US Helicopter Services Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

US Helicopter Services Market Overview:

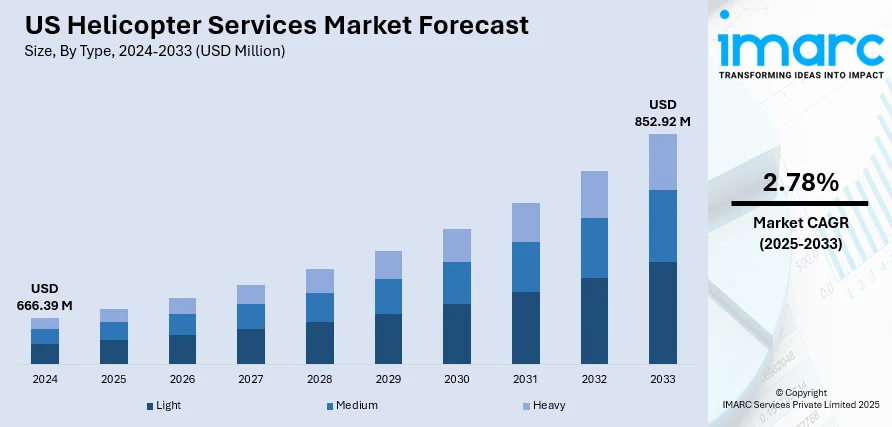

The US helicopter services market size reached USD 666.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 852.92 Million by 2033, exhibiting a growth rate (CAGR) of 2.78% during 2025-2033. The increasing demand for on-demand air transport services due to the requirement for faster, more efficient travel, particularly in traffic-congested cities, is supporting the market growth. Moreover, helicopter tourism is taking off quickly throughout the country, encouraging firms to improve their business footprint. Additionally, emergency medical services (EMS) are assuming a vital role in the increased need for helicopters, thereby expanding the US helicopter services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 666.39 Million |

| Market Forecast in 2033 | USD 852.92 Million |

| Market Growth Rate 2025-2033 | 2.78% |

US Helicopter Services Market Trends:

Growing On-Demand Air Travel Demand

The US is experiencing a rapidly increasing demand for on-demand air transport services due to the requirement for faster, more efficient travel, particularly in traffic-congested cities. With individuals seeking alternatives to land transportation, organizations are opening up helicopter services to cover this demand. Individuals are employing helicopters for business, recreational, and emergency transport purposes, cutting down on travel time considerably, particularly in traffic-prone cities. The urban air mobility (UAM) trend is also complementing this change, with people and businesses going for helicopters as a way to avoid road traffic. Corporates are enhancing the accessibility of helicopter services by having more aircraft in operation and providing flexible, timed flights. Additionally, private and corporate entities are adopting helicopter transportation for efficient and economical alternatives, driving market growth. In 2025, Electric air taxi company Joby Aviation revealed its intention to acquire the passenger segment of a leading publicly traded helicopter charter firm to accelerate its launch into commercial operations next year. The deal encompasses Blade’s most frequented routes in the New York City region and southern France, where helicopters transport passengers to beach resort destinations like Monaco, Nice, and Saint-Tropez on the French Riviera. It also features the Blade name along with its CEO, Rob Wiesenthal, who will keep leading the company as a fully owned subsidiary of Joby.

To get more information on this market, Request Sample

Expansion of Tourism and Leisure Services

Helicopter tourism is taking off quickly throughout the country, thereby supporting the US helicopter services market growth. Helicopter companies are offering stunning aerial tours that allow visitors to witness scenic vistas of landmarks, natural attractions, and city skylines. With the travel and tourism sector continuing to recover, helicopter tours are increasingly being selected as part of travel itineraries. Operators are providing customized packages for sightseeing, such as the Grand Canyon, New York City, and Miami, which are experiencing greater helicopter bookings. This is increasing demand for additional helicopters and improved services. Helicopter services also provide private charter services for sporting activities such as golfing, skiing, and for visiting remote places, strengthening the growth of the market. Luxury tourism agencies and local operators are collaborating to enhance these services, ensuring the sector’s growth and attracting more tourists to helicopter-based experiences. IMARC Group predicts that the US luxury travel market is projected to attain USD 832.7 Billion by 2033.

Growing Use in Emergency Medical Services (EMS)

Emergency medical services (EMS) are assuming a vital role in the increased need for helicopter services in the US. Air ambulances are used to fly critically ill or injured patients to the hospital in a timely fashion, particularly in remote or inaccessible areas. The demand for quick response in life-threatening situations is driving the growth of helicopter service, as helicopters can go around traffic on roads and reach places that might be inaccessible by regular ambulances. Emergency response teams are using helicopters to save lives by quickly reaching patients, greatly enhancing survival rates. Medical centers are investing in helicopter services to provide immediate medical evacuations and have the means to transport specialized care or transplant organs. With ongoing improvements in helicopter technology and greater integration into healthcare systems, EMS providers are increasingly turning to helicopters, thereby driving the US market. In 2025, Global Medical Response (GMR) declared its intentions of launching Airbus’s newly developed H140 helicopter in North America to fulfil the complex needs of the air medical transport sector.

US Helicopter Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Light

- Medium

- Heavy

The report has provided a detailed breakup and analysis of the market based on the type. This includes light, medium, and heavy.

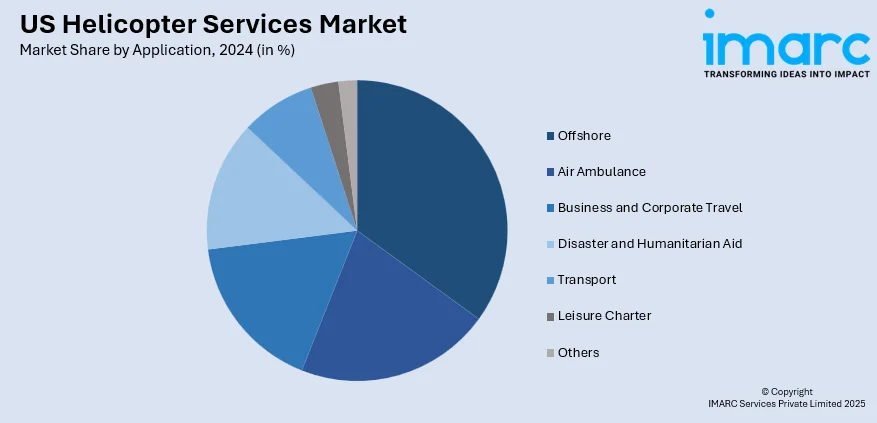

Application Insights:

- Offshore

- Air Ambulance

- Business and Corporate Travel

- Disaster and Humanitarian Aid

- Transport

- Leisure Charter

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes offshore, air ambulance, business and corporate travel, disaster and humanitarian aid, transport, leisure charter, and others.

End User Insights:

- Civil

- Commercial

- Military

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes civil, commercial, and military.

Regional Insights:

- Northeast

- Midwest

- South

- West

The report has also provided a comprehensive analysis of all the major regional markets, which include Northeast, Midwest, South, and West.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

US Helicopter Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Light, Medium, Heavy |

| Applications Covered | Offshore, Air Ambulance, Business and Corporate Travel, Disaster and Humanitarian Aid, Transport, Leisure Charter, Others |

| End Users Covered | Civil, Commercial, Military |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the US helicopter services market performed so far and how will it perform in the coming years?

- What is the breakup of the US helicopter services market on the basis of type?

- What is the breakup of the US helicopter services market on the basis of application?

- What is the breakup of the US helicopter services market on the basis of end user?

- What is the breakup of the US helicopter services market on the basis of region?

- What are the various stages in the value chain of the US helicopter services market?

- What are the key driving factors and challenges in the US helicopter services market?

- What is the structure of the US helicopter services market and who are the key players?

- What is the degree of competition in the US helicopter services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the US helicopter services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the US helicopter services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the US helicopter services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)