US Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

US Aquaculture Market Overview:

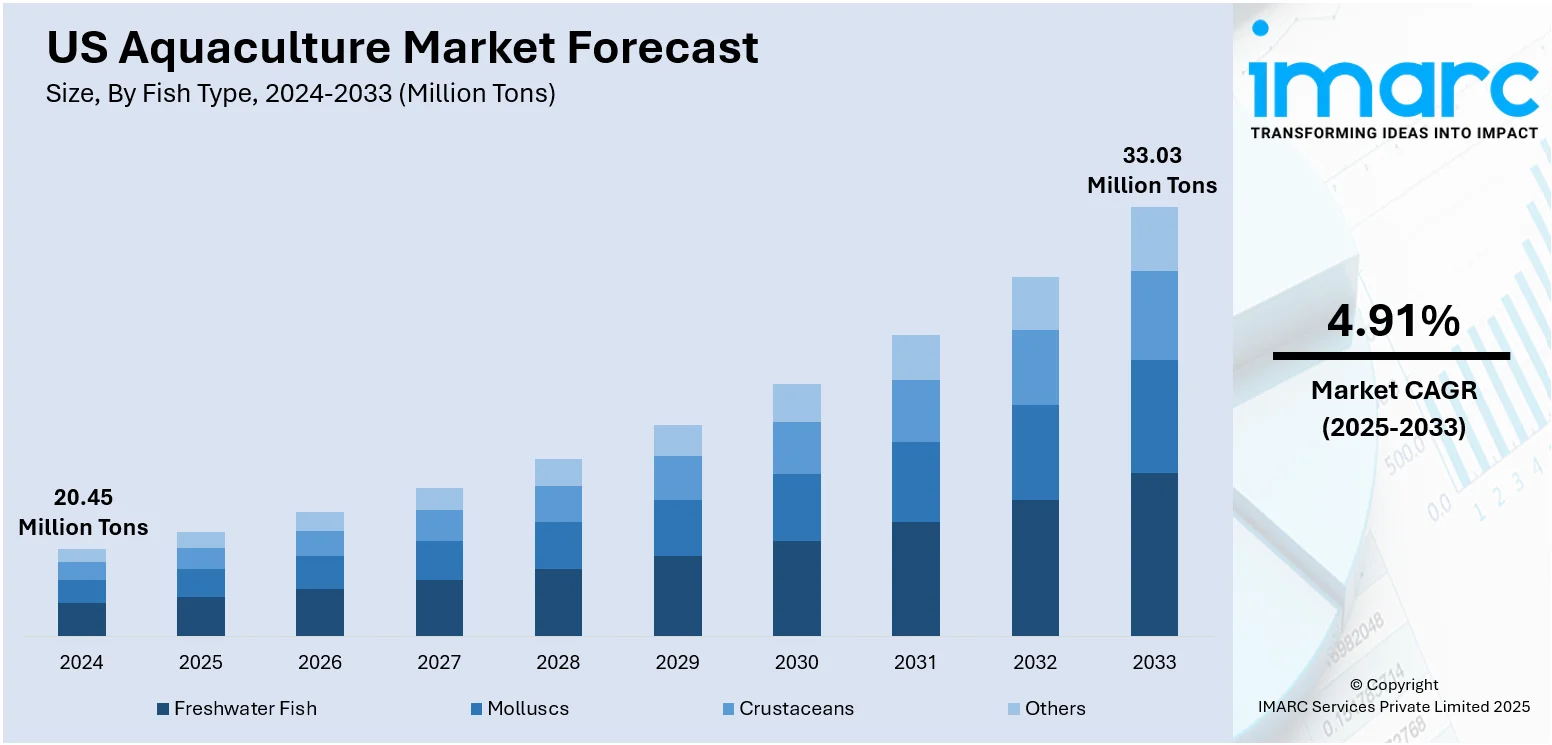

The US aquaculture market size reached 20.45 Million Tons in 2024. Looking forward, the market is projected to reach 33.03 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.91% during 2025-2033. Rising seafood demand, investment in sustainable RAS and offshore systems, alongside technological innovation in feed, genetics, and automation, are supporting expansion. Regulatory and research support further catalyze development and enhance the US aquaculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 20.45 Million Tons |

| Market Forecast in 2033 | 33.03 Million Tons |

| Market Growth Rate 2025-2033 | 4.91% |

US Aquaculture Market Trends:

Policy-Driven Expansion of Domestic Aquaculture Infrastructure

US aquaculture market growth is being propelled by supportive federal policies aimed at boosting seafood self-sufficiency and reducing reliance on imports. A landmark 2025 executive order directs the modernization of aquaculture regulations, expansion of experimental permits, and reduction of red tape for producers. This policy shift promotes land-based systems like RAS, incentivizes sustainable production practices, and strengthens coastal economies. The directive also supports a national “America First Seafood Strategy,” prioritizing domestic aquaculture products in nutrition, marketing, and export programs. As regulations ease and funding opportunities increase, industry players are better positioned to scale operations, adopt cutting-edge technologies, and meet rising demand for locally produced, high-quality seafood. Policy alignment is now a driving force behind U.S. aquaculture infrastructure growth.

To get more information on this market, Request Sample

Emergence of Cultivated Seafood as a Parallel Path to Sustainable Aquaculture

Cultivated seafood, produced from fish cells in bioreactors, is emerging as a complementary innovation to traditional aquaculture in the U.S. For instance, in August 2025, Raleigh-based startup Atlantic Fish Co. secured a $305,000 grant from the U.S. National Science Foundation (NSF) to accelerate the development of cell‑cultured black sea bass. The funding supports scalable production of cultivated white fish using cellular agriculture, a sustainable alternative to wild-caught seafood. Total non‑dilutive funding for the company now exceeds $700,000, underscoring growing confidence in its mission to deliver high-quality, eco-friendly seafood that helps reduce pressure on marine ecosystems.Unlike Recirculating Aquaculture Systems (RAS), cultivated seafood bypasses live-animal production altogether, offering precise control over nutrition, safety, and supply. As regulatory pathways evolve and consumer acceptance grows, cultivated seafood is positioned to diversify the U.S. aquaculture landscape, accelerate protein innovation, and support long-term sustainability goals alongside traditional farming systems.

US Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environment have also been provided in the report. This includes fresh water, marine water, and brackish water.

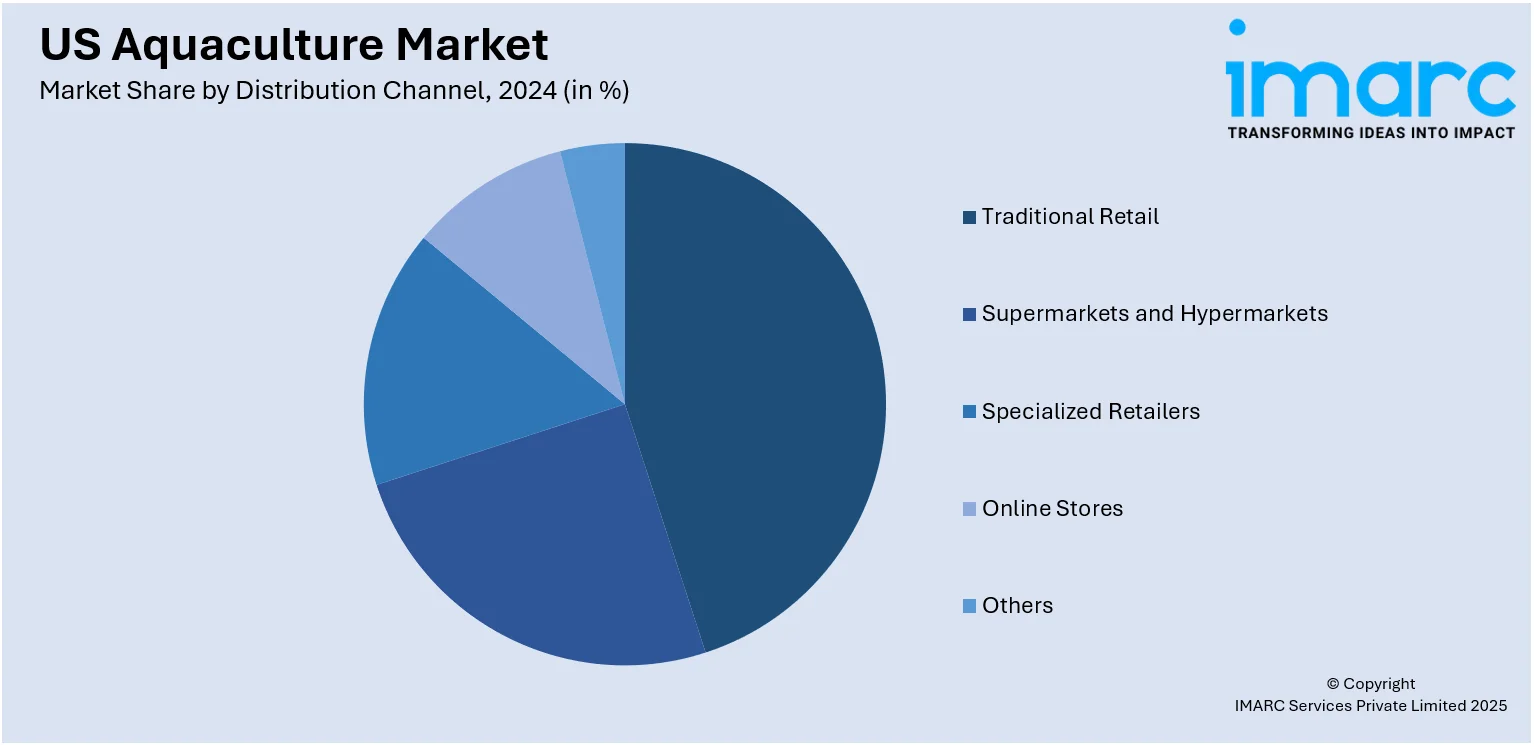

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Aquaculture Market News:

- In August 2025, Researchers at UC Santa Cruz, in collaboration with Pie Ranch and the Amah Mutsun Land Trust, are using aquaculture "backwash"—filtered water from rainbow trout tanks—to irrigate native plants sustainably. The study compares plant growth using this nutrient-rich water versus well water, aiming to understand its effects on soil and plant health. This integrated system supports habitat restoration and climate resilience, offering a model for sustainable farming. It also benefits post-fire recovery efforts by replacing invasive species with native vegetation.

- In July 2025, Aquaconnect launched BluTik, a digital seafood inspection platform delivering real-time, tamper-proof quality control reports. BluTik utilizes geotagging, timestamps, and visual audit documentation to verify pre-shipment seafood inspections, enhancing transparency and trust between suppliers and international buyers. Part of Aquaconnect Global's sourcing operations, it supports seafood trade by offering buyers instant access to certified supplier data across key markets including the U.S., Europe, and Asia.

US Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US aquaculture market performed so far and how will it perform in the coming years?

- What is the breakup of the US aquaculture market on the basis of fish type?

- What is the breakup of the US aquaculture market on the basis of environment?

- What is the breakup of the US aquaculture market on the basis of distribution channel?

- What is the breakup of the US aquaculture market on the basis of region?

- What are the various stages in the value chain of the US aquaculture market?

- What are the key driving factors and challenges in the US aquaculture market?

- What is the structure of the US aquaculture market and who are the key players?

- What is the degree of competition in the US aquaculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)