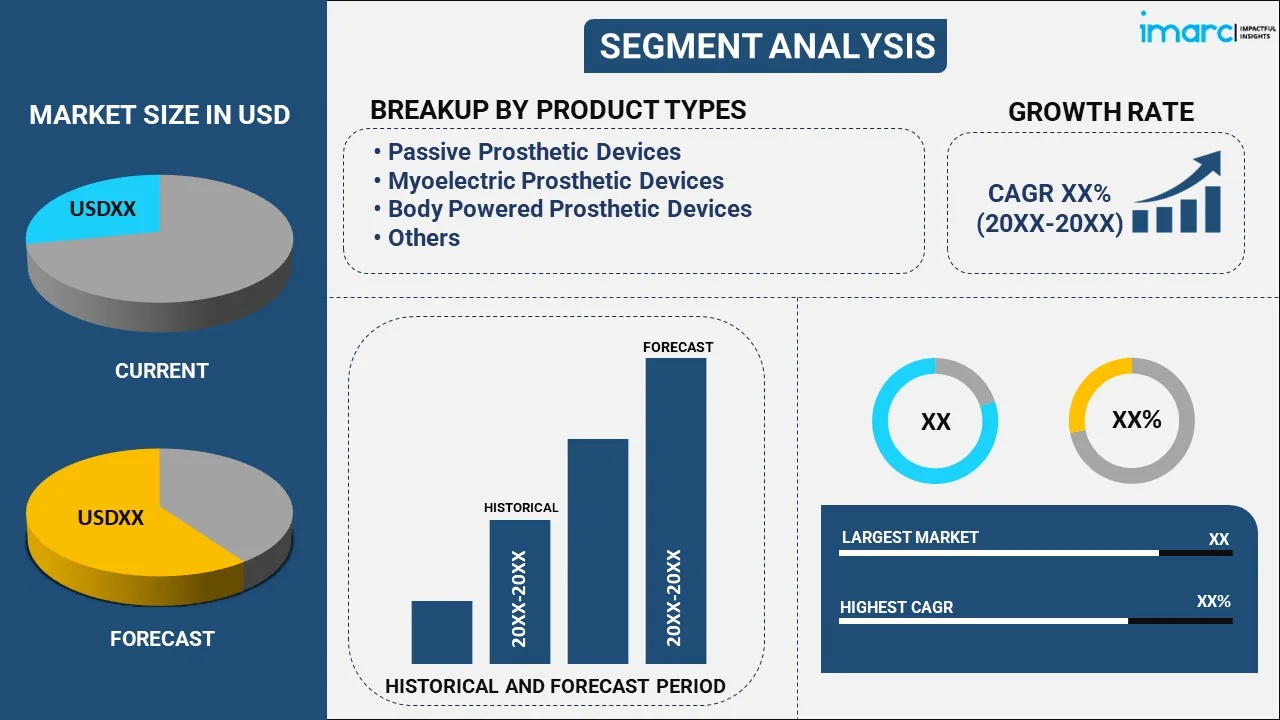

The global upper limb prosthetics market size reached USD 843.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 1,248.1 Million by 2034, exhibiting a growth rate (CAGR) of 4.31% during 2026-2034. North America dominates the market, driven by expanding insurance coverage and reimbursement policies and the growing aging population. Rising prevalence of chronic and acute indications and significant investments in the thriving healthcare industry represent some factors influencing the market research report.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 843.9 Million |

| Market Forecast in 2034 | USD 1,248.1 Million |

| Market Growth Rate (2026-2034) | 4.31% |

Upper limb prosthetics are medical equipment that are designed to replace the upper limbs of the arms, hands, wrists, and fingers of individuals who have lost them due to injury, illness, or congenital disabilities. These prosthetic devices are intended to help restore function and independence to the user, allowing them to do activities they may have previously been unable to perform or complete. They range from simple to complex, depending on the level of functionality desired. For instance, simple prosthetics provide basic gripping and grasping capabilities, while more complex prosthetics are computerized and capable of performing complex tasks. Additionally, they consist of an artificial limb, socket, harness, and an interface and control system that allows the user to control and manipulate the prosthetic. Moreover, depending on the patient’s needs, they may include additional components, such as specialized tools and software. The most common types of upper limb prosthetics are myoelectric prosthetics, body-powered prosthetics, and passive prosthetics.

To get more information on this market Request Sample

Upper Limb Prosthetics Market Trends:

Rising prevalence of accidents and traumatic injuries

The growing incidence of accidents and traumatic injuries is positively influencing the market. According to the information collected from eleven commissionerates and superintendent of police offices throughout Maharashtra, the count of accidents on state and national highways increased from 35,243 in 2023 to 36,084 in 2024. Road traffic accidents, workplace mishaps, and natural disasters contribute significantly to the number of trauma-related amputations, particularly in developing as well as industrialized nations. The physical and psychological impact of such injuries has led to the growing demand for functional, durable, and cosmetically appealing prosthetic devices that can restore mobility and independence. Healthcare providers are recommending advanced upper limb prosthetics, including myoelectric and bionic options, to improve the quality of life of patients.

Growing number of amputations due to diabetes and vascular diseases

Increasing number of amputations resulting from diabetes and vascular diseases is a significant factor propelling the market growth. With the rising burden of lifestyle-related illnesses like diabetes, cases of upper limb loss are steadily increasing. The International Diabetes Federation (IDF) Diabetes Atlas (2025) indicated that 11.1%, approximately 1 out of 9 adults (aged 20-79), were affected by diabetes, with more than 40% unaware about their diagnosis. Chronic conditions, such as peripheral artery disease (PAD), and complications linked to uncontrolled diabetes often impair blood circulation, enhancing the risk of severe infections that lead to amputations. This is catalyzing the demand for advanced prosthetic solutions that can provide functional support while improving patient comfort. Healthcare providers are prioritizing the integration of upper limb prosthetics in post-amputation rehabilitation to enhance independence and quality of life.

Expansion of rehabilitation and orthopedic centers

The growth in rehabilitation and orthopedic centers is offering a favorable market outlook by expanding access to specialized care and advanced prosthetic solutions. Rehabilitation facilities play a critical role in post-amputation recovery, offering physical therapy, training, and psychological support to patients adapting to prosthetic devices. The establishment of new orthopedic centers has improved the availability of customized prosthetic fittings and regular follow-up services. In June 2025, the Apollo Children’s Hospital created a center of excellence in pediatric orthopedics and trauma treatment in India. The facility would cater to children needing specialized orthopedic care for injuries incurred during sports activities or due to intricate congenital issues. Additionally, the integration of multidisciplinary teams in rehabilitation centers ensures holistic care, which encourages patient acceptance and effective use of prosthetics.

Key Growth Drivers of Upper Limb Prosthetics Market:

Technological advancements

Technological advancements are among the major transformative drivers of the market growth, reshaping patient outcomes and expectations. Modern innovations, such as myoelectric prosthetics, bionic arms, and devices with sensory feedback, have significantly enhanced functionality, allowing users to perform complex and precise movements with greater ease. The integration of lightweight materials, advanced robotics, and 3D printing technologies has improved the comfort, durability, and affordability of prosthetic devices. Furthermore, research in neuroprosthetics is enabling direct brain-controlled limb movements, creating new opportunities for more natural and intuitive use. These advancements are not only improving patient quality of life but also reducing stigma by offering aesthetically appealing designs. As technology continues to evolve, adoption rates are expected to rise, making prosthetics more accessible and effective globally.

Broadening insurance coverage and reimbursement policies

Broadening insurance coverage and reimbursement policies are making advanced devices more affordable and accessible to a wider patient base. Historically, high costs limited the adoption of sophisticated prosthetics, but the inclusion of these devices under health insurance schemes is reducing financial barriers. Government agencies and private insurers are recognizing the importance of prosthetics in improving patient rehabilitation and quality of life, leading to broader reimbursement support for both standard and advanced solutions like myoelectric prosthetics. This shift is encouraging patients to opt for better-quality devices without worrying about cost constraints. Moreover, favorable policies are also motivating healthcare providers to recommend advanced prosthetic options more frequently. As coverage is broadening, the demand for upper limb prosthetics continues to accelerate.

Rising military injuries

Increasing military injuries are contributing significantly to the growth of the market, as soldiers exposed to combat situations face a higher risk of traumatic amputations. Defense forces across the world are prioritizing the rehabilitation of injured personnel, ensuring they regain mobility and independence through advanced prosthetic solutions. Military hospitals and rehabilitation centers are adopting state-of-the-art prosthetics, such as bionic arms and sensor-based devices, to restore functionality and improve the quality of life for veterans and active-duty personnel. Additionally, government agencies are allocating substantial funds for research and development (R&D) of prosthetics tailored to meet the needs of injured soldiers, further fueling innovations in the market. These investments are not only benefiting the military population but also leading to advancements accessible to civilian amputees.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global upper limb prosthetics market report, along with forecasts at the global, regional, and country levels for 2026-2034. Our report has categorized the market based on product type, component, and end use.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- Passive Prosthetic Devices

- Myoelectric Prosthetic Devices

- Body Powered Prosthetic Devices

- Hybrid Prosthetic Devices

The report has provided a detailed breakup and analysis of the upper limb prosthetics market based on the product type. This includes passive prosthetic devices, myoelectric prosthetic devices, body powered prosthetic devices, and hybrid prosthetic devices. According to the report, passive prosthetic devices represented the largest segment.

Component Insights:

- Prosthetic Wrist

- Prosthetic Arm

- Prosthetic Elbow

- Prosthetic Shoulder

- Others

A detailed breakup and analysis of the upper limb prosthetics market based on the component has also been provided in the report. This includes prosthetic wrist, prosthetic arm, prosthetic elbow, prosthetic shoulder, and others. According to the report, prosthetic arm accounted for the largest upper limb prosthetics market share.

End Use Insights:

- Hospitals

- Prosthetic Clinics

- Others

The report has provided a detailed breakup and analysis of the upper limb prosthetics market based on the end use type. This includes hospitals, prosthetic clinics, and others. According to the report, prosthetic clinics represented the largest segment.

Regional Insights:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America was the largest market for upper limb prosthetics. Some of the factors driving the North America upper limb prosthetics market included its aging population, technological advancements, high healthcare expenditure, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global upper limb prosthetics market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include:

- Blatchford Limited (Endolite India Ltd)

- Coapt LLC

- Fillauer LLC

- Mobius Bionics LLC

- Motorica LLC

- Ortho Europe

- Össur

- Ottobock SE & Co. KGaA (Näder Holding GmbH & Co.)

- Protunix

- Steeper Group

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Upper Limb Prosthetics Market News:

- January 2025: The LUKE Arm, created by the University of Utah, was prepared for testing in everyday scenarios. An agreement with the startup Biologic Input Output Systems (BIOS) would assist the University of Utah in its continuing Investigational Device Exception Early Feasibility Study, facilitating the recruitment of the next participant for the clinical trial. This upcoming stage of the project signified an exhilarating move towards the commercialization and practical application of an advanced neuroprosthesis.

- September 2024: A Jordanian-driven project was launched to provide prosthetic limbs to thousands of Gaza war victims. The initiative included UK firms Koalaa and Amparo, which created user-friendly sockets for upper and lower limb prosthetics. The projected expense for each fitting was approximately £1,000 (USD 1,321).

- August 2024: Metacarpal, a startup believed to be creating the world's first mechanical bionic hand, obtained £800,000 in seed funding to expedite its prosthetics innovations. This funding would allow the firm to complete the product, initiate unit production, and increase its workforce to eight. The primary goal was to improve the lives of individuals with limb differences, while also advancing technology and broadening its functionalities in prosthetics.

Upper Limb Prosthetics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Passive Prosthetic Devices, Myoelectric Prosthetic Devices, Body Powered Prosthetic Devices, Hybrid Prosthetic Devices |

| Components Covered | Prosthetic Wrist, Prosthetic Arm, Prosthetic Elbow, Prosthetic Shoulder, Others |

| End Uses Covered | Hospitals, Prosthetic Clinics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Blatchford Limited (Endolite India Ltd), Coapt LLC, Fillauer LLC, Mobius Bionics LLC, Motorica LLC, Ortho Europe, Össur, Ottobock SE & Co. KGaA (Näder Holding GmbH & Co.), Protunix, Steeper Group, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global upper limb prosthetics market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global upper limb prosthetics market?

- What is the impact of each driver, restraint, and opportunity on the global upper limb prosthetics market?

- What are the key regional markets?

- Which countries represent the most attractive global upper limb prosthetics market?

- What is the breakup of the market based on the product type?

- Which is the most attractive product type in the upper limb prosthetics market?

- What is the breakup of the market based on the component?

- Which is the most attractive component in the upper limb prosthetics market?

- What is the breakup of the market based on end use?

- Which is the most attractive end use in the upper limb prosthetics market?

- What is the competitive structure of the global upper limb prosthetics market?

- Who are the key players/companies in the global upper limb prosthetics market?

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the upper limb prosthetics market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global upper limb prosthetics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the upper limb prosthetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)