US Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

US Agribusiness Market Overview:

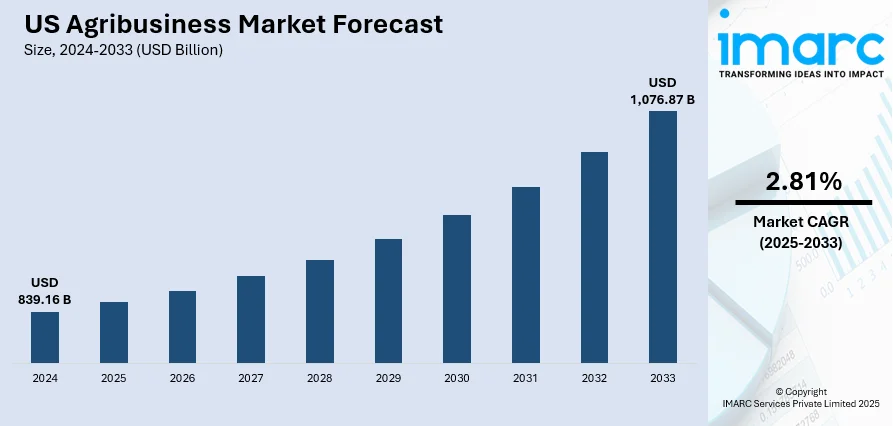

The US agribusiness market size reached USD 839.16 Billion in 2024. The market is projected to reach USD 1,076.87 Billion by 2033, exhibiting a growth rate (CAGR) of 2.81% during 2025-2033. Strong demand from international markets for US corn, soybeans, and wheat is supporting large-scale grain production, while increasing exports of beef, pork, and poultry cater to rising protein consumption in developing regions. Besides this, the growing manufacturing of biofuels is contributing to the expansion of the US agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 839.16 Billion |

| Market Forecast in 2033 | USD 1,076.87 Billion |

| Market Growth Rate 2025-2033 | 2.81% |

US Agribusiness Market Trends:

Growing exports of agricultural products

Expanding exports of grains, meat, dairy, and specialty crops are opening new revenue streams, boosting farm incomes, and strengthening the United States’ position in global agricultural trade. As reported by the US Department of Agriculture’s (USDA) weekly Export Sales Report, the sales and accumulated exports of all wheat classes for the 2024/25 marketing year reached 7.7 MMT, surpassing 2023/2024’s value by 49%. Strong demand from international markets for US corn, soybeans, and wheat is supporting large-scale grain production, while increasing exports of beef, pork, and poultry cater to rising protein consumption in developing regions. Dairy products, such as cheese, milk powder, and butter, enjoy elevated demand in regions lacking domestic production capacity, adding stability to the dairy segment. Specialty crops like almonds, walnuts, citrus fruits, and blueberries have carved niche markets abroad, where the US benefits from high quality standards and advanced farming practices. Trade agreements, reduced tariffs, and strategic access to high-growth regions in Asia, the Middle East, and Latin America are enhancing export competitiveness. This expansion is encouraging investments in advanced processing facilities, cold chain logistics, and sustainable farming practices to meet international quality and safety requirements. By diversifying markets and reducing dependence on domestic consumption alone, exports help mitigate price volatility for farmers. The steady growth of agricultural exports is creating a multiplier effect that strengthens the entire US agribusiness ecosystem.

To get more information on this market, Request Sample

Increasing demand for biofuels

Rising demand for biofuels is fueling the US agribusiness market growth by creating a strong and consistent need for feedstocks, such as corn, soybeans, and other oilseeds, which are key raw materials for ethanol and biodiesel production. As per the IMARC Group, the United States biodiesel market size reached USD 15.2 Billion in 2024. Government policies promoting renewable energy, blending mandates, and incentives for low-carbon fuels are further stimulating biofuel output, providing farmers with stable and often higher prices for their crops. The ethanol industry, heavily reliant on corn, benefits from both domestic utilization and export opportunities, while biodiesel production is catalyzing the demand for soybean oil and other vegetable oils. This expanding market is encouraging farmers to adopt high-yield varieties and advanced cultivation practices to meet industrial-scale requirements. Additionally, the biofuel sector is driving investments in storage, transportation, and processing infrastructure, which is supporting rural economic growth. Rising interest in next-generation biofuels, including those from agricultural residues and non-food crops, is broadening the scope for innovations within agribusiness.

US Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

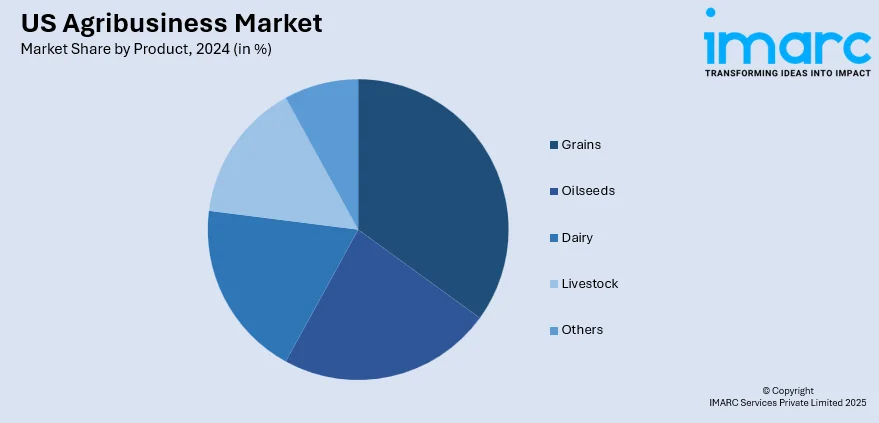

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Agribusiness Market News:

- In August 2025, the US Department of Agriculture planned to allocate USD 152 Million for Iowa's rural communities. The USDA stated that the initiatives were anticipated to enhance rural infrastructure, stimulate the state's economy, and promote private investment. Another announcement made was the appointment of Iowan Glen R. Smith as the next Under Secretary for Rural Development at the USDA. Smith, from Atlantic, had participated in agriculture and agribusiness.

- In March 2025, the US Secretary of Agriculture, Brooke Rollins, declared her plans to travel to six international markets during her initial six months in office to enhance market opportunities and increase American agricultural exports. This initiative was aimed at supporting the success of diligent agricultural producers of the United States.

US Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the US agribusiness market on the basis of product?

- What is the breakup of the US agribusiness market on the basis of region?

- What are the various stages in the value chain of the US agribusiness market?

- What are the key driving factors and challenges in the US agribusiness market?

- What is the structure of the US agribusiness market and who are the key players?

- What is the degree of competition in the US agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)