US Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

US Electric Two-Wheeler Market Overview:

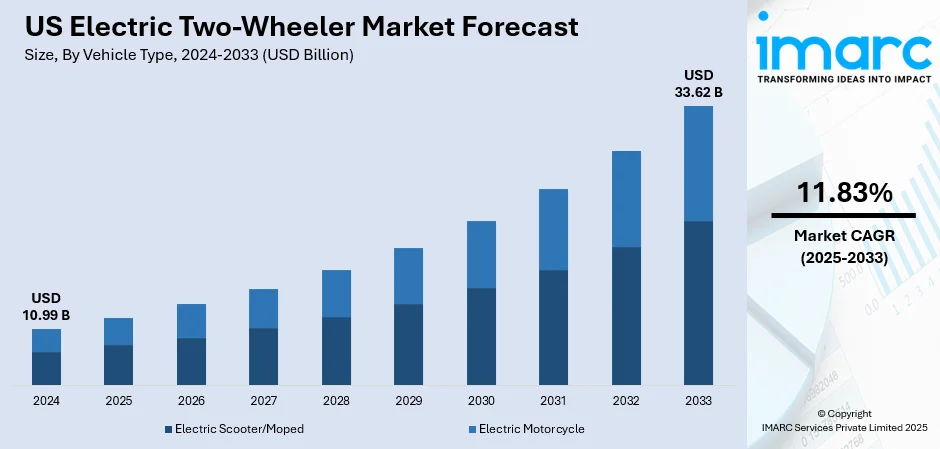

The US electric two-wheeler market size reached USD 10.99 Billion in 2024. The market is projected to reach USD 33.62 Billion by 2033, exhibiting a growth rate (CAGR) of 11.83% during 2025-2033. The market is driven by rapid technological advancements, government support, and shifting urban mobility trends. Additionally, improved battery efficiency, faster charging, and smart features are making e‑two‑wheelers more practical and appealing. Moreover, the federal and state incentives, along with expanding charging infrastructure, are reducing ownership barriers and encouraging adoption thus surging the US electric two-wheeler market share. Furthermore, growing environmental concerns, urban congestion, and the rise of shared and commercial mobility are increasing demand for compact, low‑emission transportation, positioning electric two‑wheelers as a key solution.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.99 Billion |

| Market Forecast in 2033 | USD 33.62 Billion |

| Market Growth Rate 2025-2033 | 11.83% |

US Electric Two-Wheeler Market Trends:

Technological Advancements & Falling Battery Costs

One of the most prominent US electric two-wheeler market trends is the continuous advancements in battery and motor technologies. Advances in lithium-ion battery technology have improved vehicle performance, charging speeds, and energy economy, making e-two-wheelers considerably more practical for everyday usage. With continuing reductions in battery costs due to improved production processes and economies of scale, the price difference between electric and gas/diesel vehicles decreases. These technological advances also apply to amenities such as regenerative braking, smart connectivity, and over‑the‑air updates, which improve the riding experience and appeal to technology‑conscious consumers. Companies are placing greater emphasis on providing units with greater range, quicker charging, and enhanced resilience, overcoming most of the historical impediments to adoption. These developments are making electric two‑wheelers a believable alternative for urban commuters and recreational riders alike, driving market demand.

To get more information on this market, Request Sample

Government Policies, Incentives & Infrastructure Expansion

Supportive government actions is another key driver of electric two‑wheeler adoption in the U.S. Federal and state programs provide incentives such as tax credits, rebates, and reduced registration fees, lowering ownership costs and making e‑two‑wheelers more accessible. A major push comes from investments in charging infrastructure, including the NEVI Formula Program, which has already disbursed around $2.4 billion, with another $586 million pending, to expand fast‑charging networks nationwide. This development significantly improves charging availability in urban, suburban, and even rural areas, easing range anxiety—a major barrier for potential users. Public‑private collaborations are also driving the rollout of smarter, faster, and more user‑friendly charging solutions. Together, these initiatives create a robust ecosystem for electric mobility, encouraging both consumers and businesses to transition to two‑wheeled EVs while supporting the long‑term growth of this emerging transportation segment.

Environmental & Urbanization Trends + Commercial/Shared Mobility

Increased green awareness and urbanization are major drivers of the success of electric two-wheelers. With urban traffic and air pollution challenges, small electric scooters and e-bikes are a clean, efficient option for short-distance commutes and last-mile delivery. Customers are increasingly being driven by the need to lower their environmental footprint as they seek to bypass the increasing costs and inefficiencies of car transport in densely populated urban environments. Besides, electric two-wheelers are increasingly finding application in the shared mobility and fleet markets, with businesses leveraging them for ride-sharing, delivery, and other business uses. The models provide businesses with a low-emission, cost-effective alternative, as well as consumers with convenient, on-demand use of environmentally friendly transport. Combined, these environmental and city trends are transforming transportation preferences and accelerating the US electric two-wheeler market growth as a mass-market choice in American cities.

US Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

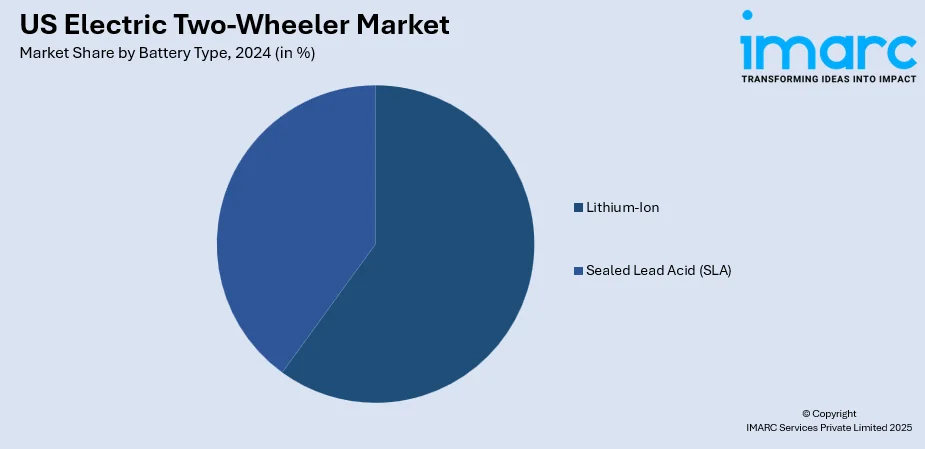

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Electric Two-Wheeler Market News:

- In June 2025, Honda unveiled the E‑VO electric motorcycle, developed with its Chinese partner Wuyang‑Honda. Priced between $4,000–$5,000, it offers up to 15.8 kW (21.2 hp), a 75 mph top speed, and 105 miles of range with three batteries. A two‑battery version delivers 68 mph and 75 miles of range. Initially for China, it may expand globally like Honda’s EM1 e:. With quick 0–31 mph acceleration in 2.8 seconds, it targets urban commuters at a competitive price.

- In March 2025, Microchip Technology launched its Electric Two‑Wheeler (E2W) ecosystem, offering pre‑validated reference designs to speed up e‑scooter and e‑bike development. Announced on March 17, 2025, the ecosystem provides automotive‑grade, scalable solutions to tackle challenges like power efficiency, system integration, and safety. With modular designs, schematics, BOMs, and global support, Microchip enables manufacturers to deliver reliable, feature‑rich electric two‑wheelers faster, enhancing innovation in the growing e‑mobility sector.

US Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the US electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the US electric two-wheeler market on the basis of battery type?

- What is the breakup of the US electric two-wheeler market on the basis of voltage type?

- What is the breakup of the US electric two-wheeler market on the basis of peak power?

- What is the breakup of the US electric two-wheeler market on the basis of battery technology?

- What is the breakup of the US electric two-wheeler market on the basis of motor placement?

- What is the breakup of the US electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the US electric two-wheeler market?

- What are the key driving factors and challenges in the US electric two-wheeler market?

- What is the structure of the US electric two-wheeler market and who are the key players?

- What is the degree of competition in the US electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)