US Automotive Composites Market Size, Share, Trends, and Forecast by Material Type, Resin Type, Application, Resin Group, Fiber Type, and Region, 2025-2033

US Automotive Composites Market Size and Share:

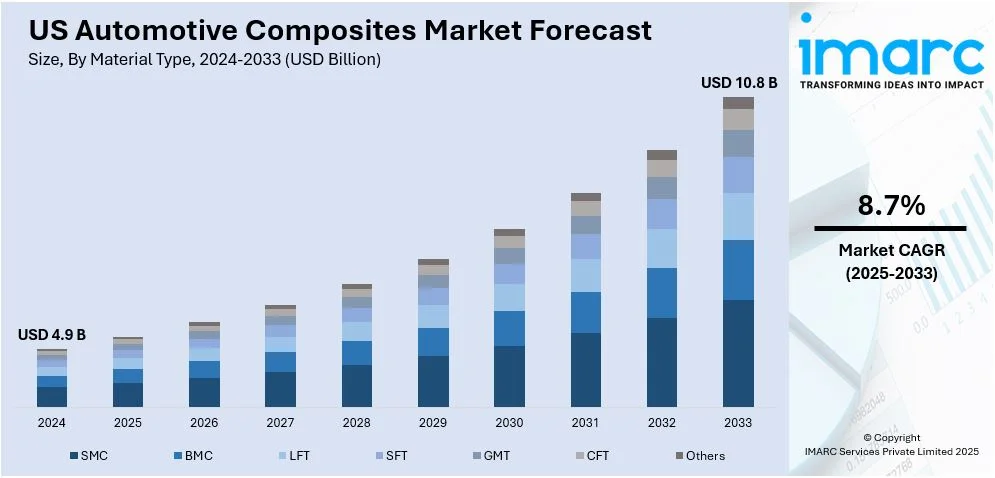

The US automotive composites market size was valued at USD 4.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.8 Billion by 2033, exhibiting a CAGR of 8.7% from 2025-2033. The market is rapidly expanding mainly driven by the rising demand for lightweight and fuel-efficient vehicles along with an enhanced focus on sustainability. Increased investment in research and development and broader applications across automotive sectors are expected to sustain market expansion in the coming years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.9 Billion |

| Market Forecast in 2033 | USD 10.8 Billion |

| Market Growth Rate (2025-2033) | 8.7% |

The United States automotive composites market is primarily driven by the increasing demand for lightweight materials in vehicle manufacturing. Automakers are striving to reduce vehicle weight to enhance fuel efficiency and meet stringent emission regulations set by the government. Composites, such as carbon fiber, fiberglass, and polymer matrices, offer high strength to weight ratios making them ideal for various automotive applications, including body panels, structural components, and interior parts. The push towards electric vehicles amplifies this trend as lighter vehicles can extend battery life and overall range making composites a critical component in the evolving automotive landscape. According to the data published by the US Energy Information Administration, in Q2 2024 United States electric and hybrid vehicle sales increased to 18.7%, which was a hike from 17.8% in Q1. Hybrid sales surged 30.7% to 9.6% while BEVs held 7.1%.

Another significant driver is the growing emphasis on sustainability and environmental impact within the automotive industry. Composites contribute to this by enabling the use of recyclable and ecofriendly materials aligning with manufacturers goals to reduce their carbon footprint. For instance, in September 2024, Exel Composites announced its partnership with Ineos to use over 100 metric tons of Envirez bio-based resin reducing manufacturing emissions by 21%. This transition aids in phasing out hydrocarbon derived resins while maintaining performance. Technological advancements in composite manufacturing, such as automation and cost-effective production techniques, have also made these materials more accessible and economically viable. The increasing investment in research and development (R&D) by both automotive companies and composite material suppliers fosters innovation leading to improved performance and broader adoption across various vehicle segments. These factors collectively propel the growth of the automotive composites market in the United States.

US Automotive Composites Market Trends:

Expansion of Recycled Composites

The expansion of recycled composites in the United States automotive market is driven by a heightened emphasis on sustainability and environmental responsibility. Automakers are increasingly incorporating recycled materials such as recycled carbon fiber and thermoplastic elastomers into vehicle components to reduce dependence on virgin resources and lower the overall carbon footprint. For instance, in October 2024, Avient Corporation expanded its reSound™ REC TPE AF 7210 grades to Asia offering PCR-based solutions for automotive applications. These materials containing 25%-55% post-consumer recycled content meet stringent VOC and aging tests supporting regulatory compliance and the growing demand for sustainable solutions in the automotive industry. This shift not only supports regulatory compliance with stricter emissions and waste management laws but also appeals to environmentally conscious consumers. Advances in recycling technologies have made it feasible to produce high quality recycled composites that match or exceed the performance of traditional materials.

Growth in Electric Vehicles

Composites are pivotal in the evolution of electric vehicles particularly in addressing the weight challenges posed by heavy battery packs. By leveraging lightweight materials such as carbon fiber reinforced polymers manufacturers can significantly reduce vehicle weight leading to improved battery efficiency and extended driving range. For instance, in June 2024, Aptera announced its plans to develop a solar electric vehicle featuring a carbon fiber reinforced polymer body known as BinC created with CPC Group's expertise. The lightweight design enables a 1,000 mile range utilizing solar panels for continuous charging. The vehicle's innovative composite materials align with Aptera’s sustainability goals. Additionally, the inherent flexibility of composite materials enables innovative design possibilities allowing engineers to optimize space and functionality within EV architectures. This design freedom supports streamlined aerodynamics, enhanced safety features and efficient energy use.

Advancements in Composite Materials

Advancements in composite materials and manufacturing technologies are significantly driving the US automotive composites market forward. Innovations in materials such as developing composites with enhanced durability, thermal resistance and recyclability meet the industry's demand for high performance and sustainable solutions. For instance, in July 2024, Cooper Standard launched FlexiCore™ Thermoplastic Body Seal, which is a sustainable alternative to traditional metal-based seals. Made from 100% recyclable materials it offers benefits like reduced weight improved flexibility and enhanced aesthetics. The product aims to meet OEM needs while supporting the company's commitment to sustainability in the automotive industry. Concurrently, the adoption of advanced manufacturing techniques like automated fiber placement (AFP), resin transfer molding (RTM) and 3D printing is revolutionizing production processes. These technologies boost efficiency, reduce costs and enable the creation of complex geometries that were previously difficult to achieve. These advancements facilitate the scalable integration of composites in automotive applications, fueling market growth and innovation.

US Automotive Composites Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the US automotive composites market, along with forecasts at the regional and country levels from 2025-2033. The market has been categorized based on material type, resin type, application, resin group, and fiber type.

Analysis by Material Type:

- SMC

- BMC

- LFT

- SFT

- GMT

- CFT

- Others

SMC is a key material in the US automotive composites market valued for its excellent strength to weight ratio and versatility. It is commonly used in exterior parts like hoods, fenders and trunk lids offering durability and design flexibility. With growing emphasis on fuel efficiency and lightweight materials SMC continues to gain traction especially in electric vehicles. Its ability to produce complex shapes and its cost-effectiveness make it a popular choice in high volume automotive manufacturing.

BMC is widely utilized in the US automotive market for components requiring high mechanical strength and thermal stability such as under the hood parts and electrical housings. Its excellent insulating properties and resistance to corrosion make it ideal for harsh automotive environments. As electric vehicles gain momentum BMC is increasingly used for battery enclosures and structural components driving its market growth. Its moldability and cost efficiency further enhance its appeal in automotive production.

LFT is a prominent material in the US automotive composites market known for its high impact resistance and lightweight properties. It is frequently used in structural applications like door modules, seat structures and instrument panels. The material’s superior strength and recyclability align with industry trends emphasizing sustainability. The rise of electric vehicles and the need for high performance materials continue to boost the adoption of LFT in modern automotive designs.

SFT is a versatile material in the US automotive composites market offering cost-effective solutions for non-structural components such as interior panels and trims. It provides good strength and thermal resistance while being lightweight. SFT’s ease of processing and compatibility with various polymer matrices make it suitable for a wide range of automotive applications. Growing demand for lightweight vehicles supports the increased use of SFT in the industry.

GMT is valued in the US automotive market for its exceptional stiffness and impact resistance making it ideal for structural applications like underbody shields and bumper reinforcements. Its lightweight nature contributes to improved fuel efficiency aligning with the automotive industry's goals. GMT’s recyclability and ease of molding complex shapes ensure its continued demand particularly as manufacturers prioritize sustainability and performance in vehicle production.

CFT is gaining prominence in the US automotive composites market due to its unmatched strength to weight ratio and stiffness. It is used in high-performance and luxury vehicles for applications such as chassis components and body panels. With the shift toward electric vehicles CFT plays a crucial role in lightweighting strategies. Although cost intensive, advancements in manufacturing processes are making CFT more accessible driving its adoption across broader automotive segments.

Analysis by Resin Type:

- PP Composites

- PBT Composites

- Others

Polypropylene (PP) composites are gaining traction in the US automotive market due to their lightweight and cost-effective properties. These materials are widely used in interior and exterior vehicle components such as dashboards, bumpers and trims offering excellent durability and design flexibility. Their recyclability aligns with the growing focus on sustainable automotive production while advancements in composite technology continue to enhance their mechanical properties. The increasing adoption of electric vehicles further boosts demand for PP composites.

Polybutylene terephthalate (PBT) composites are essential in the US automotive market particularly for applications requiring high heat resistance and dimensional stability. These composites are commonly utilized in electrical components such as connectors and housings due to their excellent insulating properties. The rising electrification of vehicles is driving demand for PBT composites as they meet performance standards in challenging environments. Their robust characteristics and adaptability make them critical in advancing modern automotive designs.

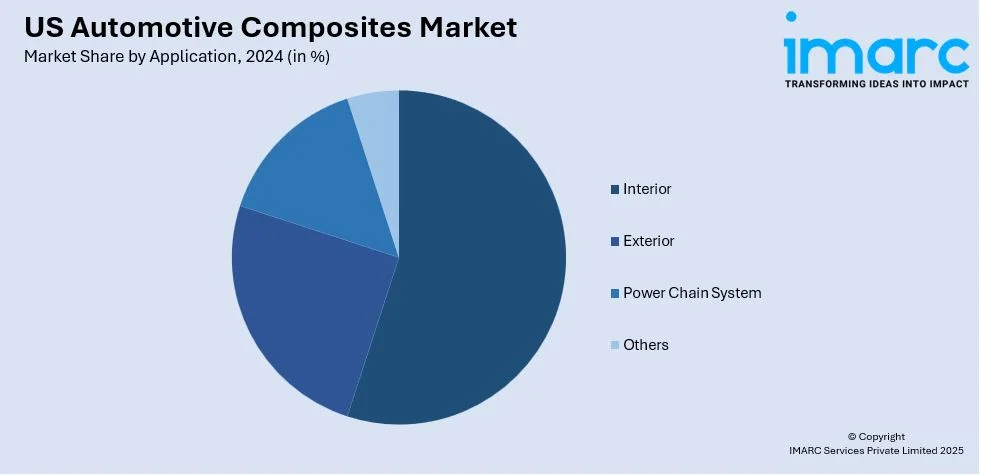

Analysis by Application:

- Interior

- Exterior

- Power Chain System

- Others

In the US automotive composites market interior applications focus on lightweight and durable materials for components like dashboards, door panels and seat structures. Composites offer excellent design flexibility enabling innovative aesthetics and enhanced functionality. Their noise dampening and thermal insulation properties improve cabin comfort. With an increasing emphasis on sustainability, recyclable and bio-based composites are gaining popularity for interiors. These materials meet the demand for modern and efficient designs in both conventional and electric vehicles.

Exterior applications dominate the US automotive composites market with materials used for bumpers, hoods, fenders, and roof panels. Composites provide superior impact resistance and corrosion protection while reducing vehicle weight contributing to better fuel efficiency. Their ability to create complex shapes and integrate multiple functions in a single part enhances manufacturing efficiency. The growing adoption of electric vehicles and the need for aerodynamic designs are driving the demand for advanced composite materials in exterior components.

In the US automotive composites market power chain applications include lightweight and durable materials for key components, such as drive shafts, chains, and gears. Composites enhance strength and wear resistance ensuring optimal performance under high mechanical stress. Their ability to reduce overall weight contributes to improved energy efficiency and vehicle dynamics. The growing adoption of electric and hybrid vehicles has intensified the demand for advanced composites in power chain systems to support smoother and more efficient power delivery.

Analysis by Resin Group:

- Thermoset Composites

- Thermoplastics Composites

Thermoset composites are a vital segment of the United States automotive composites market prized for their superior mechanical properties and thermal resistance. These materials are extensively used in manufacturing body panels, structural components, and under-the-hood parts. Thermosets offer excellent dimensional stability, chemical resistance and durability making them ideal for high stress automotive applications. Additionally, their ability to be molded into complex shapes with high precision supports efficient mass production catering to the automotive industry's demand for lightweight and robust components.

Thermoplastic composites are rapidly gaining traction in the United States automotive composites market due to their versatility and recyclability. These composites are used in interior parts and exterior panels. Thermoplastics offer advantages such as faster processing times, design flexibility and the ability to be reshaped and recycled aligning with sustainability goals. Their excellent impact resistance, lightweight nature, and ease of integration into existing manufacturing processes make them increasingly preferred for innovative and fuel-efficient vehicle designs.

Analysis by Fiber Type:

- Glass Fiber Composites

- Carbon Fiber Composites

- Others

Glass fiber composites are a cornerstone of the United States automotive composites market prized for their cost-effectiveness and robust mechanical properties. These composites are extensively used in manufacturing body panels, interior components, and structural parts due to their high strength, durability, and impact resistance. Glass fibers enhance stiffness and dimensional stability while maintaining lightweight characteristics which contribute to improved fuel efficiency and vehicle performance. Additionally, glass fiber composites offer excellent thermal and electrical insulation making them versatile for various automotive applications and promoting their widespread adoption in the industry.

Carbon fiber composites occupy a premium segment of the United States automotive composites market celebrated for their exceptional strength-to-weight ratio and superior performance. These composites are commonly used in high-performance and luxury vehicles for components such as chassis, body panels and interior trims. Carbon fibers provide unparalleled rigidity, lightweight properties and excellent fatigue resistance enhancing vehicle efficiency, handling, and fuel economy. Furthermore, carbon fiber composites enable innovative design possibilities and support sustainability efforts by reducing overall vehicle weight and emissions. Advances in manufacturing techniques and increasing affordability are driving their growing adoption in the automotive sector.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region plays a vital role in the United States automotive composites market driven by its dense network of automotive manufacturers and suppliers. States like Michigan, Ohio and Pennsylvania are key hubs hosting major automotive plants and research centers focused on composite material innovation. The region benefits from a skilled workforce and strong infrastructure supporting advanced manufacturing and high-tech composite applications. Additionally, proximity to major ports and urban centers facilitates efficient distribution and logistics enhancing the region’s competitiveness in the automotive composites supply chain.

The Midwest is a cornerstone of the US automotive composites market often referred to as the heart of the American automotive industry. States such as Michigan, Indiana and Illinois house numerous leading automotive manufacturers and Tier-1 suppliers specializing in composite materials. The region excels in large-scale production capabilities and has a robust ecosystem for research and development in automotive composites. Strong collaboration between industry and academia fosters innovation while established transportation networks ensure seamless distribution reinforcing the Midwest’s pivotal role in the national composites landscape.

The South region is rapidly emerging as a significant player in the US automotive composites market driven by its favorable business climate and expanding automotive manufacturing base. States like Texas, Alabama and Georgia attract major automotive investments due to lower operational costs and incentives. The region is experiencing growth in the production of composite components for both traditional and electric vehicles supported by a burgeoning network of suppliers and advanced manufacturing facilities. Additionally, the South’s strategic location supports efficient distribution across the eastern and central United States boosting its market presence.

The West region is a dynamic and innovative segment of the United States automotive composites market characterized by its focus on cutting-edge technologies and sustainable materials. States such as California, Michigan and Oregon are leaders in automotive research particularly in electric and autonomous vehicle development. The region benefits from a strong emphasis on environmental regulations and sustainability, driving the adoption of lightweight and recyclable composite materials. Additionally, the West hosts numerous startups and tech companies that collaborate with established automakers fostering a culture of innovation and accelerating the integration of advanced composites in automotive applications.

Competitive Landscape:

The US automotive composites market is highly competitive, driven by innovations in lightweight materials and rising demand for fuel-efficient vehicles. Key players dominate the market by leveraging advanced technologies and extensive product portfolios. These companies focus on partnerships, mergers, and R&D to strengthen their positions. Startups and mid-sized firms are also entering the market, targeting niche applications and electric vehicle components. Competition intensifies with the shift toward sustainability, as manufacturers prioritize recyclable and bio-based composites. Differentiation through performance, cost-efficiency, and scalability remains a critical factor in gaining market share.

The report provides a comprehensive analysis of the competitive landscape in the US automotive composites market with detailed profiles of all major companies.

Latest News and Developments:

- In November 2024, Toray Advanced Composites expanded its continuous fiber-reinforced thermoplastic portfolio by acquiring assets and technology from Gordon Plastics in Colorado. The 47,000 sq. ft. facility will enhance production capabilities for unidirectional tapes, supporting growth in sectors like sporting goods and industrial markets, according to Chief Technology Officer Steve Cease.

US Automotive Composites Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Material Types Covered | SMC, BMC, LFT, SFT, GMT, CFT, Others |

| Resin Types Covered | PP Composites, PBT Composites, Others |

| Applications Covered | Interior, Exterior, Power Chain System, Others |

| Resin Groups Covered | Thermoset Composites, Thermoplastics Composites |

| Fiber Types Covered | Glass Fiber Composites, Carbon Fiber Composites, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US automotive composites market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the US automotive composites market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US automotive composites industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Automotive composites are advanced materials made by combining two or more constituent materials, typically fibers like carbon or glass with resins. These composites offer lightweight, high-strength solutions for automotive applications, including body panels, interior components, and structural parts, enhancing fuel efficiency and sustainability.

The US automotive composites market was valued at USD 4.9 Billion in 2024.

IMARC estimates the US automotive composites market to exhibit a CAGR of 8.7% during 2025-2033.

The market is driven by increasing demand for lightweight materials to improve fuel efficiency, stringent emission regulations, the rise of electric vehicles, and sustainability goals promoting recyclable and eco-friendly composites. Technological advancements in manufacturing and expanding EV adoption also boost demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)