US Family Offices Market Size, Share, Trends and Forecast by Type, Office Type, Asset Class, Service Type, and Region, 2025-2033

US Family Offices Market Overview:

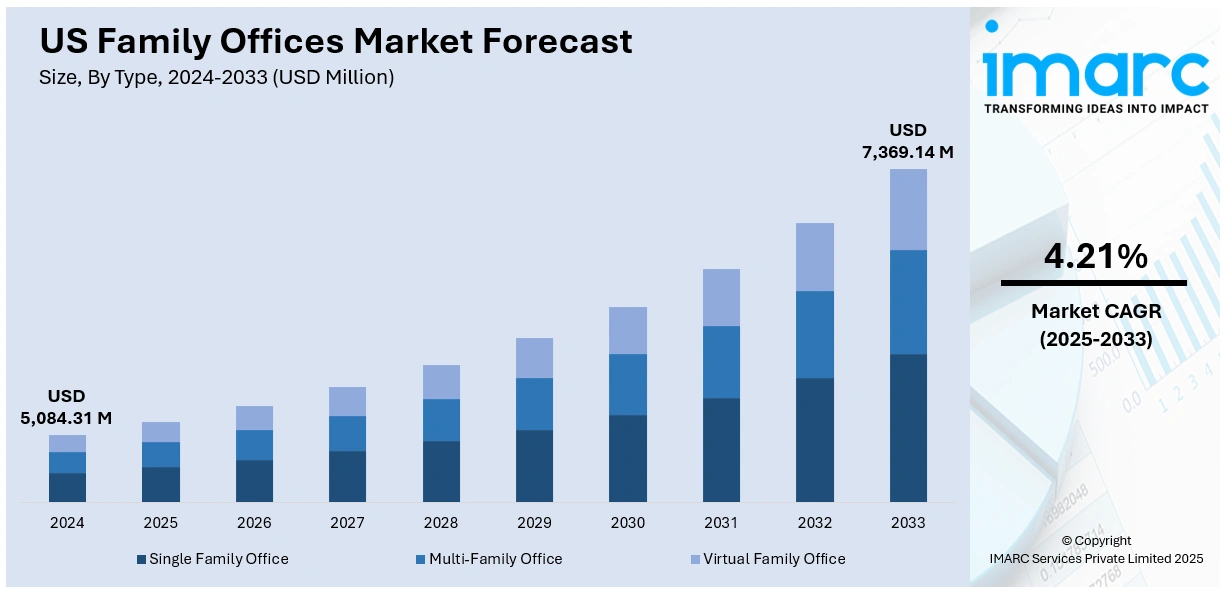

The US family offices market size reached USD 5,084.31 Million in 2024. The market is projected to reach USD 7,369.14 Million by 2033, exhibiting a growth rate (CAGR) of 4.21% during 2025-2033. The market is experiencing a dynamic reformation, fueled by diversification into alternatives, incorporation of sustainability norms, and the embrace of sophisticated technology. These changes demonstrate heightening focus on control, influence, and data-driven decision-making, aligning wealth strategies with shifting market conditions and generational values. Increased collaboration, direct investment, and ESG-oriented initiatives are supporting the industry's resilience and long-term growth potential. These trends are likely to solidify and grow the US family offices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,084.31 Million |

| Market Forecast in 2033 | USD 7,369.14 Million |

| Market Growth Rate 2025-2033 | 4.21% |

US Family Offices Market Trends:

Emergence of Direct Investments in Alternative Assets

Family offices in the US are increasingly diversifying from conventional equities and fixed income into direct investments in alternative assets like private equity, venture capital, real estate, and infrastructure. The motive is greater control, transparency, and long-term value creation. By avoiding intermediaries, family offices can be customized to respond to unique family values, risk appetite, and legacy objectives. Alternative investments are also being quite robust in times of market turmoil with the promise of diversification as well as inflation hedging opportunities. In addition, more family offices are joining co-investment networks so that they can gain access to large deals and pool expertise. These drivers are leading to US family offices market growth as they endeavor to create solid, multi-generational portfolios. Such investment is [broader market dynamics in which innovation, sustainability, and personalized asset allocation strategies are at the forefront of sustaining wealth and growing influence across industries.

To get more information on this market, Request Sample

Integration of Sustainability and Impact Investing

One rising trend among US family offices is incorporating environmental, social, and governance (ESG) values into investment approaches, with impact investing gaining significant traction. These offices are increasingly investing in projects and businesses that create quantifiable social and environmental impacts alongside competitive financial rewards. The strategy is not confined to philanthropy but is moving into core portfolio investments such as renewable energy, sustainable agriculture, and healthcare innovation. This is a reflection of a generation change, with young family members prioritizing purposeful wealth management. Beyond that, standardized reporting guidelines and more advanced ESG analytics are making it easier for family offices to quantify and monitor their impacts. Aligning wealth goals with those of society at large has further supported market expansion, indicating a structural change in the wealth management paradigm. This focus on responsible investing reflects one of the most characteristic US family offices market trends influencing capital deployment strategy over the next few years.

Embracing Advanced Technology and Data Analytics

United States family offices are embracing advanced technology and data analytics to improve operational efficiency, investment decision-making, and risk management. Digitalization is helping these organizations to streamline administrative tasks, consolidate portfolio performance monitoring, and perform advanced market analysis in real-time. Predictive analytics and artificial intelligence are applied to spot upcoming opportunities, fine-tune asset allocation, and recognize early warning signs of possible market disruption. Secure digital platforms are also enhancing sharing of information and collaboration between family members, advisors, and investment partners. As operational complexity improves, technology adoption becomes a key force behind market growth through increasing agility and accuracy in wealth management. This mirrors market trends where data-driven approaches are no longer optional but obligatory to ensure staying ahead of the competition, asset protection, and long-term legacy preservation in an increasingly complex economic and regulatory environment.

US Family Offices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, office type, asset class, and service type.

Type Insights:

- Single Family Office

- Multi-Family Office

- Virtual Family Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes single family office, multi-family office, and virtual family office.

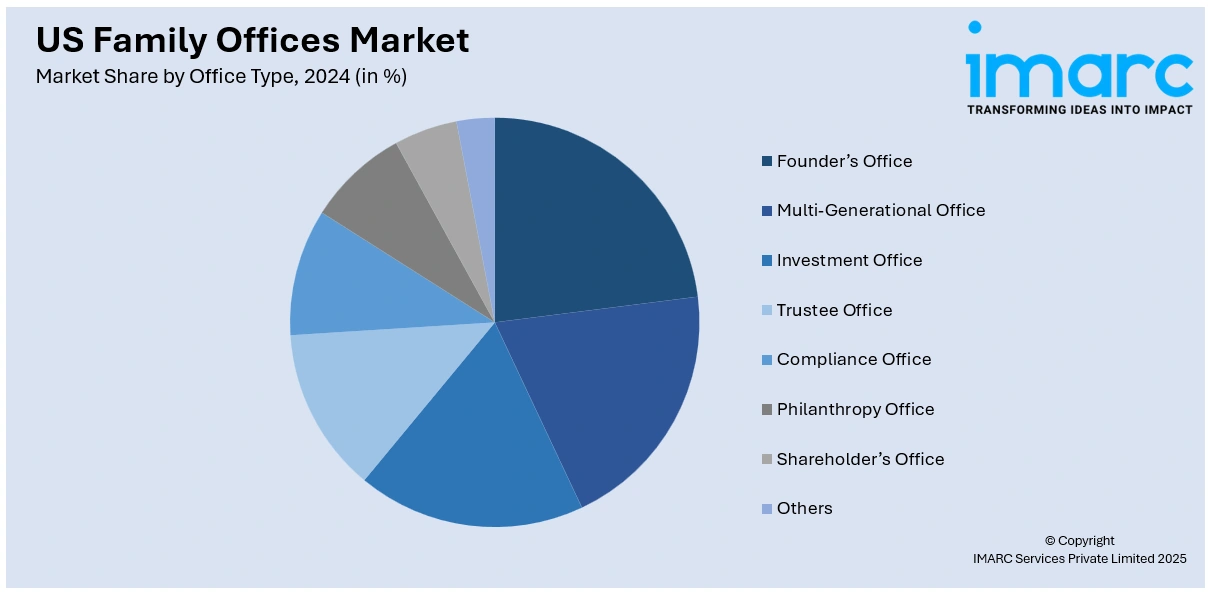

Office Type Insights:

- Founder’s Office

- Multi-Generational Office

- Investment Office

- Trustee Office

- Compliance Office

- Philanthropy Office

- Shareholder’s Office

- Others

A detailed breakup and analysis of the market based on the office type have also been provided in the report. This includes founder’s office, multi-generational office, investment office, trustee office, compliance office, philanthropy office, shareholder’s office, and others.

Asset Class Insights:

- Bonds

- Equalities

- Alternatives Investments

- Commodities

- Cash or Cash Equivalents

The report has provided a detailed breakup and analysis of the market based on the asset class. This includes bonds, equalities, alternatives investments, commodities, and cash or cash equivalents.

Service Type Insights:

- Financial Planning

- Strategy

- Governance

- Advisory

- Others

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes financial planning, strategy, governance, advisory, and others.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Family Offices Market News:

- In February 2025, Robertson Stephens introduced a family office service for ultra-high-net-worth individuals who are beyond multi-family office platforms but are not yet ready for a single-family office. Headed by Bruce Stewart, it provides bespoke solutions for families with advanced wealth management and investment needs.

- In October 2024, the Family Office Resource Group (FORG) launched with support from The 4100 Group Financial Services to help RIAs support ultra-high-net-worth clients, providing white-labeled solutions like outsourced CFO, accounting, business legacy planning, concierge services, family governance, and cybersecurity assistance.

US Family Offices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Family Office, Multi-Family Office, Virtual Family Office |

| Office Types Covered | Founder’s Office, Multi-Generational Office, Investment Office, Trustee Office, Compliance Office, Philanthropy Office, Shareholder’s Office, Others |

| Asset Classes Covered | Bonds, Equalities, Alternatives Investments, Commodities, Cash or Cash Equivalents |

| Service Types Covered | Financial Planning, Strategy, Governance, Advisory, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US family offices market performed so far and how will it perform in the coming years?

- What is the breakup of the US family offices market on the basis of type?

- What is the breakup of the US family offices market on the basis of office type?

- What is the breakup of the US family offices market on the basis of asset class?

- What is the breakup of the US family offices market on the basis of service type?

- What is the breakup of the US family offices market on the basis of region?

- What are the various stages in the value chain of the US family offices market?

- What are the key driving factors and challenges in the US family offices market?

- What is the structure of the US family offices market and who are the key players?

- What is the degree of competition in the US family offices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US family offices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US family offices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US family offices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)