US AI Sensors Market Size, Share, Trends and Forecast by Sensor Type, Application, Technology, and Region, 2025-2033

US AI Sensors Market Size and Share:

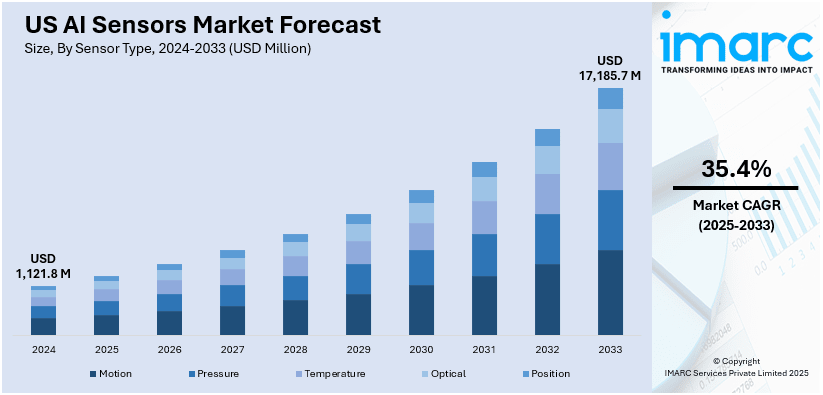

The US AI sensors market size was valued at USD 1,121.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 17,185.7 Million by 2033, exhibiting a CAGR of 35.4% from 2025-2033. The market is witnessing significant growth due to the increasing adoption of AI in industrial automation and the rising demand for AI-enabled sensors in autonomous vehicles. Moreover, the growing integration of AI sensors in edge computing, increasing deployment of AI sensors in smart cities, and advancements in AI sensors for healthcare applications are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,121.8 Million |

| Market Forecast in 2033 | USD 17,185.7 Million |

| Market Growth Rate (2025-2033) | 35.4% |

The U.S. AI sensors market is booming as artificial intelligence finds increasing implementation in industrial automation. AI-based sensors in manufacturing, logistics, and supply chain are supporting realistic monitoring, predictive maintenance, and quality control. The role of AI-enabled sensors is to optimize operation efficiency in automation by means of decision-making, reducing machine downtime, and minimizing human intervention. Demand continues to gain traction on the back of various factors, such as the push toward Industry 4.0 and smart factories with companies investing in AI-enhanced sensors for robotics, computer vision, and automated inspection systems. For instance, in 2024, Siemens and Microsoft enhanced the Industrial Copilot with Azure OpenAI, revolutionizing automation. Over 100 companies, including Schaeffler and thyssenkrupp, use it to streamline processes, address labor shortages, and drive innovation. Government initiatives promoting advanced manufacturing technologies and digital transformation across key industries are also contributing to market expansion.

The growing development in personal vehicles and connected vehicles are among the most major drives for the U.S. AI sensors market. An automobile manufacturer and manufacturer have brought into the fold sensors driven by artificial intelligence, e.g., autonomous vehicles such as LiDAR, radar, and camera-based vision systems that are expected to heighten the safety, navigation, and decision-making of the vehicle. For instance, in 2025, NVIDIA introduced generative AI models for Omniverse, expanding into robotics, autonomous vehicles, and vision AI, accelerating industrial AI adoption. Physical AI will revolutionize the $50 trillion manufacturing and logistics industries through digital twins and advanced automation. The National Highway Traffic Safety Administration (NHTSA) and other regulatory bodies are supporting advancements in vehicle automation, further accelerating adoption. AI-powered sensors improve object detection, collision avoidance, and adaptive cruise control, driving their demand in both passenger and commercial vehicle segments. Expanding investment in electric and self-driving vehicle technologies is expected to further stimulate market growth.

US AI Sensors Market Trends:

Growing Integration of AI Sensors in Edge Computing

The U.S. AI sensors market is witnessing a surge in the adoption of edge computing, where AI algorithms process data directly on embedded sensors rather than relying on cloud-based systems. This trend is driven by the need for faster decision-making, reduced latency, and enhanced data privacy. AI-powered edge sensors are increasingly deployed in industrial automation, healthcare, and smart infrastructure applications, enabling real-time analytics and localized processing. Companies are investing in AI chips and sensor fusion technologies that enhance on-device intelligence, allowing businesses to operate more efficiently while reducing dependence on external data centers. For instance, in 2024, the National Geospatial Intelligence Agency (NGA) will issue a $700 million contract to train AI-driven computer vision systems, including its Maven program, for advanced target identification and intelligence analysis.

Increasing Deployment of AI Sensors in Smart Cities

The expansion of smart city initiatives across the United States is contributing to the widespread adoption of AI-driven sensors. These sensors play a critical role in traffic management, environmental monitoring, and public safety applications. For instance, in 2024, U.S. Commerce Secretary Gina Raimondo launched the AI Safety Institute Consortium (AISIC) to unite stakeholders in developing AI safety guidelines, supporting President Biden’s Executive Order on risk management and security. AI-powered surveillance systems equipped with advanced sensors improve security through real-time threat detection, while smart traffic sensors optimize urban mobility by analyzing vehicle and pedestrian flow. Government investments in intelligent infrastructure projects and IoT-enabled urban solutions are further driving demand. AI sensors integrated with 5G connectivity are enhancing the efficiency of smart city networks by providing seamless data transmission and improved automation.

Advancements in AI Sensors for Healthcare Applications

AI-driven sensors are transforming healthcare by enabling precision diagnostics, remote patient monitoring, and predictive analytics. For instance, in 2025, the AHA Center for Health Innovation released a report guiding hospital executives on AI adoption, featuring insights from 12 experts and research on transforming health care operations with AI-powered technologies. Wearable medical devices equipped with AI sensors can track vital signs, detect abnormalities, and provide real-time health insights. Hospitals and clinics are increasingly adopting AI-powered imaging sensors for faster and more accurate disease detection. The demand for AI sensors in personalized medicine and telehealth is rising, particularly with the increasing focus on proactive healthcare management. Advancements in biosensors and AI-driven medical imaging are expected to further expand the role of AI sensors in improving patient outcomes and healthcare efficiency.

US AI Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the US AI sensors market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on sensor type, application, and technology.

Analysis by Sensor Type:

- Motion

- Pressure

- Temperature

- Optical

- Position

The sensors of the self-expanding states, driven by AI and dedicated to the automotive markets, provide systems for autonomous drive and driver assistance (ADAS) and in-vehicle monitoring. Collision avoidance, adaptive cruise control, and lane keeping improve through LiDAR, radar, motion, and position sensors. Pressure and temperature sensors installed in an AI environment optimize EV battery management for safety and energy efficiency and ensure predictive maintenance in real-time for the new smart cars.

Smartphones, wearables, and AR/VR, as well as smart home devices, have brought AI-powered sensors to U.S. consumers. Optical, motion, and biometric sensors contribute to facial recognition, gesture control, and interactive real-time users. Temperature and pressure sensors enriched with AI promise advancements in battery performance and efficiency in devices, revolutionizing gaming, human fitness tracking, and home automation systems are future adaptation of the system to users.

AI-integrated sensors in U.S. manufacturing enable maintenance prediction, process automation, and real-time quality control. Position, motion, and temperature sensors are optimized for robotic systems, industrial automation, and smart factories. Machine vision is enhanced with AI-driven optical sensors for defect detection, while pressure sensors work to monitor hydraulic and pneumatic systems, thereby improving efficiency, safety, and production accuracy across industrial operations.

AI sensors for the aerospace and defense markets in the U.S. support autonomous aircraft, surveillance, and missile guidance systems. Optical, motion, and position sensors will bring improvements in navigation, tracking of targets, and situational awareness. Temperature and pressure sensors coupled with AI will lead to improved engine performance, maintenance proactively predicted, and safety measures on flights, boosting applications within defense innovations, UAV technology, and space missions.

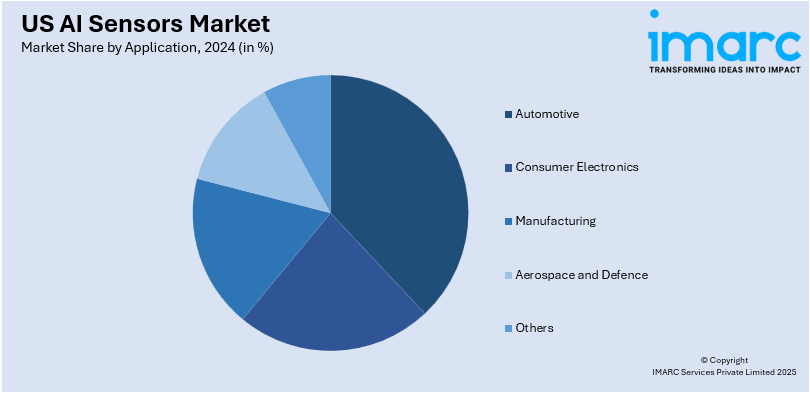

Analysis by Application:

- Automotive

- Consumer Electronics

- Manufacturing

- Aerospace and Defence

- Others

The sensors of the self-expanding states, driven by AI and dedicated to the automotive markets, provide systems for autonomous drive and driver assistance (ADAS) and in-vehicle monitoring. Collision avoidance, adaptive cruise control, and lane keeping improve through LiDAR, radar, motion, and position sensors. Pressure and temperature sensors installed in an AI environment optimize EV battery management for safety and energy efficiency and ensure predictive maintenance in real-time for the new smart cars.

Smartphones, wearables, and AR/VR, as well as smart home devices, have brought AI-powered sensors to U.S. consumers. Optical, motion, and biometric sensors contribute to facial recognition, gesture control, and interactive real-time users. Temperature and pressure sensors enriched with AI promise advancements in battery performance and efficiency in devices, revolutionizing gaming, human fitness tracking, and home automation systems are future adaptation of the system to users.

AI-integrated sensors in U.S. manufacturing enable maintenance prediction, process automation, and real-time quality control. Position, motion, and temperature sensors are optimized for robotic systems, industrial automation, and smart factories. Machine vision is enhanced with AI-driven optical sensors for defect detection, while pressure sensors work to monitor hydraulic and pneumatic systems, thereby improving efficiency, safety, and production accuracy across industrial operations.

AI sensors for the aerospace and defense markets in the U.S. support autonomous aircraft, surveillance, and missile guidance systems. Optical, motion, and position sensors will bring improvements in navigation, tracking of targets, and situational awareness. Temperature and pressure sensors coupled with AI will lead to improved engine performance, maintenance proactively predicted, and safety measures on flights, boosting applications within defense innovations, UAV technology, and space missions.

Analysis by Technology:

- NLP

- Machine Learning

- Computer Vision

NLP enhances AI sensor applications in voice recognition, smart assistants, and human-machine interaction across the U.S. market. AI-powered NLP models process spoken commands in automotive systems, smart homes, and consumer electronics. Integrated with optical and motion sensors, NLP enables gesture-based AI assistants, real-time transcription, and adaptive control interfaces, improving user experience and automation.

ML optimizes sensor data processing in predictive maintenance, autonomous systems, and industrial automation in the U.S. AI sensor market. ML algorithms analyze real-time data from motion, pressure, and temperature sensors to detect anomalies, enhance decision-making, and improve efficiency. ML-driven IoT and smart sensors support automated factories, self-learning robots, and intelligent monitoring systems.

Computer vision enhances autonomous vehicles, facial recognition, industrial inspection, and surveillance systems in the U.S. AI sensor market. Optical and LiDAR sensors process real-time image and video data for object detection, navigation, and security applications. AI-powered vision systems in manufacturing and healthcare improve quality control, medical imaging, and smart city infrastructure with high accuracy.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast United States leads sensor AI adoption in finance, healthcare, and robotics. Cities such as Boston and New York are leaders in AI-driven medical diagnostics, automation, and cybersecurity. Optical and biometric sensors are used for smart surveillance and protection against fintech fraud; AI-powered motion sensors and NLP sensors aid in robotics, digital assistants, and automated trading systems in research hubs and industries.

The Midwest plays a role in the adoption of AI sensors in manufacturing, agriculture, and the automotive sector. Motion, position, and machine vision sensors are being incorporated in smart factories and autonomous vehicles across states like Michigan and Ohio. AI agricultural sensors optimize precision farming, crop health monitoring, and equipment automation, making the Midwest the center of industrial AI and agricultural innovation.

The Southern U.S. fosters AI sensor adoption in energy, logistics, and aerospace. Texas and Florida lead in AI-driven oil refining, smart grids, and space exploration. AI-powered pressure and temperature sensors optimize industrial automation and power management, while optical and motion sensors support autonomous drones, defense systems, and automated shipping logistics in growing industries.

The West Coast is the center for AI sensor innovations in technology, electric vehicles, and renewable energy. Silicon Valley leads in integrating computer vision, NLP, and deep learning sensors for use in autonomous driving, smart cities, and AI-powered consumer electronics. AI-integrated optical and LiDAR sensors are powering breakthroughs in EVs, robots, and industrial automation, thereby defining future applications of AI sensors.

Competitive Landscape:

The U.S. AI sensors market is highly competitive, with key players focusing on technological advancements, strategic partnerships, and product innovation. Major companies, including Intel Corporation, Texas Instruments, NVIDIA Corporation, and Qualcomm, are investing in AI-driven sensor technologies for applications in automotive, industrial automation, and healthcare. For instance, in 2024, Siemens launched Industrial PCs with NVIDIA GPUs, accelerating AI applications in manufacturing. This integration, part of Industrial Operations X, enables 25-fold faster AI execution, reducing costs and speeding time-to-market. Startups and emerging players are introducing specialized AI sensors to cater to niche markets, intensifying competition. Collaborations between sensor manufacturers and AI software developers are driving innovation. Additionally, increasing investments in AI research and government initiatives supporting AI-driven industries are influencing market dynamics and fostering competition among established and emerging players.

The report provides a comprehensive analysis of the competitive landscape in the US AI sensors market with detailed profiles of all major companies.

Latest News and Developments:

- In February 2025, Honeywell introduced the latest Honeywell Forge Production Intelligence, integrating performance monitoring with a generative AI assistant. This tool enables operators and managers to automate tasks, troubleshoot issues, and access insights using natural language, enhancing KPI analysis, asset relationships, and production efficiency across industrial operations.

- In January 2025, Microsoft announced an $80 billion AI investment plan for data centers, with over half allocated to U.S. facilities. This move comes as China expands AI initiatives and the EU enforces its AI Act, shaping global AI development and regulatory frameworks for responsible deployment and innovation.

US AI Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sensor Types Covered | Motion, Pressure, Temperature, Optical, Position |

| Applications Covered | Automotive, Consumer Electronics, Manufacturing, Aerospace and Defence, Others |

| Technologies Covered | NLP, Machine Learning, Computer Vision |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US AI sensors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the US AI sensors market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US AI sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The AI sensors market in the US was valued at USD 1,121.8 Million in 2024.

The growth of the U.S. AI sensors market is driven by increasing adoption of AI across industries, advancements in IoT devices, and significant investments in research and development. These factors collectively enhance automation, efficiency, and real-time data processing capabilities, propelling market expansion.

The US AI sensors market is projected to exhibit a CAGR of 35.4% during 2025-2033, reaching a value of USD 17,185.7 Million by 2033.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)